- Florida’s No-Fault Insurance System

- Benefits of No-Fault Insurance in Florida

- Limitations of No-Fault Insurance in Florida

- Understanding Your Insurance Policy

- Legal Considerations in Florida’s No-Fault System: Is Florida A No Fault Car Insurance State

- Impact of No-Fault Insurance on Florida’s Economy

- Final Conclusion

- FAQ Summary

Is florida a no fault car insurance state – Is Florida a no-fault car insurance state? This question is crucial for anyone driving in the Sunshine State, as Florida’s unique insurance system significantly impacts how car accidents are handled. Understanding the ins and outs of Florida’s no-fault system is essential for navigating the complexities of car insurance claims and ensuring you receive the compensation you deserve.

Florida operates under a “no-fault” insurance system, which means that drivers are primarily responsible for covering their own medical expenses and lost wages after an accident, regardless of who was at fault. This system is designed to simplify the claims process and reduce litigation, but it also comes with its own set of limitations and exceptions.

Florida’s No-Fault Insurance System

Florida’s no-fault insurance system is a unique approach to handling car accidents. It aims to streamline the claims process and reduce litigation by requiring all drivers to carry Personal Injury Protection (PIP) coverage. This coverage provides benefits for medical expenses and lost wages, regardless of who is at fault for the accident.

Personal Injury Protection (PIP) Coverage

PIP coverage in Florida is designed to cover medical expenses and lost wages for the insured and their passengers, regardless of fault. This coverage provides a first-party benefit, meaning it pays directly to the insured individual rather than the other party involved in the accident. The amount of PIP coverage required by law in Florida is $10,000.

- Medical Expenses: PIP coverage will cover reasonable and necessary medical expenses incurred as a result of the accident, including doctor visits, hospital stays, surgery, and rehabilitation.

- Lost Wages: PIP coverage can also provide compensation for lost wages, up to 80% of the insured’s average weekly wage.

- Death Benefits: In the event of a fatality, PIP coverage may provide death benefits to the deceased’s beneficiaries.

Limitations and Exceptions to No-Fault Coverage

While Florida’s no-fault system is designed to simplify the claims process, there are limitations and exceptions to its application.

- Threshold for Filing a Lawsuit: Florida’s no-fault system requires drivers to meet a “threshold” of injury before they can sue the at-fault driver for pain and suffering. This threshold is typically met if the insured sustains “serious injuries” such as permanent disability, significant scarring or disfigurement, or death.

- Exclusions from Coverage: Certain types of accidents and injuries may be excluded from PIP coverage. For example, PIP coverage may not apply to accidents that occur while driving under the influence of alcohol or drugs.

- “No-Fault” is Not “Fault-Free”: While Florida’s no-fault system simplifies the claims process, it doesn’t mean the at-fault driver is not liable. If the insured meets the threshold for filing a lawsuit, they can still pursue damages for pain and suffering, lost wages, and other expenses beyond PIP coverage.

Benefits of No-Fault Insurance in Florida

Florida’s no-fault insurance system offers several advantages for drivers, including quicker claim processing and reduced litigation. This system is designed to streamline the process of obtaining medical treatment and compensation for injuries following an accident.

Streamlined Claim Processing

No-fault insurance simplifies the process of filing a claim. When an accident occurs, drivers involved file claims with their own insurance companies, regardless of who was at fault. This eliminates the need for lengthy investigations and disputes about fault, which can significantly reduce the time it takes to receive compensation.

Reduced Litigation

The no-fault system aims to minimize lawsuits and court battles by encouraging drivers to seek compensation through their own insurance policies. Since drivers are generally compensated for their injuries regardless of fault, there is less incentive to sue other drivers involved in an accident. This can save time, money, and stress for everyone involved.

Prompt Medical Treatment

No-fault insurance ensures that injured drivers can access medical treatment promptly. Drivers can seek medical attention without having to wait for fault to be determined, allowing them to focus on their recovery. The no-fault system guarantees coverage for medical expenses, encouraging individuals to seek necessary medical care without financial concerns.

Limitations of No-Fault Insurance in Florida

Florida’s no-fault insurance system, while designed to streamline accident claims, has inherent limitations that can impact accident victims. These limitations are crucial to understand, as they may influence your ability to seek full compensation for your injuries.

Limited Compensation for Pain and Suffering

One of the most significant limitations of Florida’s no-fault system is the restricted compensation for pain and suffering. Unlike traditional negligence claims, where you can seek damages for emotional distress, physical discomfort, and other intangible losses, no-fault insurance in Florida only covers economic losses, such as medical bills and lost wages. This limitation can leave accident victims feeling financially and emotionally burdened, especially when dealing with severe injuries that cause significant pain and suffering.

Situations Requiring Traditional Negligence Claims, Is florida a no fault car insurance state

While no-fault insurance covers basic medical expenses and lost wages, there are specific situations where a driver might need to file a traditional negligence claim, bypassing the no-fault system. This typically occurs when:

- The injuries are severe and exceed the no-fault coverage limits. Florida’s no-fault insurance offers a maximum coverage of $10,000 for medical expenses and lost wages. If your injuries result in expenses exceeding this limit, you may need to file a negligence claim to seek additional compensation.

- The accident involves a hit-and-run driver. In cases where the other driver is unidentified or flees the scene, you can pursue a negligence claim against your own insurance company under the uninsured motorist coverage.

- The accident involves a driver who was clearly at fault. If the other driver was intoxicated, speeding, or otherwise negligent, you may be able to file a negligence claim against them directly.

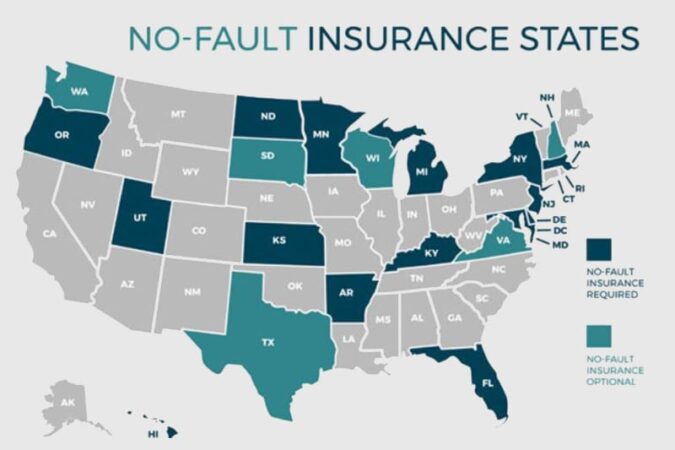

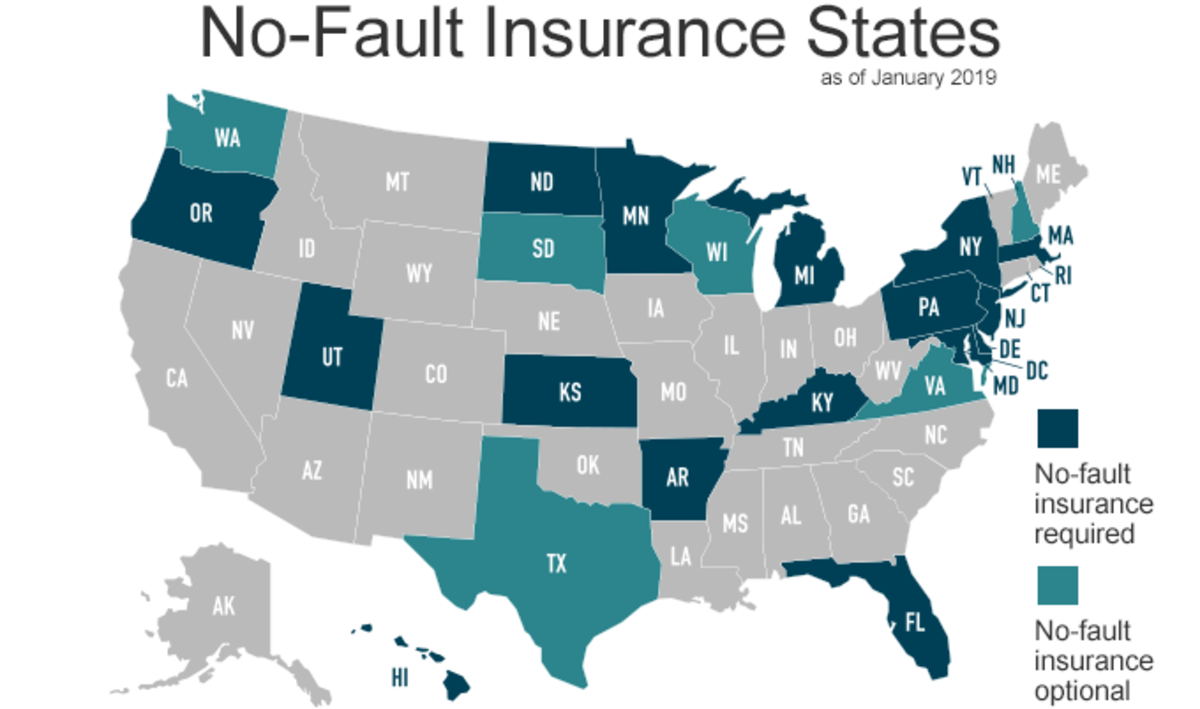

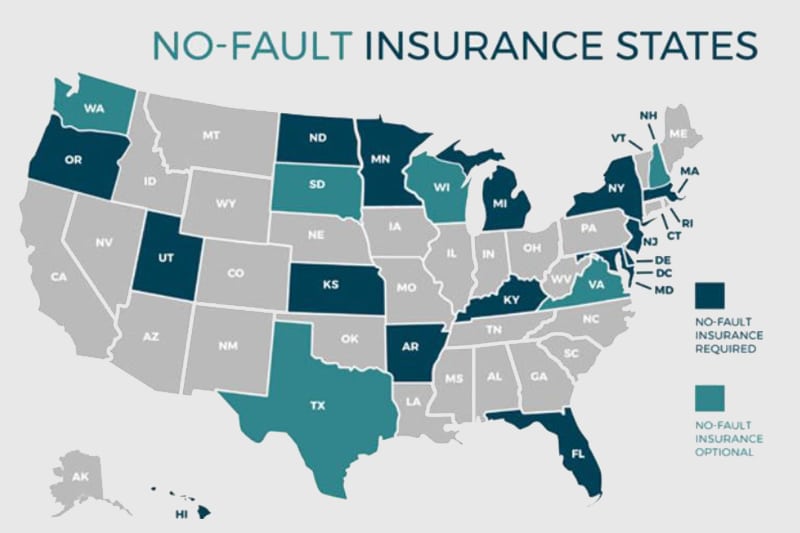

Comparison with Other States

Compared to other states, Florida’s no-fault system stands out with its strict limitations on pain and suffering compensation. Many states allow for pain and suffering damages in no-fault systems, even if they have lower coverage limits. For instance, in Michigan, no-fault insurance covers all reasonable medical expenses and lost wages, and allows for limited pain and suffering compensation. However, Michigan has a higher threshold for filing negligence claims. This highlights the diverse approaches to no-fault insurance across the country.

Understanding Your Insurance Policy

Navigating the intricacies of Florida’s no-fault insurance system can feel overwhelming, but understanding the key components of your policy is crucial for maximizing your benefits and ensuring you’re adequately protected in the event of an accident. This section delves into the essential elements of a Florida no-fault insurance policy, including coverage limits, deductibles, and exclusions, to provide a clear picture of what your policy covers and what it doesn’t.

Essential Elements of a Florida No-Fault Insurance Policy

Your Florida no-fault insurance policy is a legally binding agreement outlining the terms and conditions of coverage. It’s essential to thoroughly review your policy to understand its key elements:

| Element | Description |

|---|---|

| Coverage Limits | These limits specify the maximum amount your insurance company will pay for covered expenses, such as medical bills, lost wages, and other related costs. |

| Deductibles | The deductible is the amount you’re responsible for paying out-of-pocket before your insurance coverage kicks in. |

| Exclusions | Exclusions are specific situations or circumstances not covered by your policy. Understanding these exclusions is crucial to avoid surprises in the event of a claim. |

Filing a Claim Under Florida’s No-Fault System

The process of filing a claim under Florida’s no-fault system involves a series of steps. Understanding these steps can help you navigate the process efficiently and ensure a smoother experience:

Types of No-Fault Insurance Policies in Florida

Florida offers different types of no-fault insurance policies, each with its own coverage features and limitations. Understanding the key differences between these policies can help you choose the option that best suits your individual needs and circumstances:

| Policy Type | Key Differences |

|---|---|

| Personal Injury Protection (PIP) | PIP coverage provides benefits for medical expenses, lost wages, and other related costs, regardless of fault. It has a standard coverage limit of $10,000, but you can choose higher limits. |

| Collision Coverage | Collision coverage pays for repairs or replacement of your vehicle if it’s involved in an accident, regardless of fault. It typically has a deductible, and the payout is limited to the actual cash value of your vehicle. |

| Comprehensive Coverage | Comprehensive coverage covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It also typically has a deductible. |

Legal Considerations in Florida’s No-Fault System: Is Florida A No Fault Car Insurance State

Florida’s no-fault insurance system is governed by a complex set of laws and regulations, and navigating these legal aspects is crucial for understanding your rights and responsibilities. The Florida Department of Financial Services plays a vital role in overseeing the system, ensuring its fairness and effectiveness. This section delves into the legal procedures for resolving disputes and the consequences of violating no-fault insurance laws.

Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) is responsible for regulating the no-fault insurance system. The DFS sets the minimum coverage requirements, approves insurance rates, and investigates complaints against insurance companies.

- The DFS ensures that insurance companies comply with Florida’s no-fault laws, protecting consumers from unfair practices.

- The DFS also plays a crucial role in resolving disputes between policyholders and insurance companies. The DFS has a dedicated division for handling consumer complaints and mediating disputes.

- The DFS has the authority to impose fines and penalties on insurance companies that violate state regulations.

Resolving Disputes Related to No-Fault Insurance Claims

Disputes regarding no-fault insurance claims are common, and understanding the legal procedures for resolving these issues is essential.

- The first step in resolving a dispute is to contact your insurance company and attempt to resolve the issue directly.

- If you are unable to reach a settlement with your insurance company, you can file a complaint with the DFS.

- You can also file a lawsuit in civil court to pursue your claim. However, this can be a lengthy and costly process.

- If you are considering filing a lawsuit, it is essential to consult with an attorney who specializes in insurance law.

Legal Ramifications of Violating Florida’s No-Fault Insurance Laws

Violating Florida’s no-fault insurance laws can have serious legal consequences.

- Insurance companies that fail to comply with the no-fault laws can face fines and penalties from the DFS.

- Individuals who violate the no-fault laws, such as driving without insurance or filing fraudulent claims, can face criminal charges.

- If you are involved in a car accident, it is crucial to understand your rights and responsibilities under Florida’s no-fault insurance laws.

Impact of No-Fault Insurance on Florida’s Economy

Florida’s no-fault insurance system has a significant impact on the state’s economy, influencing both the healthcare system and the insurance industry. While it aims to streamline accident claims and reduce litigation, its effects are multifaceted and have sparked ongoing debates about its effectiveness and potential for reform.

Impact on Florida’s Healthcare System

The no-fault system’s influence on Florida’s healthcare system is notable. By limiting direct access to lawsuits for minor injuries, it has potentially reduced the number of frivolous claims and lowered healthcare costs associated with such claims. However, it has also been criticized for discouraging comprehensive medical treatment due to the limitations on personal injury protection (PIP) benefits. This can lead to individuals seeking less extensive care, potentially impacting their long-term health outcomes.

Impact on Florida’s Insurance Industry

Florida’s no-fault insurance system has had a significant impact on the state’s insurance industry. It has created a competitive market for auto insurance, with numerous companies offering policies that cater to different needs. However, the system has also been criticized for leading to high insurance premiums due to factors such as fraud and abuse within the system. The high premiums have made it difficult for some Floridians to afford adequate coverage, potentially leading to underinsurance and financial hardship in case of accidents.

Impact on Florida’s Traffic Safety Statistics

The impact of Florida’s no-fault insurance system on traffic safety statistics is a subject of ongoing debate. While proponents argue that the system encourages responsible driving by removing the incentive for lawsuits, critics contend that it may contribute to increased accidents due to the potential for less stringent enforcement of traffic laws. The system’s impact on traffic safety remains complex and requires further analysis to draw definitive conclusions.

Ongoing Debate Regarding Potential Reforms

Florida’s no-fault insurance system has been subject to ongoing debate regarding potential reforms. Proponents of reform argue that the system needs adjustments to address issues such as high insurance premiums, fraud, and limited access to medical care. They propose changes such as increasing PIP benefits, implementing stricter fraud prevention measures, and allowing greater flexibility in choosing medical providers. However, opponents of reform argue that significant changes to the system could disrupt its current benefits and lead to unintended consequences.

Final Conclusion

Navigating Florida’s no-fault insurance system can be a complex journey, but understanding the intricacies of this unique system can empower you to protect your rights and ensure you receive the appropriate compensation after an accident. Whether you’re a seasoned driver or just starting out, staying informed about the advantages and disadvantages of Florida’s no-fault insurance is crucial for safeguarding your financial well-being and navigating the complexities of car insurance claims.

FAQ Summary

What are the minimum insurance requirements in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage.

Can I sue the other driver in a Florida car accident?

You can only sue the other driver in a Florida car accident if your injuries meet certain thresholds, such as exceeding $10,000 in medical expenses or involving a permanent injury.

What is the “threshold” for filing a lawsuit in Florida?

The “threshold” for filing a lawsuit in Florida refers to the minimum amount of medical expenses or severity of injury required to pursue a negligence claim against the other driver. This threshold varies depending on the type of injury and the specific circumstances of the accident.

How does Florida’s no-fault system affect uninsured motorists?

Florida’s no-fault system does not apply to uninsured motorists. If you are involved in an accident with an uninsured driver, you will need to file a claim with your own insurance company under your uninsured motorist coverage.