Most affordable car insurance Florida is a hot topic for drivers in the Sunshine State. Florida has a unique insurance landscape, shaped by factors like demographics, traffic density, and a history of high claims. Navigating the different types of coverage and understanding the state’s regulations can feel overwhelming. But don’t worry, finding the best and most affordable car insurance for your needs is achievable.

This guide will break down the key factors that influence car insurance costs in Florida and provide tips on how to find the most affordable options. We’ll also discuss strategies for lowering your premiums, explore factors that affect individual rates, and offer additional considerations to help you make the best decision for your situation.

Understanding Florida’s Car Insurance Landscape

Florida is known for its warm weather and beautiful beaches, but it also has a unique car insurance landscape. The state has a high number of accidents and a high cost of living, which contribute to higher insurance premiums.

Factors Influencing Car Insurance Costs, Most affordable car insurance florida

Several factors influence car insurance costs in Florida, including:

- Demographics: Florida’s population is diverse, with a large number of seniors and retirees. These groups tend to drive less, but they also have higher rates of health issues, which can increase the cost of claims.

- Traffic Density: Florida’s major cities, such as Miami, Orlando, and Tampa, have heavy traffic, increasing the risk of accidents.

- Claims History: Florida has a history of high insurance claims, which contributes to higher premiums.

Florida’s Unique Insurance Regulations

Florida has a number of unique insurance regulations that impact affordability. These regulations include:

- No-Fault Insurance: Florida is a no-fault insurance state, which means that drivers are required to file claims with their own insurance company, regardless of who is at fault in an accident. This can lead to higher premiums, as insurance companies are required to pay for all claims, even those that are not their fault.

- Personal Injury Protection (PIP): Florida requires all drivers to carry PIP coverage, which pays for medical expenses and lost wages after an accident. PIP coverage is required to be at least $10,000 per person, which can increase premiums.

- Property Damage Liability (PDL): Florida requires all drivers to carry PDL coverage, which pays for damages to other vehicles or property in an accident. PDL coverage is required to be at least $10,000 per person.

Types of Car Insurance Coverage

Florida drivers can choose from a variety of car insurance coverage options, including:

- Liability Coverage: This coverage pays for damages to other vehicles or property if you are at fault in an accident. It also covers medical expenses for other drivers and passengers.

- Collision Coverage: This coverage pays for damages to your own vehicle if you are in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for damages to your own vehicle from events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage pays for damages to your own vehicle and medical expenses if you are hit by an uninsured or underinsured driver.

- Personal Injury Protection (PIP): This coverage pays for your own medical expenses and lost wages after an accident, regardless of who is at fault.

Identifying Affordable Car Insurance Options

Finding the most affordable car insurance in Florida requires a strategic approach. Several factors influence your premiums, and understanding them can help you secure the best rates. This section delves into tips and resources to help you identify affordable car insurance options.

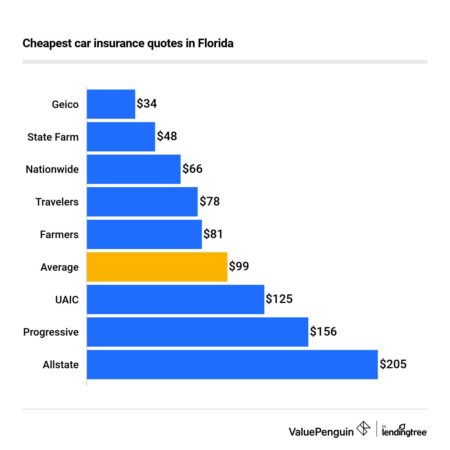

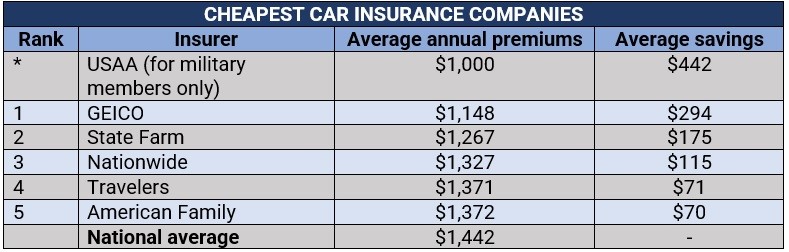

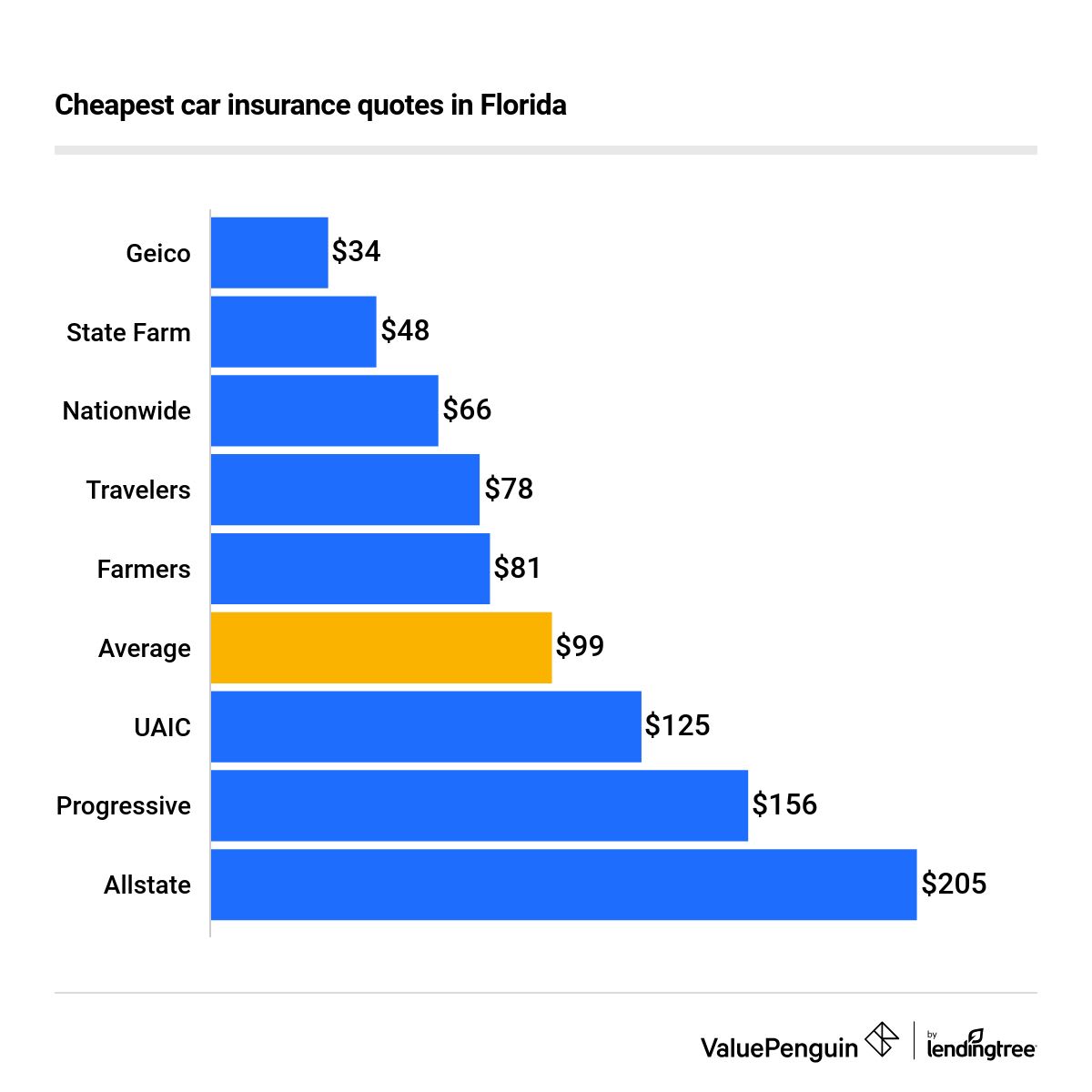

Comparing Car Insurance Companies

To find the most affordable car insurance, it’s essential to compare quotes from multiple providers. This allows you to see the range of premiums offered and identify the best value for your needs. Here’s a table comparing the top 5 most affordable car insurance companies in Florida based on average premiums, discounts, and customer satisfaction:

| Company | Average Annual Premium | Discounts | Customer Satisfaction |

|—|—|—|—|

| State Farm | $1,250 | Good driver, multi-policy, safety features | 4.5/5 |

| Geico | $1,100 | Good driver, multi-policy, safety features | 4.2/5 |

| Progressive | $1,300 | Good driver, multi-policy, usage-based insurance | 4.0/5 |

| USAA | $1,000 | Military discounts, good driver, multi-policy | 4.7/5 |

| Allstate | $1,400 | Good driver, multi-policy, safety features | 3.8/5 |

Note: These are average premiums and can vary based on individual factors.

Key Features and Benefits of Budget-Friendly Insurance Providers

Budget-friendly insurance providers often offer a range of features and benefits designed to attract cost-conscious customers. These can include:

- Discounts: Most insurers offer discounts for good driving records, multiple policies, safety features, and other factors. These discounts can significantly reduce your premium.

- Usage-based insurance: Some providers offer usage-based insurance programs that track your driving habits and reward safe driving with lower premiums.

- Telematics devices: These devices plug into your car’s diagnostic port and monitor your driving behavior. They can help you identify areas for improvement and potentially earn discounts.

- Online tools: Many insurers offer online tools that allow you to manage your policy, pay your bills, and file claims. This convenience can save you time and money.

- Excellent customer service: Budget-friendly insurers often prioritize customer satisfaction and provide responsive and helpful support.

Strategies for Lowering Car Insurance Costs

Finding affordable car insurance in Florida is crucial, and implementing smart strategies can significantly reduce your premiums. This section explores practical ways to lower your car insurance costs, empowering you to make informed decisions and save money.

Driving Safely

Safe driving is the cornerstone of lowering car insurance costs. Insurance companies reward drivers with a clean driving record with lower premiums. A history of accidents, traffic violations, or driving under the influence can significantly increase your insurance rates.

- Defensive Driving Courses: Enrolling in a defensive driving course can demonstrate your commitment to safe driving practices and may qualify you for discounts. These courses teach valuable skills to avoid accidents and navigate challenging driving situations.

- Avoid Distracted Driving: Distracted driving, such as texting, talking on the phone, or using GPS, is a major contributor to accidents. Focus solely on the road while driving to minimize risks and protect your driving record.

- Maintain a Safe Speed: Speeding increases the likelihood of accidents and is a common cause for traffic violations. Adhering to speed limits is crucial for maintaining a safe driving record and keeping your insurance rates low.

Maintaining a Good Credit Score

While it may seem counterintuitive, your credit score can impact your car insurance premiums in many states, including Florida. Insurance companies use credit scores as an indicator of financial responsibility, and a higher credit score generally translates to lower insurance rates.

- Monitor Your Credit Score: Regularly check your credit report for errors and take steps to improve your score. You can obtain a free credit report from each of the three major credit bureaus annually at AnnualCreditReport.com.

- Pay Bills on Time: Making timely payments on your bills, including credit cards, loans, and utilities, is essential for maintaining a good credit score.

- Reduce Credit Utilization: Your credit utilization ratio is the amount of credit you’re using compared to your total available credit. Keeping this ratio low by using less than 30% of your available credit can improve your credit score.

Bundling Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in significant discounts. Insurance companies incentivize customers to bundle their policies, recognizing the convenience and loyalty this demonstrates.

- Compare Bundled Quotes: Contact multiple insurance companies to compare quotes for bundled policies. Explore different combinations of policies to find the most affordable option.

- Evaluate Your Needs: Determine the specific coverage you need for each policy and ensure that bundling aligns with your overall insurance requirements.

Choosing a Higher Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lead to lower premiums, as you are essentially taking on more financial responsibility in the event of an accident.

- Assess Your Risk Tolerance: Consider your financial situation and ability to cover a higher deductible if an accident occurs. A higher deductible may be suitable if you have a strong emergency fund or are comfortable with a higher out-of-pocket expense.

- Calculate Potential Savings: Compare the premiums for different deductible amounts to determine the potential savings. Weigh the cost savings against the increased financial risk you’re assuming.

Opting for a Less Comprehensive Coverage Plan

The level of coverage you choose impacts your insurance premiums. Consider your specific needs and the potential risks you face when deciding on the type and amount of coverage.

- Review Coverage Options: Understand the different types of coverage available, such as liability, collision, and comprehensive. Determine which coverages are essential for your situation and which you can potentially reduce or eliminate.

- Assess Your Vehicle’s Value: For older vehicles with lower value, consider reducing or eliminating collision and comprehensive coverage, as the potential payout may not justify the premium cost.

Discounts Offered by Insurance Companies

Insurance companies often offer a variety of discounts to incentivize safe driving practices, responsible behavior, and loyalty.

- Safe Driver Discounts: These discounts reward drivers with a clean driving record, demonstrating their commitment to safe driving.

- Good Student Discounts: Students who maintain good grades may qualify for discounts, reflecting their responsible behavior and commitment to education.

- Multi-Car Discounts: Insurance companies often offer discounts for insuring multiple vehicles with the same company, recognizing the loyalty and bundled business.

- Other Discounts: Other potential discounts include discounts for anti-theft devices, driver training courses, and membership in certain organizations.

Closure: Most Affordable Car Insurance Florida

In the end, securing the most affordable car insurance in Florida requires a combination of understanding your needs, comparing quotes from different providers, and taking advantage of available discounts. By following the strategies Artikeld in this guide, you can confidently navigate the insurance landscape and find a policy that provides the coverage you need at a price you can afford. Remember, a little research and effort can go a long way in saving you money on your car insurance.

Query Resolution

What is the average car insurance cost in Florida?

The average car insurance cost in Florida varies depending on factors like your age, driving history, vehicle type, and location. However, the state has a higher average cost than the national average.

What are some common discounts offered by car insurance companies in Florida?

Many insurance companies in Florida offer discounts for safe driving, good student records, multiple car policies, and other factors. Be sure to ask about available discounts when getting quotes.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or even more frequently if your circumstances change, such as a new car purchase, a change in your driving record, or a move to a new location.