- Introduction to Long-Term Care Insurance in Florida: Long-term Care Insurance Florida

- Eligibility and Qualification Requirements

- Types of Long-Term Care Insurance Policies

- Cost and Premiums

- Benefits and Coverage

- Finding and Choosing a Provider

- The Importance of Financial Planning

- Government Resources and Support

- Legal and Regulatory Considerations

- Future Trends and Considerations

- Last Word

- Frequently Asked Questions

Long-term care insurance Florida can be a vital component of comprehensive financial planning, safeguarding you and your loved ones against the potentially devastating costs of unexpected long-term care needs. This type of insurance provides coverage for a wide range of services, including assistance with activities of daily living, such as bathing, dressing, and eating, as well as skilled nursing care and home health services.

Whether you’re a young professional starting to plan for the future or a senior citizen seeking peace of mind, understanding the benefits and intricacies of long-term care insurance in Florida is crucial. This guide will delve into the essential aspects of this coverage, empowering you to make informed decisions about your long-term care needs.

Introduction to Long-Term Care Insurance in Florida: Long-term Care Insurance Florida

Long-term care insurance in Florida is a crucial financial planning tool designed to help individuals cover the costs of long-term care services when they are unable to care for themselves due to age, illness, or disability. These services are often needed for extended periods and can be very expensive, putting a significant strain on personal finances and family resources.

Long-term care insurance provides financial protection by paying for a portion or all of the costs associated with long-term care, allowing individuals to maintain their quality of life and avoid depleting their savings or relying solely on family members for support.

Types of Long-Term Care Services Covered

Long-term care insurance policies in Florida typically cover a wide range of services, including:

- Nursing Home Care: This includes skilled nursing care provided in a nursing home facility, such as assistance with daily living activities, medication management, and medical treatments.

- Assisted Living: This type of care provides support with activities of daily living in a residential setting, offering a more independent lifestyle compared to a nursing home.

- Home Health Care: This involves receiving care in the comfort of one’s own home, including nursing services, physical therapy, occupational therapy, and personal care assistance.

- Adult Day Care: This provides social and recreational activities, as well as supervision and assistance with daily living tasks, for individuals who need care during the day but can return home at night.

- Respite Care: This offers temporary relief to family caregivers by providing short-term care services for individuals who need long-term care.

Situations Where Long-Term Care Insurance is Beneficial

Long-term care insurance can be beneficial in various situations, including:

- Individuals with a family history of chronic illnesses: If an individual has a family history of conditions like Alzheimer’s disease, Parkinson’s disease, or stroke, they may be at a higher risk of needing long-term care and could benefit from insurance.

- Individuals with existing health conditions: Those with pre-existing health conditions that could lead to the need for long-term care, such as diabetes, heart disease, or arthritis, may find insurance valuable.

- Individuals with limited financial resources: Long-term care insurance can help protect individuals from depleting their savings or relying on family members to cover the costs of care.

- Individuals who value independence: Insurance can provide financial security and peace of mind, allowing individuals to maintain their independence and choose the type of care they prefer.

Eligibility and Qualification Requirements

In Florida, long-term care insurance is available to individuals who meet certain eligibility requirements. These requirements are designed to ensure that the insurance policy is suitable for the applicant’s needs and circumstances. Understanding these criteria is crucial for anyone considering purchasing long-term care insurance.

Health and Financial Requirements

To qualify for long-term care insurance in Florida, individuals must meet specific health and financial requirements. These requirements are established by insurance companies to assess the risk associated with providing coverage.

- Health Requirements: Insurance companies typically require applicants to undergo a medical examination or provide detailed medical history information. This evaluation helps determine the applicant’s overall health status and potential for needing long-term care services in the future. Factors considered include pre-existing conditions, current health status, and lifestyle habits.

- Financial Requirements: Insurance companies also evaluate the applicant’s financial situation to ensure they can afford the premiums. This may involve reviewing income, assets, and existing debt. Applicants must demonstrate financial stability and the ability to consistently pay premiums.

Eligibility Factors and Their Impact on Policy Approval

The following table provides a summary of key eligibility factors and their impact on policy approval for long-term care insurance in Florida:

| Eligibility Factor | Impact on Policy Approval |

|---|---|

| Age | Younger applicants generally receive lower premiums, while older applicants may face higher premiums or even denial of coverage due to increased risk of needing long-term care. |

| Health Status | Individuals with pre-existing conditions or poor health may face higher premiums, limitations on coverage, or denial of coverage. |

| Financial Situation | Applicants with a stable income and sufficient assets are more likely to be approved for coverage. Those with limited income or significant debt may face difficulty obtaining coverage. |

| Lifestyle Habits | Applicants with healthy lifestyle habits, such as regular exercise and a balanced diet, may receive lower premiums than those with unhealthy habits. |

| Family History | A family history of long-term care needs can increase the likelihood of needing coverage, potentially leading to higher premiums or more stringent eligibility requirements. |

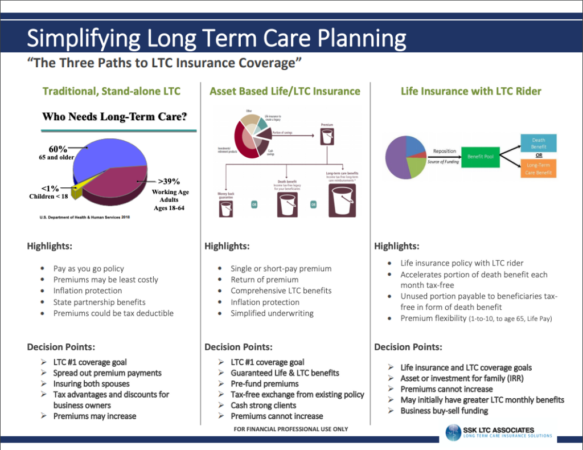

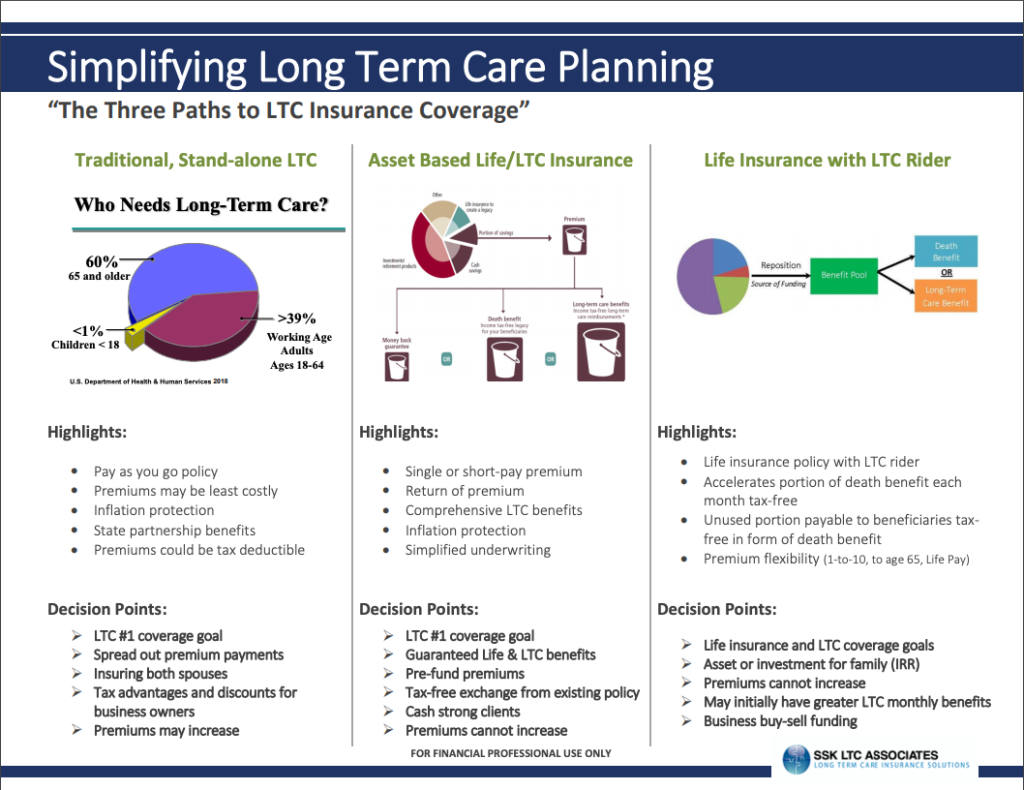

Types of Long-Term Care Insurance Policies

Long-term care insurance policies are designed to help individuals cover the costs of long-term care services, which are often not covered by traditional health insurance. These policies can provide financial assistance for a range of services, including nursing home care, assisted living, adult day care, and home health care.

In Florida, there are several types of long-term care insurance policies available, each with its own unique features, benefits, and limitations. Understanding the different types of policies is crucial to selecting the one that best suits your individual needs and financial situation.

Types of Long-Term Care Insurance Policies in Florida

| Policy Type | Coverage | Benefits | Costs |

|---|---|---|---|

| Traditional Long-Term Care Insurance | Provides coverage for a wide range of long-term care services, including nursing home care, assisted living, adult day care, and home health care. | Offers financial assistance for the costs of long-term care services, including skilled nursing care, personal care, and medical supplies. | Premiums can vary significantly depending on factors such as age, health, and the amount of coverage selected. |

| Hybrid Long-Term Care Insurance | Combines features of traditional long-term care insurance with life insurance or an annuity. | Offers coverage for long-term care services, as well as a death benefit or a lump-sum payment. | Premiums can be higher than traditional long-term care insurance, but they may also offer tax advantages. |

| Partnership Long-Term Care Insurance | A type of traditional long-term care insurance that is designed to help individuals qualify for Medicaid. | Provides coverage for long-term care services, and it can also help to protect assets from being spent on long-term care costs. | Premiums are typically higher than traditional long-term care insurance, but they may offer significant financial protection. |

| Stand-Alone Long-Term Care Insurance | Provides coverage for specific types of long-term care services, such as nursing home care or home health care. | Offers financial assistance for the costs of long-term care services, but it may not cover all types of services. | Premiums can be lower than traditional long-term care insurance, but they may also offer less comprehensive coverage. |

Traditional Long-Term Care Insurance

Traditional long-term care insurance policies provide coverage for a wide range of long-term care services, including nursing home care, assisted living, adult day care, and home health care. These policies typically offer a daily or monthly benefit amount that can be used to pay for the costs of these services.

- Coverage: Traditional long-term care insurance policies typically cover a wide range of long-term care services, including nursing home care, assisted living, adult day care, and home health care. Some policies may also cover other services, such as hospice care or respite care.

- Benefits: The benefits of traditional long-term care insurance policies can vary depending on the specific policy, but they typically include financial assistance for the costs of long-term care services, such as skilled nursing care, personal care, and medical supplies. Some policies may also offer benefits such as a daily or monthly benefit amount, a lump-sum payment, or a combination of both.

- Costs: The costs of traditional long-term care insurance policies can vary significantly depending on factors such as age, health, and the amount of coverage selected. Premiums are typically higher for older individuals or those with pre-existing health conditions.

Hybrid Long-Term Care Insurance

Hybrid long-term care insurance policies combine features of traditional long-term care insurance with life insurance or an annuity. These policies can provide coverage for long-term care services, as well as a death benefit or a lump-sum payment.

- Coverage: Hybrid long-term care insurance policies typically provide coverage for a range of long-term care services, such as nursing home care, assisted living, adult day care, and home health care. Some policies may also offer a death benefit or a lump-sum payment, which can be used to pay for funeral expenses or other final expenses.

- Benefits: The benefits of hybrid long-term care insurance policies can vary depending on the specific policy, but they typically include financial assistance for the costs of long-term care services, as well as a death benefit or a lump-sum payment. Some policies may also offer tax advantages, such as tax-deferred growth of the death benefit.

- Costs: The costs of hybrid long-term care insurance policies can be higher than traditional long-term care insurance, but they may also offer tax advantages. The premiums are typically based on a combination of factors, including age, health, and the amount of coverage selected.

Partnership Long-Term Care Insurance

Partnership long-term care insurance is a type of traditional long-term care insurance that is designed to help individuals qualify for Medicaid. These policies typically offer a higher daily or monthly benefit amount than traditional long-term care insurance policies, and they may also include features that help to protect assets from being spent on long-term care costs.

- Coverage: Partnership long-term care insurance policies provide coverage for a range of long-term care services, such as nursing home care, assisted living, adult day care, and home health care. These policies are designed to help individuals qualify for Medicaid, which can help to cover the costs of long-term care services if the individual’s assets are depleted.

- Benefits: The benefits of partnership long-term care insurance policies include financial assistance for the costs of long-term care services, as well as protection for assets from being spent on long-term care costs. These policies typically offer a higher daily or monthly benefit amount than traditional long-term care insurance policies, and they may also include features that help to protect assets from being spent on long-term care costs.

- Costs: The costs of partnership long-term care insurance policies are typically higher than traditional long-term care insurance policies, but they may offer significant financial protection. The premiums are typically based on a combination of factors, including age, health, and the amount of coverage selected.

Stand-Alone Long-Term Care Insurance

Stand-alone long-term care insurance policies provide coverage for specific types of long-term care services, such as nursing home care or home health care. These policies typically offer a daily or monthly benefit amount that can be used to pay for the costs of these services.

- Coverage: Stand-alone long-term care insurance policies typically provide coverage for specific types of long-term care services, such as nursing home care or home health care. These policies may not cover all types of long-term care services, such as assisted living or adult day care.

- Benefits: The benefits of stand-alone long-term care insurance policies can vary depending on the specific policy, but they typically include financial assistance for the costs of long-term care services, such as skilled nursing care, personal care, and medical supplies. Some policies may also offer benefits such as a daily or monthly benefit amount, a lump-sum payment, or a combination of both.

- Costs: The costs of stand-alone long-term care insurance policies can be lower than traditional long-term care insurance policies, but they may also offer less comprehensive coverage. The premiums are typically based on a combination of factors, including age, health, and the amount of coverage selected.

Cost and Premiums

The cost of long-term care insurance in Florida is influenced by various factors, and premiums can vary significantly depending on individual circumstances. Understanding these factors and how they impact premium costs is crucial for making informed decisions about long-term care insurance.

Factors Influencing Premiums

- Age: Premiums generally increase with age as the risk of needing long-term care rises.

- Health: Individuals with pre-existing health conditions or a family history of long-term care needs may face higher premiums.

- Coverage Level: The amount of daily benefit, the length of coverage, and the types of care covered all influence premium costs. Higher coverage levels typically lead to higher premiums.

- Policy Type: Different types of policies, such as traditional, hybrid, or partnership policies, have varying premium structures and coverage features.

- Deductible: A higher deductible can lower premiums, but it also means you’ll pay more out of pocket before your benefits kick in.

- Inflation Protection: Adding inflation protection to your policy can help safeguard your benefits against rising healthcare costs, but it will also increase your premiums.

- State Regulations: Florida has specific regulations governing long-term care insurance, which can impact premium costs.

- Insurance Company: Premiums can vary between different insurance companies, so it’s essential to compare quotes from multiple providers.

Average Premium Costs

Average premium costs for long-term care insurance in Florida can vary significantly based on the factors discussed above. Here are some illustrative examples:

| Policy Type | Age | Coverage Level | Average Monthly Premium |

|---|---|---|---|

| Traditional | 55 | $150 daily benefit, 3 years of coverage | $200 – $300 |

| Hybrid | 60 | $200 daily benefit, 5 years of coverage | $350 – $500 |

| Partnership | 65 | $250 daily benefit, 4 years of coverage | $400 – $600 |

These are just estimates, and actual premiums may vary depending on individual circumstances. It’s important to obtain personalized quotes from insurance companies to determine the exact cost of a policy.

Impact of Age, Health, and Coverage on Premiums

The following table demonstrates the impact of age, health, and coverage on premium costs for a hypothetical individual:

| Age | Health | Coverage Level | Average Monthly Premium |

|---|---|---|---|

| 50 | Excellent | $100 daily benefit, 2 years of coverage | $100 |

| 60 | Good | $150 daily benefit, 3 years of coverage | $250 |

| 70 | Fair | $200 daily benefit, 4 years of coverage | $500 |

As you can see, premiums increase significantly with age and declining health. Higher coverage levels also contribute to higher premium costs.

Benefits and Coverage

Long-term care insurance policies in Florida offer a range of benefits and services designed to help individuals pay for the costs associated with long-term care needs. The specific benefits and coverage provided will vary depending on the policy you choose, but generally include assistance with activities of daily living (ADLs), such as bathing, dressing, eating, toileting, transferring, and continence.

Benefit Payment and Limitations

The payment of benefits is typically structured as a daily or monthly allowance, which can be used to pay for a variety of long-term care services. However, there are limitations to consider.

- Benefit Period: Most policies have a benefit period, which is the maximum amount of time benefits will be paid. This period can range from a few years to a lifetime, depending on the policy.

- Daily or Monthly Benefit Limit: Policies often have a daily or monthly limit on the amount of benefits that can be paid. This limit will vary based on the policy and its coverage level.

- Elimination Period: An elimination period is a waiting period before benefits start. This period can range from a few days to several months, and it is intended to help reduce the cost of premiums.

- Pre-existing Conditions: Some policies may have exclusions for pre-existing conditions, meaning they will not cover care for conditions that existed before the policy was purchased.

Common Benefits and Coverage

Here’s a table showcasing the common benefits, coverage limits, and exclusions:

| Benefit | Coverage Limits | Exclusions |

|---|---|---|

| Nursing Home Care | May have a daily or monthly limit on the amount of benefits paid. | May exclude care for certain conditions, such as mental illness or substance abuse. |

| Assisted Living Care | May have a daily or monthly limit on the amount of benefits paid. | May exclude care for certain conditions, such as mental illness or substance abuse. |

| Home Health Care | May have a daily or monthly limit on the amount of benefits paid. | May exclude care for certain conditions, such as mental illness or substance abuse. |

| Adult Day Care | May have a daily or monthly limit on the amount of benefits paid. | May exclude care for certain conditions, such as mental illness or substance abuse. |

| Respite Care | May have a daily or monthly limit on the amount of benefits paid. | May exclude care for certain conditions, such as mental illness or substance abuse. |

Finding and Choosing a Provider

Choosing the right long-term care insurance provider is a crucial step in securing your financial future. This decision should be made with careful consideration, as the policy you choose will impact your coverage and financial protection for years to come.

Reputable Providers in Florida

Finding a reputable long-term care insurance provider in Florida requires research and due diligence. It is recommended to look for providers with a strong track record of financial stability, customer satisfaction, and a commitment to providing quality coverage.

- Check Financial Stability: Look for providers with a strong financial rating from reputable agencies like A.M. Best, Moody’s, and Standard & Poor’s. These ratings indicate the provider’s ability to meet its financial obligations and pay claims.

- Customer Satisfaction: Explore customer reviews and ratings from independent sources like the Better Business Bureau (BBB), Consumer Reports, and JD Power. These sources provide insights into the provider’s customer service, claims handling process, and overall customer experience.

- Coverage and Features: Compare policy features and benefits offered by different providers. Consider factors such as coverage limits, benefit periods, inflation protection, and the availability of optional riders.

- Provider Reputation: Research the provider’s history, including any past complaints or legal issues. You can find this information on the Florida Department of Insurance website or through online searches.

Resources and Organizations

Several resources and organizations can assist in finding suitable long-term care insurance providers in Florida. These organizations provide valuable information, guidance, and support throughout the selection process.

- Florida Department of Insurance: The Florida Department of Insurance website offers a wealth of information on long-term care insurance, including consumer guides, provider directories, and complaint procedures.

- National Association of Insurance Commissioners (NAIC): The NAIC provides a comprehensive resource center for long-term care insurance, including information on consumer protection, policy features, and finding a provider.

- Long-Term Care Insurance Consumer Coalition (LTCICC): The LTCICC is a non-profit organization dedicated to educating consumers about long-term care insurance and providing resources for making informed decisions.

- AARP: AARP offers a variety of resources for seniors, including information on long-term care insurance, provider directories, and educational materials.

- Independent Insurance Agents and Brokers: Independent agents and brokers can provide personalized advice and guidance on selecting the right long-term care insurance policy for your needs.

Comparing Quotes and Policy Features

Once you have identified a few potential providers, it is essential to compare quotes and policy features before making a decision. This step helps ensure you are getting the best value for your money and the coverage that best meets your needs.

- Request Quotes: Contact multiple providers and request quotes for similar coverage levels. This allows you to compare premiums and coverage options side-by-side.

- Review Policy Features: Carefully review the policy documents, including the coverage details, exclusions, limitations, and premium structure. Pay close attention to factors such as coverage limits, benefit periods, inflation protection, and the availability of optional riders.

- Consider Your Needs: Assess your individual needs and circumstances, such as your health, age, financial situation, and care preferences. Choose a policy that aligns with your specific requirements and provides adequate financial protection.

- Ask Questions: Don’t hesitate to ask questions about the policy features, coverage, and the provider’s claims handling process. Ensure you understand the policy terms and conditions before making a decision.

The Importance of Financial Planning

Long-term care insurance plays a crucial role in comprehensive financial planning, helping individuals and families prepare for the potential financial burdens associated with long-term care needs. By integrating long-term care insurance into your financial strategy, you can safeguard your assets and ensure a secure future, even in the face of unexpected long-term care expenses.

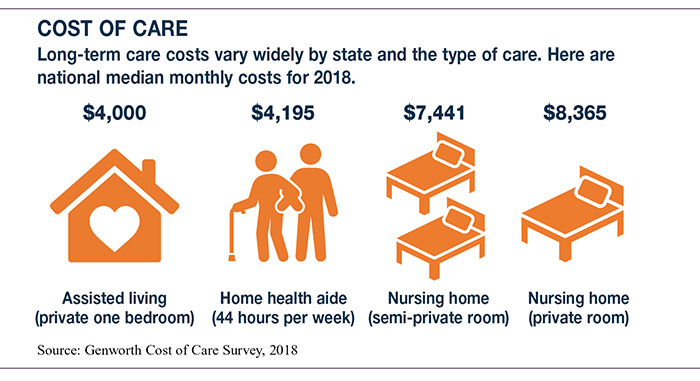

The Potential Financial Impact of Long-Term Care Needs Without Insurance

Without adequate long-term care insurance, the financial impact of long-term care needs can be devastating, potentially depleting life savings, jeopardizing retirement plans, and placing a heavy burden on loved ones. The costs of long-term care services can vary significantly depending on the type of care required, the location, and the duration of care.

The average annual cost of a private room in a nursing home in Florida is over $100,000.

This expense can quickly drain your financial resources, especially if you need care for several years. Furthermore, the lack of long-term care insurance can strain family relationships as loved ones may feel obligated to provide care, potentially sacrificing their own careers and financial security.

Government Resources and Support

Florida offers a variety of government programs and resources designed to assist individuals with long-term care needs. These programs can provide financial assistance, support services, and access to specialized care. Understanding these resources can be crucial for individuals and families navigating the complexities of long-term care planning.

Medicaid

Medicaid is a federal and state-funded program that provides health insurance coverage to low-income individuals and families. In Florida, Medicaid can help pay for long-term care services, including nursing home care, assisted living, and home health services.

To qualify for Medicaid long-term care benefits in Florida, individuals must meet specific income and asset requirements. These requirements can vary depending on the individual’s situation and the specific type of long-term care needed.

- Income Limits: Medicaid has income limits for eligibility. The exact limit depends on the individual’s marital status and whether they are living in a nursing home or community setting.

- Asset Limits: Florida has asset limits for Medicaid eligibility. This includes cash, savings accounts, real estate, and other assets. There are exceptions for certain assets, such as a primary residence and a car.

Medicaid can be a valuable resource for individuals who need long-term care but lack the financial resources to pay for it. It can help supplement long-term care insurance coverage by covering expenses that are not covered by the insurance policy.

Florida Long-Term Care Ombudsman Program

The Florida Long-Term Care Ombudsman Program is a state-funded program that advocates for the rights and well-being of residents in long-term care facilities. Ombudsmen investigate complaints, provide information and support to residents and their families, and work to improve the quality of care in long-term care facilities.

Other Government Programs

Florida offers a range of other government programs that can provide support for individuals with long-term care needs. These programs may provide financial assistance, caregiver support, or access to specialized services.

- Florida Department of Elder Affairs: This agency offers a variety of resources and services for older adults, including information about long-term care options, financial assistance programs, and caregiver support.

- Area Agencies on Aging: Florida has 11 Area Agencies on Aging (AAAs) that provide a range of services to older adults, including information and referral services, transportation assistance, and case management.

- Veterans Affairs: The Department of Veterans Affairs offers a variety of programs and services for veterans, including long-term care benefits.

Legal and Regulatory Considerations

Florida’s long-term care insurance market is governed by a comprehensive legal and regulatory framework designed to protect consumers and ensure the solvency of insurance providers. This framework encompasses various state and federal laws, regulations, and oversight mechanisms that influence the availability, affordability, and quality of long-term care insurance in the state.

Florida’s Long-Term Care Insurance Laws and Regulations

The Florida Department of Financial Services (DFS) is the primary regulatory body responsible for overseeing the long-term care insurance market in the state. The DFS establishes and enforces rules and regulations governing the issuance, marketing, and administration of long-term care insurance policies. These regulations address various aspects of the insurance process, including:

- Policy Form and Content: The DFS mandates specific requirements for policy forms, ensuring clarity and transparency in policy language and coverage provisions.

- Rate Filings and Approval: Insurance providers must submit their proposed rates for approval to the DFS, which reviews them for adequacy and fairness to policyholders.

- Marketing and Sales Practices: The DFS regulates marketing and sales practices to prevent deceptive or misleading representations and ensure that consumers receive accurate information about long-term care insurance products.

- Consumer Protection: Florida law provides several consumer protections for long-term care insurance policyholders, including the right to a free-look period to review the policy, the right to cancel the policy within 30 days of purchase, and the right to a guaranteed renewable policy that cannot be canceled due to age or health changes.

Rights and Responsibilities of Policyholders and Providers

Florida law Artikels the rights and responsibilities of both policyholders and long-term care insurance providers.

- Policyholders: Policyholders have the right to receive clear and accurate information about their policy, the right to choose their care provider, the right to appeal claims denials, and the right to seek assistance from the DFS if they believe their rights have been violated.

- Insurance Providers: Insurance providers are obligated to issue policies that comply with Florida law, to process claims promptly and fairly, to provide policyholders with clear and accurate information, and to maintain financial solvency to ensure the payment of claims.

Key Consumer Protection Laws

Florida has enacted several consumer protection laws specifically designed to safeguard long-term care insurance policyholders.

- The Florida Long-Term Care Insurance Act: This act establishes the regulatory framework for long-term care insurance in the state, including provisions for policy form standardization, rate regulation, marketing and sales practices, and consumer protection.

- The Florida Unfair Insurance Trade Practices Act: This act prohibits unfair and deceptive insurance practices, including misrepresentation, coercion, and unfair discrimination.

- The Florida Insurance Code: This code provides a comprehensive framework for the regulation of the insurance industry in Florida, including provisions related to consumer protection, financial solvency, and market conduct.

The Role of the Florida Department of Financial Services, Long-term care insurance florida

The DFS plays a crucial role in protecting consumers and ensuring the integrity of the long-term care insurance market in Florida. The DFS:

- Licenses and Regulates Insurance Providers: The DFS licenses and regulates long-term care insurance providers to ensure their financial stability and compliance with state laws.

- Reviews Policy Forms and Rates: The DFS reviews policy forms and rates to ensure they are clear, accurate, and fair to policyholders.

- Investigates Consumer Complaints: The DFS investigates consumer complaints about long-term care insurance providers and takes appropriate action to address violations of state law.

- Provides Consumer Education: The DFS provides educational resources and information to consumers about long-term care insurance to help them make informed decisions.

Future Trends and Considerations

The long-term care insurance industry in Florida, like its national counterpart, is constantly evolving, driven by demographic shifts, technological advancements, and healthcare reforms. Understanding these trends is crucial for individuals seeking long-term care coverage and for insurers developing future strategies.

Impact of Technological Advancements

Technological advancements are reshaping the long-term care landscape in Florida. Telehealth, remote monitoring, and artificial intelligence (AI) are playing increasingly significant roles in care delivery, potentially impacting coverage and costs.

- Telehealth: Telehealth platforms allow individuals to access medical care remotely, reducing the need for expensive and time-consuming in-person visits. This could lead to lower costs for long-term care services, particularly for routine check-ups and consultations. For example, a recent study by the American Medical Association found that telehealth consultations cost an average of 20% less than in-person visits.

- Remote Monitoring: Remote monitoring devices can track vital signs, medication adherence, and other health indicators, enabling early detection of health issues and reducing the need for hospitalization. This can lead to improved health outcomes and potentially lower costs for long-term care services. For instance, a study published in the Journal of the American Geriatrics Society found that remote monitoring programs reduced hospital readmissions by 15%.

- Artificial Intelligence (AI): AI-powered tools can assist in tasks such as care planning, medication management, and personalized care recommendations. This could enhance the efficiency and effectiveness of long-term care services, potentially leading to cost savings. For example, an AI-powered care planning tool developed by a leading healthcare technology company can create personalized care plans for individuals based on their individual needs and preferences, reducing the need for manual planning and potentially saving time and costs.

Last Word

Navigating the complexities of long-term care insurance in Florida can feel daunting, but with careful planning and research, you can find the right coverage to protect your financial well-being and ensure a comfortable future. By understanding the different policy options, costs, and benefits, you can make informed decisions that align with your unique needs and circumstances. Remember, seeking guidance from a qualified insurance professional can provide valuable insights and help you navigate the intricacies of this crucial aspect of financial planning.

Frequently Asked Questions

What are the common exclusions in long-term care insurance policies in Florida?

Common exclusions may include pre-existing conditions, certain types of care like custodial care, and care received in a hospital setting. It’s crucial to carefully review the policy details to understand the specific exclusions.

How can I find a reputable long-term care insurance provider in Florida?

You can start by seeking recommendations from trusted sources, such as financial advisors, friends, or family members. Additionally, online resources like the Florida Department of Insurance and the National Association of Insurance Commissioners can provide valuable information and lists of licensed providers.

What are the tax implications of long-term care insurance premiums in Florida?

Long-term care insurance premiums may be tax-deductible under certain circumstances, depending on your age and health status. It’s best to consult with a tax professional to understand the specific tax implications for your situation.