Navigating the world of leased car insurance in Florida can feel like driving through a maze of regulations and requirements. Leased car insurance requirements Florida are a critical aspect of owning a leased vehicle, ensuring both financial protection and compliance with state laws. Understanding these requirements is crucial for every leaseholder, as it safeguards you from potential financial burdens in case of accidents, damage, or theft.

Florida, like many states, has specific insurance mandates for leased cars. This includes minimum liability coverage to protect you and others on the road, as well as additional coverage options tailored to the unique aspects of leasing a vehicle. This guide delves into the key elements of leased car insurance in Florida, providing insights into the types of coverage, factors influencing premiums, and the importance of choosing the right insurance provider.

Florida’s Compulsory Insurance Requirements: Leased Car Insurance Requirements Florida

Florida law requires all drivers to carry a minimum amount of liability insurance, regardless of whether they own or lease their vehicle. This ensures that financial protection is available for victims of accidents caused by uninsured or underinsured drivers. This requirement is essential for leased car owners, as they are financially responsible for any damages or injuries resulting from accidents involving their leased vehicles.

Financial Responsibility Laws, Leased car insurance requirements florida

Florida’s financial responsibility laws mandate that all drivers prove their ability to pay for damages and injuries resulting from accidents they cause. This is typically achieved by carrying adequate liability insurance. Failure to meet these requirements can lead to serious consequences, including:

- Suspension of driving privileges

- Vehicle registration suspension

- Fines and penalties

- Potential legal action in case of an accident

These consequences highlight the importance of complying with Florida’s financial responsibility laws, especially for leased car owners, who are financially responsible for their vehicles.

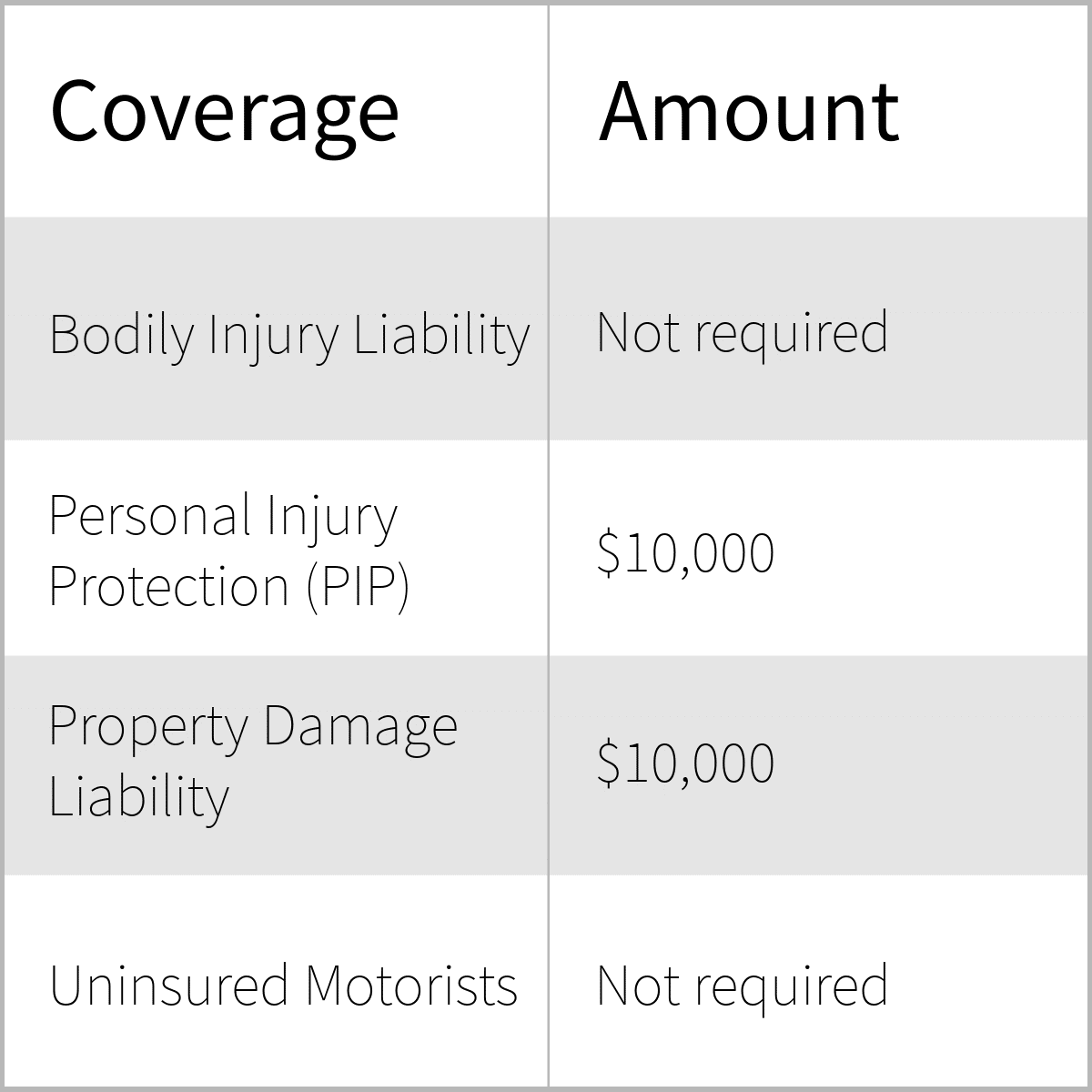

Minimum Liability Insurance Coverage

Florida’s minimum liability insurance requirements are as follows:

- Bodily Injury Liability: $10,000 per person / $20,000 per accident

- Property Damage Liability: $10,000 per accident

- Personal Injury Protection (PIP): $10,000 per person

These coverage amounts are the minimum required by law. However, leased car owners may be required to carry higher coverage amounts as specified in their lease agreements.

Bodily Injury Liability: Covers medical expenses, lost wages, and other damages resulting from injuries caused to other people in an accident.

Property Damage Liability: Covers damages to another person’s property, such as their vehicle or other belongings, in an accident.

Personal Injury Protection (PIP): Covers medical expenses, lost wages, and other damages for the insured person, regardless of fault, in an accident.

Lease Agreement and Insurance Provisions

Lease agreements in Florida typically contain specific insurance requirements that lessees must meet to protect the leasing company’s financial interests. These provisions are crucial for both the lessee and the leasing company, ensuring that the vehicle is adequately insured in case of an accident or other damage.

Insurance Requirements in Lease Agreements

Lease agreements usually specify the minimum insurance coverage required, which typically includes liability insurance, collision coverage, and comprehensive coverage. These coverages protect the leasing company against financial losses arising from accidents, theft, or damage to the leased vehicle.

- Liability Insurance: This coverage protects the lessee and the leasing company from financial responsibility for bodily injury or property damage caused by the lessee’s negligence while driving the leased vehicle. The minimum liability limits required by the lease agreement are usually higher than the state-mandated minimums.

- Collision Coverage: This coverage pays for repairs or replacement of the leased vehicle if it is damaged in an accident, regardless of fault. Collision coverage protects the leasing company against financial losses due to damage to the leased vehicle.

- Comprehensive Coverage: This coverage protects the leased vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Comprehensive coverage ensures that the leasing company is not responsible for replacing or repairing the leased vehicle if it is damaged by such events.

Loss of Use Coverage

Some lease agreements may also require the lessee to obtain “loss of use” coverage. This coverage compensates the leasing company for the loss of income they incur while the leased vehicle is being repaired or replaced due to an accident or other covered event.

“Loss of use” coverage reimburses the leasing company for the rental fees they have to pay for a replacement vehicle while the leased vehicle is unavailable.

Adding the Leasing Company as a Named Insured

To ensure that the leasing company is adequately protected, lease agreements often require the lessee to add the leasing company as a named insured on their insurance policy. This means that the leasing company is listed as an insured party on the policy, giving them the right to file a claim and receive compensation for any covered losses.

- Benefits of Adding the Leasing Company: Adding the leasing company as a named insured ensures that they are covered for any losses related to the leased vehicle, even if the lessee is at fault. This protects the leasing company’s financial interests and simplifies the claims process in case of an accident or other covered event.

- Process of Adding the Leasing Company: The process of adding the leasing company as a named insured varies depending on the insurance company. However, it usually involves providing the insurance company with the leasing company’s name, address, and policy number. The lessee should contact their insurance agent or broker to discuss the specific requirements and procedures for adding the leasing company to their policy.

Types of Insurance Coverage for Leased Cars

In Florida, leasing a car comes with specific insurance requirements to protect both the leasing company and the lessee. While the minimum coverage required by law may suffice, it’s often advisable to consider additional coverage options for comprehensive protection.

Types of Coverage for Leased Cars

Understanding the various types of insurance coverage available for leased cars is crucial to make informed decisions about your protection and financial responsibility. Here are the common types of coverage you should consider:

- Liability Coverage: This is the minimum required insurance in Florida, covering bodily injury and property damage to others in case of an accident caused by you. However, it doesn’t cover your vehicle’s damage or your own injuries.

- Personal Injury Protection (PIP): This coverage, also mandatory in Florida, pays for medical expenses and lost wages for you and your passengers in an accident, regardless of fault.

- Collision Coverage: This coverage pays for repairs or replacement of your leased vehicle if it’s damaged in an accident, regardless of fault. It’s typically recommended for leased cars, as you’re responsible for any damage to the vehicle.

- Comprehensive Coverage: This coverage protects your leased car against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It’s advisable for leased cars as it covers damage not covered by collision coverage.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you and your passengers if you’re involved in an accident with an uninsured or underinsured driver. It can cover medical expenses, lost wages, and property damage.

Benefits of Comprehensive Coverage

Comprehensive coverage offers financial protection against a wide range of perils that can damage your leased vehicle, including:

- Theft: If your car is stolen, comprehensive coverage helps cover the cost of replacing it or paying the leasing company for the remaining lease payments.

- Vandalism: This coverage can help repair or replace your vehicle if it’s damaged by vandalism, such as broken windows or graffiti.

- Fire: Comprehensive coverage can pay for repairs or replacement of your car if it’s damaged in a fire, regardless of whether it’s your fault.

- Natural Disasters: This coverage can protect your car against damage caused by events like hurricanes, floods, earthquakes, or hailstorms.

Benefits of Collision Coverage

Collision coverage provides financial protection for repairs or replacement of your leased vehicle if it’s damaged in an accident, even if you’re at fault. Here’s why it’s essential for leased cars:

- Financial Responsibility: You’re responsible for any damage to the leased vehicle, and collision coverage can help you avoid significant out-of-pocket expenses.

- Lease Agreement: Most lease agreements require you to maintain collision coverage throughout the lease term. Failing to do so can result in penalties or even termination of the lease.

- Peace of Mind: Knowing that your car is insured for collision damage provides peace of mind, knowing you’re protected in case of an accident.

Benefits of Uninsured/Underinsured Motorist Coverage (UM/UIM)

UM/UIM coverage is crucial for leased cars in Florida, as it protects you in situations where the other driver is uninsured or doesn’t have enough insurance to cover your losses. Here’s why it’s essential:

- Hit-and-Run Accidents: This coverage can help cover your expenses if you’re hit by a driver who flees the scene.

- Insufficient Coverage: If the other driver has minimal liability coverage, UM/UIM can make up the difference in your losses.

- Financial Protection: This coverage ensures you’re financially protected even if the other driver is uninsured or underinsured, preventing you from bearing the burden of their negligence.

Comparing Coverage Options and Costs

The cost of insurance coverage for leased cars can vary depending on factors such as your driving history, age, vehicle type, and location. It’s important to compare quotes from multiple insurance companies to find the best coverage at a reasonable price.

- Liability Coverage: This is typically the most affordable coverage option, as it’s the minimum required by law. However, it offers limited protection.

- PIP: This coverage is mandatory in Florida and is generally included in your insurance premium.

- Collision and Comprehensive Coverage: These coverages are typically more expensive than liability coverage but offer significant financial protection. The cost can vary depending on the value of your leased vehicle.

- UM/UIM Coverage: This coverage is generally an additional cost but provides essential protection against uninsured or underinsured drivers.

Factors Affecting Insurance Premiums

Understanding the factors that influence leased car insurance premiums in Florida is crucial for securing the best rates. Several factors, from your driving history to the type of car you lease, can significantly impact your insurance costs. This knowledge empowers you to make informed decisions and potentially save money on your insurance.

Driver’s Age and Driving History

Your age and driving history are two of the most significant factors affecting your car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. As a result, insurance companies typically charge higher premiums for younger drivers. Your driving history also plays a crucial role. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher premiums.

Vehicle Type

The type of vehicle you lease can also impact your insurance premiums. Luxury cars, high-performance vehicles, and vehicles with expensive parts tend to have higher insurance premiums. This is because these vehicles are more expensive to repair or replace in case of an accident.

Credit Score

Surprisingly, your credit score can also influence your car insurance premiums in Florida. Insurance companies use credit scores as an indicator of your financial responsibility. Individuals with good credit scores are typically seen as less risky to insure and may qualify for lower premiums.

Driving Location

The location where you primarily drive your leased car can also affect your insurance premiums. Urban areas with heavy traffic and higher crime rates tend to have higher accident rates. As a result, insurance companies may charge higher premiums for drivers who reside in these areas.

Tips for Obtaining Discounts on Leased Car Insurance

- Safe Driving Course Completion: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount on your premiums.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may qualify for a multi-car discount.

- Bundling Policies: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant savings.

- Good Student Discount: If you’re a student with good grades, you may be eligible for a good student discount.

- Loyalty Discount: Some insurance companies offer loyalty discounts to customers who have been with them for a certain period.

- Anti-theft Devices: Installing anti-theft devices in your leased car, such as an alarm system or GPS tracking, can reduce your insurance premiums.

Outcome Summary

In conclusion, understanding leased car insurance requirements in Florida is essential for any leaseholder. By complying with state regulations, securing adequate coverage, and making informed decisions about your insurance provider, you can navigate the complexities of leased car insurance with confidence. Remember to carefully review your lease agreement, compare quotes from multiple insurers, and consider factors such as your driving history, vehicle type, and financial situation when selecting your policy. Armed with this knowledge, you can drive your leased car with peace of mind, knowing you’re protected from the unexpected.

FAQ Resource

What is the minimum liability coverage required for leased cars in Florida?

Florida requires a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person, with a total of $20,000 in BIL per accident.

Do I need collision and comprehensive coverage for a leased car in Florida?

While not mandatory, collision and comprehensive coverage are highly recommended for leased cars. These coverages protect you against damage from accidents and other events, such as theft or vandalism.

What is gap insurance, and is it necessary for a leased car?

Gap insurance covers the difference between the actual cash value of your leased car and the amount you owe on the lease in case of a total loss. It’s often recommended for leased vehicles, as the actual cash value may be lower than the outstanding lease balance.

How can I get discounts on leased car insurance in Florida?

Discounts are available for various factors, including safe driving records, good credit scores, multiple car insurance, and safety features in your vehicle. Ask your insurer about available discounts.