Is State Farm a good homeowners insurance company? That’s a question many homeowners ask themselves, especially when it comes to protecting their biggest investment. State Farm is a household name, known for its iconic commercials and friendly jingle. But does their reputation translate to quality homeowners insurance? Let’s break down the good, the bad, and the maybe-not-so-good about State Farm to see if they’re the right fit for you.

From their history and financial stability to coverage options and customer service, we’ll dive into the details to help you make an informed decision. We’ll also compare State Farm to other big-name insurance companies to give you a well-rounded picture. So buckle up, it’s time to get insured and informed!

Claims Process and Customer Support: Is State Farm A Good Homeowners Insurance Company

State Farm’s claims process is designed to be straightforward and efficient, aiming to provide a smooth experience for policyholders. The company has a robust system in place to handle claims promptly and fairly.

Steps Involved in the Claims Process

The claims process at State Farm generally involves the following steps:

- Reporting the Claim: Policyholders can report claims through various channels, including phone, online, or through a mobile app. State Farm’s website and mobile app provide convenient platforms for reporting claims, allowing policyholders to submit details and upload supporting documents.

- Initial Assessment: Once a claim is reported, State Farm will initiate an assessment to gather information and determine the nature and extent of the damage. This may involve contacting the policyholder to clarify details, scheduling an inspection, or requesting additional documentation.

- Claim Processing: Based on the assessment, State Farm will process the claim and determine the coverage and amount of compensation. The company will review the policy terms and conditions, evaluate the damages, and consider any applicable deductibles.

- Payment and Resolution: If the claim is approved, State Farm will issue payment to the policyholder or directly to the service provider, such as a repair shop. The company strives to resolve claims promptly, and the turnaround time can vary depending on the complexity of the claim and the availability of required information.

Customer Support Channels

State Farm provides multiple customer support channels to assist policyholders with their claims and other inquiries. These channels include:

- Phone Support: State Farm has a dedicated customer service hotline available 24/7, allowing policyholders to reach a representative at any time. This option provides immediate assistance and allows for real-time communication.

- Online Resources: State Farm’s website offers comprehensive information on claims procedures, FAQs, and other resources. The website also provides a secure platform for policyholders to manage their accounts, track claims, and submit documents online.

- Mobile App: State Farm’s mobile app provides a convenient and accessible platform for policyholders to manage their insurance needs, including reporting claims, tracking progress, and communicating with customer service representatives.

- Email Support: State Farm also offers email support, allowing policyholders to submit inquiries and receive responses in a timely manner.

Customer Reviews and Experiences, Is state farm a good homeowners insurance company

Customer reviews and experiences provide insights into State Farm’s claims handling and customer support responsiveness. While customer satisfaction can vary, State Farm generally receives positive feedback for its claims process.

“I recently had to file a claim for a damaged roof after a hailstorm. The process was surprisingly smooth and efficient. The claims adjuster was professional and helpful, and the payment was processed promptly.” – Sarah M.

“State Farm’s customer service has always been excellent. I’ve had to contact them a few times over the years, and they’ve always been responsive and helpful. They’ve made the insurance process much less stressful.” – John S.

However, there are instances where customers have reported delays or difficulties in the claims process.

“I had a minor car accident, and it took a while for the claim to be processed. I had to call several times to get updates, and it felt like I was getting the runaround.” – Emily L.

“I was disappointed with the communication during my claim process. I didn’t receive updates regularly, and it was difficult to get in touch with a representative.” – David K.

It’s important to note that individual experiences can vary, and customer satisfaction may depend on factors such as the complexity of the claim, the specific representative assigned, and the overall efficiency of the local office.

Strengths and Weaknesses of State Farm

State Farm is a household name in the insurance industry, known for its extensive reach and reputation for customer service. However, like any insurance provider, it has its own set of strengths and weaknesses that potential policyholders should consider before making a decision.

Strengths of State Farm

State Farm boasts a strong financial foundation, a wide range of coverage options, and a positive reputation for customer service.

- Financial Stability: State Farm is a mutual company, meaning that it is owned by its policyholders. This structure provides a strong financial foundation, as the company’s profits are distributed to policyholders in the form of dividends or lower premiums. State Farm consistently ranks high in financial stability ratings, providing reassurance to policyholders that the company can meet its obligations in the event of a claim.

- Extensive Coverage Options: State Farm offers a comprehensive suite of homeowners insurance policies, including standard coverage for dwelling, personal property, liability, and additional living expenses. They also provide a variety of optional coverage options, such as earthquake insurance, flood insurance, and identity theft protection, allowing policyholders to customize their coverage to meet their specific needs.

- Customer Service Reputation: State Farm has a long-standing reputation for excellent customer service. The company has a network of agents across the country, providing personalized support and guidance to policyholders. State Farm also invests heavily in technology, offering convenient online and mobile platforms for managing policies, filing claims, and accessing customer support.

Weaknesses of State Farm

While State Farm offers numerous benefits, it’s essential to acknowledge potential weaknesses, such as pricing and coverage limitations.

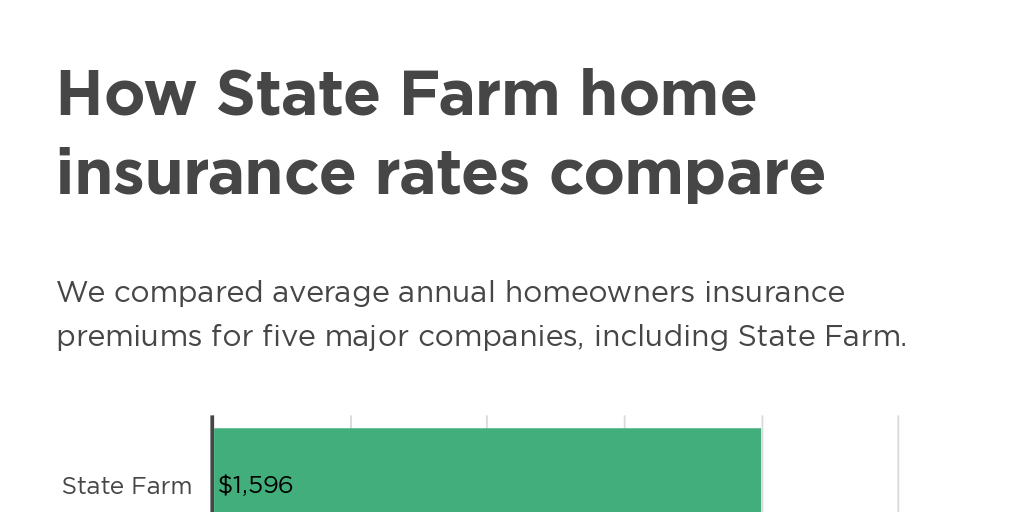

- Pricing: State Farm’s premiums can sometimes be higher compared to other insurance providers. This can be attributed to factors like the company’s financial stability, extensive coverage options, and strong customer service reputation. However, policyholders should compare quotes from multiple insurers to ensure they are getting the best value for their money.

- Coverage Limitations: State Farm, like other insurance providers, may have specific coverage limitations. For example, some policies may have limits on the amount of coverage available for certain types of personal property, such as jewelry or fine art. It’s crucial to carefully review policy documents and understand the coverage limitations before purchasing a policy.

Alternative Homeowners Insurance Providers

Finding the right homeowners insurance company can be a bit like finding the perfect pair of jeans – you want something that fits your needs, budget, and style. While State Farm is a popular choice, it’s not the only game in town. Let’s check out some other players in the homeowners insurance game.

Comparison of Homeowners Insurance Providers

Choosing the right homeowners insurance company is crucial, and comparing different options is essential to find the best fit for your needs and budget. Here’s a table comparing State Farm with other prominent homeowners insurance providers, highlighting key features:

| Provider | Coverage Options | Pricing | Customer Service Ratings | Financial Stability |

|---|---|---|---|---|

| State Farm | Comprehensive coverage options, including standard and optional coverage for various perils, personal property, and liability. | Competitive pricing, often varying based on location, risk factors, and coverage options. | Generally positive customer service ratings, but can vary depending on individual experiences. | Highly rated for financial stability with a strong A+ rating from A.M. Best. |

| Allstate | Offers a wide range of coverage options, including standard and optional coverage for various perils, personal property, and liability. | Competitive pricing, often varying based on location, risk factors, and coverage options. | Mixed customer service ratings, with some positive and negative experiences reported. | Highly rated for financial stability with a strong A+ rating from A.M. Best. |

| Liberty Mutual | Provides comprehensive coverage options, including standard and optional coverage for various perils, personal property, and liability. | Competitive pricing, often varying based on location, risk factors, and coverage options. | Generally positive customer service ratings, with a focus on customer satisfaction. | Highly rated for financial stability with a strong A+ rating from A.M. Best. |

| USAA | Offers a range of coverage options, including standard and optional coverage for various perils, personal property, and liability. | Competitive pricing, often varying based on location, risk factors, and coverage options. | Excellent customer service ratings, particularly for military members and their families. | Highly rated for financial stability with a strong A+ rating from A.M. Best. |

Tips for Choosing the Right Homeowners Insurance

Finding the right homeowners insurance policy can feel like navigating a maze of jargon and fine print. But don’t worry, it doesn’t have to be a stressful experience! By understanding your needs and doing a little research, you can find a policy that protects your biggest investment – your home.

Determining Your Coverage Needs

Before you start shopping around, it’s important to know what kind of coverage you need. Consider factors like the value of your home, the cost of rebuilding it, and the amount of personal property you have. You’ll also want to think about potential risks, such as flooding, earthquakes, or severe weather.

Budgeting for Homeowners Insurance

Homeowners insurance is an essential expense, but it’s also important to find a policy that fits your budget. The cost of insurance can vary significantly based on factors like your location, the age and condition of your home, and your coverage options. It’s wise to get quotes from multiple insurers to compare prices and coverage options.

Getting Quotes and Comparing Options

The best way to find the right homeowners insurance policy is to get quotes from multiple insurers and compare their offerings. You can do this online, over the phone, or by working with an insurance agent. Be sure to ask each insurer about their coverage options, deductibles, and discounts.

Final Thoughts

When it comes to homeowners insurance, there’s no one-size-fits-all answer. While State Farm boasts a strong reputation and offers competitive coverage, it’s essential to weigh your individual needs and budget against their offerings. By comparing quotes, understanding your coverage needs, and considering customer reviews, you can make a decision that protects your home and peace of mind.

FAQ Guide

What are some common discounts offered by State Farm?

State Farm offers a variety of discounts, including those for bundling multiple insurance policies, having safety features in your home, and being a good driver. Check with your local State Farm agent to see what discounts you qualify for.

How does State Farm’s claims process work?

State Farm offers multiple ways to file a claim, including online, by phone, or through a local agent. They aim to process claims quickly and fairly, but the specific timeline can vary depending on the complexity of the claim.

Is State Farm a good option for homeowners with unique needs?

State Farm offers a wide range of coverage options, but some homeowners may find that their specific needs aren’t fully met. It’s essential to discuss your individual needs with a State Farm agent to determine if their policies are the right fit for you.