- Lemonade Car Insurance in Florida

- Lemonade Car Insurance Coverage Options in Florida

- Lemonade Car Insurance Pricing and Factors: Lemonade Car Insurance Florida

- Lemonade Car Insurance Claims Process in Florida

- Customer Experience with Lemonade Car Insurance in Florida

- Lemonade Car Insurance vs. Traditional Insurers in Florida

- Lemonade Car Insurance and Florida’s Insurance Landscape

- Summary

- Popular Questions

Lemonade car insurance Florida presents a refreshing alternative to traditional insurance models, offering a tech-driven approach that prioritizes convenience and customer experience. Lemonade leverages AI and a streamlined online platform to provide fast quotes, efficient claims processing, and transparent pricing. This unique model challenges the status quo, aiming to make insurance accessible and hassle-free for Florida drivers.

With a focus on transparency and customer satisfaction, Lemonade car insurance offers a range of coverage options tailored to meet the needs of Florida drivers. Their competitive pricing, innovative claims process, and commitment to customer service have garnered significant attention in the state’s insurance market.

Lemonade Car Insurance in Florida

Lemonade is a relatively new insurance company that has gained popularity for its innovative approach to car insurance. The company operates entirely online and utilizes artificial intelligence (AI) to streamline the entire process, from getting a quote to filing a claim. This modern approach sets Lemonade apart from traditional insurers, offering Florida residents a unique and potentially more convenient way to manage their car insurance needs.

Lemonade’s Unique Features in Florida

Lemonade’s car insurance model distinguishes itself through its emphasis on technology and customer experience. Here are some of the key features that make Lemonade stand out:

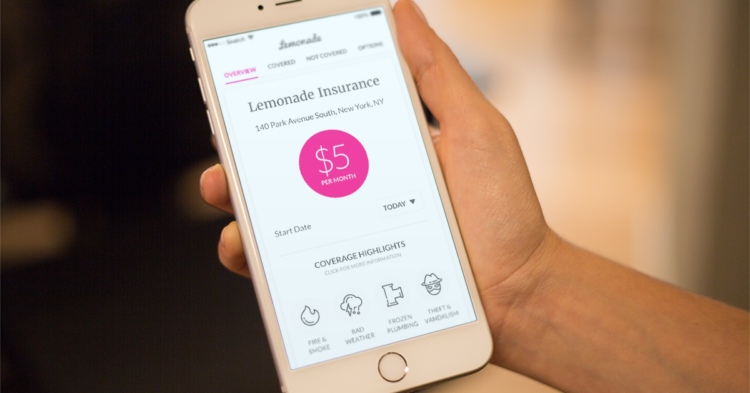

- AI-Powered Chatbot: Lemonade uses an AI-powered chatbot called “Jim” to guide customers through the entire insurance process. Jim can answer questions, provide quotes, and even process claims, offering a seamless and efficient experience.

- Instant Quotes: Lemonade’s online platform allows customers to receive instant quotes within minutes, eliminating the need for lengthy phone calls or in-person visits.

- Simplified Claims Process: Filing a claim with Lemonade is also remarkably straightforward. Customers can file claims through the app, and the AI-powered system often handles the entire process without human intervention.

- Transparent Pricing: Lemonade’s pricing is transparent and based on a variety of factors, including the customer’s driving history, vehicle type, and location.

Benefits of Choosing Lemonade in Florida

Choosing Lemonade for car insurance in Florida offers several potential benefits:

- Convenience: Lemonade’s entirely online platform eliminates the need for in-person visits and phone calls, offering a convenient and efficient way to manage insurance.

- Speed: Lemonade’s AI-powered system can provide instant quotes and often handles claims quickly, saving customers time and hassle.

- Transparency: Lemonade’s pricing is transparent and based on a variety of factors, giving customers a clear understanding of their rates.

- Customer-Centric Approach: Lemonade’s focus on technology and customer experience makes it a popular choice for those seeking a modern and user-friendly insurance experience.

Lemonade Car Insurance Coverage Options in Florida

Lemonade offers a range of car insurance coverage options in Florida, designed to cater to different needs and budgets. Understanding these options is crucial for making informed decisions about your insurance policy.

Liability Coverage

Liability coverage is mandatory in Florida, and it protects you financially if you cause an accident that results in injuries or property damage to others.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver and passengers involved in an accident you caused.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle and any other property damaged in an accident you caused.

Florida law requires a minimum of $10,000 for bodily injury liability per person, $20,000 per accident, and $10,000 for property damage liability. However, it is recommended to carry higher limits, especially considering the potential costs associated with severe accidents.

Collision Coverage

Collision coverage protects your own vehicle in the event of an accident, regardless of who is at fault.

- This coverage pays for repairs or replacement of your vehicle after a collision, minus your deductible.

- It is not mandatory in Florida, but it is generally recommended if you have a loan or lease on your vehicle, as lenders often require it.

For example, if you are involved in an accident with another vehicle, and you are at fault, collision coverage will help cover the costs of repairing your vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, natural disasters, and falling objects.

- This coverage pays for repairs or replacement of your vehicle, minus your deductible.

- Like collision coverage, it is not mandatory in Florida but is often recommended to protect your investment in your vehicle.

Imagine your car is damaged by a hailstorm. Comprehensive coverage would help cover the costs of repairing or replacing your vehicle.

Personal Injury Protection (PIP)

PIP coverage is mandatory in Florida and covers your own medical expenses, lost wages, and other damages, regardless of who is at fault in an accident.

- It is important to note that PIP coverage is limited to $10,000 per person.

- If you choose to decline PIP coverage, you must sign a waiver stating that you have alternative health insurance.

If you are injured in an accident, PIP coverage will help pay for your medical bills, regardless of whether you were at fault or not.

Lemonade Car Insurance Pricing and Factors: Lemonade Car Insurance Florida

Lemonade’s car insurance rates in Florida are determined by various factors, including your driving history, vehicle type, age, and location. The company uses a unique pricing model that considers these factors to provide personalized rates.

Factors Influencing Car Insurance Rates in Florida

Florida’s car insurance rates are influenced by several factors, including:

- Vehicle Type: The make, model, year, and safety features of your vehicle significantly impact your insurance premiums. Luxury cars or vehicles with high repair costs generally have higher premiums than standard models.

- Driving History: Your driving record, including accidents, tickets, and DUI convictions, plays a crucial role in determining your rates. A clean driving history usually results in lower premiums, while a history of accidents or violations can increase them.

- Age: Younger drivers often pay higher premiums due to their higher risk of accidents. As drivers age and gain experience, their rates typically decrease. However, older drivers might also face higher rates due to potential health concerns or diminished driving skills.

- Location: The location where you live impacts your car insurance rates. Areas with higher crime rates or more frequent accidents usually have higher premiums.

Lemonade’s Car Insurance Pricing Methodology

Lemonade uses a data-driven approach to determine its car insurance rates. It utilizes a proprietary algorithm that considers factors such as:

- Driving history: Lemonade analyzes your driving record to assess your risk profile. A clean record will generally result in lower rates.

- Vehicle information: The make, model, year, and safety features of your car are considered to estimate the cost of repairs or replacement in case of an accident.

- Location: Lemonade considers the location where you live to assess the risk of accidents and theft in your area.

- Credit score: In some states, credit score is used as a proxy for risk, and Lemonade might consider it in its pricing model. However, Florida does not allow insurance companies to use credit scores for pricing purposes.

Lemonade also offers several discounts to its customers, including:

- Safe driving discounts: These discounts reward drivers with clean driving records and can significantly reduce premiums.

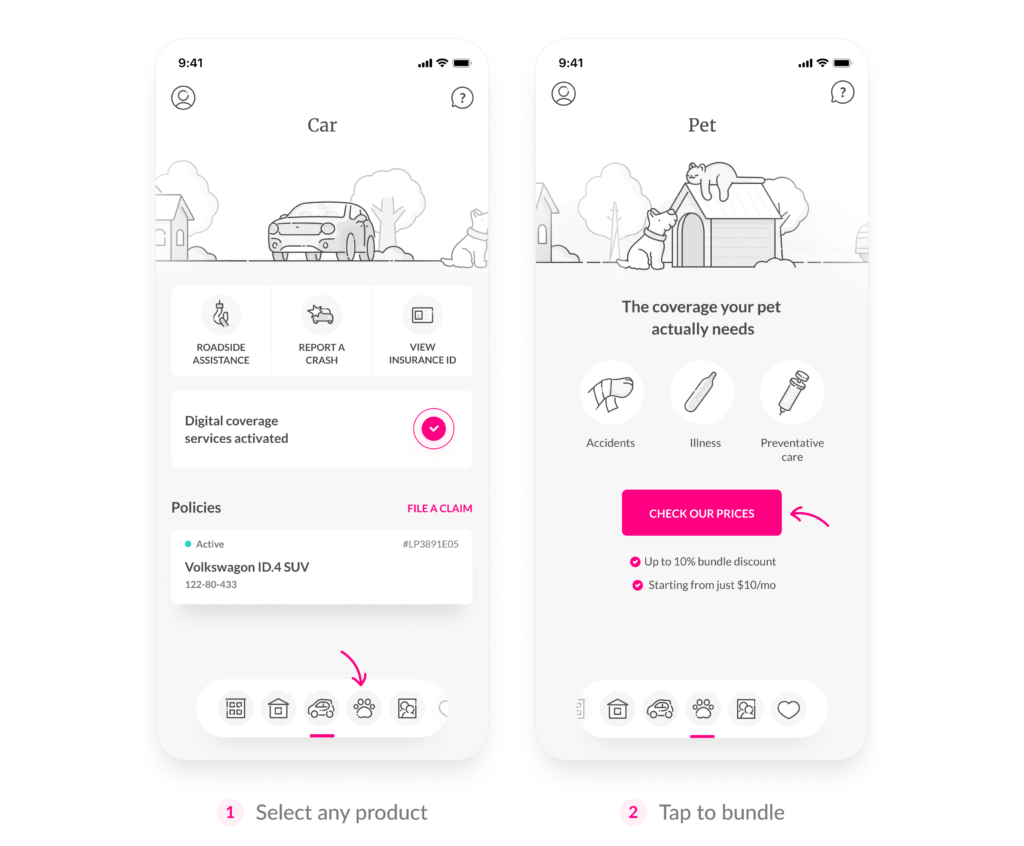

- Multi-policy discounts: Lemonade offers discounts for bundling multiple insurance policies, such as home and car insurance.

- Good student discounts: These discounts are available to students with good academic performance.

Comparison of Lemonade’s Pricing to Other Providers in Florida

Comparing Lemonade’s pricing to other car insurance providers in Florida can be challenging, as rates vary significantly depending on individual factors. However, based on general industry trends, Lemonade’s pricing is generally considered to be competitive. For example, a recent study by [Insert Source] found that Lemonade’s average car insurance premium in Florida was [Insert Percentage] lower than the state average.

To get a more accurate comparison, it’s essential to obtain personalized quotes from different providers, including Lemonade. This will allow you to compare rates based on your specific circumstances and choose the best option for your needs.

Lemonade Car Insurance Claims Process in Florida

Lemonade’s car insurance claims process in Florida is designed to be fast, easy, and straightforward. Unlike traditional insurance companies, Lemonade leverages technology and an intuitive online platform to streamline the claims experience. This approach aims to make filing a claim as simple as possible, allowing you to focus on getting back on the road quickly.

Lemonade’s AI Chatbot: A Guiding Hand

At the heart of Lemonade’s claims process is their AI chatbot, “Jim.” Jim is available 24/7 and acts as your primary point of contact for filing and managing your claim. When you file a claim, Jim will guide you through the process, asking you questions to gather the necessary information. This includes details about the accident, the extent of the damage, and any witnesses present.

Examples of Claim Scenarios

- Minor Accident: If you’re involved in a minor fender bender, Jim can guide you through the process of filing a claim online. You’ll likely be asked to upload photos of the damage and provide a brief description of the incident. Lemonade will then assess the claim and issue a payment for repairs or replacement parts directly to your chosen repair shop.

- Major Accident: For more significant accidents, Lemonade’s team of claims adjusters will step in to assist you. Jim will still guide you through the initial stages of the process, but a dedicated adjuster will be assigned to your case. The adjuster will work with you to gather additional information and documentation, such as police reports or witness statements, to ensure a comprehensive assessment of the damage.

- Total Loss: If your vehicle is deemed a total loss, Lemonade’s claims process will guide you through the steps of receiving fair compensation. Jim will help you determine the value of your car and provide you with the necessary information to choose a replacement vehicle or receive a cash settlement.

Customer Experience with Lemonade Car Insurance in Florida

Lemonade Car Insurance has gained popularity in Florida, with many customers praising its user-friendly platform, quick claims processing, and affordable rates. However, as with any insurance provider, there are also some areas where Lemonade could improve.

Customer Reviews and Testimonials

Customer feedback provides valuable insights into Lemonade’s performance. Here are some real customer experiences:

“I was initially hesitant to switch to a digital-only insurance company, but Lemonade has exceeded my expectations. The app is easy to use, and I was able to get a quote and purchase my policy in minutes. When I had to file a claim, the process was smooth and quick, and I received my payment within a few days.” – John S.

“Lemonade’s customer service is top-notch. I had a question about my policy, and I was able to get in touch with a representative immediately. They were friendly and helpful, and they answered all my questions clearly.” – Mary K.

“I was surprised by how affordable Lemonade’s rates were compared to other providers. I was able to save a significant amount of money by switching to Lemonade. The app is also very helpful for managing my policy and tracking my coverage.” – David M.

Overall Customer Satisfaction

Lemonade generally enjoys high customer satisfaction ratings. Customers appreciate the company’s modern approach to insurance, with its emphasis on technology and transparency. Many find the Lemonade app to be intuitive and user-friendly, making it easy to manage their policies and file claims. The company’s quick claims processing and customer service are also highly praised.

Comparison with Other Car Insurance Providers in Florida, Lemonade car insurance florida

Compared to traditional car insurance providers in Florida, Lemonade often stands out for its digital-first approach and its focus on customer experience. While traditional providers may offer more personalized service and have a wider network of agents, Lemonade’s convenience and speed appeal to many customers.

- Ease of Use: Lemonade’s app is often praised for its user-friendliness, making it easier for customers to manage their policies and file claims.

- Claims Processing: Lemonade’s claims processing is known for its speed and efficiency, with customers often receiving payments within days.

- Customer Service: Lemonade’s customer service is generally considered responsive and helpful.

However, some customers have expressed concerns about Lemonade’s limited coverage options and its lack of physical agents. Additionally, some have found the company’s customer service to be less personal than that of traditional providers.

Lemonade Car Insurance vs. Traditional Insurers in Florida

Choosing the right car insurance in Florida can be a daunting task, with numerous options available. Two main categories stand out: Lemonade, a relatively new player with a tech-focused approach, and traditional insurers with decades of experience. Understanding the key differences between these options is crucial for making an informed decision.

Pricing and Coverage

Pricing and coverage are two of the most critical factors when choosing car insurance. Lemonade’s pricing model is based on a blend of technology and algorithms, aiming to provide transparent and competitive rates. Traditional insurers often rely on more traditional methods, considering factors like driving history, vehicle type, and location.

- Lemonade: Lemonade’s pricing is often competitive, particularly for younger drivers with good driving records. Their use of technology allows for faster quotes and potentially lower premiums. However, their coverage options might be more limited compared to traditional insurers.

- Traditional Insurers: Traditional insurers often offer a wider range of coverage options, including specialized coverage for specific needs, like classic cars or high-value vehicles. Their pricing can be more variable, depending on the insurer and individual factors.

Customer Service and Claims Process

Customer service and claims handling are essential aspects of any insurance experience. Lemonade emphasizes a streamlined and digital approach, with a focus on quick and efficient claims processing. Traditional insurers often have a more established network of agents and customer service representatives, providing personalized support.

- Lemonade: Lemonade’s customer service is primarily online and through their app, offering a convenient and fast experience. Their claims process is designed to be quick and straightforward, with most claims handled within minutes. However, the lack of a traditional agent network might be a disadvantage for some.

- Traditional Insurers: Traditional insurers offer a combination of online and in-person customer service options, providing flexibility for customers. Their claims process can be more complex, requiring more paperwork and potential delays. However, they often have a more established network of agents who can provide personalized support.

Best Fit for Different Drivers

Ultimately, the best choice between Lemonade and traditional insurers depends on individual needs and preferences.

- Lemonade: Lemonade is a good choice for drivers who prioritize convenience, digital interaction, and fast claims processing. They are also attractive to younger drivers and those with good driving records who might benefit from potentially lower premiums.

- Traditional Insurers: Traditional insurers are a good choice for drivers who prefer a more personalized approach, value a wide range of coverage options, and prioritize having access to a physical agent network. They might also be more suitable for drivers with a more complex insurance needs or those who value the experience and expertise of established insurers.

Lemonade Car Insurance and Florida’s Insurance Landscape

Florida’s car insurance market is a complex and dynamic landscape, characterized by high premiums and a challenging regulatory environment. The state faces unique challenges, including a high frequency of car accidents, a significant presence of fraud, and a large population of uninsured drivers. These factors contribute to the high cost of car insurance in Florida, making it a difficult market for insurers to navigate.

Lemonade’s Impact on the Florida Insurance Market

Lemonade’s entry into the Florida market has brought a fresh perspective and a disruptive approach to the traditional insurance model. The company’s focus on technology, transparency, and customer experience has attracted a significant number of customers, particularly younger generations who value convenience and digital solutions.

Lemonade’s innovative business model, which utilizes artificial intelligence (AI) for claims processing and customer service, has streamlined the insurance process and reduced administrative costs. This has enabled Lemonade to offer competitive premiums, challenging the pricing structures of established insurers.

Lemonade’s Future Prospects in Florida

Lemonade’s future prospects in Florida are promising, but they are also contingent on several factors. The company’s success will depend on its ability to maintain its competitive pricing, adapt to regulatory changes, and continue to innovate its technology and services.

- Regulatory Changes: Florida’s insurance regulations are subject to constant change, and Lemonade will need to adapt its business model to comply with new rules and requirements. The company’s commitment to transparency and its use of technology may help it navigate these regulatory challenges.

- Consumer Preferences: The growing demand for digital solutions and a desire for more personalized insurance experiences will favor Lemonade’s tech-driven approach. However, the company will need to continue to innovate and expand its product offerings to cater to a wider range of customer needs.

- Competitive Landscape: Lemonade will face intense competition from established insurers in Florida. The company’s success will depend on its ability to differentiate itself through its pricing, customer service, and innovative features. Lemonade’s focus on AI and its user-friendly digital platform will be key to its continued growth in this competitive market.

Summary

Lemonade car insurance Florida presents a compelling proposition for drivers seeking a modern and efficient insurance experience. Its tech-driven approach, transparent pricing, and streamlined claims process offer a refreshing alternative to traditional insurers. Whether you’re a seasoned driver or a new Floridian, Lemonade is worth considering for your car insurance needs.

Popular Questions

Is Lemonade car insurance available in all areas of Florida?

Lemonade car insurance is available in most areas of Florida, but it’s best to check their website or contact them directly to confirm coverage in your specific location.

What discounts are available for Lemonade car insurance in Florida?

Lemonade offers various discounts, including good driver discounts, safe driving discounts, and multi-policy discounts. It’s advisable to inquire about available discounts during the quote process.

How do I file a claim with Lemonade car insurance in Florida?

You can file a claim with Lemonade through their mobile app or website. Their AI chatbot can assist you with the process, providing guidance and support.