Navigating the world of car insurance in Florida can feel like driving through a maze. Finding the least expensive car insurance in Florida requires understanding the factors that influence costs, exploring affordable options, and employing smart strategies to save. From mandatory coverages to optional protections, the choices you make directly impact your premium. This guide delves into the intricacies of Florida’s car insurance market, providing insights on how to find the best coverage at the most affordable price.

Florida’s unique insurance landscape, driven by factors like weather patterns, high population density, and a litigious environment, can lead to higher premiums compared to other states. Understanding these factors is crucial for making informed decisions about your car insurance.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance market is unique and complex, influenced by a combination of factors that contribute to its high costs. Understanding these factors is crucial for drivers seeking the most affordable coverage.

Factors Influencing Car Insurance Costs in Florida

Several factors play a significant role in determining car insurance costs in Florida. These include:

- High Number of Accidents and Claims: Florida has a high frequency of car accidents, leading to a greater number of insurance claims. This puts upward pressure on insurance premiums to cover the increased costs associated with accidents and claims.

- High Property Values: Florida’s real estate market is characterized by high property values, which can significantly impact insurance costs in the event of an accident. This is especially true for areas with a high concentration of luxury vehicles.

- Fraudulent Claims: Florida is known for having a significant problem with insurance fraud, particularly in the realm of staged accidents. This fraud inflates insurance costs for all drivers as insurers need to factor in the risk of fraudulent claims.

- Hurricane Risk: Florida is highly vulnerable to hurricanes, which can cause widespread damage to vehicles. Insurance companies factor in this risk into their premiums, particularly for coastal areas.

- High Cost of Living: Florida’s high cost of living, including medical expenses, also contributes to higher car insurance premiums. This is because insurance companies need to cover the cost of medical care in the event of an accident.

- State-Mandated Coverage: Florida requires all drivers to carry a minimum amount of Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. These mandatory coverage requirements can impact insurance costs.

Unique Aspects of Florida’s Insurance Market, Least expensive car insurance in florida

Florida’s car insurance market has several unique aspects that influence costs:

- No-Fault Insurance System: Florida operates under a no-fault insurance system, where drivers are primarily responsible for their own medical expenses after an accident, regardless of fault. This system can lead to higher insurance costs as drivers are more likely to file claims for minor injuries.

- Limited Tort System: Florida has a limited tort system, which restricts a driver’s ability to sue for non-economic damages, such as pain and suffering, unless they meet certain criteria. This system can influence insurance costs by limiting the potential liability for insurance companies.

- High Competition Among Insurance Companies: Florida has a highly competitive insurance market, with many companies vying for customers. This competition can drive down premiums for some drivers but can also lead to complex pricing structures and variations in coverage offerings.

Florida’s Insurance Regulations

The Florida Office of Insurance Regulation (OIR) plays a vital role in overseeing the state’s insurance market, including car insurance. The OIR sets regulations and standards to ensure fair and competitive pricing practices. It also investigates complaints against insurance companies and works to protect consumers from unfair or deceptive practices.

Key Factors Determining Car Insurance Costs: Least Expensive Car Insurance In Florida

Car insurance premiums in Florida are influenced by a complex interplay of factors, each contributing to the final cost. Understanding these factors is crucial for drivers seeking the most affordable coverage.

Driving History

A driver’s history plays a significant role in determining insurance premiums. Insurance companies consider factors such as past accidents, traffic violations, and driving experience.

- Accidents: Drivers with a history of accidents are considered higher risk and often face higher premiums. The number, severity, and recency of accidents are all taken into account. For example, a driver with a recent at-fault accident may see a significant increase in their premiums compared to someone with a clean driving record.

- Traffic Violations: Traffic violations like speeding tickets, DUI/DWI, or reckless driving can also increase insurance costs. These violations indicate a higher risk of future accidents and can lead to higher premiums. The severity and frequency of violations are considered when calculating premiums.

- Driving Experience: Newer drivers, especially those under 25, are statistically more likely to be involved in accidents. Insurance companies often charge higher premiums for young drivers due to their lack of experience. As drivers gain experience and demonstrate safe driving habits, their premiums may decrease over time.

Vehicle Type

The type of vehicle you drive also influences your insurance costs.

- Make and Model: Certain car makes and models are statistically more prone to accidents or theft, which can impact insurance premiums. For example, sports cars or luxury vehicles may have higher premiums due to their higher repair costs and increased risk of theft.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and stability control are often considered safer and may qualify for discounts. Insurance companies recognize these features as reducing the risk of accidents and injuries, leading to lower premiums.

- Vehicle Value: The value of your vehicle also plays a role. More expensive vehicles generally have higher insurance premiums due to the higher cost of repairs or replacement in case of an accident.

Coverage Options

The level of coverage you choose significantly impacts your insurance costs.

- Liability Coverage: Liability coverage is required in Florida and protects you financially if you cause an accident that results in injury or property damage to others. Higher liability limits offer greater protection but also come with higher premiums.

- Collision and Comprehensive Coverage: These coverages are optional and protect your vehicle from damage due to accidents or other events like theft or vandalism. Choosing higher deductibles (the amount you pay out of pocket before insurance kicks in) can lower your premiums.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have adequate insurance. Choosing higher limits can provide greater financial security but also increase premiums.

Demographics and Location

Factors like age, gender, marital status, and location can also influence insurance costs.

- Age: Younger drivers, especially those under 25, are often charged higher premiums due to their higher risk of accidents. As drivers age and gain experience, their premiums may decrease. Older drivers may face higher premiums due to potential health issues that could affect their driving abilities.

- Gender: Historically, insurance companies have charged women lower premiums than men, as women have statistically lower accident rates. However, this practice is becoming less common in many states, including Florida.

- Marital Status: Married drivers are often considered lower risk and may receive lower premiums compared to single drivers. This is because married drivers tend to have more stable lifestyles and may be more responsible on the road.

- Location: Your zip code can significantly impact insurance costs. Areas with higher crime rates, traffic congestion, or a higher frequency of accidents may have higher premiums. Insurance companies consider the risk associated with different locations when setting rates.

Exploring Affordable Car Insurance Options

Finding the right car insurance in Florida can be challenging, especially when trying to balance affordability with comprehensive coverage. This section will explore various options, provide tips for finding affordable car insurance, and explain how to effectively compare quotes from different insurers.

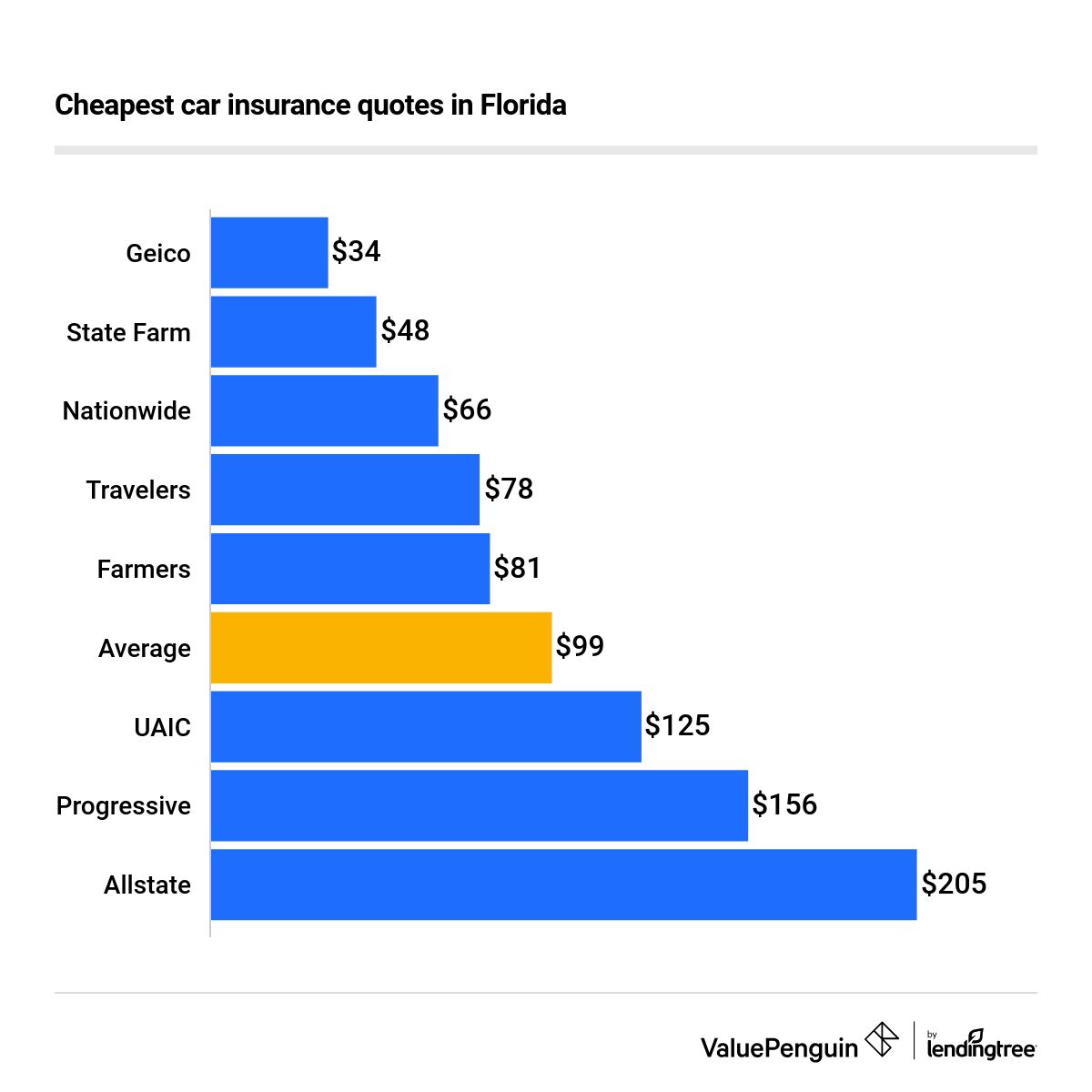

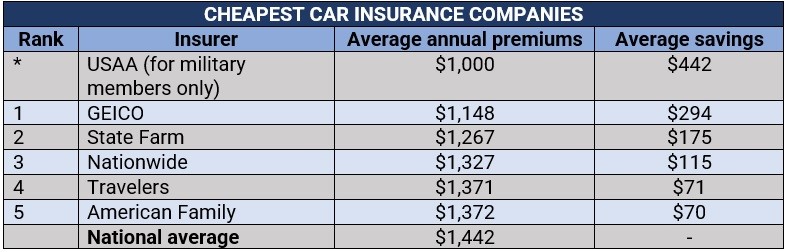

Comparing Car Insurance Providers in Florida

Choosing the right car insurance provider in Florida requires careful consideration of factors like coverage, pricing, and customer reviews. To help you navigate this process, here’s a comparison table showcasing some popular insurers in Florida:

| Provider | Coverage Options | Average Annual Premium | Customer Reviews |

|—|—|—|—|

| State Farm | Comprehensive, collision, liability, uninsured/underinsured motorist | $1,200 – $1,800 | 4.5/5 stars |

| GEICO | Comprehensive, collision, liability, uninsured/underinsured motorist | $1,000 – $1,600 | 4.2/5 stars |

| Progressive | Comprehensive, collision, liability, uninsured/underinsured motorist | $1,100 – $1,700 | 4.0/5 stars |

| USAA | Comprehensive, collision, liability, uninsured/underinsured motorist | $1,050 – $1,550 | 4.7/5 stars |

| Allstate | Comprehensive, collision, liability, uninsured/underinsured motorist | $1,300 – $1,900 | 3.8/5 stars |

Remember that these are just average estimates, and your actual premium will depend on individual factors like your driving history, vehicle type, and location.

Tips for Finding Affordable Car Insurance in Florida

Finding affordable car insurance in Florida requires a proactive approach. Here are some tips to help you secure the best rates:

- Shop Around: Obtain quotes from multiple insurers to compare coverage and pricing. Online comparison websites can streamline this process.

- Bundle Policies: Consider bundling your car insurance with other policies like homeowners or renters insurance to potentially receive discounts.

- Increase Your Deductible: A higher deductible typically translates to lower premiums. However, ensure you can comfortably afford the deductible in case of an accident.

- Maintain a Clean Driving Record: Avoid traffic violations and accidents, as these can significantly increase your premiums.

- Improve Your Credit Score: While not always a factor, a good credit score can sometimes influence your insurance rates.

- Consider Discounts: Many insurers offer discounts for safe driving, good student status, and anti-theft devices. Inquire about available discounts to potentially reduce your premiums.

Comparing Quotes Effectively

When comparing quotes, it’s essential to ensure you’re comparing apples to apples. This means comparing the same coverage levels and deductibles across different insurers. Consider these factors:

- Coverage Levels: Compare the same coverage levels, including liability limits, comprehensive and collision coverage, and uninsured/underinsured motorist coverage.

- Deductibles: Ensure you’re comparing quotes with the same deductible amount. A higher deductible usually means lower premiums.

- Additional Features: Check for any additional features or benefits offered by each insurer, such as roadside assistance, rental car reimbursement, or accident forgiveness.

- Customer Service: Consider the insurer’s reputation for customer service and claims handling. Read online reviews and seek recommendations from friends or family.

Essential Car Insurance Coverage in Florida

Florida’s car insurance laws mandate specific coverages to protect drivers and their victims in case of accidents. Understanding these mandatory coverages and considering optional ones can significantly impact your overall insurance costs and protection.

Mandatory Car Insurance Coverages

Florida law requires all drivers to carry specific car insurance coverages to protect themselves and others in case of an accident. These coverages provide financial protection against potential financial losses, ensuring that victims receive compensation for their injuries and property damage.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs incurred by the insured driver and passengers, regardless of who is at fault in an accident. Florida’s PIP coverage is limited to $10,000 per person and $20,000 per accident.

- Property Damage Liability (PDL): This coverage pays for damages to the other driver’s vehicle or property if you are found at fault in an accident. Florida’s minimum PDL coverage is $10,000.

Optional Car Insurance Coverages

While Florida law mandates PIP and PDL, you can choose to purchase additional coverages to enhance your protection and peace of mind. These optional coverages can help protect you from financial burdens in case of accidents or other incidents.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is particularly useful if your car is financed or leased, as lenders typically require it.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. While not mandatory, it can be valuable if your car is relatively new or has a high value.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured. It can help cover your medical expenses, lost wages, and property damage.

- Medical Payments Coverage (Med Pay): This coverage supplements PIP by providing additional medical expense coverage, regardless of fault. It can be helpful for covering expenses that exceed your PIP limits or for covering passengers who are not eligible for PIP benefits.

Benefits and Drawbacks of Optional Coverages

Each optional coverage offers specific benefits and drawbacks that you should consider before purchasing them. Carefully evaluate your individual needs and circumstances to determine if these coverages are right for you.

Collision Coverage

- Benefits: Pays for repairs or replacement of your vehicle after an accident, regardless of fault. Provides financial protection if you are at fault in an accident or if the other driver is uninsured or underinsured.

- Drawbacks: Higher premiums, may not be necessary if your car is old or has low value. Deductibles can be high, meaning you will have to pay a portion of the repair costs.

Comprehensive Coverage

- Benefits: Protects your vehicle from damages caused by events other than accidents. Provides financial protection for theft, vandalism, fire, natural disasters, and other covered incidents.

- Drawbacks: Higher premiums, may not be necessary if your car is old or has low value. Deductibles can be high, meaning you will have to pay a portion of the repair costs.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

- Benefits: Provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured. Can help cover medical expenses, lost wages, and property damage.

- Drawbacks: Higher premiums, may not be necessary if you live in an area with a low number of uninsured drivers.

Medical Payments Coverage (Med Pay)

- Benefits: Supplements PIP by providing additional medical expense coverage, regardless of fault. Can help cover expenses that exceed your PIP limits or for covering passengers who are not eligible for PIP benefits.

- Drawbacks: Higher premiums, may not be necessary if you have sufficient PIP coverage.

Saving Money on Car Insurance

In Florida, where car insurance is mandatory, finding ways to lower your premiums is essential. Several strategies can help you save money on your car insurance. By understanding these tactics and implementing them, you can significantly reduce your annual costs.

Discounts

Discounts are one of the most effective ways to lower your car insurance premiums. Insurance companies offer a wide range of discounts based on various factors, including:

- Good Driving Record: Maintaining a clean driving record with no accidents or violations is crucial. Many insurers reward safe drivers with significant discounts.

- Safety Features: Cars equipped with safety features like anti-theft devices, airbags, and anti-lock brakes qualify for discounts. These features demonstrate a commitment to safety and reduce the risk of accidents.

- Bundling Policies: Combining your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to substantial savings. Insurers often offer discounts for bundling multiple policies with them.

- Payment Frequency: Paying your premiums annually or semi-annually can often result in a lower overall cost compared to monthly payments.

- Student Discounts: Good students with high GPAs may be eligible for discounts. This recognizes their responsible behavior and lower risk profile.

- Military Discounts: Active military personnel and veterans may qualify for discounts, acknowledging their service and dedication.

- Professional Affiliations: Some insurance companies offer discounts to members of certain professional organizations or associations.

Safe Driving Habits

Beyond discounts, practicing safe driving habits is essential for lowering your insurance premiums. Safe driving not only reduces your risk of accidents but also demonstrates responsible behavior to insurers.

- Avoid Distractions: Using cell phones while driving, even hands-free, can significantly increase your risk of accidents. Avoid distractions like texting, eating, or applying makeup while driving.

- Maintain Vehicle Condition: Regular maintenance, including oil changes, tire rotations, and brake inspections, ensures your vehicle operates safely and reduces the risk of breakdowns or accidents.

- Defensive Driving: Practicing defensive driving techniques, such as maintaining a safe distance from other vehicles, anticipating potential hazards, and being aware of your surroundings, can help you avoid accidents.

- Drive Safely at Night: Night driving presents increased risks due to reduced visibility. Be extra cautious at night, adjust your speed, and be aware of potential hazards.

Negotiating with Insurance Providers

Negotiating with insurance providers can be an effective way to lower your premiums.

- Shop Around: Obtain quotes from multiple insurance companies to compare rates and coverage options. This allows you to identify the best deals available.

- Be Prepared: Before negotiating, gather all relevant information, including your driving history, vehicle details, and any applicable discounts.

- Be Polite and Persistent: Approach the negotiation process with a polite and professional demeanor. Express your willingness to negotiate and highlight your commitment to safe driving.

- Consider Payment Options: Explore different payment options, such as paying annually or semi-annually, which may offer lower rates.

Wrap-Up

Armed with knowledge and a proactive approach, finding the least expensive car insurance in Florida is achievable. By comparing quotes, exploring discounts, and understanding your coverage needs, you can secure affordable protection for your vehicle. Remember, being informed is your greatest asset in this journey, empowering you to make the right choices and navigate Florida’s insurance market with confidence.

FAQ Summary

What are some common discounts offered by car insurance companies in Florida?

Many insurers offer discounts for good driving records, safe driving courses, bundling multiple insurance policies, and installing safety features in your car.

How can I get a free car insurance quote?

Most insurance companies offer free online quote tools. You can also contact them directly to get a personalized quote.

Is it legal to drive without car insurance in Florida?

No, it is illegal to drive without car insurance in Florida. You must have at least the minimum required coverage, which includes personal injury protection (PIP) and property damage liability (PDL).