- Erie Insurance Overview

- Insurance Products and Services: Is Erie Insurance A Good Insurance Company

- Customer Experience and Service

- Financial Stability and Performance

- Comparison to Competitors

- Pros and Cons of Erie Insurance

- Factors to Consider When Choosing Erie Insurance

- Ending Remarks

- Essential Questionnaire

Is Erie Insurance a good insurance company? That’s a question many people ask when searching for the best protection for their assets. Erie Insurance, known for its regional focus and commitment to customer service, has built a strong reputation over the years. But is it the right fit for you? This guide dives deep into the world of Erie Insurance, exploring its history, products, customer experiences, financial stability, and more. We’ll compare Erie to its competitors, weigh the pros and cons, and help you decide if Erie Insurance is the right choice for your unique needs.

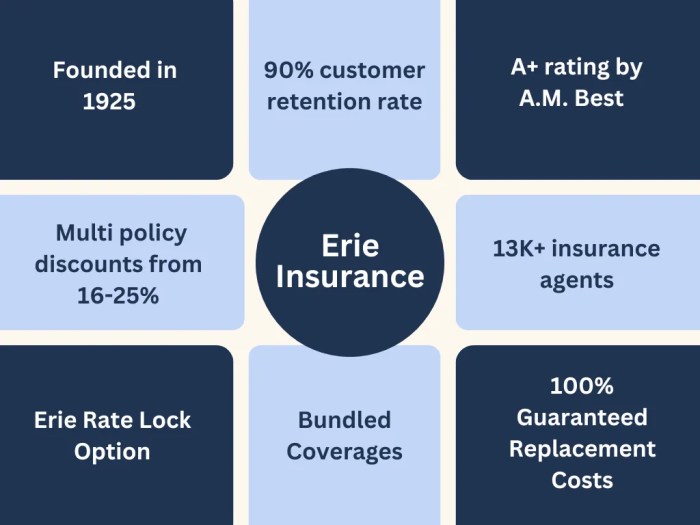

Erie Insurance was founded in 1925 in Erie, Pennsylvania, and has since expanded its reach across the United States. The company prides itself on its strong community ties and commitment to providing personalized insurance solutions. Erie Insurance offers a wide range of products, including auto, home, business, and life insurance, with a focus on comprehensive coverage and competitive pricing.

Erie Insurance Overview

Erie Insurance is a well-established insurance company with a rich history and a strong reputation in the industry. Founded in 1925, Erie has been providing insurance coverage to individuals and families for almost a century.

Erie Insurance primarily focuses on providing property and casualty insurance products. The company’s core values are centered around customer service, community involvement, and financial stability.

Erie Insurance’s Mission and Goals

Erie Insurance’s mission statement emphasizes its commitment to providing superior insurance products and services to its customers. The company aims to build long-term relationships with its policyholders by offering competitive rates, personalized service, and a commitment to fairness and transparency. Erie’s key goals include:

- Maintaining a strong financial position to ensure the company’s long-term stability and ability to meet its obligations to policyholders.

- Providing exceptional customer service by building relationships with policyholders and meeting their needs.

- Developing innovative insurance products and services to meet the evolving needs of its customers.

- Expanding its geographic reach to serve a wider customer base.

- Maintaining a strong commitment to community involvement by supporting local organizations and initiatives.

Insurance Products and Services: Is Erie Insurance A Good Insurance Company

Erie Insurance offers a comprehensive suite of insurance products designed to protect individuals, families, and businesses. They are known for their focus on personalized service and their commitment to providing competitive rates and comprehensive coverage options.

Auto Insurance

Erie Insurance offers a wide range of auto insurance coverage options to meet the needs of diverse drivers. Their policies provide financial protection against various risks associated with vehicle ownership, including accidents, theft, and damage.

- Liability Coverage: This coverage protects you financially if you are found responsible for an accident that causes injuries or damage to another person or their property. It includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other expenses incurred as a result of an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage provides financial protection if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your losses.

Home Insurance

Erie Insurance offers a variety of home insurance policies designed to protect your home and belongings from various risks. They provide financial protection against losses caused by fire, theft, vandalism, natural disasters, and other covered perils.

- Dwelling Coverage: This coverage protects the physical structure of your home, including the foundation, walls, roof, and other permanent fixtures.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, clothing, and other personal items.

- Liability Coverage: This coverage protects you financially if someone is injured on your property or if you are found responsible for causing damage to someone else’s property.

- Additional Living Expenses Coverage: This coverage helps pay for temporary housing and other expenses if you are unable to live in your home due to a covered loss.

Business Insurance

Erie Insurance offers a comprehensive range of business insurance solutions to protect businesses of all sizes. Their policies provide financial protection against various risks that businesses face, including property damage, liability claims, and business interruptions.

- Property Insurance: This coverage protects your business property, such as buildings, equipment, inventory, and other assets, from damage caused by fire, theft, vandalism, and other covered perils.

- Liability Insurance: This coverage protects your business from financial losses resulting from lawsuits or claims filed by third parties for injuries or property damage caused by your business operations.

- Workers’ Compensation Insurance: This coverage provides financial protection for employees who are injured or become ill as a result of their work. It covers medical expenses, lost wages, and other benefits.

- Business Interruption Insurance: This coverage provides financial protection for lost income and expenses incurred if your business is forced to shut down due to a covered event, such as a fire or natural disaster.

Life Insurance

Erie Insurance offers various life insurance products to help families and loved ones financially protect themselves in the event of a death. Their life insurance policies provide a death benefit that can be used to cover expenses such as funeral costs, outstanding debts, and living expenses.

- Term Life Insurance: This type of insurance provides coverage for a specific period, such as 10, 20, or 30 years. It is typically more affordable than permanent life insurance but does not build cash value.

- Whole Life Insurance: This type of insurance provides lifelong coverage and builds cash value that can be borrowed against or withdrawn. It is generally more expensive than term life insurance.

- Universal Life Insurance: This type of insurance offers flexible premiums and death benefit options. It also allows you to accumulate cash value that can be used for various purposes.

Customer Experience and Service

Erie Insurance is known for its dedication to providing exceptional customer service. They strive to make the insurance process as smooth and stress-free as possible for their policyholders. Their commitment to customer satisfaction is reflected in their consistently high ratings and positive reviews.

Customer Satisfaction Ratings and Reviews

Erie Insurance consistently receives high marks for customer satisfaction. J.D. Power, a well-respected research firm, consistently ranks Erie Insurance highly in its annual customer satisfaction surveys. For example, in the 2023 J.D. Power U.S. Auto Insurance Satisfaction Study, Erie Insurance ranked among the top performers in the industry. This indicates that Erie Insurance customers are generally satisfied with their overall experience with the company.

Erie Insurance also receives positive reviews from customers on various online platforms. Websites like Trustpilot and Google Reviews showcase a large number of satisfied customers who praise the company’s responsiveness, helpfulness, and professionalism. These reviews highlight the positive experiences customers have had with Erie Insurance, demonstrating the company’s commitment to customer satisfaction.

Customer Testimonials

Here are some examples of customer testimonials that showcase the positive experiences people have had with Erie Insurance:

“I’ve been with Erie Insurance for over 10 years and have always been impressed with their customer service. They are always prompt, helpful, and professional. I highly recommend them to anyone looking for a reliable insurance company.” – John S.

“I recently had to file a claim after an accident, and Erie Insurance made the process so easy. They were very responsive and kept me updated throughout the entire process. I was very satisfied with their handling of my claim.” – Mary L.

“I’ve been with Erie Insurance for years and have always been happy with their service. They are always there when I need them, and they are always willing to go the extra mile to help me. I wouldn’t hesitate to recommend them to anyone.” – David B.

Claims Process and Customer Support Options

Erie Insurance makes the claims process as straightforward and convenient as possible. Policyholders can file claims online, over the phone, or through a mobile app. The company also offers 24/7 claims assistance, so customers can get help whenever they need it. Erie Insurance has a network of dedicated claims adjusters who work diligently to process claims quickly and fairly.

Erie Insurance offers various customer support options to ensure policyholders have access to the assistance they need. Customers can contact Erie Insurance through phone, email, or online chat. The company also has a comprehensive website with a wealth of information about its products and services. Erie Insurance is committed to providing exceptional customer service, and their dedication is reflected in their customer satisfaction ratings, positive reviews, and the positive experiences shared by their policyholders.

Financial Stability and Performance

Erie Insurance’s financial performance is a key factor in its reputation as a reliable and trustworthy insurance provider. The company has a long history of financial stability and strong performance, which is reflected in its credit ratings and consistent profitability.

Credit Ratings and Financial Stability

Erie Insurance’s financial strength is consistently recognized by major credit rating agencies. These ratings are important because they provide an independent assessment of a company’s ability to meet its financial obligations.

- A.M. Best: Erie Insurance has an A+ (Superior) financial strength rating from A.M. Best, a leading credit rating agency specializing in the insurance industry. This rating signifies Erie’s excellent ability to meet its financial obligations and its strong track record of financial performance.

- Standard & Poor’s: Erie Insurance holds an A+ (Strong) financial strength rating from Standard & Poor’s, another prominent credit rating agency. This rating reflects Erie’s robust financial position and its ability to manage its financial risks effectively.

- Moody’s: Erie Insurance has an A1 (Excellent) financial strength rating from Moody’s, a global credit rating agency. This rating indicates Erie’s high financial strength and its strong capacity to withstand financial challenges.

Financial Strength and Value Proposition

Erie Insurance’s financial strength contributes to its overall value proposition in several ways:

- Financial Stability: Erie’s strong financial position provides confidence to policyholders that the company will be able to meet its claims obligations, even in the event of unexpected or significant losses.

- Competitive Pricing: Erie’s financial strength allows it to offer competitive insurance rates. The company’s ability to manage its risks effectively and maintain a strong financial position enables it to offer competitive premiums to its customers.

- Investment in Technology and Services: Erie’s financial strength allows it to invest in technology and services that enhance the customer experience. This includes developing online tools and mobile apps for policy management and claims reporting, as well as expanding its network of agents and customer service representatives.

Comparison to Competitors

Erie Insurance, while a strong player in the insurance market, faces stiff competition from other major insurance companies. Comparing its offerings to these competitors reveals both its strengths and weaknesses.

Pricing

Erie Insurance is often lauded for its competitive pricing, particularly in certain regions and for specific types of coverage. However, its pricing strategy can vary depending on factors such as location, driving history, and the specific insurance plan.

- Lower Premiums: Erie Insurance frequently offers lower premiums compared to national giants like State Farm and Allstate, particularly for homeowners insurance in its core regions.

- Regional Focus: Erie’s focus on specific regions allows it to tailor its pricing to local market conditions, potentially resulting in more favorable rates for some customers.

- Variable Pricing: Erie’s pricing can fluctuate depending on individual risk profiles, so it’s essential to obtain quotes from multiple insurers for a comprehensive comparison.

Coverage

Erie Insurance offers a comprehensive range of insurance products, including auto, home, business, and life insurance. However, some competitors may offer more specialized coverage options or unique features.

- Standard Coverage: Erie provides standard coverage options for most insurance types, meeting the needs of the majority of customers.

- Limited Specialty Coverage: Compared to national insurers, Erie may have fewer specialized coverage options, such as specific types of business insurance or niche personal insurance products.

- Focus on Core Products: Erie prioritizes its core insurance products, such as auto and home insurance, ensuring robust coverage within these areas.

Customer Service

Erie Insurance has consistently earned high marks for its customer service, emphasizing personalized attention and local agency support. However, some customers may prefer the convenience and accessibility of online-focused competitors.

- Strong Local Network: Erie’s extensive network of independent agents provides personalized service and local expertise.

- High Customer Satisfaction: Erie consistently receives high customer satisfaction ratings, reflecting its commitment to responsive and helpful service.

- Limited Online Options: While Erie offers online services, its emphasis on local agents may limit its appeal to customers who prefer purely digital interactions.

Pros and Cons of Erie Insurance

Erie Insurance is a regional insurance company with a strong reputation for customer service and financial stability. However, it is important to weigh the pros and cons before making a decision about whether Erie Insurance is the right choice for you.

Advantages of Choosing Erie Insurance

Erie Insurance offers several key advantages that make it an attractive option for many policyholders. These advantages include:

- Strong Financial Stability: Erie Insurance has a strong financial track record, with a high A.M. Best rating, indicating its ability to meet its financial obligations. This financial stability provides peace of mind to policyholders, knowing that their insurance company is financially sound.

- Excellent Customer Service: Erie Insurance is consistently ranked highly for its customer service. The company has a reputation for being responsive, helpful, and easy to work with. This positive customer service experience is a major draw for many policyholders.

- Competitive Pricing: Erie Insurance offers competitive rates, especially for customers who are loyal and have a good driving record. The company’s pricing structure can be very attractive, particularly for drivers who have a low risk profile.

- Wide Range of Coverage Options: Erie Insurance offers a comprehensive range of insurance products, including auto, home, business, and life insurance. This broad selection allows customers to insure their various needs with one company, simplifying their insurance portfolio.

- Strong Claims Handling Process: Erie Insurance is known for its efficient and fair claims handling process. The company works diligently to resolve claims quickly and fairly, ensuring that policyholders receive the compensation they deserve.

Disadvantages of Choosing Erie Insurance

While Erie Insurance offers many advantages, it also has some potential drawbacks:

- Limited Geographic Availability: Erie Insurance’s coverage area is primarily limited to the Mid-Atlantic and Northeast regions of the United States. This geographic limitation may be a drawback for individuals living outside these areas.

- Less Online Functionality: Compared to some national insurers, Erie Insurance has a less robust online presence. Some policyholders may find the company’s website and online tools less user-friendly or comprehensive than those offered by other insurers.

- Potential for Higher Rates for High-Risk Drivers: While Erie Insurance offers competitive rates for low-risk drivers, rates for high-risk drivers may be higher than those offered by other insurers.

Factors to Consider When Choosing Erie Insurance

Choosing the right insurance provider is a crucial decision that requires careful consideration of various factors. It’s like picking the perfect outfit for a big event – you want something that fits your style, budget, and the occasion. When it comes to insurance, you need a provider that fits your needs and provides the coverage you require.

Coverage Options and Limits

Coverage options and limits are key factors to consider when choosing an insurance provider. You need to make sure the provider offers the types of coverage you need and that the limits are sufficient to protect you in case of an accident or disaster. Erie Insurance offers a wide range of insurance products, including auto, home, renters, business, and life insurance. You can customize your coverage options and limits to meet your specific needs.

For example, if you have a high-value car, you might want to consider increasing your collision and comprehensive coverage limits.

To determine if Erie Insurance’s coverage options and limits are a good fit for you, you should review your current insurance policies and compare them to Erie’s offerings. Consider your individual needs and risk tolerance.

Pricing and Discounts

Insurance premiums can vary significantly from one provider to another, so it’s important to compare prices before making a decision. Erie Insurance is known for its competitive pricing and offers a variety of discounts, such as multi-policy discounts, good driver discounts, and safe driver discounts. You can use Erie’s online quote tool to get a personalized quote and see how their prices compare to other providers.

To get the best possible price, consider bundling your insurance policies with Erie.

Customer Service and Claims Process, Is erie insurance a good insurance company

When you need to file a claim, you want to be sure that the insurance company will handle it quickly and efficiently. Erie Insurance has a reputation for providing excellent customer service and a smooth claims process. They have a network of independent agents who can help you with your insurance needs and a 24/7 claims hotline for emergencies.

To get a better understanding of Erie’s customer service and claims process, read online reviews and talk to other customers who have experience with the company.

Financial Stability and Reputation

It’s important to choose an insurance company that is financially stable and has a good reputation. Erie Insurance has a strong financial rating and has been in business for over 90 years. They are known for their commitment to customer satisfaction and their long-standing reputation for integrity and reliability.

To assess Erie’s financial stability, you can check their ratings from independent agencies such as A.M. Best.

Agent Network and Availability

Erie Insurance uses a network of independent agents to sell and service its policies. This means you can find an agent in your local area who can provide personalized advice and support. You can use Erie’s website to find an agent near you.

If you prefer to deal with a company directly, you might want to consider a provider that offers online services and self-service options.

Ending Remarks

When deciding on an insurance provider, it’s crucial to consider your individual needs and priorities. Erie Insurance offers a solid reputation, strong financial stability, and a commitment to customer satisfaction. However, it’s essential to compare Erie’s offerings with other insurers in your area to ensure you’re getting the best value for your money. By carefully evaluating your options and considering the factors discussed in this guide, you can make an informed decision and find the insurance provider that best suits your needs.

Essential Questionnaire

What is Erie Insurance’s customer service like?

Erie Insurance is known for its strong customer service reputation. They have a high customer satisfaction rating and are known for their responsiveness and helpfulness.

Does Erie Insurance offer discounts?

Yes, Erie Insurance offers various discounts, including safe driver discounts, multi-policy discounts, and good student discounts.

Is Erie Insurance available in all states?

No, Erie Insurance is primarily available in the Midwest and Northeast regions of the United States.