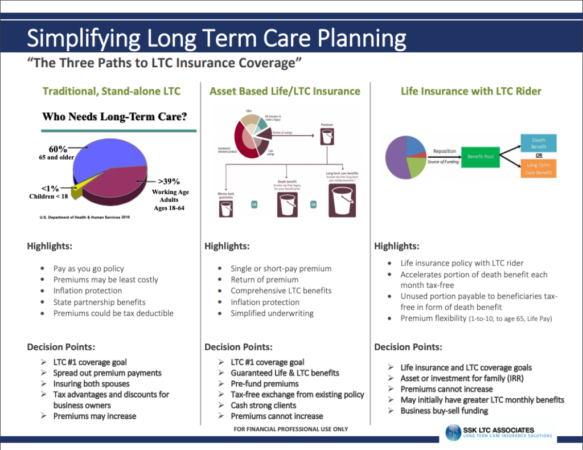

Long term care insurance Florida is a vital tool for individuals seeking peace of mind about their future health and financial security. It offers a safety net in case of unexpected health challenges that may require assistance with daily living activities. From providing coverage for skilled nursing care to home health services, long-term care insurance can help alleviate the financial burden associated with these situations, allowing you to focus on your well-being and recovery.

The purpose of this guide is to provide a comprehensive overview of long-term care insurance in Florida, including eligibility requirements, policy options, cost considerations, and resources to help you make informed decisions. Whether you’re a Florida resident considering purchasing long-term care insurance or simply seeking information about its benefits, this guide will equip you with the knowledge you need to navigate this complex yet essential aspect of financial planning.

Understanding Long-Term Care Insurance in Florida

Long-term care insurance is a valuable tool for Floridians who want to protect their financial security and ensure they have access to quality care if they become unable to perform daily activities due to age, illness, or disability. This type of insurance helps cover the costs associated with long-term care services, which can be substantial and may deplete savings quickly.

Purpose and Benefits of Long-Term Care Insurance

Long-term care insurance in Florida offers a variety of benefits, including:

- Financial Protection: It helps protect your assets and savings from being drained by the high cost of long-term care services.

- Choice and Control: You can choose the type of care you receive and where you receive it, giving you greater control over your care plan.

- Peace of Mind: Knowing that your long-term care needs will be financially covered provides peace of mind for you and your loved ones.

- Access to Quality Care: Long-term care insurance often provides access to a network of qualified providers, ensuring you receive high-quality care.

Types of Long-Term Care Services Covered

Florida long-term care insurance policies typically cover a range of services, including:

- Nursing Home Care: This includes skilled nursing care provided in a nursing home setting.

- Assisted Living: This covers services provided in assisted living facilities, which offer help with daily activities such as bathing, dressing, and medication management.

- Home Health Care: This includes nursing care, physical therapy, occupational therapy, and other services provided in your home.

- Adult Day Care: This type of care provides supervision and support for individuals who need assistance during the day but can live independently at night.

- Respite Care: This provides temporary care for individuals with long-term care needs, allowing caregivers a break from their responsibilities.

Scenarios Where Long-Term Care Insurance is Beneficial, Long term care insurance florida

Here are some examples of situations where long-term care insurance can be particularly beneficial:

- Chronic Illness: If you develop a chronic illness, such as Alzheimer’s disease or Parkinson’s disease, long-term care insurance can help cover the costs of ongoing care.

- Accident or Injury: A serious accident or injury could leave you unable to perform daily activities, requiring long-term care services.

- Aging: As you age, the likelihood of needing long-term care increases. Long-term care insurance can help protect you from the financial burden of these costs.

- Family Caregiver Support: If you have a family member who needs long-term care, long-term care insurance can help support your family caregiver financially and emotionally.

Ending Remarks: Long Term Care Insurance Florida

In conclusion, long-term care insurance in Florida can play a significant role in safeguarding your future and ensuring that you have the financial resources to access the care you need when you need it most. By understanding the intricacies of policy options, cost factors, and available resources, you can make informed decisions that align with your individual circumstances and long-term goals. Remember to carefully evaluate your needs, compare different insurance providers, and consult with a financial advisor to determine the best course of action for your unique situation.

User Queries

What are the common types of long-term care services covered by Florida insurance policies?

Common types of long-term care services covered include skilled nursing care, assisted living, adult day care, home health services, and hospice care.

How does inflation protection work with long-term care insurance?

Inflation protection ensures that your policy benefits keep pace with rising healthcare costs, guaranteeing that you have adequate coverage for future needs.

What are some resources available for individuals seeking assistance with long-term care in Florida?

The Florida Long-Term Care Ombudsman Program provides support and advocacy for individuals and families seeking long-term care services. You can also find information and resources from the Florida Department of Elder Affairs and the Florida Assisted Living Association.