Minimum car insurance in Florida is a legal requirement for all drivers, but navigating the complexities of coverage can be challenging. Understanding the specific types of insurance mandated by law, their minimum financial responsibility limits, and the factors that influence your premium is crucial for ensuring you’re adequately protected on the road. This guide delves into the essential aspects of Florida’s minimum car insurance requirements, helping you make informed decisions about your coverage.

Florida law mandates three primary types of coverage: bodily injury liability, property damage liability, and personal injury protection (PIP). Bodily injury liability covers injuries to others in an accident, while property damage liability covers damage to another person’s vehicle or property. PIP, on the other hand, covers your own medical expenses and lost wages following an accident, regardless of fault. The minimum financial responsibility limits for each coverage type are set by the state, and failing to meet these requirements can result in significant penalties, including fines, license suspension, and even jail time.

Florida’s Minimum Car Insurance Requirements

Driving in Florida without the required minimum car insurance is illegal and can result in serious consequences, including fines, license suspension, and even jail time. Understanding these requirements is crucial for all drivers in the state.

Florida’s Minimum Car Insurance Coverage Requirements

Florida law mandates that all drivers carry specific types of car insurance coverage to protect themselves and others in the event of an accident. These requirements ensure that drivers are financially responsible for damages caused by their vehicles.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident. The minimum PIP coverage required in Florida is $10,000 per person.

- Property Damage Liability (PDL): This coverage protects you financially if you cause damage to another person’s property in an accident. The minimum PDL coverage required in Florida is $10,000 per accident.

Florida’s No-Fault System

Florida operates under a “no-fault” insurance system, meaning that after an accident, each driver files a claim with their own insurance company, regardless of who caused the accident. This system aims to streamline the claims process and reduce litigation.

Understanding the Coverage Types

Florida’s minimum car insurance requirements are designed to protect drivers and passengers in the event of an accident. Understanding the purpose and scope of each coverage type is crucial for ensuring you are adequately protected.

Liability Coverage

Liability coverage is the most important type of car insurance in Florida. It protects you financially if you cause an accident that results in injury or damage to another person or their property.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and pain and suffering for the other driver and passengers injured in an accident you caused.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle or any other property damaged in an accident you caused.

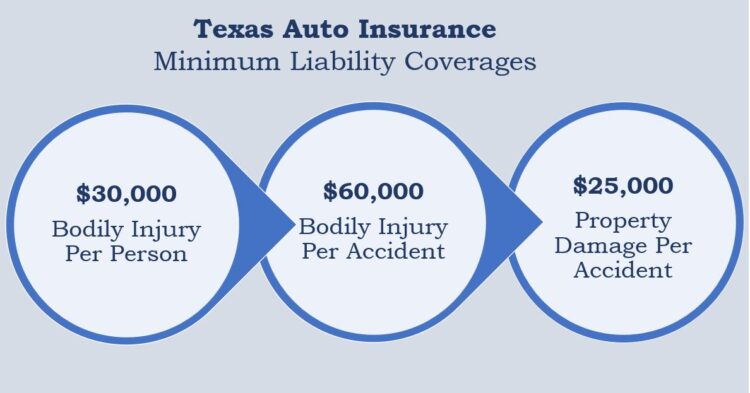

Florida’s minimum liability coverage requirements are:

- $10,000 per person for bodily injury liability

- $20,000 per accident for bodily injury liability

- $10,000 per accident for property damage liability

It is essential to understand that these are minimum requirements. If you are found liable for an accident that exceeds these limits, you will be personally responsible for the remaining costs.

Personal Injury Protection (PIP)

PIP coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault.

- Medical Expenses: PIP covers medical expenses, including doctor’s visits, hospital stays, and rehabilitation.

- Lost Wages: PIP can help replace lost wages if you are unable to work due to your injuries.

- Death Benefits: PIP can also provide death benefits to your beneficiaries if you are killed in an accident.

Florida’s minimum PIP coverage requirement is $10,000. It is important to note that PIP coverage has a $2,500 deductible, which means you will be responsible for the first $2,500 of your medical expenses.

Property Damage Liability

Property damage liability covers the cost of repairs or replacement of your own vehicle if you are involved in an accident, regardless of who is at fault.

- Vehicle Repairs or Replacement: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident.

Florida’s minimum property damage liability coverage requirement is $10,000. This coverage only applies to your own vehicle, not any other property you may damage.

Consequences of Driving Without Minimum Coverage

Driving without the required minimum car insurance in Florida can result in severe consequences, including:

- Fines and Penalties: You can be fined up to $500 for driving without insurance, and your driver’s license can be suspended.

- Vehicle Impoundment: Your vehicle can be impounded until you provide proof of insurance.

- Financial Responsibility: You will be personally responsible for all costs associated with an accident, including medical expenses, property damage, and legal fees.

- Criminal Charges: In some cases, driving without insurance can result in criminal charges.

Factors Affecting Insurance Costs

Your car insurance premiums in Florida are influenced by a variety of factors. These factors help insurance companies assess your risk profile and determine how much you will pay for coverage. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your insurance premiums. Insurance companies view drivers with a clean record as less risky and, therefore, offer lower premiums. Conversely, drivers with a history of accidents, traffic violations, or DUI convictions are considered higher risk and may face higher premiums.

- Accidents: Each accident, regardless of fault, is recorded on your driving record and can increase your premiums. The severity of the accident, such as property damage or injuries, can further impact your rates.

- Traffic Violations: Speeding tickets, running red lights, and other traffic violations can significantly raise your premiums. The number and severity of violations influence the impact on your rates.

- DUI Convictions: Driving under the influence is a serious offense that can lead to very high insurance premiums. Insurance companies consider DUI convictions a major risk factor.

Age

Age is a crucial factor in determining car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to factors like inexperience and risk-taking behavior. As drivers age, they gain experience and tend to drive more cautiously, resulting in lower premiums.

- Young Drivers: Insurance companies often charge higher premiums for young drivers to account for their higher risk profile. However, good driving records, defensive driving courses, and discounts for good students can help mitigate these costs.

- Mature Drivers: Drivers over 55 typically enjoy lower premiums due to their extensive experience and lower accident rates. However, some insurance companies may offer discounts to drivers who complete mature driver courses.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Some vehicles are considered higher risk due to factors like their performance, safety features, and theft susceptibility.

- Performance Cars: Sports cars and high-performance vehicles are often associated with higher speeds and riskier driving behaviors, leading to higher premiums.

- Luxury Cars: Luxury vehicles, even if not high-performance, are often more expensive to repair, resulting in higher insurance premiums.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and stability control may qualify for discounts, as they can reduce the severity of accidents.

Location

Your location plays a significant role in determining your car insurance premiums. Insurance companies consider factors like traffic density, crime rates, and the frequency of accidents in your area when calculating premiums.

- Urban Areas: Cities with high traffic density and congestion often have higher accident rates, leading to higher premiums.

- Rural Areas: Rural areas with lower population density and fewer cars on the road generally have lower premiums.

- Climate: Areas prone to severe weather events like hurricanes, tornadoes, or floods may have higher premiums due to the increased risk of vehicle damage.

Credit Score

Your credit score, surprisingly, can also affect your car insurance premiums. Insurance companies use credit scores as a proxy for risk assessment.

- Credit Score as a Risk Indicator: Individuals with poor credit scores are statistically more likely to have financial instability, which can translate into higher insurance premiums.

- Impact of Credit Score on Premiums: Insurance companies may charge higher premiums to drivers with poor credit scores, as they are considered a higher risk of filing claims.

Finding Affordable Car Insurance

Securing affordable car insurance in Florida is a priority for many drivers. By understanding the factors that influence your insurance costs and employing strategic tactics, you can significantly reduce your premiums.

Comparing Quotes from Multiple Insurance Providers

It is crucial to compare quotes from various insurance companies to find the most competitive rates. This process allows you to assess different coverage options, deductibles, and discounts, enabling you to make an informed decision.

Obtaining quotes from at least three to five insurance providers is recommended.

Reputable Insurance Companies Operating in Florida

Florida has a diverse range of insurance companies offering car insurance. Here is a list of reputable providers with a strong presence in the state:

- State Farm

- Geico

- Progressive

- Allstate

- USAA

- Florida Peninsula Insurance Company

- Auto-Owners Insurance

- Nationwide

Understanding Your Policy

Your car insurance policy is a legally binding contract that Artikels the terms of your coverage. Understanding its contents is crucial to ensure you receive the appropriate protection and avoid any surprises when filing a claim.

Reading your policy thoroughly can help you identify key terms, conditions, and exclusions that may affect your coverage. It’s essential to be aware of these aspects to avoid potential disputes or denial of claims.

Key Terms and Conditions

Your car insurance policy contains specific terminology that defines the coverage you receive. Understanding these terms is vital to make informed decisions about your insurance needs.

Here are some essential terms and conditions to be aware of:

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually translates to lower premiums, while a lower deductible means higher premiums.

- Premium: This is the amount you pay regularly for your car insurance coverage. Premiums are calculated based on factors such as your driving history, age, vehicle type, and location.

- Coverage Limits: These limits define the maximum amount your insurance company will pay for specific types of claims. For example, your liability coverage limit might be $100,000 per person or $300,000 per accident.

- Exclusions: These are specific events or situations that are not covered by your policy. Common exclusions include intentional acts, driving under the influence, and certain types of damage, such as wear and tear.

- Policy Period: This is the duration for which your insurance coverage is valid. It typically runs for a year and is renewed annually.

Understanding Exclusions, Minimum car insurance in florida

Exclusions are crucial aspects of your policy that Artikel situations where your insurance coverage may not apply. It’s essential to understand these exclusions to avoid surprises when filing a claim.

- Driving without a valid license: If you’re driving without a valid driver’s license, your insurance company may not cover any accidents or damages you cause.

- Driving under the influence: Accidents caused while driving under the influence of alcohol or drugs are typically excluded from coverage.

- Using your car for commercial purposes: If you use your car for business purposes without notifying your insurance company, your coverage may be limited or invalid.

- Unreported modifications: If you make significant modifications to your vehicle without informing your insurance company, your coverage may be affected.

- Certain types of damage: Some types of damage, such as wear and tear, are generally not covered by car insurance.

Common Scenarios with Unexpected Coverage Limitations

It’s crucial to understand how your policy might limit coverage in certain scenarios. Here are some common situations where policyholders might encounter unexpected coverage limitations:

- Using your car for rideshare services: If you use your car for rideshare services like Uber or Lyft without informing your insurance company, your coverage may be limited or invalid. You may need to purchase additional coverage to ensure adequate protection while driving for these services.

- Lending your car to someone without proper insurance: If you lend your car to someone who is not listed on your policy and they cause an accident, your coverage may be limited or invalid. It’s crucial to ensure that anyone driving your car has proper insurance coverage.

- Driving in a high-risk area: If you drive in areas with high crime rates or accident frequencies, your insurance premiums may be higher, and your coverage might be limited in certain situations.

- Using your car for illegal activities: If you use your car for illegal activities, such as transporting illegal substances, your coverage will likely be invalid.

End of Discussion: Minimum Car Insurance In Florida

Navigating Florida’s car insurance landscape can feel overwhelming, but by understanding the minimum requirements, exploring the factors that affect your premium, and seeking out affordable options, you can ensure you’re adequately protected on the road. Remember to carefully review your policy, compare quotes from multiple insurance providers, and consider the potential consequences of driving without the required minimum coverage. With the right knowledge and a proactive approach, you can find car insurance that meets your needs and budget.

Common Queries

What happens if I get into an accident without the required minimum car insurance?

You could face serious consequences, including fines, license suspension, and even jail time. You would also be responsible for covering all damages and injuries caused by the accident, potentially leading to significant financial hardship.

Can I choose to have higher coverage limits than the minimum requirements?

Absolutely! While the minimum coverage limits are the legal requirement, you have the option to choose higher limits for greater financial protection in the event of a serious accident.

How often should I review my car insurance policy?

It’s a good practice to review your policy at least annually, or whenever you experience a significant life change, such as a new vehicle, a change in your driving record, or a move to a different location.