Maryland car insurance is a necessity for all drivers in the state, ensuring financial protection in case of accidents. Understanding the state’s regulations, factors affecting rates, and available discounts is crucial for securing the best coverage at an affordable price. This guide provides a comprehensive overview of Maryland car insurance, covering essential aspects from mandatory requirements to finding the right policy.

From the minimum coverage levels to the impact of driving history and credit score, we delve into the intricacies of Maryland car insurance rates. We also explore ways to compare quotes, leverage discounts, and navigate the claims process, equipping you with the knowledge to make informed decisions.

Maryland Car Insurance Laws and Regulations

Maryland has strict car insurance laws in place to ensure that drivers are financially responsible for any accidents they may cause. These laws protect drivers and passengers from financial hardship in the event of an accident.

Mandatory Car Insurance Requirements

Maryland law requires all drivers to have a minimum amount of car insurance coverage. This requirement ensures that drivers have financial resources to cover potential costs associated with accidents, such as medical bills, property damage, and lost wages.

Minimum Coverage Levels

Maryland’s minimum coverage levels are as follows:

- Liability Coverage: This coverage protects you if you cause an accident that injures someone or damages their property. Maryland requires a minimum of $30,000 per person/$60,000 per accident for bodily injury liability and $15,000 for property damage liability.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of who is at fault. Maryland requires a minimum of $2,500 in PIP coverage.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages. Maryland requires UM/UIM coverage to be equal to the liability limits, which is $30,000 per person/$60,000 per accident for bodily injury and $15,000 for property damage.

Penalties for Driving Without Car Insurance

Driving without car insurance in Maryland is a serious offense. Penalties can include:

- Fines: Drivers caught without insurance can face fines of up to $1,000.

- License Suspension: The Maryland Motor Vehicle Administration (MVA) can suspend your driver’s license for up to 60 days.

- Vehicle Impoundment: Your vehicle can be impounded until you provide proof of insurance.

- Court Costs: You may have to pay court costs if you are found guilty of driving without insurance.

Financial Responsibility Laws

Maryland’s financial responsibility laws require drivers to prove they have the financial means to cover potential accident costs. These laws are designed to protect other drivers and ensure that those involved in accidents are held accountable.

Maryland’s financial responsibility laws are enforced through the MVA. Drivers are required to provide proof of insurance to the MVA, and they must maintain continuous coverage.

Factors Affecting Car Insurance Rates in Maryland

Several factors influence the cost of car insurance premiums in Maryland, affecting how much you pay. These factors are considered by insurance companies to assess the risk associated with insuring you.

Driving History

Your driving history plays a significant role in determining your car insurance rates. Insurance companies use this information to gauge your driving habits and the likelihood of you filing a claim. A clean driving record with no accidents or violations will generally result in lower premiums. However, if you have a history of accidents, traffic violations, or driving under the influence (DUI) convictions, your rates will likely be higher.

Age

Your age is another important factor that influences car insurance rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Therefore, they tend to pay higher premiums. As you age and gain more experience, your rates typically decrease.

Vehicle Type

The type of vehicle you drive also affects your insurance rates. Insurance companies consider factors such as the vehicle’s safety features, its value, and its potential for theft. Sports cars, luxury vehicles, and high-performance cars are generally considered higher risk and may result in higher premiums. Conversely, older, less expensive cars with basic safety features may have lower premiums.

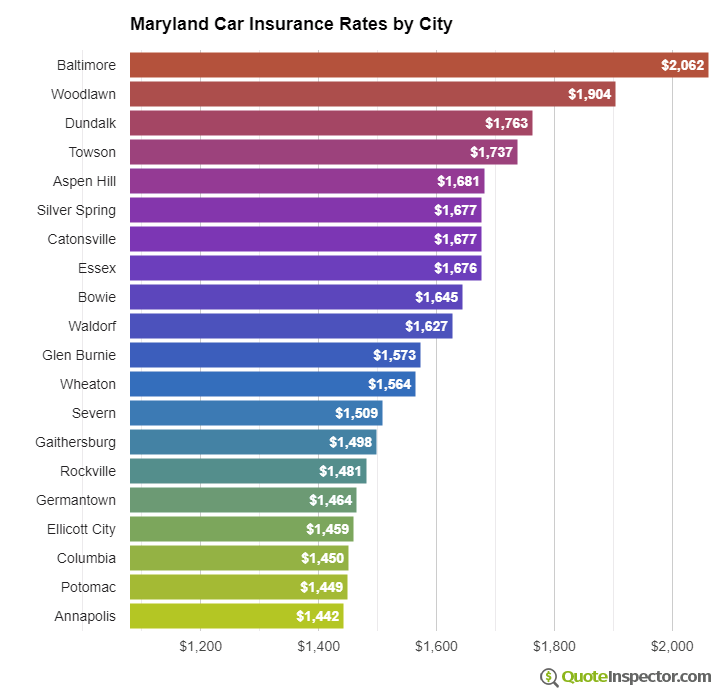

Location

The location where you live can significantly impact your car insurance rates. Insurance companies consider factors such as the density of traffic, crime rates, and the frequency of accidents in your area. Areas with higher crime rates and more accidents generally have higher insurance rates.

Credit Score

In Maryland, insurance companies can use your credit score as a factor in determining your car insurance rates. A higher credit score generally indicates a lower risk to the insurance company, which can result in lower premiums. However, this practice is controversial, and some argue that credit score is not a reliable indicator of driving behavior.

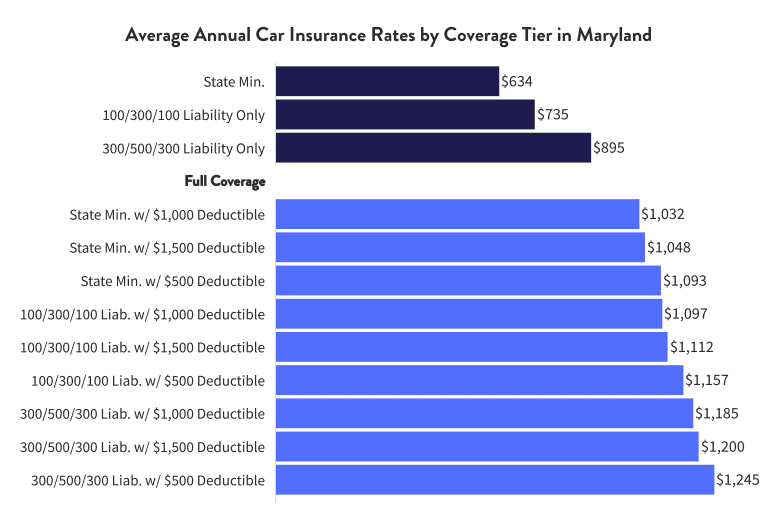

Comparison to National Averages

Maryland’s average car insurance rates are generally higher than the national average. According to the National Association of Insurance Commissioners (NAIC), the average annual car insurance premium in Maryland is around $1,100, while the national average is around $1,000.

Car Insurance Rates for Different Vehicle Types in Maryland

The following table provides a comparison of average car insurance rates for different vehicle types in Maryland:

| Vehicle Type | Average Annual Premium |

|—|—|

| Sedan | $1,000 – $1,200 |

| SUV | $1,200 – $1,400 |

| Truck | $1,400 – $1,600 |

| Sports Car | $1,600 – $1,800 |

| Luxury Car | $1,800 – $2,000 |

Note: These are just average rates and actual premiums may vary depending on other factors such as driving history, age, and location.

Finding the Best Car Insurance in Maryland

Finding the best car insurance in Maryland involves careful comparison and understanding your individual needs. By following these tips and utilizing available resources, you can secure a policy that provides adequate coverage at a competitive price.

Comparing Car Insurance Quotes

To find the best car insurance rates in Maryland, it’s crucial to compare quotes from different providers. This allows you to identify the most favorable options based on your specific circumstances.

- Gather Information: Before requesting quotes, gather essential information such as your driving history, vehicle details, and desired coverage levels. This will help you provide accurate information to insurers for personalized quotes.

- Use Online Comparison Tools: Online car insurance comparison websites allow you to enter your details once and receive quotes from multiple insurers simultaneously. This saves time and effort, enabling you to quickly compare different options side-by-side.

- Contact Insurers Directly: While online comparison tools are helpful, it’s also recommended to contact insurers directly to discuss your specific needs and ask questions. This personalized interaction can provide valuable insights and ensure you understand the coverage details.

- Review Policy Details: Carefully review each quote you receive, paying attention to the coverage limits, deductibles, and any additional features included. Consider your individual needs and risk tolerance when evaluating these factors.

- Ask About Discounts: Many insurers offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling multiple insurance policies. Inquire about available discounts and ensure you’re taking advantage of all eligible savings.

Benefits of Online Car Insurance Comparison Tools

Online car insurance comparison tools offer several advantages for Maryland residents seeking the best policy:

- Convenience: Online tools eliminate the need to contact multiple insurers individually, saving you time and effort. You can compare quotes from various providers within minutes.

- Transparency: Online platforms typically display all the essential details of each quote, including coverage limits, deductibles, and premium amounts. This transparency allows you to make informed decisions.

- Objectivity: Online comparison tools present quotes from various insurers without bias, ensuring you receive a fair and unbiased comparison of options.

- Customization: Most online platforms allow you to customize your search by specifying your desired coverage levels and other factors. This ensures you only receive quotes relevant to your needs.

Reputable Car Insurance Companies in Maryland, Maryland car insurance

Maryland is home to a wide range of reputable car insurance companies. Here are some notable providers with a strong presence in the state:

- Geico: Known for its competitive rates and extensive coverage options, Geico is a popular choice for Maryland drivers.

- State Farm: State Farm is a well-established insurer with a strong reputation for customer service and comprehensive coverage.

- Progressive: Progressive offers a wide range of coverage options and discounts, making it a versatile choice for drivers with diverse needs.

- Allstate: Allstate is another well-known insurer offering a variety of coverage options and discounts, including accident forgiveness and drive safe and save programs.

- USAA: USAA specializes in insurance for military members and their families, offering competitive rates and excellent customer service.

Comparing Car Insurance Policies

To assist you in selecting the best car insurance policy in Maryland, the following table compares key features and benefits of different policies:

| Policy Type | Coverage | Benefits | Considerations |

|---|---|---|---|

| Liability Only | Covers damages to other vehicles and injuries to others in an accident caused by you. | Most affordable option, meets state minimum requirements. | Limited coverage, does not protect your own vehicle or yourself from injuries. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Protects your vehicle investment, provides peace of mind. | Higher premiums than liability only, may not be necessary if you have an older vehicle. |

| Comprehensive | Covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters. | Provides protection against a wide range of risks, essential for newer or high-value vehicles. | Higher premiums than collision only, may not be necessary if you have an older vehicle. |

| Uninsured/Underinsured Motorist | Covers your damages and injuries if you’re involved in an accident with an uninsured or underinsured driver. | Protects you from financial losses caused by negligent drivers. | Essential for all drivers, provides additional financial security. |

Car Insurance Discounts in Maryland

Maryland car insurance companies offer a variety of discounts to help policyholders save money on their premiums. These discounts can significantly reduce your overall insurance costs, so it’s important to understand what discounts you qualify for and how to take advantage of them.

Types of Car Insurance Discounts in Maryland

Discounts are a great way to reduce your car insurance premiums. They can be applied to your policy based on various factors, such as your driving history, vehicle features, and other factors. Here are some common car insurance discounts available in Maryland:

- Safe Driver Discounts: These discounts reward drivers with clean driving records. They are typically offered to drivers who have not been involved in any accidents or traffic violations for a certain period. Some insurance companies may offer a discount for completing a defensive driving course.

- Good Student Discounts: These discounts are available to students who maintain a certain grade point average (GPA). The GPA requirement varies by insurance company, but typically ranges from 3.0 to 3.5. This discount encourages responsible behavior and academic achievement.

- Multi-Car Discounts: Insuring multiple vehicles with the same company often results in a discount on your premiums. This discount reflects the reduced risk associated with insuring multiple cars with the same insurer.

- Anti-theft Device Discounts: Installing anti-theft devices, such as alarms, immobilizers, or tracking systems, can reduce your insurance premiums. These devices deter theft, making your car less risky to insure.

- Loyalty Discounts: Some insurance companies reward long-term customers with loyalty discounts. These discounts are often given to policyholders who have been with the company for a certain number of years.

- Group Discounts: Certain groups, such as professional organizations or alumni associations, may offer discounts to their members through partnerships with insurance companies.

- Paperless Discounts: Many insurance companies offer discounts to policyholders who choose to receive their insurance documents electronically instead of by mail. This saves the company money on printing and postage costs, which they pass on to the customer.

Eligibility Criteria for Car Insurance Discounts

Each discount has specific eligibility criteria. To determine if you qualify for a discount, contact your insurance company or review your policy documents. The following table summarizes some common car insurance discounts in Maryland and their eligibility criteria:

| Discount Type | Eligibility Criteria |

|---|---|

| Safe Driver Discount | Clean driving record for a specified period (typically 3-5 years) with no accidents or traffic violations. |

| Good Student Discount | Maintaining a certain GPA (typically 3.0 or higher). |

| Multi-Car Discount | Insuring multiple vehicles with the same company. |

| Anti-theft Device Discount | Installing an approved anti-theft device on your vehicle. |

| Loyalty Discount | Being a policyholder with the company for a certain number of years. |

| Group Discount | Being a member of a qualifying group (e.g., professional organization, alumni association). |

| Paperless Discount | Opting to receive insurance documents electronically. |

Car Insurance Companies Offering Discounts in Maryland

Many insurance companies in Maryland offer a wide range of discounts. Some notable examples include:

- GEICO: GEICO offers a variety of discounts, including safe driver, good student, multi-car, and anti-theft device discounts.

- State Farm: State Farm provides discounts for safe drivers, good students, multi-car policies, and anti-theft devices.

- Progressive: Progressive offers a comprehensive range of discounts, including safe driver, good student, multi-car, and paperless discounts.

- Allstate: Allstate offers discounts for safe drivers, good students, multi-car policies, and anti-theft devices.

Car Insurance Claims Process in Maryland

Filing a car insurance claim in Maryland can be a stressful experience, but understanding the process can help you navigate it smoothly. This section Artikels the steps involved in filing a claim, the role of the Maryland Insurance Administration in resolving disputes, tips for maximizing your chances of a successful claim, and the importance of maintaining accurate records.

Steps Involved in Filing a Car Insurance Claim

The process of filing a car insurance claim in Maryland typically involves the following steps:

- Contact Your Insurance Company: Immediately after an accident, report the incident to your insurance company. This is usually done by phone, but some companies also offer online reporting options. Provide them with all the necessary details, including the date, time, and location of the accident, as well as the names and contact information of all parties involved.

- File a Claim: Your insurance company will guide you through the claim filing process. They will likely ask for additional information, such as a police report, photos of the damage, and medical records.

- Provide Necessary Documentation: Be prepared to provide all the required documentation promptly. This includes your insurance policy information, driver’s license, registration, and any other relevant documents.

- Cooperate with the Insurance Company: It is crucial to cooperate fully with your insurance company throughout the claims process. Respond to their requests for information promptly and be honest and accurate in your communication.

- Negotiate a Settlement: Once your insurance company has assessed the damage and reviewed all relevant documentation, they will offer you a settlement. You have the right to negotiate the settlement amount. If you disagree with their offer, you can seek the assistance of an independent adjuster or attorney.

- Receive Payment: If you agree to the settlement, your insurance company will issue payment for the damages. The payment can be made directly to you or to the repair shop or other service provider.

Role of the Maryland Insurance Administration

The Maryland Insurance Administration (MIA) plays a vital role in resolving insurance disputes. The MIA has the authority to investigate complaints and take action against insurance companies that engage in unfair or deceptive practices. If you have a dispute with your insurance company that you cannot resolve on your own, you can file a complaint with the MIA.

Tips for Maximizing Your Chances of a Successful Claim

Here are some tips to improve your chances of a successful car insurance claim:

- Gather Evidence: Collect as much evidence as possible after an accident, including photos, videos, witness statements, and police reports.

- Seek Medical Attention: Even if you don’t feel injured immediately, it is essential to seek medical attention promptly. This will create a record of your injuries and help you establish a claim for medical expenses.

- Keep Accurate Records: Maintain detailed records of all communications with your insurance company, including dates, times, and summaries of conversations. This will be helpful if you need to refer to these records later.

- Consult with an Attorney: If you have a complex claim or if you are having difficulty negotiating with your insurance company, it is advisable to consult with an attorney. A lawyer can help you understand your rights and navigate the legal process.

Importance of Keeping Accurate Records

Maintaining accurate records of your car insurance policies and claims is crucial for several reasons:

- Proof of Coverage: Your insurance policy is a legally binding contract that Artikels your coverage and responsibilities. It is important to keep a copy of your policy for your records.

- Claim Documentation: Keeping accurate records of your claims, including correspondence with your insurance company, will help you track the progress of your claim and ensure that you receive all the benefits to which you are entitled.

- Future Claims: Maintaining detailed records can be helpful if you need to file a claim in the future. It can provide evidence of your previous claims history and help you avoid potential disputes.

Resources for Maryland Car Insurance

Navigating the world of car insurance in Maryland can feel overwhelming, but there are several resources available to help you make informed decisions. This section will provide you with a list of helpful websites, organizations, and contact information to assist you with your car insurance needs.

Maryland Insurance Administration

The Maryland Insurance Administration (MIA) is the primary regulatory body for insurance in Maryland. It is responsible for ensuring fair and competitive insurance markets, protecting consumers, and overseeing the solvency of insurance companies. The MIA offers various resources and services to Maryland residents, including:

- Consumer Complaint Resolution: If you have a complaint about your car insurance company, you can file it with the MIA. The MIA will investigate your complaint and attempt to resolve it. You can file a complaint online, by phone, or by mail.

- Information and Education: The MIA offers a wealth of information on car insurance, including consumer guides, FAQs, and articles on various insurance topics. You can find this information on the MIA’s website.

- Licensing and Regulation: The MIA licenses and regulates insurance companies and agents operating in Maryland. This ensures that all companies and agents comply with state laws and regulations.

Contact Information for the Maryland Insurance Administration:

- Phone: (410) 468-2480 or (800) 492-6116

- Website: [https://insurance.maryland.gov/](https://insurance.maryland.gov/)

- Mailing Address: 200 St. Paul Place, Baltimore, MD 21202

Websites and Organizations Offering Car Insurance Information

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that represents insurance regulators from all 50 states, the District of Columbia, and five U.S. territories. The NAIC provides consumer information on insurance, including car insurance, on its website.

- Insurance Information Institute (III): The III is a non-profit organization that provides information and education on insurance issues. The III offers a wealth of resources on car insurance, including consumer guides, FAQs, and articles on various insurance topics.

- Maryland Department of Transportation (MDOT): MDOT provides information on car insurance requirements in Maryland, including minimum liability limits.

- Maryland Motor Vehicle Administration (MVA): The MVA provides information on car registration and titling requirements in Maryland.

Resources for Consumers Denied Car Insurance Coverage

Consumers who have been denied car insurance coverage can seek assistance from various organizations and resources.

- Maryland Insurance Administration (MIA): The MIA can help consumers who have been denied car insurance coverage. The MIA can investigate the denial and attempt to resolve the issue.

- Maryland Office of the Attorney General: The Office of the Attorney General can also help consumers who have been denied car insurance coverage. The Office can investigate the denial and take legal action against the insurance company if necessary.

- Consumer Reports: Consumer Reports is a non-profit organization that provides information and reviews on various products and services, including car insurance. Consumer Reports can help consumers find car insurance options and compare prices.

Helpful Car Insurance Resources in Maryland

| Resource | Description | Website |

|———————————————-|————————————————————————————————————————————————————————————————————————————————–|—————————————————————————————————————————————————————————————————————————————————|

| Maryland Insurance Administration (MIA) | The primary regulatory body for insurance in Maryland. Offers consumer complaint resolution, information, and education on car insurance. | [https://insurance.maryland.gov/](https://insurance.maryland.gov/) |

| National Association of Insurance Commissioners (NAIC) | Represents insurance regulators from all 50 states, the District of Columbia, and five U.S. territories. Provides consumer information on insurance, including car insurance. | [https://www.naic.org/](https://www.naic.org/) |

| Insurance Information Institute (III) | Provides information and education on insurance issues. Offers resources on car insurance, including consumer guides, FAQs, and articles on various insurance topics. | [https://www.iii.org/](https://www.iii.org/) |

| Maryland Department of Transportation (MDOT) | Provides information on car insurance requirements in Maryland, including minimum liability limits. | [https://www.mdot.maryland.gov/](https://www.mdot.maryland.gov/) |

| Maryland Motor Vehicle Administration (MVA) | Provides information on car registration and titling requirements in Maryland. | [https://www.mva.maryland.gov/](https://www.mva.maryland.gov/) |

| Consumer Reports | Provides information and reviews on various products and services, including car insurance. Can help consumers find car insurance options and compare prices. | [https://www.consumerreports.org/](https://www.consumerreports.org/) |

| Maryland Office of the Attorney General | Can help consumers who have been denied car insurance coverage. The Office can investigate the denial and take legal action against the insurance company if necessary. | [https://www.oag.state.md.us/](https://www.oag.state.md.us/) |

| Maryland Department of Human Services (DHS) | Provides information and resources for low-income Maryland residents, including access to affordable car insurance programs. | [https://dhs.maryland.gov/](https://dhs.maryland.gov/) |

Final Conclusion

Navigating the world of Maryland car insurance can be complex, but with the right information, finding the best coverage for your needs is achievable. By understanding the state’s laws, comparing quotes, and utilizing available discounts, you can ensure financial protection while staying within your budget. Remember to review your policy regularly, and don’t hesitate to reach out to the Maryland Insurance Administration for any questions or concerns.

Answers to Common Questions

What happens if I get into an accident without car insurance in Maryland?

Driving without car insurance in Maryland is illegal and can result in fines, license suspension, and even jail time. You may also be held personally liable for any damages or injuries caused in an accident.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least once a year, or whenever there’s a significant change in your life, such as a new car purchase, a change in your driving record, or a move to a new location.

What are the benefits of using an online car insurance comparison tool?

Online comparison tools allow you to quickly and easily compare quotes from multiple insurance providers, saving you time and effort. They also provide a comprehensive overview of different policy features and benefits, helping you make an informed decision.