Lowest car insurance in florida – Navigating the complex world of car insurance in Florida can be daunting, especially when searching for the lowest rates. Florida’s unique demographics, including a high-risk driver population, contribute to higher average insurance premiums compared to other states. However, with the right knowledge and strategies, finding affordable car insurance in Florida is achievable.

This guide explores key factors influencing car insurance rates in Florida, provides tips for obtaining discounts, and delves into the state’s insurance laws and regulations. Whether you’re a new driver or a seasoned motorist, understanding these aspects can help you secure the best possible car insurance coverage at a price that fits your budget.

Understanding Florida’s Insurance Laws and Regulations

Florida’s car insurance laws and regulations are unique and complex. Understanding these rules is essential for all drivers in the state, as they can significantly impact your rights and responsibilities in the event of an accident.

Florida’s Minimum Car Insurance Requirements

Florida is a “no-fault” insurance state. This means that after an accident, drivers are primarily responsible for covering their own medical expenses, regardless of who caused the accident. However, Florida law requires all drivers to carry a minimum amount of car insurance, known as Personal Injury Protection (PIP) and Property Damage Liability (PDL).

- PIP: This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who caused the accident. The minimum required PIP coverage is $10,000.

- PDL: This coverage pays for damages to another person’s vehicle or property if you are at fault in an accident. The minimum required PDL coverage is $10,000.

It’s crucial to note that these minimum requirements are just that: minimums. Failing to carry the required minimum insurance can result in significant penalties, including fines, license suspension, and even jail time. Drivers are strongly encouraged to consider purchasing additional coverage, such as uninsured/underinsured motorist coverage, to protect themselves financially in the event of an accident caused by a driver without sufficient insurance.

Understanding Florida’s No-Fault Insurance System

Florida’s no-fault insurance system is designed to streamline the claims process and reduce the number of lawsuits following accidents. However, it also has some unique implications for accident claims.

- First-Party Coverage: In a no-fault system, you file a claim with your own insurance company, regardless of who caused the accident. This means you are covered for your own injuries and damages, regardless of fault.

- Threshold for Filing a Lawsuit: Florida’s no-fault system has a “threshold” for filing a lawsuit against the other driver. You can only sue the other driver for pain and suffering if you meet certain criteria, such as exceeding a specific medical expense threshold or suffering a permanent injury.

This system can sometimes be challenging for accident victims, as they may be limited in their ability to seek compensation for pain and suffering, even if the other driver was at fault. It’s important to consult with an attorney to understand your rights and options in these situations.

Filing a Car Insurance Claim in Florida

Filing a car insurance claim in Florida requires following a specific process. Here are the necessary steps:

- Report the Accident: Contact your insurance company immediately after the accident to report the incident. Provide detailed information about the accident, including the date, time, location, and any injuries sustained.

- Gather Documentation: Collect all relevant documentation, including police reports, medical records, photos of the damage, and witness statements.

- File the Claim: Submit your claim to your insurance company in writing, along with all supporting documentation.

- Follow Up: Keep in contact with your insurance company and follow up regularly to track the status of your claim.

It’s important to be proactive and organized throughout the claims process to ensure your claim is processed promptly and fairly.

Legal Pitfalls Associated with Car Insurance Claims in Florida

Navigating car insurance claims in Florida can be challenging, and there are potential legal pitfalls to be aware of. Here are some common issues:

- PIP Coverage Limitations: PIP coverage has limits on the amount of benefits you can receive, and there are specific requirements for accessing those benefits.

- Threshold for Filing a Lawsuit: As mentioned earlier, Florida’s no-fault system has a threshold for filing a lawsuit against the other driver. Failing to meet this threshold can limit your ability to recover compensation for pain and suffering.

- Insurance Company Tactics: Insurance companies often use tactics to minimize payouts or deny claims altogether. It’s essential to understand your rights and be prepared to challenge their decisions if necessary.

Consulting with an experienced attorney can help you navigate these challenges and protect your rights.

Driving Safely in Florida: Lowest Car Insurance In Florida

Florida is a popular tourist destination known for its beautiful beaches and warm weather. However, driving in Florida can be challenging due to its unique weather conditions, heavy traffic, and diverse road hazards. This guide will provide essential tips for safe driving in Florida, helping you navigate the roads confidently and minimize the risk of accidents.

Safe Driving Practices in Florida

Florida’s weather can be unpredictable, with frequent heavy rains, thunderstorms, and even hurricanes. It’s crucial to adjust your driving habits to these conditions. Here are some tips for safe driving in Florida weather:

- Reduce speed during rain or storms to maintain control and increase visibility.

- Turn on your headlights even during daylight hours to improve visibility and make your vehicle more noticeable to others.

- Be extra cautious during heavy rain, as roads can become slippery and flooded. If you encounter standing water, avoid driving through it as it can be difficult to gauge the depth and potentially dangerous.

- If you encounter a flooded road, turn around and find an alternate route. Driving through flooded areas can be extremely dangerous and can damage your vehicle.

- Stay informed about weather forecasts and be prepared for sudden changes in conditions. Consider delaying your trip if severe weather is anticipated.

Defensive Driving Techniques

Defensive driving involves anticipating potential hazards and taking proactive measures to avoid accidents. Here are some defensive driving techniques to practice in Florida:

- Maintain a safe following distance. This allows you to react in time to sudden stops or unexpected maneuvers by other drivers.

- Be aware of your surroundings and anticipate potential hazards, such as pedestrians, cyclists, and animals crossing the road.

- Avoid distractions while driving. Put away your phone, turn off the radio, and refrain from eating or drinking while driving.

- Be mindful of blind spots and check your mirrors frequently to ensure you have a clear view of the road.

- Use your turn signals well in advance to alert other drivers of your intentions.

- Be prepared to react quickly to unexpected situations. Stay alert and focused while driving.

Vehicle Maintenance

Regular vehicle maintenance is essential for safe driving and can significantly reduce the risk of breakdowns and accidents. Here’s why:

- Ensuring proper tire pressure helps maintain traction and control, especially in wet conditions.

- Regular oil changes keep your engine running smoothly and efficiently, reducing the likelihood of breakdowns.

- Checking and maintaining your brakes ensures they are in optimal condition to stop your vehicle safely.

- Replacing worn-out windshield wipers improves visibility during rain or storms, enhancing safety.

- Regularly checking your lights ensures they are working properly, improving visibility for you and other drivers.

Common Traffic Violations in Florida, Lowest car insurance in florida

Florida has a range of traffic laws that drivers must adhere to. Violating these laws can lead to fines, points on your license, and increased insurance premiums. Some common traffic violations in Florida include:

- Speeding: Exceeding the posted speed limit can significantly increase the risk of accidents and lead to fines and points on your license.

- Driving under the influence (DUI): Driving while intoxicated is illegal and extremely dangerous. DUI convictions can result in severe penalties, including jail time, fines, and license suspension.

- Running red lights: Disregarding traffic signals can cause serious accidents. This violation can result in fines and points on your license.

- Texting while driving: Texting while driving is illegal and highly dangerous. It significantly impairs your ability to react to changing road conditions and can lead to accidents.

- Distracted driving: Any activity that takes your attention away from the road, such as talking on the phone, eating, or adjusting the radio, can be considered distracted driving. These violations can result in fines and points on your license.

Tips for New Drivers in Florida

Embarking on your journey as a new driver in Florida can be exciting, but it’s essential to navigate the road ahead with knowledge and preparedness. This guide will provide you with crucial information and advice to ensure a safe and successful driving experience.

Obtaining a Driver’s License

To legally operate a motor vehicle in Florida, you must possess a valid driver’s license. Here’s how to obtain one:

- Meet Eligibility Requirements: You must be at least 16 years old and meet Florida’s residency requirements.

- Complete a Driver Education Course: Enroll in a state-approved driver education program, which includes classroom instruction and behind-the-wheel training.

- Pass the Written Test: Demonstrate your knowledge of Florida’s traffic laws and regulations by successfully completing a written exam.

- Pass the Driving Test: After passing the written test, you’ll need to pass a practical driving test, showcasing your ability to operate a vehicle safely and proficiently.

- Apply for a License: Once you’ve passed both tests, submit an application for a driver’s license at a Florida Department of Motor Vehicles (DMV) office.

Choosing a Car

The type of car you choose can significantly impact your insurance premiums. Consider these factors when selecting a vehicle:

- Safety Features: Opt for a car equipped with advanced safety features, such as anti-lock brakes, electronic stability control, and airbags, as they can lower your insurance costs.

- Fuel Efficiency: Vehicles with higher fuel efficiency tend to be more affordable to insure.

- Vehicle History: Avoid purchasing cars with a history of accidents or major repairs, as this can increase your insurance rates.

- Insurance Quotes: Obtain insurance quotes from multiple companies before making a purchase to compare rates and coverage options.

Securing Affordable Car Insurance

Car insurance is mandatory in Florida, and finding affordable coverage is essential. Here are some tips to help you secure the best rates:

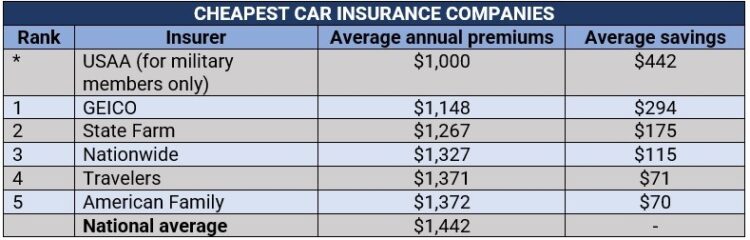

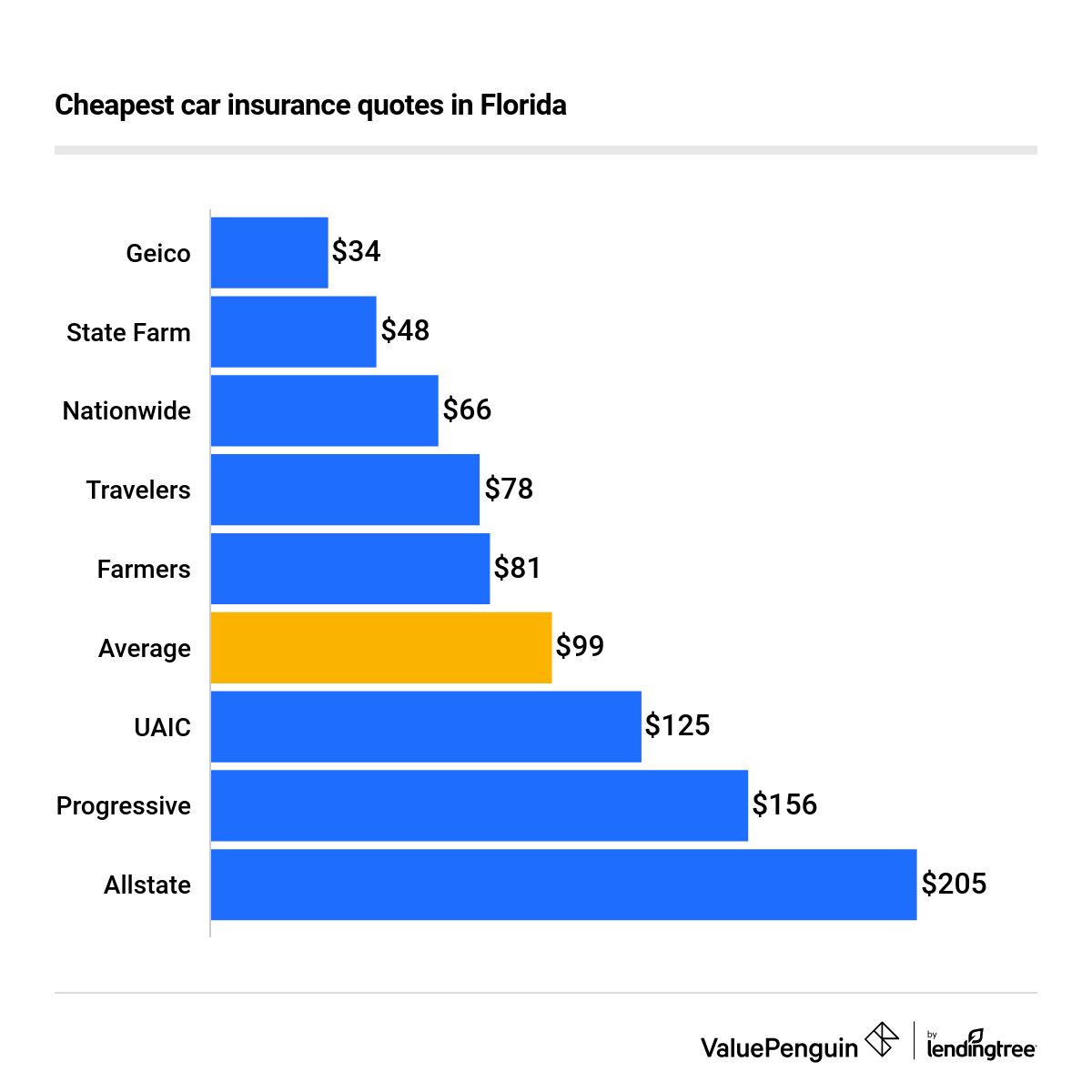

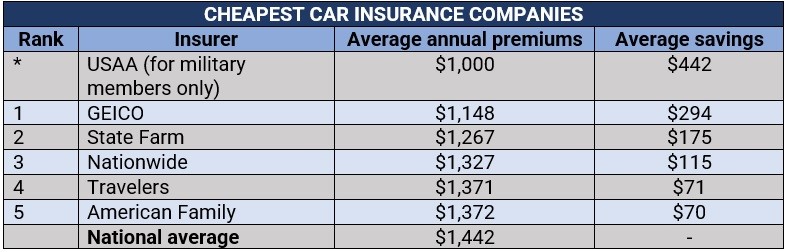

- Shop Around: Get quotes from several insurance companies to compare prices and coverage options.

- Maintain a Good Driving Record: Avoid traffic violations and accidents, as these can significantly increase your premiums.

- Consider Discounts: Inquire about available discounts, such as good student discounts, safe driver discounts, and multi-car discounts.

- Increase Your Deductible: A higher deductible typically translates to lower premiums.

- Bundle Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

Impact of Driving Experience on Insurance Premiums

New drivers often face higher insurance premiums due to their lack of experience. Insurance companies perceive inexperienced drivers as posing a greater risk, leading to higher rates.

“Insurance companies assess your driving history, including accidents, violations, and driving experience, to determine your insurance premiums.”

Building a Positive Driving Record

Developing a positive driving record is crucial for securing affordable car insurance in the long run. Here’s how to achieve this:

- Obey Traffic Laws: Always follow traffic rules and regulations to avoid violations.

- Drive Defensively: Be aware of your surroundings and anticipate potential hazards.

- Avoid Distractions: Refrain from using cell phones, texting, or engaging in other distracting activities while driving.

- Maintain Your Vehicle: Ensure your car is in good working condition to prevent breakdowns and accidents.

Benefits of Driver Education Programs

Enrolling in a driver education program can provide numerous benefits for new drivers:

- Enhanced Driving Skills: Driver education programs offer comprehensive training on safe driving techniques, traffic laws, and emergency procedures.

- Reduced Insurance Premiums: Many insurance companies offer discounts to drivers who complete a driver education course.

- Increased Confidence: Driver education programs can help new drivers build confidence and develop essential skills behind the wheel.

Conclusion

By understanding the factors that impact car insurance rates in Florida, drivers can take proactive steps to secure affordable coverage. From comparing quotes and utilizing discounts to driving safely and maintaining a clean driving record, there are numerous strategies to reduce premiums. Remember, securing the lowest car insurance in Florida requires research, comparison, and a commitment to responsible driving practices.

Helpful Answers

What are the minimum car insurance requirements in Florida?

Florida requires drivers to carry at least $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage. This is known as the “no-fault” system, where drivers are primarily responsible for their own medical expenses after an accident, regardless of fault.

How can I get a discount on my car insurance in Florida?

Many insurance companies offer discounts for good driving records, safe driving courses, bundling insurance policies, and installing safety features in your vehicle. Ask your insurance provider about available discounts.

What is the best way to compare car insurance quotes in Florida?

Use online comparison tools that allow you to enter your information once and receive quotes from multiple insurance providers. This allows for quick and easy comparison of rates and coverage options.

What are some tips for driving safely in Florida?

Be aware of Florida’s unique weather conditions, such as heavy rain and hurricanes. Practice defensive driving techniques, stay alert, and avoid distractions. Regularly maintain your vehicle to ensure it’s in good working order.