Low cost car insurance near me is a phrase many of us search for, seeking affordable protection for our vehicles. But finding the right balance between price and coverage can be tricky. Many factors influence car insurance costs, including your age, driving history, vehicle type, and even your location. Understanding these factors is key to finding the best deal for your needs.

This guide explores the world of car insurance, offering tips on how to compare quotes, understand policy features, and ultimately save money on your premiums. We’ll also discuss common questions and concerns, providing you with the information you need to make an informed decision.

Understanding “Low Cost Car Insurance Near Me”

Finding affordable car insurance is a priority for many drivers. “Low cost car insurance near me” reflects the desire for competitive rates tailored to a specific location. This means finding insurance that provides adequate coverage at a price that fits your budget.

Factors Influencing Car Insurance Costs

The cost of car insurance is determined by various factors, and understanding these factors can help you find the best rates.

- Age and Driving Experience: Younger drivers typically pay higher premiums due to their lack of experience. As you gain more experience, your rates usually decrease.

- Driving History: Your driving record plays a significant role. Accidents, traffic violations, and DUI convictions can lead to higher premiums. Maintaining a clean driving record is essential for lower rates.

- Vehicle Type: The type of vehicle you drive affects your insurance costs. High-performance cars, luxury vehicles, and expensive models generally have higher insurance premiums. This is due to the higher cost of repairs and replacement.

- Location: Your location is a key factor. Areas with higher rates of car theft, accidents, or vandalism typically have higher insurance premiums. Urban areas often have higher rates compared to rural areas.

- Credit Score: In many states, insurance companies consider your credit score when setting rates. A good credit score can lead to lower premiums, while a poor credit score may result in higher rates.

Types of Car Insurance Policies

Car insurance policies offer different levels of coverage, each with its own features and costs. Understanding the different types of policies can help you choose the right one for your needs.

- Liability Coverage: This is the most basic type of car insurance. It covers damages to other people’s property and injuries caused by an accident if you are at fault. Liability coverage is typically required by law.

- Collision Coverage: This covers damage to your own vehicle in an accident, regardless of who is at fault. It typically has a deductible, which is the amount you pay out-of-pocket before the insurance company covers the remaining costs.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. It also typically has a deductible.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses and property damage.

Finding the Right Insurance Provider

Finding the right car insurance provider can be overwhelming, especially when you’re looking for a low-cost option. It’s essential to compare quotes from different providers and understand the factors that influence your premium.

Resources for Finding Quotes

Finding quotes from different car insurance providers is the first step in securing a low-cost policy. Here are some resources to help you in your search:

- Comparison Websites: Websites like Policygenius, The Zebra, and NerdWallet allow you to compare quotes from multiple insurance companies simultaneously, making it easy to find the best deal.

- Insurance Company Websites: You can also get quotes directly from insurance company websites, such as Geico, State Farm, and Progressive. This allows you to explore the company’s specific coverage options and discounts.

Key Factors to Consider

When choosing a car insurance provider, it’s important to consider several factors beyond just the price:

- Reputation: Look for companies with a good reputation for customer service, financial stability, and claims handling. You can check online reviews and ratings from organizations like the Better Business Bureau (BBB).

- Customer Service: Consider how easy it is to reach the company and how responsive they are to your inquiries. Look for providers with 24/7 customer support and convenient online platforms.

- Coverage Options: Make sure the provider offers the coverage you need, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Compare the limits and deductibles offered by different companies.

- Pricing: While price is a major factor, don’t solely focus on the lowest quote. Consider the overall value and the coverage you’re getting for the price. Compare quotes from different providers, taking into account the factors mentioned above.

Comparing Insurance Providers

Here’s a table comparing the pros and cons of different insurance providers, based on factors like reputation, customer service, coverage options, and pricing:

| Provider | Pros | Cons |

|---|---|---|

| Geico | Known for low rates and convenient online services. | May not have the best customer service reputation. |

| State Farm | Offers comprehensive coverage options and strong customer service. | Rates can be higher compared to some competitors. |

| Progressive | Provides various discounts and customizable coverage options. | Can be challenging to reach customer service representatives. |

| Liberty Mutual | Offers strong financial stability and a wide range of discounts. | May have limited coverage options in some areas. |

| USAA | Provides excellent customer service and competitive rates for military members and their families. | Limited availability to only military members and their families. |

Getting a Quote and Comparing Options

Getting a car insurance quote is a crucial step in finding the right coverage for your needs and budget. By obtaining quotes from multiple insurance providers, you can compare different plans and choose the one that offers the best value.

Obtaining a Car Insurance Quote

Requesting a car insurance quote is a straightforward process that usually involves providing basic information about yourself and your vehicle.

Checklist of Essential Information

- Personal Information: Your name, address, date of birth, driving history, and contact information.

- Vehicle Information: Make, model, year, VIN (Vehicle Identification Number), mileage, and intended use of the vehicle (e.g., daily commute, occasional use).

- Driving History: Information about your driving record, including any accidents, violations, or claims.

- Coverage Preferences: The type of coverage you desire, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Payment Information: Preferred payment method and frequency.

Comparing Quotes

Once you have received quotes from multiple insurance providers, it is essential to compare them thoroughly to find the best value.

Key Factors to Consider

- Premium Amount: The total cost of the insurance policy.

- Coverage Limits: The maximum amount the insurer will pay for covered losses.

- Deductibles: The amount you pay out-of-pocket before the insurance coverage kicks in.

- Discounts: Any available discounts, such as safe driver, good student, or multi-car discounts.

- Customer Service: The insurer’s reputation for providing excellent customer service and handling claims efficiently.

Tips for Effective Comparison

- Use a Quote Comparison Website: Online platforms like Compare.com or Insurify can help you obtain quotes from multiple providers simultaneously.

- Contact Insurance Providers Directly: Reach out to insurance providers you are interested in to discuss your specific needs and get personalized quotes.

- Read Policy Details Carefully: Pay close attention to the fine print of each policy to understand the coverage limits, deductibles, and exclusions.

- Consider Long-Term Costs: Factor in potential future changes in your driving habits, vehicle value, and insurance rates when making your decision.

Understanding Policy Features and Coverage

Car insurance policies come with various coverage options, each designed to protect you financially in different situations. Understanding these options and their implications is crucial for finding the right policy that suits your needs and budget.

Understanding Different Types of Coverage

Car insurance policies typically offer several types of coverage, each addressing specific risks. Here’s a breakdown of the most common ones:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It covers medical expenses, lost wages, and property damage costs up to the policy limits. This is usually the most essential coverage and is mandatory in most states.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of fault. You’ll need to pay your deductible before the insurance company covers the rest of the costs.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. Similar to collision coverage, you’ll have to pay your deductible before the insurance company covers the rest.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to cover your damages. It helps cover your medical expenses, lost wages, and property damage costs.

- Personal Injury Protection (PIP): This coverage, often mandatory in certain states, covers your medical expenses and lost wages regardless of who’s at fault in an accident. It’s particularly important if you’re concerned about covering medical bills in case of an accident.

Understanding Deductibles and Premiums

- Deductible: This is the amount you agree to pay out of pocket for covered repairs or replacement before your insurance company starts paying. A higher deductible typically means a lower premium, while a lower deductible means a higher premium.

- Premium: This is the amount you pay for your car insurance policy, usually on a monthly or annual basis. Your premium is determined by several factors, including your driving record, age, location, vehicle type, and the coverage you choose.

Key Features and Benefits of Different Coverage Options

| Coverage Type | Key Features | Benefits |

|---|---|---|

| Liability Coverage | Protects you from financial responsibility if you cause an accident. Covers medical expenses, lost wages, and property damage costs. | Provides financial protection in case of accidents, preventing you from having to pay out of pocket for significant costs. |

| Collision Coverage | Covers repairs or replacement of your vehicle if damaged in a collision, regardless of fault. Requires a deductible payment. | Protects your investment in your vehicle, ensuring you can repair or replace it after an accident. |

| Comprehensive Coverage | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. Requires a deductible payment. | Provides peace of mind knowing your vehicle is protected from various risks beyond collisions. |

| Uninsured/Underinsured Motorist Coverage | Covers your damages if you’re involved in an accident with an uninsured or underinsured driver. | Offers protection against financial losses caused by drivers who don’t have sufficient insurance. |

| Personal Injury Protection (PIP) | Covers your medical expenses and lost wages regardless of fault in an accident. | Provides financial support for your recovery, covering medical bills and lost income after an accident. |

Tips for Saving Money on Car Insurance

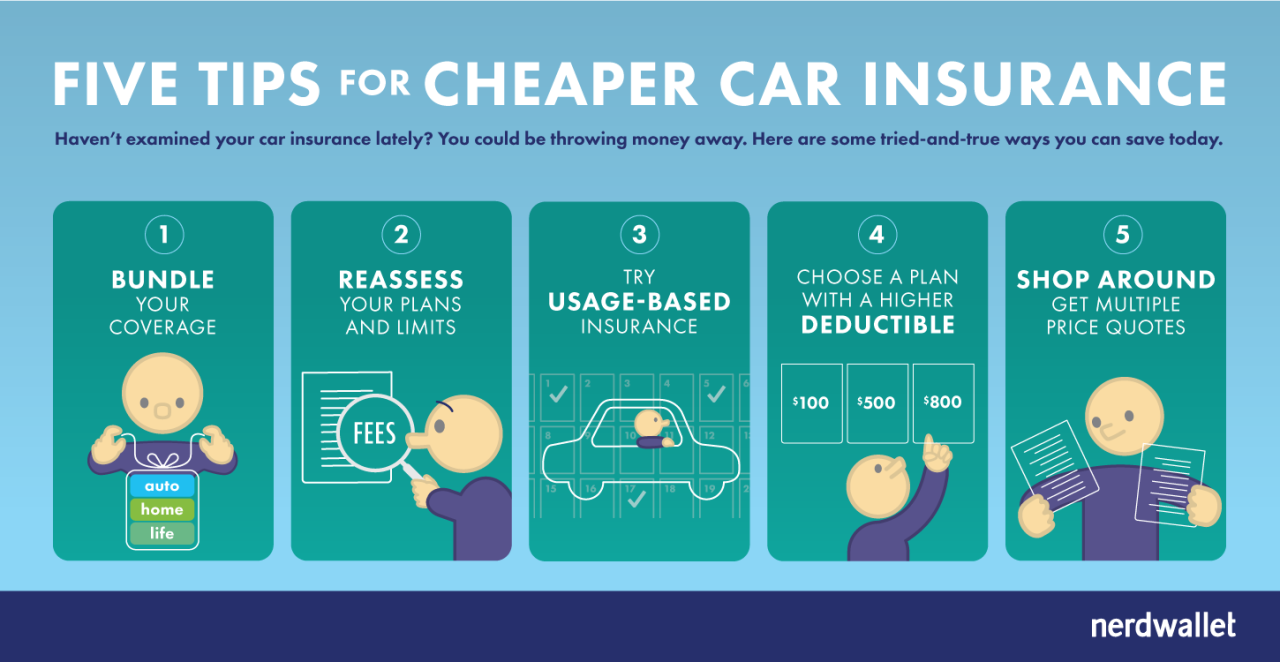

Finding the right car insurance policy can be a challenge, but it doesn’t have to be a costly one. There are many ways to save money on your car insurance premiums. Here are some practical tips to consider:

Maintain a Good Driving Record, Low cost car insurance near me

A clean driving record is one of the most significant factors influencing your car insurance premiums. Insurance companies reward drivers with a history of safe driving by offering lower rates. A good driving record includes:

- Avoiding accidents: Each accident, even if it’s not your fault, can increase your premiums.

- Avoiding traffic violations: Speeding tickets, reckless driving, and other violations can lead to higher premiums.

- Maintaining a clean driving record: By staying accident-free and avoiding traffic violations, you can demonstrate your responsible driving habits to insurers.

Choose a Car with Safety Features

Cars equipped with safety features are generally considered less risky to insure. Insurance companies often offer discounts for vehicles with features like:

- Anti-theft systems: These systems deter theft and can reduce your insurance premiums.

- Airbags: Airbags provide crucial protection in case of an accident, reducing the risk of injury and potentially lowering insurance costs.

- Anti-lock brakes (ABS): ABS systems help drivers maintain control of their vehicles during braking, reducing the likelihood of accidents and, in turn, lowering premiums.

- Electronic stability control (ESC): ESC helps prevent skidding and loss of control, making the vehicle safer and potentially lowering insurance costs.

Bundle Your Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant savings. Many insurance companies offer discounts for bundling multiple policies.

Consider Increasing Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your monthly premiums. However, it’s essential to consider your financial situation and ensure you can afford to pay the higher deductible if you need to file a claim.

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Compare quotes from multiple insurers to find the best rates. Online comparison tools can help streamline this process.

Location and Insurance Premiums

Your location can significantly impact your car insurance premiums. Factors like:

- Population density: Areas with high population density often have higher accident rates, which can lead to higher insurance premiums.

- Crime rates: Areas with high crime rates, especially car theft, may have higher insurance premiums.

- Weather conditions: Areas prone to severe weather events like hurricanes, earthquakes, or hailstorms may have higher insurance premiums.

Negotiate with Your Insurance Provider

Don’t hesitate to negotiate with your insurance provider for a lower rate. Highlight your good driving record, safety features in your car, and any other factors that might make you a low-risk driver. You can also ask about discounts for:

- Good student discounts: These discounts are often available for students who maintain a certain GPA.

- Safe driver discounts: Many insurers offer discounts for drivers who complete defensive driving courses.

- Loyalty discounts: Insurance companies may reward long-term customers with discounts.

Navigating the Claims Process

Filing a car insurance claim can be a stressful experience, but understanding the process can make it easier. Knowing the steps involved, the necessary documents, and the role of the insurance adjuster can help you navigate this process smoothly.

Filing a Claim

You should file a claim as soon as possible after an accident. Most insurance companies have online portals, mobile apps, or phone lines for reporting claims. You will need to provide basic information about the accident, such as the date, time, location, and the parties involved. You should also provide details about the damage to your vehicle and any injuries sustained.

Document Checklist

Having the following documents readily available will expedite the claims process:

- Your insurance policy details: This includes your policy number, coverage limits, and deductible.

- Driver’s license and registration: These documents prove your identity and ownership of the vehicle.

- Police report: If the accident involved another vehicle or resulted in injuries, a police report is essential.

- Photos of the damage: Take clear pictures of the damage to your vehicle from all angles.

- Witness statements: If there were witnesses to the accident, get their contact information and statements.

- Medical records: If you or anyone else was injured, obtain medical records from your doctor.

- Repair estimates: Get estimates from reputable repair shops for the cost of repairs.

Role of the Insurance Adjuster

The insurance adjuster is responsible for investigating the claim and determining the extent of the damage. They will review the documents you provide and may conduct an inspection of your vehicle. The adjuster will then assess the claim and make a decision on whether to approve or deny it.

The insurance adjuster will be your primary contact throughout the claims process. It’s important to communicate with them clearly and provide all the necessary information.

Epilogue

Securing affordable car insurance doesn’t have to be a stressful experience. By understanding the factors that influence premiums, utilizing available resources, and comparing quotes from various providers, you can find the best low cost car insurance near you. Remember, it’s essential to choose a policy that provides the right level of coverage for your needs and budget. Don’t hesitate to contact insurance providers directly with any questions or concerns. With a little research and planning, you can find the peace of mind you deserve, knowing your vehicle is protected.

General Inquiries

What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance covers the rest of the claim. A higher deductible generally means a lower premium, while a lower deductible means a higher premium. Consider your risk tolerance and budget when choosing a deductible.

What are some common coverage options included in car insurance policies?

Common coverage options include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Each type of coverage protects you in different situations, and it’s important to understand what each covers before making a decision.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least once a year, or whenever you experience a significant life change, such as getting married, having a child, or moving to a new location. Your needs may change, and you may be able to find a better deal with a different provider.