- Florida Lease Car Insurance Requirements Overview: Lease Car Insurance Requirements Florida

- Liability Coverage

- Collision and Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

- Personal Injury Protection (PIP)

- Lease Agreement Specifics

- Insurance Provider Options

- Consequences of Insufficient Coverage

- Tips for Obtaining and Maintaining Coverage

- Epilogue

- FAQ Overview

Lease car insurance requirements Florida are crucial for protecting yourself and your vehicle financially. When you lease a car in Florida, you are legally obligated to carry specific types of insurance coverage to meet both state and lease agreement requirements. This ensures that you are financially protected in case of an accident or other unforeseen events.

Understanding the different types of insurance coverage, their importance, and the potential consequences of insufficient coverage is essential for responsible lease car ownership. This guide will delve into the specifics of lease car insurance requirements in Florida, providing you with the knowledge to make informed decisions and avoid costly surprises.

Florida Lease Car Insurance Requirements Overview: Lease Car Insurance Requirements Florida

In Florida, driving a leased vehicle necessitates adhering to specific insurance requirements. These requirements are typically Artikeld in the lease agreement and enforced by the state’s Department of Motor Vehicles (DMV). Understanding these regulations is crucial for leaseholders to ensure compliance and avoid potential penalties.

Insurance Coverage Mandated by Lease Agreements

Lease agreements typically require comprehensive insurance coverage, protecting the vehicle against various risks. The most common types of coverage include:

- Liability Coverage: This protects the lessee and the leasing company against financial losses resulting from accidents caused by the lessee. It covers bodily injury and property damage to third parties.

- Collision Coverage: This covers repairs or replacement of the leased vehicle in case of an accident, regardless of fault. It is typically required to protect the leasing company’s financial interest in the vehicle.

- Comprehensive Coverage: This covers damage to the leased vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): This coverage, mandated by Florida law, provides medical benefits for the lessee and passengers in the leased vehicle, regardless of fault. It covers medical expenses, lost wages, and other related costs.

- Uninsured Motorist Coverage: This coverage protects the lessee and passengers in the leased vehicle from financial losses caused by accidents involving uninsured or underinsured drivers.

Florida Department of Motor Vehicles (DMV) Regulations

The Florida DMV mandates that all vehicles registered in the state, including leased vehicles, must have a minimum amount of liability insurance. This includes:

- Bodily Injury Liability: $10,000 per person and $20,000 per accident.

- Property Damage Liability: $10,000 per accident.

Lease agreements may require higher coverage limits than the DMV minimums. It is essential for lessees to review their lease agreements carefully and ensure that their insurance policy meets all the required coverage levels.

Liability Coverage

In Florida, liability insurance is mandatory for all car owners. It protects you financially if you’re at fault in an accident that causes injuries or damages to others.

Liability insurance is essential to cover the costs of damages or injuries you may cause to others in an accident. It also helps protect your assets, like your home or savings, from being seized to pay for damages.

Types of Liability Coverage

Liability coverage is typically divided into two main categories: bodily injury liability and property damage liability. Each type of coverage has a specific limit, which represents the maximum amount your insurance company will pay for claims related to that category.

- Bodily injury liability covers medical expenses, lost wages, and pain and suffering for the other driver and passengers involved in an accident if you are at fault.

- Property damage liability covers repairs or replacement costs for the other driver’s vehicle and any other property damaged in an accident if you are at fault.

Scenarios Where Liability Insurance is Crucial

Liability insurance is essential in several situations. Here are a few examples of scenarios where liability insurance is crucial:

- You cause an accident that injures another driver: Your liability insurance will cover their medical bills, lost wages, and pain and suffering, up to your policy’s limits.

- You cause an accident that damages another driver’s vehicle: Your liability insurance will cover the cost of repairs or replacement, up to your policy’s limits.

- You cause an accident that damages property, such as a building or a fence: Your liability insurance will cover the cost of repairs or replacement, up to your policy’s limits.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional insurance coverages for leased vehicles in Florida. They provide financial protection for damages to your leased car, offering peace of mind and financial security in case of accidents or unforeseen events.

Benefits of Collision and Comprehensive Coverage

Having collision and comprehensive coverage on your leased vehicle in Florida offers several advantages:

- Financial Protection: Collision and comprehensive coverage protect you from significant financial burdens in case of accidents or damage to your leased vehicle. These coverages can help cover the cost of repairs or replacement, ensuring you’re not responsible for hefty repair bills or the cost of replacing the car.

- Peace of Mind: Knowing you have collision and comprehensive coverage can provide you with peace of mind, knowing that you are financially protected in the event of an accident or damage to your leased vehicle. This can help reduce stress and anxiety, allowing you to focus on other aspects of your life.

- Compliance with Lease Agreement: Many lease agreements require collision and comprehensive coverage as a condition of the lease. Having these coverages ensures you meet the terms of your lease agreement and avoid potential penalties or complications.

Examples of Situations Where Collision and Comprehensive Coverage Applies

Here are some examples of situations where collision and comprehensive coverage would apply:

- Collision Coverage: Collision coverage would apply if your leased vehicle is damaged in an accident with another vehicle or an object, such as a tree or a pole. This coverage would help pay for repairs or replacement of your car, regardless of who is at fault.

- Comprehensive Coverage: Comprehensive coverage would apply if your leased vehicle is damaged by events other than collisions, such as theft, vandalism, fire, hail, or a natural disaster. This coverage can help pay for repairs or replacement of your car, even if you were not involved in an accident.

Uninsured/Underinsured Motorist Coverage

In Florida, uninsured/underinsured motorist (UM/UIM) coverage is a vital component of car insurance. This coverage safeguards you financially if you are involved in an accident caused by a driver who lacks sufficient insurance or no insurance at all. It’s crucial to understand the potential risks of driving without UM/UIM coverage and how it can protect you in various scenarios.

The Importance of Uninsured/Underinsured Motorist Coverage

UM/UIM coverage is essential for Florida drivers because it provides financial protection in situations where the other driver is at fault but does not have adequate insurance to cover your losses. This coverage can help you pay for medical expenses, lost wages, and property damage.

- Financial Protection: UM/UIM coverage can help you recover costs associated with injuries and property damage, even if the at-fault driver is uninsured or underinsured. It helps you avoid substantial out-of-pocket expenses.

- Peace of Mind: Knowing you have UM/UIM coverage can provide peace of mind, knowing that you are protected in case of an accident with an uninsured or underinsured driver.

Potential Risks of Driving Without UM/UIM Coverage, Lease car insurance requirements florida

Driving without UM/UIM coverage in Florida can expose you to significant financial risks. In a collision with an uninsured or underinsured driver, you could be left responsible for covering your own medical bills, property damage, and other related expenses.

- Financial Burden: Without UM/UIM coverage, you may be forced to pay for your losses out of pocket, potentially leading to significant financial hardship.

- Legal Issues: If you are injured in an accident caused by an uninsured driver, you may need to pursue legal action to recover your losses.

Situations Where UM/UIM Coverage Is Beneficial

UM/UIM coverage can be a lifesaver in various scenarios, including:

- Hit-and-Run Accidents: If a driver hits your vehicle and flees the scene, you may not be able to identify or locate the driver to seek compensation. UM/UIM coverage can step in to cover your losses.

- Accidents with Underinsured Drivers: If the other driver’s insurance limits are insufficient to cover your losses, UM/UIM coverage can help make up the difference.

- Accidents with Drivers Who Have No Insurance: In Florida, it is illegal to drive without insurance. However, some drivers still operate vehicles without coverage. UM/UIM coverage protects you in such situations.

Personal Injury Protection (PIP)

Florida is a no-fault insurance state, which means that drivers are primarily responsible for covering their own medical expenses and lost wages after an accident, regardless of who is at fault. This is where Personal Injury Protection (PIP) coverage comes in.

PIP coverage is mandatory for all Florida drivers and is designed to help cover medical expenses, lost wages, and other related costs incurred as a result of an accident, regardless of who is at fault. It is a crucial component of Florida’s no-fault insurance system.

Benefits of PIP Coverage

PIP coverage provides several benefits to Florida drivers in the event of an accident. These benefits include:

- Medical Expenses: PIP coverage helps pay for medical expenses related to the accident, such as doctor’s visits, hospital stays, surgery, and rehabilitation.

- Lost Wages: If you are unable to work due to injuries sustained in an accident, PIP coverage can help replace a portion of your lost income.

- Death Benefits: If an accident results in a fatality, PIP coverage can provide death benefits to the deceased’s beneficiaries.

- Other Expenses: PIP coverage can also help cover other expenses related to the accident, such as funeral expenses, transportation costs, and childcare.

Limitations of PIP Coverage

While PIP coverage offers valuable benefits, it does have certain limitations.

- Coverage Limits: PIP coverage in Florida is limited to $10,000 per person for medical expenses and $5,000 for lost wages. This means that if your medical expenses exceed $10,000, you will be responsible for the remaining amount.

- Deductibles: PIP coverage often comes with a deductible, which is the amount you must pay out of pocket before your PIP coverage kicks in. The deductible can vary depending on your insurance policy.

- Medical Provider Networks: Some PIP policies may require you to seek treatment from specific medical providers within their network. If you choose to see a provider outside of the network, you may have to pay a higher out-of-pocket cost.

Situations Where PIP Coverage Applies

PIP coverage applies to a wide range of situations, including:

- Accidents involving your own vehicle: If you are involved in an accident while driving your own car, your PIP coverage will apply, regardless of who is at fault.

- Accidents involving other vehicles: PIP coverage also applies to accidents involving other vehicles, even if you are not at fault.

- Hit-and-run accidents: If you are involved in a hit-and-run accident, your PIP coverage will still apply.

- Accidents involving pedestrians or cyclists: PIP coverage applies to accidents involving pedestrians or cyclists, even if you are not at fault.

Lease Agreement Specifics

Lease agreements often contain specific insurance requirements that go beyond the minimum state-mandated coverage. These requirements are designed to protect the leasing company’s financial interests in the vehicle.

It is crucial to thoroughly review the lease agreement to understand the insurance provisions. Failure to comply with these requirements can result in financial penalties or even lease termination.

Insurance Requirements in Lease Agreements

Lease agreements typically specify the minimum insurance coverage levels required, including:

- Liability Coverage: This coverage protects the lessee and the leasing company from financial losses due to accidents caused by the lessee. The lease agreement may specify a higher liability limit than the state minimum.

- Collision and Comprehensive Coverage: These coverages protect the vehicle against damage from accidents and other events, such as theft or vandalism. Lease agreements often require the lessee to carry both collision and comprehensive coverage with deductibles that are acceptable to the leasing company.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the lessee and passengers in the event of an accident with an uninsured or underinsured driver. Lease agreements may require this coverage with specific limits.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for the lessee and passengers in the event of an accident, regardless of fault. Lease agreements may require PIP coverage with specific limits.

In addition to coverage types, lease agreements may also specify:

- Named Insureds: The lease agreement may require the leasing company to be named as an additional insured on the policy. This ensures that the leasing company is protected in the event of an accident.

- Insurance Provider: Some lease agreements may specify that the lessee must obtain insurance from a particular provider or group of providers.

- Deductible Limits: Lease agreements may set limits on the deductibles for collision and comprehensive coverage.

- Proof of Insurance: The lessee may be required to provide proof of insurance to the leasing company on a regular basis, such as annually or when making lease payments.

It is important to note that the specific insurance requirements in a lease agreement can vary depending on the leasing company, the vehicle, and the state.

Insurance Provider Options

Choosing the right insurance provider for your leased car in Florida is crucial. You need a company that offers comprehensive coverage, competitive pricing, and excellent customer service. Several insurance providers cater to Florida residents, each with its strengths and weaknesses.

Comparing Insurance Providers

When comparing insurance providers, consider factors like coverage options, pricing, and customer service. Some providers offer specialized coverage for leased vehicles, while others may have more competitive rates for certain types of drivers. You can use online comparison tools or speak with insurance agents to get quotes and compare different options.

| Provider | Coverage Options | Pricing | Customer Service |

|---|---|---|---|

| State Farm | Comprehensive coverage, including collision, liability, and personal injury protection | Competitive rates, discounts available for safe driving and bundling policies | High customer satisfaction ratings, available 24/7 through phone, email, and online chat |

| Geico | Comprehensive coverage, including collision, liability, and uninsured/underinsured motorist coverage | Competitive rates, discounts available for good driving history and multiple vehicles | High customer satisfaction ratings, available 24/7 through phone, email, and online chat |

| Progressive | Comprehensive coverage, including collision, liability, and personal injury protection | Competitive rates, discounts available for good driving history and safe driving courses | High customer satisfaction ratings, available 24/7 through phone, email, and online chat |

| Allstate | Comprehensive coverage, including collision, liability, and uninsured/underinsured motorist coverage | Competitive rates, discounts available for safe driving and bundling policies | High customer satisfaction ratings, available 24/7 through phone, email, and online chat |

Consequences of Insufficient Coverage

Driving a leased vehicle without adequate insurance in Florida can lead to serious financial and legal consequences. Failing to meet the insurance requirements Artikeld in your lease agreement can result in substantial costs, potential legal action, and even the loss of your leased vehicle.

Financial Implications

Not meeting your lease agreement’s insurance requirements can lead to significant financial burdens. Here’s a breakdown of the potential costs:

- Increased Insurance Premiums: If you’re caught driving with inadequate coverage, your insurance provider may increase your premiums significantly. This is because you are considered a higher risk due to your past actions.

- Lease Termination Fees: Your lease agreement likely includes clauses regarding insurance requirements. Failing to meet these requirements can result in hefty lease termination fees.

- Out-of-Pocket Expenses: In the event of an accident, you’ll be responsible for covering any damages to your leased vehicle, other vehicles involved, and any medical expenses, even if you are not at fault. This could result in significant out-of-pocket expenses.

- Legal Fees: If you’re involved in an accident without adequate insurance, you could be sued by the other party. This could lead to substantial legal fees and potential financial judgments against you.

Real-World Scenarios

Consider these real-world scenarios to understand the potential consequences of driving a leased vehicle without sufficient insurance:

- Scenario 1: You’re involved in an accident and are found at fault. Your insurance coverage is insufficient to cover the damages to the other vehicle and their medical expenses. You’ll be responsible for covering the difference, which could be thousands of dollars. Additionally, you could face legal action from the other party, further increasing your financial burden.

- Scenario 2: You’re involved in an accident with an uninsured driver. You have minimal coverage and are responsible for covering the costs of your own vehicle’s repairs, medical expenses, and potential legal fees. This could result in significant out-of-pocket expenses, potentially forcing you to default on your lease payments.

Tips for Obtaining and Maintaining Coverage

Securing the right insurance coverage for your leased vehicle in Florida involves careful consideration of your needs and budget. It’s crucial to navigate the process effectively to ensure you’re adequately protected while managing your expenses.

Negotiating Insurance Rates and Coverage Options

Negotiating insurance rates and coverage options can significantly impact your overall costs. Here are some strategies to consider:

- Shop around and compare quotes: Contact multiple insurance providers to obtain quotes and compare their rates and coverage options. This allows you to identify the best value for your specific needs.

- Bundle your policies: Consider bundling your auto insurance with other policies, such as homeowners or renters insurance, to potentially qualify for discounts.

- Take advantage of discounts: Explore available discounts, such as safe driving discounts, good student discounts, and multi-car discounts, to reduce your premium.

- Increase your deductible: Increasing your deductible can lower your premium, but it also means you’ll have to pay more out of pocket in case of an accident. Carefully weigh the pros and cons of this option.

- Consider coverage options carefully: Evaluate your needs and choose the coverage options that provide adequate protection without unnecessary expenses. For example, you might consider dropping collision and comprehensive coverage if your leased vehicle is older and has a lower value.

Maintaining Insurance Coverage Throughout the Lease Term

Maintaining consistent insurance coverage is essential throughout the lease term. Failure to do so can lead to significant financial consequences. Here are some tips to ensure uninterrupted coverage:

- Set reminders for premium payments: Establish a system to remind yourself of upcoming premium payments to avoid lapses in coverage.

- Review your policy periodically: Regularly review your policy to ensure it still meets your needs and to identify potential opportunities for cost savings.

- Notify your insurer of changes: Inform your insurer of any significant changes, such as a change in address, driving habits, or vehicle usage, to ensure your policy remains accurate and relevant.

- Maintain a good driving record: A clean driving record can qualify you for discounts and potentially lower your premiums. Avoid traffic violations and accidents to maintain a favorable record.

- Pay your premiums on time: Timely premium payments are crucial for maintaining continuous coverage. Late payments can lead to penalties and even cancellation of your policy.

Epilogue

Navigating the world of lease car insurance in Florida can seem daunting, but with careful planning and understanding, you can ensure that you have the right coverage to protect yourself financially. By adhering to state regulations, fulfilling lease agreement requirements, and choosing the right insurance provider, you can drive confidently knowing that you are covered in the event of an accident or other unforeseen circumstances. Remember to review your insurance policy regularly and make adjustments as needed to maintain adequate coverage throughout your lease term.

FAQ Overview

What are the minimum liability coverage requirements in Florida for leased cars?

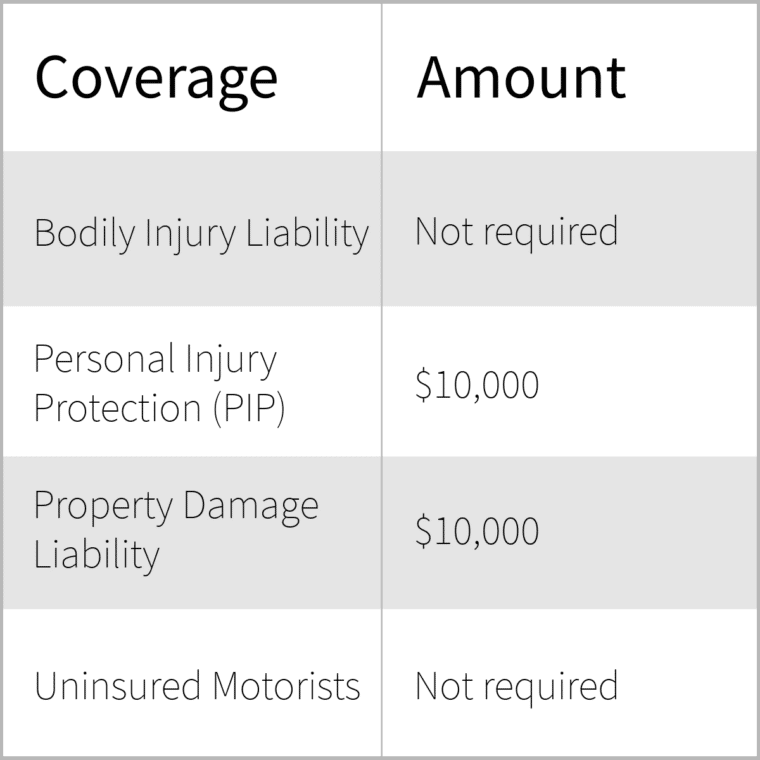

Florida requires a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage for all vehicles, including leased cars.

What are the consequences of not meeting the insurance requirements in my lease agreement?

Failing to maintain the required insurance coverage can lead to several consequences, including:

- Denial of insurance claims

- Financial penalties and fees

- Termination of your lease agreement

- Legal liabilities in case of an accident

Can I use my own insurance policy for my leased car?

Yes, you can use your existing insurance policy for your leased car, but it must meet the requirements Artikeld in your lease agreement. You may need to add the leased vehicle to your policy or adjust your coverage levels to comply with the lease terms.

How do I find the best insurance provider for my leased car in Florida?

To find the best insurance provider, compare quotes from different insurers, considering factors such as coverage options, pricing, customer service, and financial stability. You can use online comparison tools or consult with an insurance broker for assistance.