Is Kaiser Permanente a good insurance company? This question is on the minds of many people seeking affordable and comprehensive healthcare coverage. Kaiser Permanente, a unique integrated healthcare system, has been a major player in the US healthcare landscape for decades. They offer a distinctive approach to healthcare, combining insurance and medical services under one umbrella. But is it the right choice for you? Let’s explore the pros and cons of Kaiser Permanente, delve into its strengths and weaknesses, and help you determine if it’s a good fit for your individual needs.

From its humble beginnings as a healthcare plan for shipyard workers in the 1940s, Kaiser Permanente has grown into a national powerhouse, serving millions of Americans across the country. The organization’s integrated model, where doctors, hospitals, and insurance are all part of the same system, aims to provide streamlined care and better coordination between providers. This model, while unique, has its advantages and disadvantages, which we’ll explore in detail.

Kaiser Permanente Overview

Kaiser Permanente is a giant in the healthcare world, known for its unique approach to patient care. It’s not just another insurance company – it’s a healthcare system that’s got your back from the doctor’s office to the hospital.

History of Kaiser Permanente

Kaiser Permanente’s story begins with a guy named Henry J. Kaiser, a construction magnate who was building dams and other projects during World War II. He needed to keep his workers healthy, so he created a healthcare plan for them. This plan, along with the expertise of Dr. Sidney Garfield, a physician who pioneered the concept of group medical practice, eventually evolved into what we know today as Kaiser Permanente.

Integrated Healthcare Model

Kaiser Permanente’s big secret sauce? Its integrated healthcare model. It’s like a one-stop shop for all your healthcare needs. They’ve got doctors, hospitals, clinics, pharmacies, and even mental health services, all under one roof. This means they can coordinate care better, leading to fewer redundancies and more efficient use of resources.

Geographic Reach and Service Areas

Kaiser Permanente is a big player in the healthcare game, serving over 12.4 million members across eight states and the District of Columbia. They’re a major presence on the West Coast, with a strong footprint in California, Oregon, Washington, and Colorado. But they’re also expanding their reach to other parts of the country, like Georgia, Maryland, Virginia, and the District of Columbia.

Pros of Kaiser Permanente

Kaiser Permanente, known for its integrated healthcare model, offers a unique set of advantages that can appeal to many individuals and families.

Kaiser Permanente’s Network of Doctors and Hospitals

Kaiser Permanente boasts a vast network of doctors, hospitals, and clinics across the United States. This extensive network provides members with convenient access to a wide range of medical services, including primary care, specialty care, and emergency services. The integration of these services under one umbrella ensures seamless coordination of care, minimizing the need for referrals and paperwork.

Benefits of Kaiser Permanente’s Preventive Care Programs

Kaiser Permanente emphasizes preventive care, recognizing that early detection and intervention can significantly improve health outcomes and reduce healthcare costs. The organization offers a comprehensive range of preventive care programs, including:

- Annual checkups and screenings

- Immunizations

- Health education and counseling

- Wellness programs

These programs aim to identify potential health risks early on, enabling timely interventions and promoting overall well-being.

Kaiser Permanente’s Patient Satisfaction Ratings

Kaiser Permanente consistently ranks high in patient satisfaction surveys. The organization’s focus on patient-centered care, personalized attention, and convenient access to services contributes to its positive reputation. For example, in 2022, Kaiser Permanente received an average patient satisfaction rating of 4.5 out of 5 stars, indicating high levels of member satisfaction.

Kaiser Permanente’s Focus on Technology and Digital Health Tools

Kaiser Permanente is at the forefront of healthcare innovation, leveraging technology to enhance patient care and improve efficiency. The organization offers a variety of digital health tools, including:

- Online appointment scheduling

- Secure messaging with providers

- Mobile apps for managing health information

- Telehealth services for virtual consultations

These digital tools empower members to take an active role in their health management, improving access to care and promoting patient engagement.

Cons of Kaiser Permanente

Kaiser Permanente, while a popular and well-regarded health insurance provider, isn’t without its drawbacks. Like any large organization, it faces challenges that may impact your experience.

Provider Network Limitations

Kaiser Permanente operates under a closed network model, meaning you’re limited to seeing doctors and specialists within their network. While this ensures coordinated care, it can be restrictive if you prefer a specific doctor outside the network or need specialized care not offered within the network. For instance, you might have to travel further to see a specialist or rely on referrals from Kaiser Permanente providers.

Wait Times for Appointments

Kaiser Permanente’s popularity and extensive membership can lead to longer wait times for appointments, especially for specialized care or in high-demand areas. While some members report quick access to appointments, others may face delays, particularly during peak seasons or for urgent care needs.

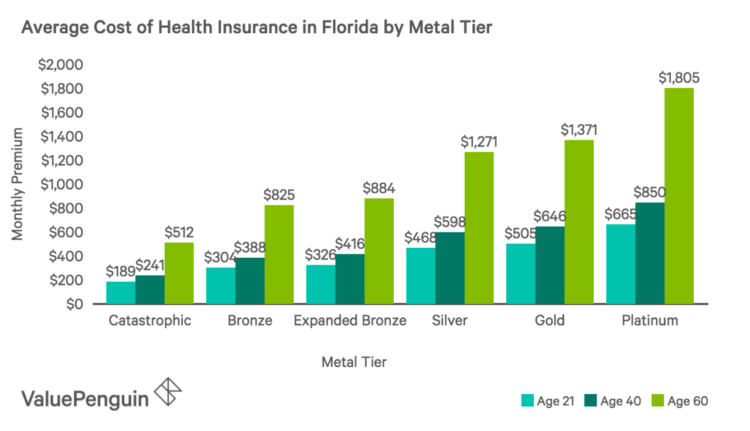

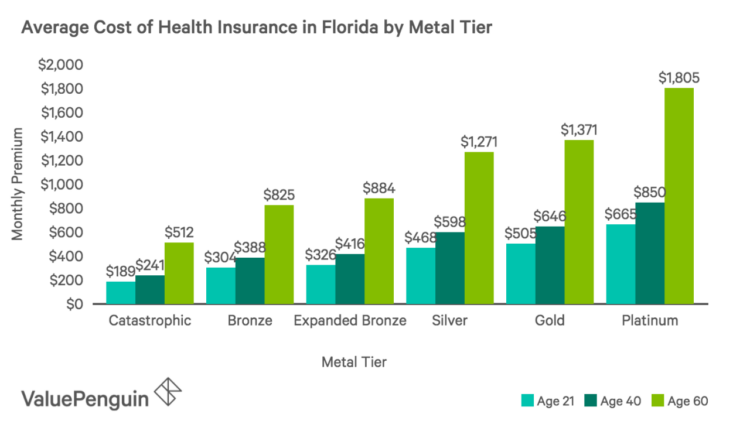

Cost Comparisons, Is kaiser permanente a good insurance company

Kaiser Permanente offers various plans, but their costs can vary depending on your location, age, and health status. It’s crucial to compare Kaiser Permanente’s plans with other insurance options, considering factors like deductibles, co-pays, and out-of-pocket expenses. You might find that other plans offer better coverage or affordability depending on your individual needs and budget.

Customer Service Challenges

Like any large organization, Kaiser Permanente can experience customer service issues, particularly during busy periods or when dealing with complex medical needs. Some members report difficulties reaching customer service representatives, navigating online portals, or resolving billing disputes.

Factors to Consider When Choosing Kaiser Permanente: Is Kaiser Permanente A Good Insurance Company

Choosing a health insurance plan is a big decision, and it’s important to consider all your options before making a choice. Kaiser Permanente is a large and well-known health insurance company, but it’s not the right fit for everyone. To help you decide if Kaiser Permanente is the right choice for you, it’s important to weigh the factors discussed in this section.

Comparing Kaiser Permanente Plans

Kaiser Permanente offers a variety of health insurance plans, each with its own set of features and benefits. It’s important to compare these plans to find one that meets your needs and budget. Here’s a table comparing some of the key features of different Kaiser Permanente plans:

| Plan Type | Co-pays | Deductibles | Coverage |

|—|—|—|—|

| Basic | High | High | Limited |

| Silver | Medium | Medium | Moderate |

| Gold | Low | Low | Comprehensive |

| Platinum | Very Low | Very Low | Extensive |

Questions to Ask When Considering Kaiser Permanente

Before deciding to enroll in a Kaiser Permanente plan, it’s essential to ask yourself a few key questions. These questions will help you determine if Kaiser Permanente aligns with your health needs and preferences.

- Do you live within Kaiser Permanente’s service area? Kaiser Permanente has a network of doctors and hospitals, and you’ll need to live within their service area to access their services.

- Do you need access to specialists? Kaiser Permanente has a large network of specialists, but it’s important to ensure they have the specialists you need.

- Are you comfortable with Kaiser Permanente’s network of doctors and hospitals? You’ll need to choose a doctor from Kaiser Permanente’s network, so it’s important to make sure you’re comfortable with their providers.

- What is your budget for health insurance? Kaiser Permanente plans vary in cost, so it’s important to consider your budget when choosing a plan.

Comparing Kaiser Permanente to Other Insurance Plans

When comparing Kaiser Permanente to other insurance plans, there are a few key factors to consider. These factors will help you decide if Kaiser Permanente offers the best value for your needs.

- Network size: Kaiser Permanente has a large network of doctors and hospitals, but it’s important to compare this to the networks of other insurance plans. Make sure the network includes providers you trust and are comfortable with.

- Cost: Kaiser Permanente plans vary in cost, so it’s important to compare their premiums and out-of-pocket expenses to other insurance plans. Consider your budget and the value you’re getting for the price.

- Coverage: Kaiser Permanente offers a variety of coverage options, so it’s important to compare their plans to other insurance plans. Consider your health needs and make sure the plan you choose offers the coverage you need.

- Customer service: Kaiser Permanente has a reputation for good customer service, but it’s important to compare their customer service to other insurance plans. Read reviews and talk to other people who have used Kaiser Permanente to get a sense of their customer service experience.

Alternatives to Kaiser Permanente

If you’re not sure Kaiser Permanente is the right fit for you, don’t worry! There are plenty of other health insurance options out there. The healthcare landscape is a vast and varied one, and finding the perfect plan is all about matching your individual needs with the right provider.

Major Health Insurance Providers

Here’s a quick rundown of some of the big players in the health insurance game:

- UnitedHealthcare: The biggest health insurance company in the US, UnitedHealthcare offers a wide range of plans, including HMOs, PPOs, and POS plans. They have a vast network of providers, which means you’ll likely have plenty of options for doctors and hospitals. However, their premiums can be higher than some other insurers.

- Anthem: Another major player, Anthem offers plans in most states. They’re known for their strong provider networks and their focus on preventive care. They also offer a range of plans, including HMOs, PPOs, and POS plans.

- Cigna: Cigna is a global health service company that offers a variety of health insurance plans, including HMOs, PPOs, and POS plans. They’re known for their strong customer service and their commitment to providing quality care.

- Aetna: Aetna is a large health insurance company that offers a variety of plans, including HMOs, PPOs, and POS plans. They’re known for their focus on wellness and their commitment to providing affordable care.

Comparing Benefits and Drawbacks

When comparing Kaiser Permanente to other health insurance providers, consider these factors:

- Network Size: Kaiser Permanente has a more limited network than some other providers, meaning you may have fewer choices for doctors and hospitals. However, they do have a strong network of providers in the areas they serve.

- Cost: Kaiser Permanente is often known for its lower premiums compared to other health insurance providers. However, it’s important to consider the total cost of care, including deductibles, co-pays, and out-of-pocket expenses.

- Customer Service: Kaiser Permanente has a reputation for good customer service. However, experiences can vary, so it’s important to read reviews and compare customer service ratings.

- Quality of Care: Kaiser Permanente is known for its commitment to quality care. They have a strong focus on preventive care and have a large network of doctors and hospitals. However, it’s important to research the quality of care in your specific area.

Importance of Individual Healthcare Needs and Preferences

Ultimately, the best health insurance provider for you depends on your individual needs and preferences. Consider your budget, your health status, your location, and your preferred type of care.

“It’s like finding the perfect pair of shoes. You might have a general idea of what you’re looking for, but you need to try on a few different pairs to find the right fit.”

Do your research, compare options, and talk to your doctor or a health insurance broker to get expert advice.

Summary

Ultimately, deciding whether Kaiser Permanente is a good insurance company for you comes down to your individual needs and preferences. Consider factors like your location, preferred healthcare providers, desired level of access to care, and budget. Weigh the pros and cons carefully, explore alternative insurance plans, and make an informed decision that aligns with your healthcare priorities. Remember, choosing the right insurance plan is a crucial step towards securing your health and well-being.

Top FAQs

What is Kaiser Permanente’s reputation for customer service?

Kaiser Permanente’s customer service reputation is mixed. Some patients praise their responsive and helpful staff, while others have experienced difficulties getting through to customer service representatives or resolving issues.

How does Kaiser Permanente compare to other insurance plans in terms of coverage?

Kaiser Permanente offers a variety of plans with varying levels of coverage. It’s essential to compare their plans to other options available in your area to determine which best suits your needs and budget.

Are there any specific types of healthcare that Kaiser Permanente excels in?

Kaiser Permanente is known for its strong preventive care programs and its emphasis on mental health services. They have a dedicated network of mental health professionals and offer comprehensive mental health coverage.

What are the common complaints about Kaiser Permanente?

Some common complaints about Kaiser Permanente include long wait times for appointments, limited provider networks, and occasional challenges with navigating their online systems.