Lowest car insurance rates Florida: Finding affordable coverage in the Sunshine State can feel like a daunting task. With high traffic and a unique insurance landscape, navigating the world of car insurance quotes can be overwhelming. But, don’t despair! This guide will equip you with the knowledge and strategies to secure the best rates possible.

Understanding the factors that influence car insurance rates in Florida is crucial. This includes your driving history, age, vehicle type, and even your credit score. We’ll break down these key factors and provide insights into the unique characteristics of the Florida car insurance market. We’ll also explore various discounts and savings opportunities available to you, helping you maximize your budget.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance market is unique and complex, influenced by a variety of factors. Understanding these factors is crucial for drivers seeking the lowest possible rates.

Factors Influencing Car Insurance Rates in Florida

Florida’s car insurance rates are determined by a combination of factors, including:

- Driving Record: A clean driving record with no accidents or traffic violations is essential for securing lower rates. Insurance companies consider your history of claims and violations to assess your risk profile.

- Age and Gender: Younger and inexperienced drivers generally face higher rates due to their statistically higher risk of accidents. Gender can also play a role, with males typically paying more than females.

- Vehicle Type: The make, model, and year of your vehicle are crucial factors. High-performance or luxury cars are often more expensive to insure due to their higher repair costs and greater risk of theft.

- Location: Florida’s geography significantly impacts insurance rates. Areas with high population density, heavy traffic, and higher rates of accidents generally have higher premiums.

- Coverage Levels: The amount of coverage you choose directly affects your premiums. Higher coverage limits, such as comprehensive and collision coverage, will result in higher rates.

- Credit Score: While not legal in all states, some Florida insurers use credit scores as a factor in determining rates. A good credit score can lead to lower premiums, while a poor credit score can result in higher rates.

- Insurance History: Your past insurance history, including any lapses in coverage, can affect your rates. Continuous coverage with a good track record can earn you discounts.

Unique Characteristics of Florida’s Car Insurance Market

Florida’s car insurance market is characterized by several unique features:

- High Rates: Florida has consistently ranked among the states with the highest average car insurance rates. This is attributed to factors such as a high volume of accidents, a large number of uninsured drivers, and the state’s no-fault insurance system.

- No-Fault Insurance: Florida operates under a no-fault insurance system, meaning drivers are required to file claims with their own insurance company regardless of who caused the accident. This system can lead to higher rates due to the increased number of claims.

- Personal Injury Protection (PIP): Florida law requires drivers to carry Personal Injury Protection (PIP) coverage, which covers medical expenses for injuries sustained in an accident. PIP coverage is mandatory and can contribute significantly to insurance premiums.

- High Number of Uninsured Drivers: Florida has a high number of uninsured drivers, which increases the risk for insured drivers and can contribute to higher premiums.

- Florida Automobile Joint Underwriting Association (FAJUA): The FAJUA is a state-run insurance pool that provides coverage to drivers who have been denied coverage by private insurers. Drivers who are insured through the FAJUA typically pay higher premiums.

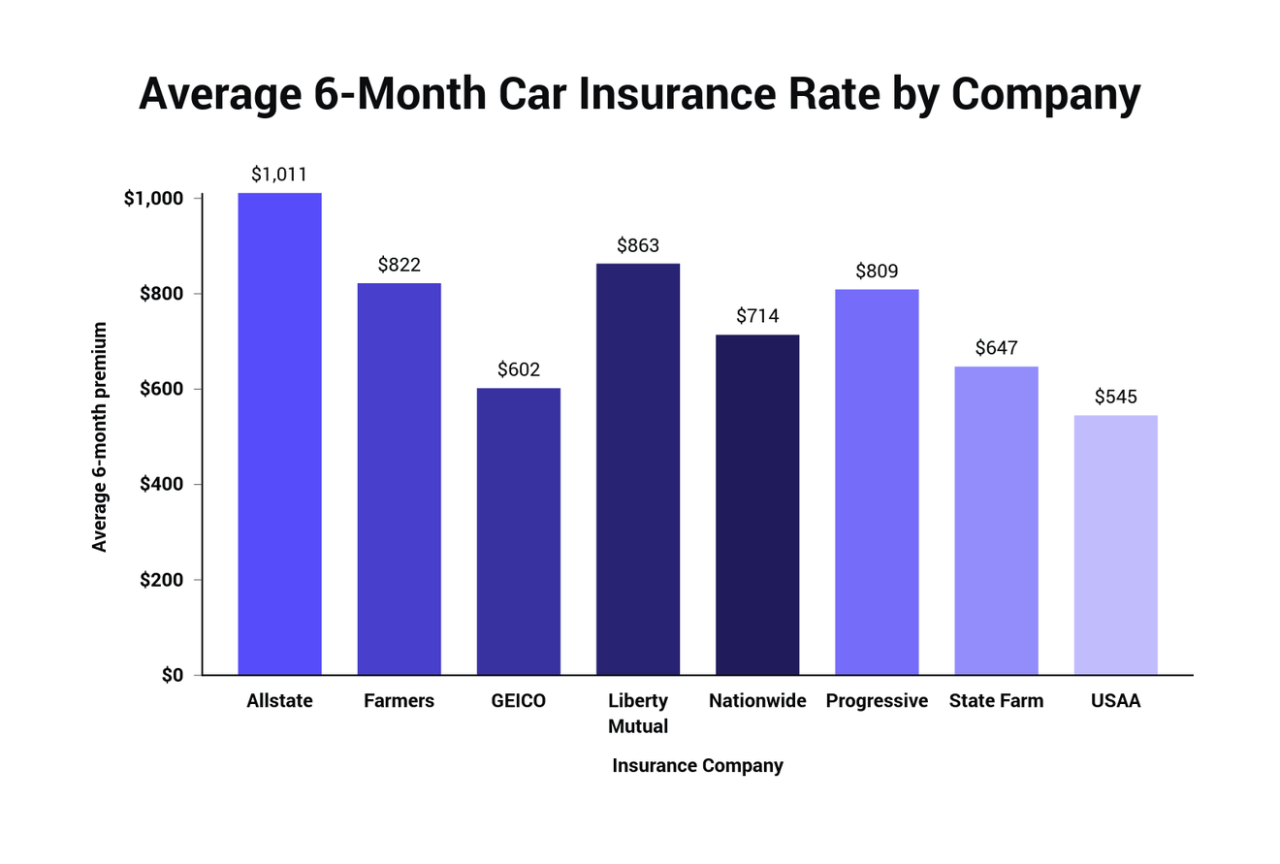

Major Car Insurance Providers in Florida

Florida is home to a diverse range of car insurance providers, both national and regional. Some of the major players in the Florida market include:

- State Farm: State Farm is the largest auto insurer in the United States, with a strong presence in Florida. They offer a wide range of coverage options and discounts.

- GEICO: GEICO is another major national insurer known for its competitive rates and extensive advertising. They offer a variety of coverage options and discounts.

- Progressive: Progressive is a leading national insurer that offers a wide range of coverage options and discounts, including its well-known “Name Your Price” tool.

- Allstate: Allstate is a major national insurer that offers a variety of coverage options and discounts, including its “Drive Safe and Save” program.

- USAA: USAA is a military-focused insurer that offers competitive rates and excellent customer service. Membership is limited to active military personnel, veterans, and their families.

- Florida Peninsula Insurance Company: Florida Peninsula is a regional insurer that specializes in providing coverage to drivers in Florida. They offer a variety of coverage options and discounts.

- Auto-Owners Insurance: Auto-Owners is a regional insurer that offers a variety of coverage options and discounts, including its “Safe Driver” program.

- Nationwide: Nationwide is a national insurer that offers a variety of coverage options and discounts, including its “On Your Side” program.

Finding the Lowest Rates

Finding the most affordable car insurance in Florida requires a strategic approach. By comparing quotes from multiple insurers and understanding the key factors that influence premiums, you can potentially save hundreds of dollars each year.

Comparing Quotes

It’s crucial to obtain quotes from multiple insurance companies to find the best rates. Here’s how to effectively compare car insurance quotes in Florida:

- Use online comparison websites: Websites like Policygenius, Insurance.com, and The Zebra allow you to compare quotes from various insurers simultaneously. This saves you time and effort.

- Contact insurance companies directly: Don’t solely rely on comparison websites. Reach out to insurance companies directly to get personalized quotes.

- Provide accurate information: Ensure you provide accurate details about your vehicle, driving history, and other relevant factors to receive precise quotes.

- Ask about discounts: Many insurers offer discounts for good driving records, safety features, bundling insurance policies, and more. Inquire about these discounts to potentially lower your premium.

Key Factors Affecting Rates

Several factors determine your car insurance premiums in Florida. Understanding these factors can help you make informed decisions to potentially lower your costs.

- Driving History: Your driving record is a major factor in determining your premium. Accidents, traffic violations, and DUI convictions can significantly increase your rates.

- Age and Gender: Younger drivers typically pay higher premiums due to their higher risk of accidents. Gender also plays a role, with males generally paying slightly more than females.

- Vehicle Type: The make, model, and year of your car affect your premium. Sports cars and luxury vehicles are generally more expensive to insure due to their higher repair costs and theft risk.

- Location: Florida’s geographical location influences premiums. Areas with higher accident rates or crime rates may have higher insurance costs.

- Coverage Levels: The amount of coverage you choose impacts your premium. Higher coverage limits generally mean higher premiums.

- Credit Score: In some states, including Florida, insurance companies may use your credit score as a factor in determining your premium. A good credit score can lead to lower rates.

Regularly Reviewing Your Needs

Your car insurance needs can change over time. It’s essential to review your policy periodically to ensure it still meets your requirements.

- Changes in driving habits: If you’ve become a more experienced driver or drive less frequently, you may qualify for lower premiums.

- Vehicle changes: If you’ve purchased a new car, traded in your old vehicle, or made modifications, you need to update your insurance policy.

- Life changes: Significant life events, such as marriage, divorce, or having children, may affect your insurance needs and premiums.

Key Factors Affecting Rates: Lowest Car Insurance Rates Florida

Car insurance rates in Florida, like in other states, are determined by a complex interplay of factors. These factors can vary significantly from one insurer to another, making it crucial to compare quotes from multiple companies to find the best deal.

Driving History

Your driving history is a significant factor in determining your car insurance rates. Insurers assess your risk based on your past driving behavior, considering factors such as:

- Accidents: Having a history of accidents, even minor ones, can increase your premiums. Insurers view accidents as indicators of higher risk, making you more likely to file claims in the future.

- Traffic Violations: Speeding tickets, DUI convictions, and other traffic violations also increase your rates. These violations suggest a higher likelihood of risky driving behavior, leading insurers to charge higher premiums.

- Years of Driving Experience: Drivers with less experience generally have higher rates. Insurers perceive inexperienced drivers as more prone to accidents, leading to higher premiums.

Age

Your age is another crucial factor influencing car insurance rates. Young drivers, especially those under 25, often face higher premiums due to their higher risk of accidents. This is because young drivers have less experience behind the wheel and are more likely to engage in risky behaviors. As drivers age, their premiums tend to decrease as they gain more experience and become statistically less likely to be involved in accidents.

Vehicle Type

The type of vehicle you drive significantly impacts your car insurance rates. Insurers consider factors such as:

- Vehicle Value: More expensive vehicles are generally more costly to repair or replace, leading to higher insurance premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, often qualify for discounts.

- Vehicle Performance: High-performance vehicles, such as sports cars, are considered riskier to drive and are typically associated with higher insurance rates.

Credit Score

In many states, including Florida, insurers can use your credit score as a factor in determining your car insurance rates. A higher credit score generally indicates financial responsibility, making you a lower-risk customer. Conversely, a lower credit score might suggest a higher risk of filing claims, leading to higher premiums.

Coverage Options

The type and amount of coverage you choose also influence your car insurance rates.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. Higher liability limits generally result in higher premiums.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Choosing a higher deductible, which is the amount you pay out-of-pocket before your insurance kicks in, can lower your premiums.

- Comprehensive Coverage: This coverage protects you against damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. Like collision coverage, a higher deductible can reduce your premiums.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured.

Discounts and Savings

In Florida, finding the lowest car insurance rates is often about maximizing discounts. Many insurance companies offer various discounts that can significantly reduce your premiums. By understanding these discounts and how to qualify for them, you can save money on your car insurance.

Common Car Insurance Discounts in Florida

Discounts are a significant way to reduce your car insurance costs. Here are some common discounts offered by Florida insurance companies:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, meaning no accidents or traffic violations within a specific timeframe.

- Safe Driver Discount: This discount is similar to the good driver discount but may be offered for a longer period of time, rewarding drivers with a consistently safe driving history.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount. This discount is typically offered to drivers who insure two or more vehicles.

- Multi-Policy Discount: Insuring multiple types of insurance, like home, renters, or life insurance, with the same company can earn you a multi-policy discount. This discount is usually a percentage off your car insurance premium.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can qualify you for a discount. This course teaches safe driving techniques and can help you avoid accidents.

- Good Student Discount: Students with good grades or high GPAs may be eligible for a good student discount. This discount is usually offered to students who maintain a certain GPA or academic standing.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, in your vehicle can reduce your insurance premium. These devices help deter theft and reduce the risk of damage to your car.

- Loyalty Discount: Some insurance companies offer loyalty discounts to customers who have been with them for a certain period of time. This discount is a reward for customer retention and loyalty.

- Early Payment Discount: Paying your car insurance premium in full or on time can earn you an early payment discount. This discount encourages prompt payment and reduces administrative costs for insurance companies.

- Telematics Discount: Some insurance companies offer discounts for using telematics devices. These devices track your driving behavior and can provide you with feedback to improve your driving habits. Based on your safe driving record, you may be eligible for a discount.

- Vehicle Safety Features Discount: Cars with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, may qualify for a discount. These features reduce the risk of accidents and injuries, making your car safer to drive.

- Pay-in-Full Discount: Paying your annual premium in full upfront may qualify you for a discount. This discount is offered by some insurance companies as an incentive for paying your premium early.

Maximizing Discounts and Savings

It is essential to take advantage of as many discounts as possible to lower your insurance premiums. Here are some tips to help you maximize discounts:

- Review Your Driving Record: Maintain a clean driving record by avoiding accidents and traffic violations.

- Bundle Insurance Policies: Consider bundling your car insurance with other insurance policies, such as home, renters, or life insurance, to qualify for a multi-policy discount.

- Complete a Defensive Driving Course: Enroll in a state-approved defensive driving course to earn a discount and learn valuable driving skills.

- Maintain Good Grades: If you are a student, maintain good grades to qualify for a good student discount.

- Install Anti-theft Devices: Install anti-theft devices in your vehicle to qualify for a discount and deter theft.

- Compare Quotes: Obtain quotes from multiple insurance companies and compare their rates and available discounts.

- Pay Your Premium on Time: Pay your premium on time or in full to qualify for early payment discounts.

- Ask About Available Discounts: Contact your insurance company or agent to inquire about available discounts and eligibility requirements.

- Consider Telematics Programs: If your insurance company offers telematics programs, consider enrolling to track your driving behavior and potentially earn a discount.

Bundling Insurance Policies, Lowest car insurance rates florida

Bundling your car insurance with other insurance policies, such as home, renters, or life insurance, can be a smart way to save money. Bundling typically offers a multi-policy discount, which can significantly reduce your overall insurance costs. By insuring multiple policies with the same company, you can benefit from:

- Lower Premiums: Bundling often results in lower premiums compared to purchasing individual policies.

- Convenience: Managing all your insurance policies with one company can be more convenient, simplifying billing and communication.

- Simplified Claims Process: In case of an accident or claim, dealing with one insurance company for all your policies can streamline the process.

Insurance Coverage Options

In Florida, understanding the various car insurance coverage options is crucial for finding the right balance between affordability and protection. While some coverages are mandatory, others are optional, offering additional protection in specific situations. This section will Artikel the different types of car insurance coverage available in Florida and their associated benefits and limitations.

Liability Coverage

Liability coverage is the most important aspect of car insurance in Florida. It protects you financially if you cause an accident that results in injury or damage to another person or their property. In Florida, liability coverage is mandatory and includes two components:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other party due to your negligence. The coverage limits are typically expressed as two numbers, for example, 25/50/10, where 25 represents the maximum amount payable per person for bodily injury, 50 represents the maximum amount payable per accident, and 10 represents the maximum amount payable for property damage.

- Property Damage Liability: This coverage pays for damages to the other party’s vehicle or property. The coverage limit is typically expressed as a single number, for example, 10,000, representing the maximum amount payable for property damage per accident.

It is essential to have adequate liability coverage to protect yourself from potentially catastrophic financial losses in the event of an accident.

In Florida, the minimum required liability coverage limits are 10/20/10. However, it is highly recommended to have higher coverage limits, as the minimum limits may not be sufficient to cover all damages in a serious accident.

Navigating Claims and Disputes

Accidents happen, and when they do, knowing how to navigate the claims process is crucial. Understanding your rights and responsibilities is essential to ensure a smooth and successful experience.

Filing a Car Insurance Claim in Florida

In Florida, filing a car insurance claim typically involves the following steps:

- Contact your insurance company immediately after the accident. Report the incident and provide all necessary details, such as the date, time, location, and parties involved.

- File a police report if the accident involves injuries or property damage exceeding $500. The police report will serve as official documentation of the incident.

- Gather evidence. Take photos of the damage to your vehicle and the accident scene. Obtain contact information from any witnesses.

- Complete a claim form. Your insurance company will provide you with a claim form, which you need to fill out accurately and submit.

- Cooperate with your insurance company’s investigation. This may involve providing additional information, attending an inspection, or submitting medical records.

- Negotiate a settlement. Your insurance company will assess the damage and offer a settlement amount. You have the right to negotiate this amount if you believe it is insufficient.

Resolving Disputes with Your Insurance Company

If you disagree with your insurance company’s decision, you can pursue the following options:

- File an appeal. Most insurance companies have an internal appeals process that allows you to challenge their initial decision.

- Contact the Florida Department of Financial Services. This agency regulates insurance companies in Florida and can help resolve disputes between policyholders and insurers.

- Seek legal counsel. If you are unable to reach a resolution through other means, you can consult with an attorney specializing in insurance law.

Tips for a Smooth Claims Experience

- Keep detailed records. Document all communication with your insurance company, including dates, times, and summaries of conversations.

- Be proactive. Don’t wait for your insurance company to contact you. Initiate communication and follow up regularly to ensure your claim is progressing.

- Be honest and accurate. Providing false information or exaggerating the extent of your damages can jeopardize your claim.

- Be patient. The claims process can take time, especially if there are complex issues or disputes.

Resources and Support

Finding the right car insurance policy in Florida can be a complex process, and it’s important to have access to reliable resources and support. Whether you’re seeking information, seeking to understand your rights, or navigating a claim, various organizations and agencies are available to assist you.

Organizations Offering Car Insurance Information and Support

This section provides a list of reputable organizations that offer car insurance information and support in Florida. These organizations can help you understand your options, compare quotes, and resolve disputes with your insurer.

| Organization | Website | Description |

|---|---|---|

| Florida Office of Insurance Regulation (OIR) | https://www.floir.com/ | The OIR is the state agency responsible for regulating the insurance industry in Florida. They provide information on car insurance, consumer rights, and complaints. |

| Florida Department of Financial Services (DFS) | https://www.myfloridacfo.com/ | The DFS is the state agency responsible for overseeing the financial services industry in Florida, including insurance. They provide information on consumer protection and financial literacy. |

| National Association of Insurance Commissioners (NAIC) | https://www.naic.org/ | The NAIC is a non-profit organization that represents state insurance regulators. They provide information on consumer rights and insurance issues. |

| Florida Consumer Action Network (FCAN) | https://www.fcan.org/ | FCAN is a non-profit organization that advocates for consumer rights in Florida. They provide information on insurance issues and consumer protection. |

Resources for Understanding Consumer Rights and Responsibilities

This section provides resources for consumers seeking to understand their rights and responsibilities related to car insurance in Florida. These resources can help you navigate the insurance process and ensure you are treated fairly.

- Florida’s “No-Fault” Law: Florida is a “no-fault” insurance state. This means that if you are involved in an accident, your own insurance company will cover your medical expenses and lost wages, regardless of who was at fault. However, there are limits on the amount of coverage provided under the no-fault system.

- Personal Injury Protection (PIP): PIP coverage is required in Florida and covers medical expenses and lost wages for injuries sustained in an accident.

- Property Damage Liability: This coverage protects you from financial losses if you are responsible for damaging another person’s property.

- Uninsured Motorist Coverage: This coverage protects you if you are involved in an accident with an uninsured or underinsured driver.

- Florida’s Financial Responsibility Law: This law requires drivers to have financial responsibility for accidents they cause. This can be met by having car insurance or by posting a bond.

- Filing a Complaint: If you have a problem with your insurance company, you can file a complaint with the Florida Office of Insurance Regulation (OIR).

Government Agencies Regulating Car Insurance in Florida

This section provides links to government agencies that regulate car insurance in Florida. These agencies are responsible for ensuring that insurance companies comply with state laws and protect consumer rights.

- Florida Office of Insurance Regulation (OIR): https://www.floir.com/

- Florida Department of Financial Services (DFS): https://www.myfloridacfo.com/

Summary

By understanding the Florida car insurance landscape, employing effective comparison strategies, and taking advantage of available discounts, you can secure the lowest possible rates. Remember, staying informed and actively managing your insurance needs is key to finding the best coverage at a price that fits your budget. Take control of your car insurance journey and enjoy the peace of mind that comes with knowing you have the right protection.

FAQ

What are the main factors that influence car insurance rates in Florida?

Factors like your driving history, age, vehicle type, credit score, and coverage options all play a significant role in determining your car insurance rates in Florida.

How can I find the lowest car insurance rates in Florida?

Use online comparison tools, get quotes from multiple insurance companies, and consider factors like discounts, coverage options, and customer service.

What are some common car insurance discounts available in Florida?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and bundling discounts for home and auto insurance.

What types of car insurance coverage are available in Florida?

Common types of coverage include liability insurance, collision coverage, comprehensive coverage, and personal injury protection (PIP).

What are the steps involved in filing a car insurance claim in Florida?

Report the accident to your insurance company, gather necessary information, and follow their instructions for filing a claim. Be prepared to provide details about the accident and any damages.