Minimum coverage car insurance Florida is a legal requirement for all drivers, ensuring basic financial protection in the event of an accident. This type of insurance provides the bare minimum coverage mandated by the state, covering liability, personal injury protection (PIP), and property damage liability. While it may seem tempting to opt for the cheapest option, it’s crucial to understand the potential drawbacks of minimum coverage, such as limited financial protection and potential financial burdens in case of a serious accident.

This guide will delve into the intricacies of minimum coverage car insurance in Florida, exploring factors that influence its cost, its advantages and disadvantages, and alternative coverage options. We’ll also discuss the process of obtaining minimum coverage, including tips for negotiating rates and finding the best deal.

Understanding Minimum Coverage Car Insurance in Florida: Minimum Coverage Car Insurance Florida

In Florida, driving without minimum coverage car insurance is illegal. The state mandates that all drivers carry specific types of insurance to protect themselves and others in case of an accident. This ensures financial responsibility and helps cover potential costs associated with accidents.

The Legal Requirements for Minimum Coverage Car Insurance in Florida

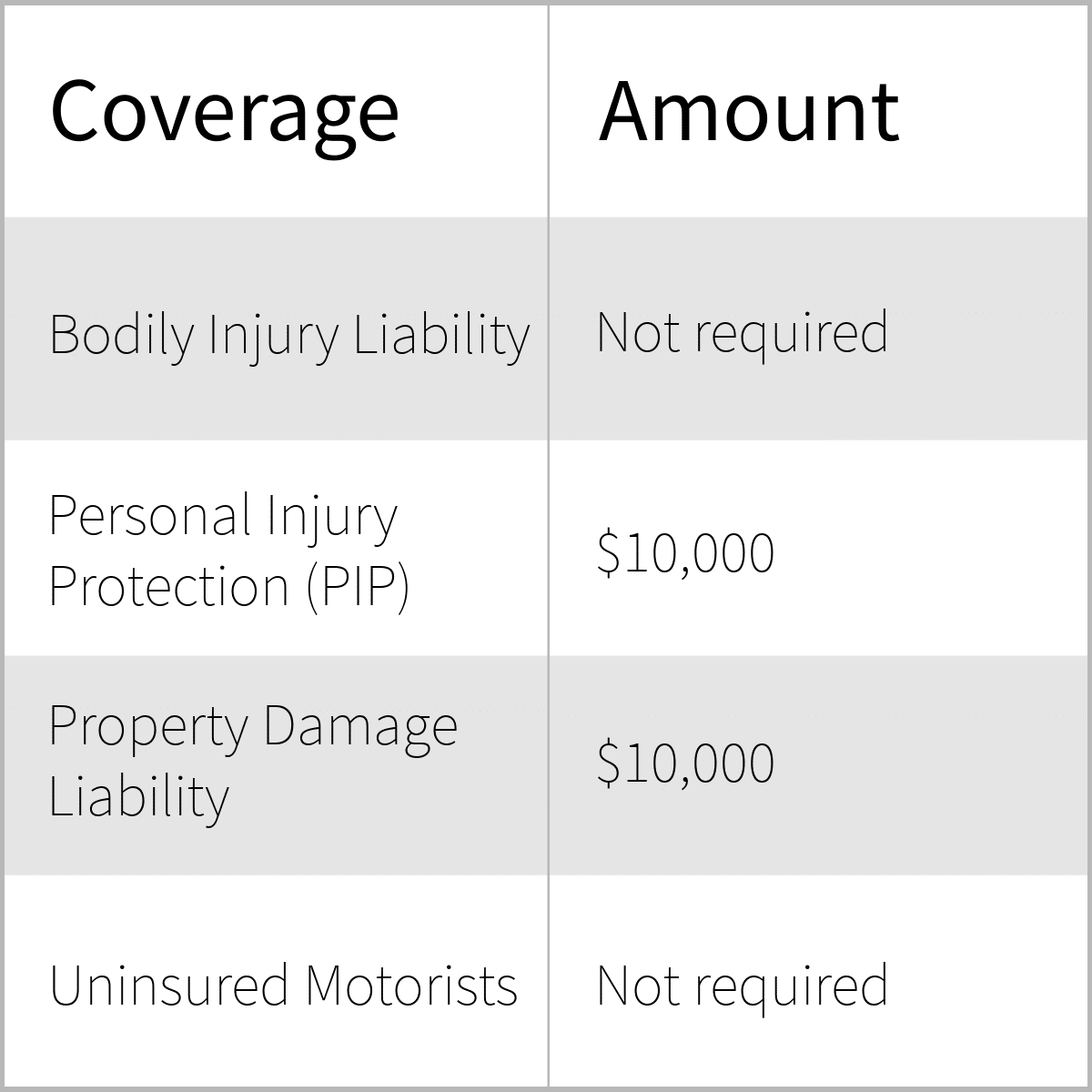

Florida law requires drivers to have the following minimum coverage car insurance:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault. The minimum PIP coverage required in Florida is $10,000 per person.

- Property Damage Liability (PDL): This coverage pays for damages to the other driver’s vehicle or property if the insured driver is at fault in an accident. The minimum PDL coverage required in Florida is $10,000 per accident.

- Bodily Injury Liability (BIL): This coverage pays for medical expenses, lost wages, and other related costs for the other driver and passengers if the insured driver is at fault in an accident. The minimum BIL coverage required in Florida is $10,000 per person and $20,000 per accident.

Consequences of Driving Without Minimum Coverage Insurance

Driving without minimum coverage insurance in Florida can have severe consequences, including:

- Fines and Penalties: Drivers caught driving without insurance face fines of up to $500 and license suspension.

- Vehicle Impoundment: The vehicle involved in the accident may be impounded until proof of insurance is provided.

- Financial Responsibility: If the driver is at fault in an accident, they will be personally liable for all damages, including medical expenses, lost wages, and property repairs.

- Criminal Charges: In some cases, driving without insurance may lead to criminal charges, especially if the driver is involved in a serious accident.

Breakdown of Coverage Included in Minimum Coverage

Minimum coverage car insurance in Florida includes three main types of coverage:

- Personal Injury Protection (PIP): This coverage is a no-fault benefit, meaning it covers medical expenses, lost wages, and other related costs for the insured driver and passengers regardless of who caused the accident. PIP coverage is limited to $10,000 per person.

- Property Damage Liability (PDL): This coverage protects the insured driver from financial responsibility for damages to the other driver’s vehicle or property if the insured driver is at fault in an accident. PDL coverage is limited to $10,000 per accident.

- Bodily Injury Liability (BIL): This coverage protects the insured driver from financial responsibility for injuries to the other driver and passengers if the insured driver is at fault in an accident. BIL coverage is limited to $10,000 per person and $20,000 per accident.

Factors Affecting Minimum Coverage Costs

The cost of minimum coverage car insurance in Florida can vary greatly depending on several factors. Understanding these factors can help you make informed decisions about your insurance needs and potentially save money on your premiums.

Age and Driving Experience

Your age and driving history are significant factors influencing your minimum coverage insurance costs. Younger drivers, especially those with limited driving experience, are statistically more likely to be involved in accidents. Insurance companies consider this higher risk and charge higher premiums. As you gain experience and age, your premiums may decrease.

Driving History

Your driving history plays a crucial role in determining your insurance rates. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

Vehicle Type

The type of vehicle you drive is another key factor. Sports cars, luxury vehicles, and high-performance vehicles are generally considered more expensive to repair or replace, leading to higher insurance premiums. Older, less expensive vehicles typically have lower insurance costs.

Location

Your location in Florida also influences your insurance rates. Areas with higher rates of car theft, accidents, or vandalism may have higher insurance premiums. Urban areas often have higher rates than rural areas due to increased traffic density and risk factors.

Credit Score

In Florida, insurance companies can use your credit score to determine your insurance rates. A good credit score may qualify you for lower premiums, while a poor credit score could result in higher rates. This is because a good credit score is often associated with responsible financial behavior, which can be an indicator of responsible driving habits.

Coverage Levels

While minimum coverage insurance is the most affordable option, it provides the least amount of protection. Higher coverage levels, such as comprehensive and collision coverage, offer more protection but come with higher premiums.

Benefits and Drawbacks of Minimum Coverage

Minimum coverage car insurance in Florida is the least expensive option available, but it also offers the least amount of financial protection. While it may seem appealing to save money on premiums, it’s crucial to weigh the potential drawbacks before making a decision.

Advantages of Minimum Coverage

The primary advantage of minimum coverage is its affordability. By choosing only the legally required coverage, drivers can significantly reduce their insurance premiums compared to those with higher coverage options. This can be particularly beneficial for individuals on a tight budget or those with limited financial resources.

Disadvantages of Minimum Coverage

While minimum coverage offers lower premiums, it comes with significant limitations in terms of financial protection. In the event of an accident, the coverage provided by minimum coverage may not be sufficient to cover all expenses, leaving you responsible for the remaining costs.

Comparison of Coverage Options

The following table compares the coverage provided by minimum coverage and higher coverage options:

| Coverage Option | Coverage Provided |

|—|—|

| Minimum Coverage |

– Bodily Injury Liability: $10,000 per person / $20,000 per accident

– Property Damage Liability: $10,000 per accident

– Personal Injury Protection (PIP): $10,000 per person

– Uninsured Motorist Coverage: $10,000 per person / $20,000 per accident |

| Higher Coverage Options |

– Bodily Injury Liability: $100,000 per person / $300,000 per accident

– Property Damage Liability: $100,000 per accident

– Personal Injury Protection (PIP): $100,000 per person

– Uninsured Motorist Coverage: $100,000 per person / $300,000 per accident

– Collision Coverage: Covers damage to your vehicle in an accident, regardless of fault

– Comprehensive Coverage: Covers damage to your vehicle from non-collision events, such as theft or vandalism |

As you can see, minimum coverage provides the bare minimum financial protection required by law. Higher coverage options offer significantly more financial protection in the event of an accident, but at a higher premium cost.

It is crucial to carefully consider your individual needs and financial situation before deciding on the level of car insurance coverage that is right for you.

Alternatives to Minimum Coverage

While minimum coverage car insurance in Florida fulfills the legal requirements, it might not offer adequate protection in various situations. Drivers seeking more comprehensive coverage can consider various optional coverage options that provide additional financial security in the event of an accident.

These optional coverage options can provide greater financial protection and peace of mind, but it’s crucial to weigh the benefits against the increased costs.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. This coverage is beneficial for drivers who own newer vehicles or those with significant loan balances, as it helps cover the costs of repairs or replacement. For instance, if you’re involved in an accident with a deer and your car is totaled, collision coverage would help you replace your vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, hail, or floods. It’s particularly valuable for drivers who live in areas prone to natural disasters or have expensive vehicles. Imagine your car is damaged by a hailstorm; comprehensive coverage would help cover the repair costs.

Uninsured Motorist Coverage

Uninsured motorist coverage protects you and your passengers if you’re injured in an accident caused by a driver without insurance or with insufficient coverage. This coverage is essential, as it can help cover medical expenses, lost wages, and other damages. If you’re hit by a driver who doesn’t have insurance, uninsured motorist coverage would provide financial protection.

Underinsured Motorist Coverage

Underinsured motorist coverage is similar to uninsured motorist coverage, but it applies when the other driver has insurance but their coverage limits are insufficient to cover your losses. This coverage can be crucial in situations where the other driver’s insurance limits are low, and your injuries or damages exceed their coverage. For example, if you’re injured in an accident caused by a driver with a $10,000 liability limit, and your medical expenses exceed this amount, underinsured motorist coverage can help cover the difference.

Obtaining Minimum Coverage Insurance in Florida

Getting minimum coverage car insurance in Florida involves a straightforward process that requires gathering information, comparing quotes, and selecting a provider that aligns with your needs and budget.

Getting Quotes

To begin, you’ll need to gather essential information, including your driver’s license number, vehicle identification number (VIN), and driving history. This information is necessary for insurance companies to accurately assess your risk profile and generate personalized quotes.

- You can obtain quotes online, over the phone, or by visiting an insurance agent in person.

- When requesting quotes, be transparent about your driving history, including any accidents or violations, to ensure you receive accurate pricing.

Comparing Rates

Once you have several quotes, carefully compare the rates and coverage offered by different insurance providers. Consider factors like:

- Deductibles: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Premiums: The monthly or annual cost of your insurance policy.

- Coverage limits: The maximum amount your insurance will pay for specific types of claims.

- Discounts: Available discounts for safe driving, good student status, or bundling multiple insurance policies.

Choosing a Provider

After comparing quotes, select an insurance provider that offers the best combination of coverage, price, and customer service. Consider the following:

- Financial stability: Ensure the insurance company is financially sound and capable of fulfilling its obligations in case of a claim.

- Customer reviews: Read online reviews from other customers to gauge the provider’s reputation for claims handling and customer satisfaction.

- Claims process: Understand the insurer’s claims process, including the steps involved and the average processing time.

Negotiating Insurance Rates

While minimum coverage rates are regulated in Florida, you can still negotiate your insurance premiums. Here are some tips:

- Shop around: Obtain quotes from multiple insurers to compare prices and coverage options.

- Bundle policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance, to potentially qualify for discounts.

- Improve your driving record: Maintaining a clean driving record by avoiding accidents and traffic violations can lower your insurance premiums.

- Ask about discounts: Inquire about available discounts, such as good student discounts, safe driver discounts, or discounts for anti-theft devices.

Comparison of Insurance Providers, Minimum coverage car insurance florida

| Insurance Provider | Coverage Limits | Deductibles | Premiums | Discounts |

|—|—|—|—|—|

| State Farm | $10,000 per person, $20,000 per accident | $500 | $50-$100 per month | Safe driver, good student, bundling |

| Geico | $10,000 per person, $20,000 per accident | $500 | $40-$80 per month | Safe driver, good student, bundling |

| Progressive | $10,000 per person, $20,000 per accident | $500 | $45-$90 per month | Safe driver, good student, bundling |

| Allstate | $10,000 per person, $20,000 per accident | $500 | $55-$110 per month | Safe driver, good student, bundling |

Last Recap

Understanding the intricacies of minimum coverage car insurance in Florida is essential for all drivers. While it may offer lower premiums, it’s crucial to weigh the potential drawbacks of limited financial protection against the benefits of lower costs. By carefully considering your individual needs and financial situation, you can make an informed decision about the type of car insurance that best suits your circumstances. Remember, it’s always wise to seek professional advice from an insurance agent to ensure you have adequate coverage for your specific needs.

Top FAQs

What happens if I drive without minimum coverage insurance in Florida?

Driving without minimum coverage insurance in Florida is illegal and can result in serious consequences, including fines, license suspension, and even jail time. Additionally, you could face significant financial liability in the event of an accident.

Can I customize my minimum coverage policy with additional coverage?

Yes, you can add optional coverage to your minimum coverage policy, such as collision, comprehensive, and uninsured motorist coverage. These additional coverages can provide greater financial protection in various situations.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least once a year, or whenever there are significant changes in your driving habits, vehicle, or financial situation. This ensures that you have the appropriate coverage and that you’re not paying for unnecessary extras.