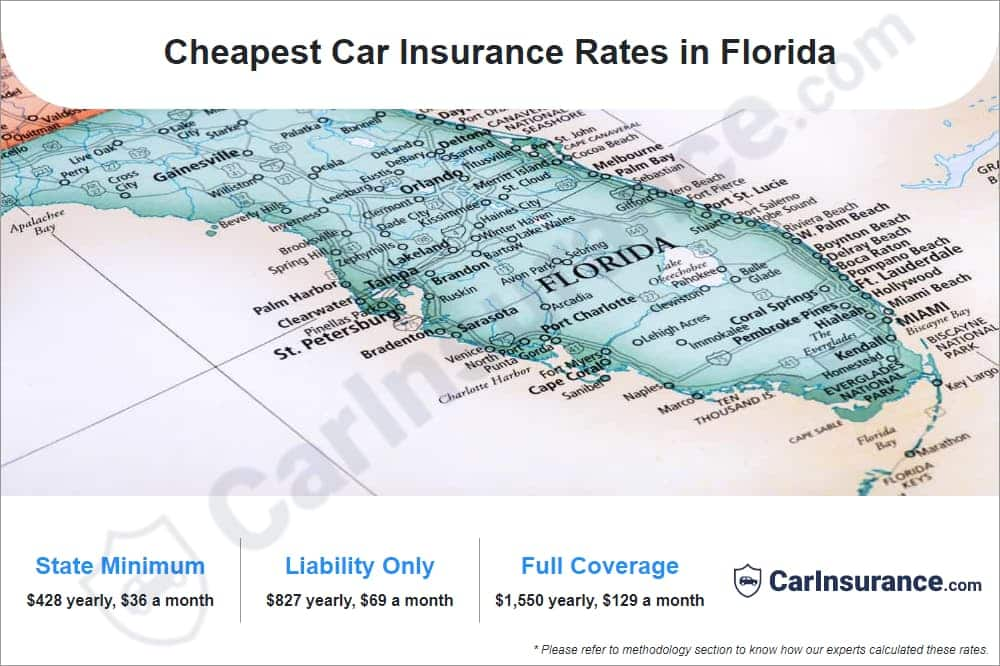

Lowest car insurance rates in Florida are a hot topic for drivers looking to save money. The Sunshine State’s unique blend of high population density, frequent weather events, and a large number of uninsured drivers makes finding affordable coverage a challenge. But with careful planning and a little research, you can find the best deals and protect yourself on the road.

Understanding how Florida’s car insurance market works is essential. The state’s Office of Insurance Regulation (OIR) oversees the industry, but insurance companies have a lot of flexibility in setting rates. This means your driving history, vehicle type, age, and even your credit score can significantly impact your premium.

Understanding Florida’s Car Insurance Market: Lowest Car Insurance Rates In Florida

Florida’s car insurance market is a complex and unique environment shaped by various factors that influence rates and regulations. Unlike other states, Florida faces distinct challenges that contribute to higher insurance premiums.

Factors Influencing Florida’s Car Insurance Rates, Lowest car insurance rates in florida

The high population density in Florida, particularly in urban areas, leads to increased traffic congestion and a higher likelihood of accidents. The state’s warm climate and proximity to the coast also expose drivers to frequent weather events like hurricanes and tropical storms, resulting in more claims and higher premiums. Additionally, Florida has a significant number of uninsured drivers, which creates a burden on insured drivers as they often end up paying for the costs of accidents involving uninsured motorists.

Comparison of Florida’s Car Insurance Market with Other States

Compared to other states, Florida’s car insurance market is characterized by its unique regulatory framework and pricing structure. The state’s “no-fault” insurance system requires drivers to be covered for their own medical expenses regardless of who caused the accident. This system, while designed to protect injured drivers, has contributed to higher insurance costs due to increased claims. Florida’s “personal injury protection” (PIP) coverage, which covers medical expenses, is mandatory and has a minimum coverage requirement, further contributing to higher premiums.

The Role of the Florida Office of Insurance Regulation (OIR)

The Florida Office of Insurance Regulation (OIR) plays a crucial role in overseeing and regulating the state’s car insurance industry. The OIR sets insurance rates, reviews rate filings, and ensures that insurance companies comply with state laws and regulations. It also investigates consumer complaints and resolves disputes between insurance companies and policyholders. The OIR’s primary objective is to protect consumers and ensure a fair and competitive car insurance market in Florida.

Factors Influencing Car Insurance Rates

Car insurance premiums in Florida are determined by a complex interplay of various factors, reflecting the unique risks associated with each driver and vehicle. Insurance companies carefully assess these factors to calculate personalized rates that accurately reflect the likelihood of an accident and the potential costs involved.

Driving History

Your driving history is a crucial factor in determining your car insurance rates. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will significantly increase your rates.

- Accidents: Each accident, regardless of fault, will likely increase your premiums. The severity of the accident, such as injuries or property damage, will also influence the rate increase.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations can lead to higher premiums. The severity of the violation and the frequency of violations will affect the rate increase.

- DUI Convictions: Driving under the influence of alcohol or drugs is a serious offense that carries significant penalties, including steep increases in car insurance rates. The severity of the DUI and the number of convictions will determine the impact on your premiums.

Vehicle Type

The type of vehicle you drive plays a significant role in determining your insurance rates. Certain vehicles are considered riskier than others due to factors such as safety features, repair costs, and theft susceptibility.

- Make and Model: Some car models are known for their safety features and lower repair costs, resulting in lower insurance premiums. Conversely, vehicles with a history of frequent accidents or high repair costs will typically have higher premiums.

- Year of Manufacture: Newer vehicles generally have better safety features and are less likely to be involved in accidents, leading to lower insurance rates. Older vehicles, especially those with outdated safety technology, may have higher premiums.

- Engine Size and Performance: High-performance vehicles with powerful engines are often associated with higher risks and therefore higher insurance premiums. Insurance companies consider the potential for higher speeds and more aggressive driving behavior when assessing these vehicles.

Age

Age is a factor that insurance companies consider because it correlates with driving experience and risk. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to their lack of experience.

- Young Drivers: Inexperience and higher risk-taking behavior among young drivers often result in higher insurance premiums. However, as drivers gain experience and reach their mid-20s, their premiums typically decrease.

- Older Drivers: While older drivers generally have more experience, they may face increased risks due to age-related factors such as declining eyesight, slower reaction times, and potential health conditions. Insurance companies may adjust premiums accordingly for older drivers.

Location

The location where you live significantly impacts your car insurance rates. Factors such as population density, traffic congestion, crime rates, and weather conditions all influence the risk of accidents and the cost of insurance.

- Urban Areas: Cities and densely populated areas often have higher traffic volumes, increasing the likelihood of accidents. Higher crime rates in urban areas can also contribute to higher insurance premiums.

- Rural Areas: Rural areas generally have lower traffic volumes and crime rates, leading to lower insurance premiums. However, long distances between destinations and potentially challenging weather conditions can impact rates.

- Weather Conditions: Regions prone to severe weather events, such as hurricanes, tornadoes, or heavy snowfall, often have higher insurance premiums. Insurance companies factor in the risk of damage to vehicles due to these events.

Credit Score

In Florida, credit score is a factor considered by insurance companies when determining car insurance rates. The rationale behind this practice is that individuals with good credit history are considered more responsible and less likely to file claims.

“Florida law allows insurance companies to use credit history to determine insurance rates, but it prohibits the use of credit scores for certain types of insurance, such as health insurance.”

- Impact on Premiums: Drivers with higher credit scores generally qualify for lower car insurance premiums. Conversely, those with lower credit scores may face higher premiums.

- Fairness and Accuracy: The use of credit score in insurance pricing has been a subject of debate, with concerns about its fairness and accuracy. Some argue that credit score is not a reliable indicator of driving behavior and can unfairly penalize individuals with limited credit history or those who have experienced financial hardship.

Coverage Options

The type of coverage you choose for your car insurance policy significantly affects your premiums. Different coverage options offer varying levels of protection and come with different price tags.

- Liability Coverage: This coverage is mandatory in Florida and protects you financially if you are at fault in an accident that causes injuries or property damage to others. The minimum liability limits required by law are $10,000 per person for bodily injury, $20,000 per accident for bodily injury, and $10,000 for property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. Collision coverage is optional but highly recommended for most drivers.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Comprehensive coverage is also optional but recommended for drivers who want protection against a wider range of risks.

- Impact on Rates: Choosing higher coverage limits or adding optional coverages will generally result in higher insurance premiums. However, the added protection can provide significant financial peace of mind in the event of an accident or other unforeseen event.

Ultimate Conclusion

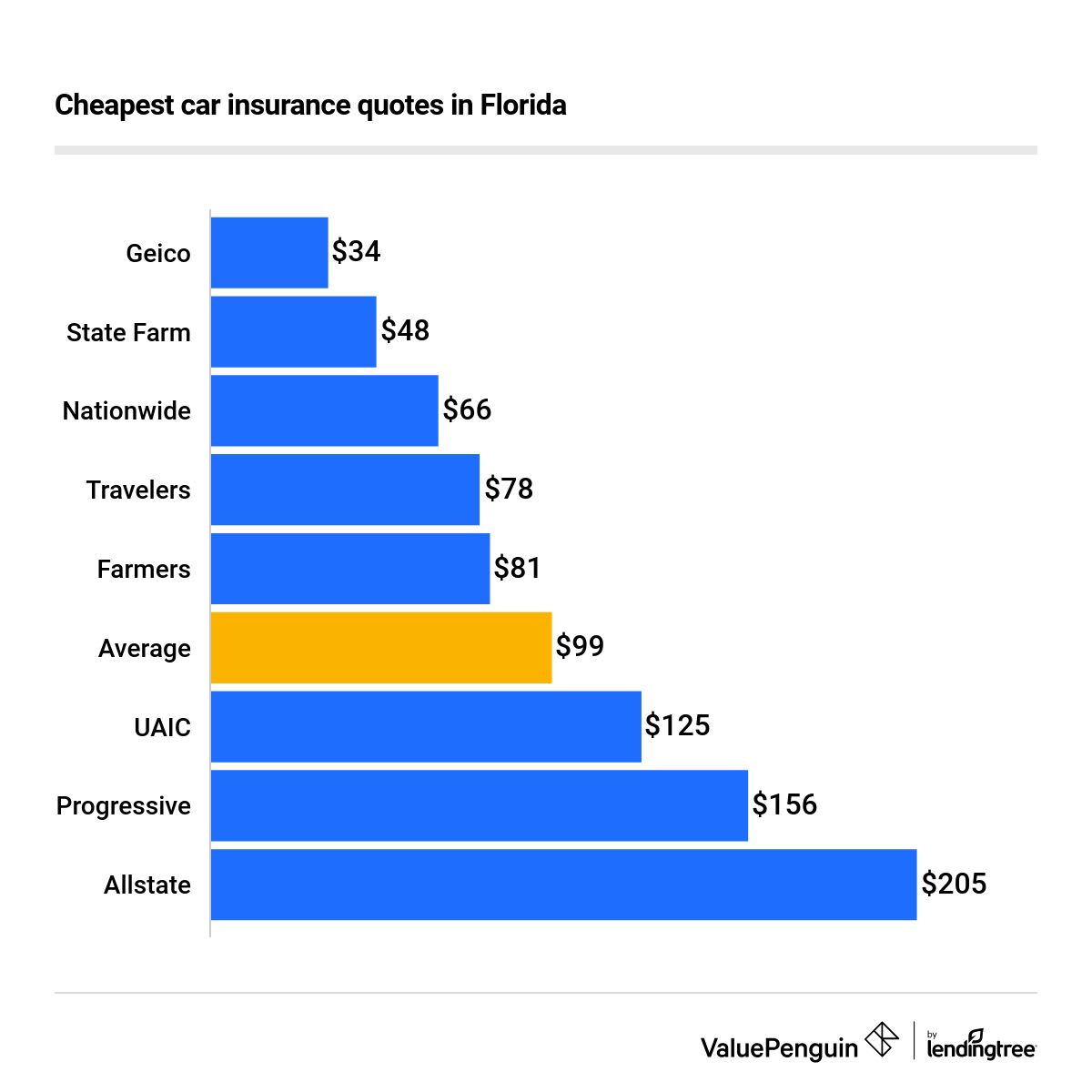

Finding the lowest car insurance rates in Florida requires a strategic approach. By comparing quotes, understanding your coverage needs, and taking advantage of available discounts, you can minimize your costs and protect yourself financially. Remember, the right car insurance policy can provide peace of mind and safeguard your financial future in case of an accident.

Popular Questions

What are the minimum car insurance requirements in Florida?

Florida requires all drivers to carry at least $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage.

How can I get a free car insurance quote?

Most car insurance companies offer free online quotes. Simply enter your information, including your driving history, vehicle details, and desired coverage, and you’ll receive a personalized quote.

What is the best way to compare car insurance quotes?

Use a car insurance comparison website or contact multiple insurance companies directly to get quotes. Compare the coverage options, premiums, and customer service ratings before making a decision.