Online car insurance Florida offers a convenient way to find the best coverage for your needs. Florida’s unique driving environment, with its high population density and frequent natural disasters, can make finding affordable car insurance a challenge. This guide explores the key factors that influence online car insurance rates in Florida, helping you navigate the process of getting quotes and selecting a reputable provider.

Understanding Florida’s car insurance landscape is essential for making informed decisions. The state requires specific types of coverage, including Personal Injury Protection (PIP), Property Damage Liability (PDL), and Uninsured Motorist Coverage (UM). While these are mandatory, additional coverage options like collision and comprehensive insurance can provide extra protection.

Understanding Florida’s Car Insurance Landscape: Online Car Insurance Florida

Florida’s car insurance market is unique and complex, influenced by several factors that impact the cost of coverage. Understanding these factors is crucial for Florida residents to make informed decisions about their car insurance needs.

Factors Influencing Car Insurance Costs in Florida

Florida’s high population density, frequent natural disasters, and a litigious environment contribute significantly to the state’s car insurance costs.

- High Population Density: Florida’s large and growing population leads to increased traffic congestion and a higher frequency of accidents. This translates into higher insurance claims and, consequently, higher premiums.

- Frequent Natural Disasters: Florida is prone to hurricanes, floods, and other natural disasters. Insurance companies factor in the risk of these events, leading to higher premiums for drivers in areas susceptible to such hazards.

- Litigious Environment: Florida is known for its high number of lawsuits related to car accidents. This litigious environment drives up insurance costs as companies need to cover legal expenses and potential payouts.

Required Car Insurance Coverage in Florida

Florida law mandates that all drivers carry specific types of car insurance coverage to protect themselves and others in the event of an accident.

- Personal Injury Protection (PIP): PIP coverage pays for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault. Florida’s PIP law is unique, requiring drivers to carry at least $10,000 in coverage.

- Property Damage Liability (PDL): PDL coverage protects the insured driver against financial responsibility for damages to another person’s property. Florida requires drivers to carry at least $10,000 in PDL coverage.

- Uninsured Motorist Coverage (UM): UM coverage provides financial protection for the insured driver and passengers if they are involved in an accident with an uninsured or underinsured driver. Florida requires drivers to carry at least $10,000 in UM coverage.

Optional Car Insurance Coverage in Florida

While required coverage is essential, drivers can choose to purchase additional optional coverage to enhance their protection.

- Collision Coverage: Collision coverage pays for repairs or replacement of the insured vehicle if it is damaged in an accident, regardless of fault. This coverage is optional but recommended, especially for newer or more expensive vehicles.

- Comprehensive Coverage: Comprehensive coverage protects the insured vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. This coverage is optional but recommended for drivers who want to protect their vehicle against a wider range of risks.

- Rental Reimbursement: Rental reimbursement coverage provides financial assistance to the insured driver for the cost of a rental car while their vehicle is being repaired or replaced after an accident. This coverage is optional and can be helpful for drivers who rely on their vehicles for transportation.

Key Factors Affecting Online Car Insurance Rates

Understanding the factors that influence your car insurance rates in Florida is crucial for finding the best coverage at an affordable price. Online car insurance providers utilize various data points to assess risk and determine your premium. This section will delve into the key factors that impact your online car insurance rates in Florida, allowing you to better understand how your individual circumstances affect your premium.

Driving History

Your driving history is one of the most significant factors determining your car insurance rates. Insurance companies carefully analyze your driving record to assess your risk of being involved in an accident. This includes:

- Accidents: Any accidents you’ve been involved in, regardless of fault, will increase your premium. The severity of the accident and the number of accidents you’ve had will further impact your rates. For instance, a minor fender bender will typically have a lesser impact on your premium compared to a major accident involving injuries or significant property damage.

- Traffic Violations: Traffic violations, such as speeding tickets, running red lights, and parking violations, can also raise your insurance rates. The severity of the violation and the number of violations you’ve received will affect your premium. A single speeding ticket might result in a minor increase, while multiple violations could lead to a more substantial premium increase.

- DUI Convictions: A DUI conviction has the most significant impact on your insurance rates. Insurance companies view DUI convictions as a serious indicator of risky behavior and will likely impose substantial premium increases. These increases can be significantly higher than those for other traffic violations and may even lead to the cancellation of your policy.

Vehicle Type

The type of vehicle you drive also influences your car insurance rates. Insurance companies consider factors such as:

- Safety Ratings: Vehicles with higher safety ratings, such as those awarded by the Insurance Institute for Highway Safety (IIHS) or the National Highway Traffic Safety Administration (NHTSA), tend to have lower insurance premiums. This is because these vehicles are considered safer and less likely to result in costly accidents.

- Make and Model: Certain makes and models of vehicles are more prone to accidents or theft, resulting in higher insurance premiums. For example, sports cars and luxury vehicles often have higher insurance rates due to their higher performance and value. Conversely, vehicles with a history of reliability and lower repair costs may have lower insurance premiums.

- Year: The year of your vehicle also plays a role in determining your insurance rates. Newer vehicles generally have more advanced safety features and are less likely to be totaled in an accident, leading to lower premiums. Older vehicles may have higher premiums due to their increased risk of breakdowns, repairs, and theft.

Age and Driving Experience

Your age and driving experience are crucial factors influencing your car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to lack of experience. This higher risk translates into higher insurance premiums for young drivers. However, as you gain more experience and reach a certain age, your insurance rates typically decrease.

Location

Your location, specifically your zip code, can significantly impact your car insurance rates. This is because insurance companies consider factors such as:

- Crime Rates: Areas with higher crime rates, including vehicle theft, tend to have higher car insurance premiums. Insurance companies consider the risk of your vehicle being stolen or damaged due to crime in your area.

- Traffic Congestion: Areas with heavy traffic congestion increase the likelihood of accidents. Insurance companies may charge higher premiums in areas with high traffic density due to the increased risk of accidents.

- Population Density: Areas with higher population density often have more drivers on the road, leading to a higher risk of accidents. Insurance companies may adjust premiums based on the population density of your location.

Navigating Online Car Insurance Quotes

The convenience and transparency of online car insurance quotes have revolutionized the way Floridians shop for coverage. Online platforms offer a streamlined process for comparing rates, understanding coverage options, and securing the best deal.

Benefits of Obtaining Online Car Insurance Quotes

Online car insurance quotes offer several advantages over traditional methods, making it a popular choice for many Floridians.

- Convenience and Accessibility: Online platforms allow you to request quotes anytime, anywhere, eliminating the need for phone calls or in-person visits.

- Speed and Efficiency: The online process is significantly faster, providing instant quotes without waiting for a representative.

- Transparency and Comparison: Online platforms display multiple quotes side-by-side, enabling you to compare rates, coverage options, and discounts across different providers.

- Reduced Pressure: Obtaining quotes online allows you to research and compare options at your own pace without feeling pressured by sales agents.

Drawbacks of Obtaining Online Car Insurance Quotes

While online quotes offer numerous benefits, they also come with certain drawbacks.

- Limited Personalization: Online platforms may not capture all the nuances of your individual situation, potentially leading to inaccurate quotes.

- Potential for Misinformation: The online environment can be prone to misleading information or deceptive practices, requiring careful evaluation of quotes.

- Lack of Personal Interaction: Online quotes lack the opportunity for personalized advice and guidance from insurance professionals.

Obtaining Accurate Online Car Insurance Quotes

To ensure accurate and reliable online car insurance quotes, follow these steps:

- Gather Necessary Information: Prepare essential details, such as your driving history, vehicle information, desired coverage levels, and contact information.

- Use Reputable Comparison Websites: Choose well-established comparison platforms known for their accuracy and comprehensive coverage.

- Provide Accurate Information: Be honest and precise when entering your details to avoid inaccurate quotes.

- Compare Quotes Thoroughly: Review quotes from multiple providers, focusing on coverage details, premiums, and discounts.

- Read Policy Documents: Carefully review the policy documents to understand the terms and conditions of each quote.

Negotiating Car Insurance Rates Online

While online platforms may not offer traditional negotiation, you can still explore ways to lower your car insurance rates:

- Bundle Policies: Combining multiple insurance policies, such as car and homeowners, can often lead to significant discounts.

- Increase Deductibles: Raising your deductible, the amount you pay out-of-pocket before insurance coverage kicks in, can reduce your premium.

- Explore Discounts: Investigate available discounts, such as safe driving records, good student discounts, and multi-car discounts.

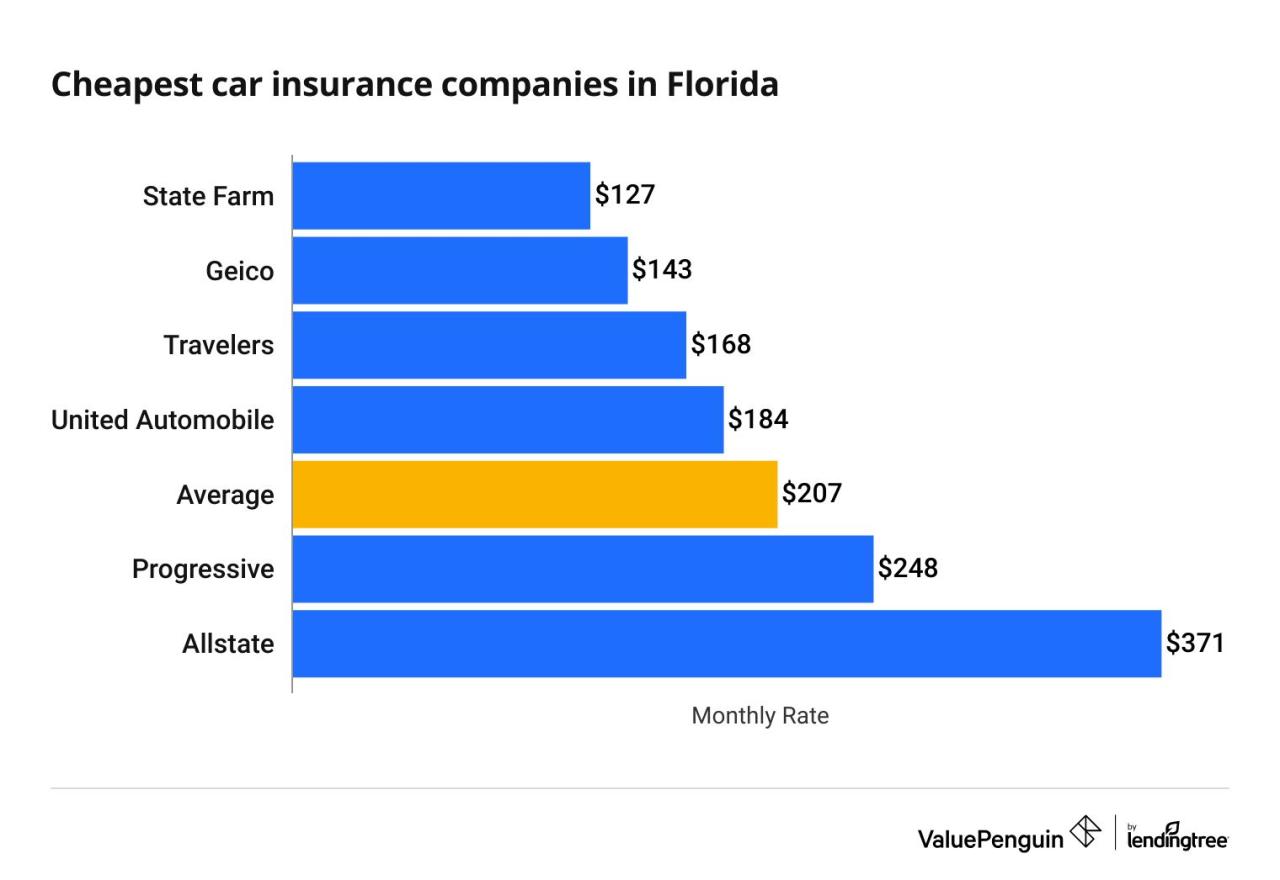

Reputable Online Car Insurance Providers in Florida

Finding the right car insurance provider in Florida can be overwhelming, especially with the abundance of options available. Online car insurance providers have gained popularity for their convenience, competitive rates, and digital-first approach. This section will delve into the top online car insurance providers in Florida, examining their key features, coverage options, and customer service ratings to help you make an informed decision.

Top Online Car Insurance Providers in Florida

Choosing the right online car insurance provider in Florida is crucial for ensuring adequate coverage and cost-effectiveness. Here are some of the leading providers, known for their strong reputation, competitive pricing, and user-friendly online platforms:

- Geico: Geico is a well-known national provider offering a wide range of coverage options, including comprehensive and collision coverage, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. Geico’s online platform is user-friendly, allowing for quick and easy quote comparisons. Their customer service is highly rated, with a 24/7 helpline and online chat support.

- Progressive: Progressive is another major national provider known for its innovative features, including its “Name Your Price” tool, which allows customers to set their desired premium and see the coverage options that fit their budget. Progressive also offers a variety of discounts, including safe driver, good student, and multi-car discounts. Their online platform is comprehensive and offers various resources, including educational materials and claims assistance.

- State Farm: State Farm is a leading national provider known for its strong financial stability and commitment to customer service. They offer a wide range of coverage options, including comprehensive and collision coverage, PIP, and UM/UIM coverage. State Farm’s online platform is user-friendly, allowing for quick and easy quote comparisons. They also have a strong network of local agents who can provide personalized assistance.

- USAA: USAA is a highly-rated provider that exclusively serves active military personnel, veterans, and their families. USAA offers a wide range of coverage options, including comprehensive and collision coverage, PIP, and UM/UIM coverage. They are known for their exceptional customer service and financial stability. USAA’s online platform is user-friendly and provides a seamless experience for members.

- Liberty Mutual: Liberty Mutual is a major national provider known for its personalized coverage options and discounts. They offer a variety of coverage options, including comprehensive and collision coverage, PIP, and UM/UIM coverage. Liberty Mutual’s online platform is user-friendly and allows for easy quote comparisons. They also offer a variety of discounts, including safe driver, good student, and multi-car discounts.

Comparison of Online Car Insurance Providers in Florida

To further assist you in your decision-making process, here is a table comparing the key features, pros, and cons of the top online car insurance providers in Florida:

| Provider | Key Features | Pros | Cons | Target Customer Segment |

|---|---|---|---|---|

| Geico | Wide coverage options, user-friendly online platform, 24/7 customer service | Competitive pricing, excellent customer service, easy online experience | Limited customization options, may not offer the most comprehensive coverage | Drivers seeking affordable rates and convenient online services |

| Progressive | “Name Your Price” tool, variety of discounts, comprehensive online platform | Flexible pricing options, innovative features, strong customer service | May not offer the most competitive rates for all drivers, complex online platform | Drivers seeking personalized pricing and a wide range of discounts |

| State Farm | Wide coverage options, strong financial stability, local agent network | Reliable coverage, excellent customer service, strong financial backing | May not offer the most competitive rates for all drivers, limited online customization | Drivers seeking reliable coverage and personalized assistance from local agents |

| USAA | Exclusive service for military personnel, veterans, and their families, exceptional customer service | Highly competitive rates, exceptional customer service, strong financial stability | Limited availability to non-military members | Active military personnel, veterans, and their families |

| Liberty Mutual | Personalized coverage options, variety of discounts, user-friendly online platform | Competitive pricing, personalized coverage options, strong customer service | May not offer the most competitive rates for all drivers, limited online customization | Drivers seeking personalized coverage and discounts |

Importance of Researching and Selecting a Reputable Online Car Insurance Provider

Researching and selecting a reputable online car insurance provider is crucial for ensuring that you have the right coverage at a competitive price. Consider factors such as:

- Coverage options: Ensure that the provider offers the coverage options that meet your specific needs, including liability, collision, comprehensive, PIP, and UM/UIM coverage.

- Pricing: Compare quotes from multiple providers to ensure that you are getting the best possible rate. Consider factors such as your driving history, vehicle type, and location.

- Customer service: Look for a provider with a strong reputation for customer service. Check online reviews and ratings to gauge the provider’s responsiveness and helpfulness.

- Financial stability: Choose a provider with a strong financial rating, as this indicates their ability to pay claims in the event of an accident.

- Online platform: Ensure that the provider’s online platform is user-friendly and allows for easy quote comparisons, policy management, and claims reporting.

Tips for Saving Money on Online Car Insurance

Navigating the world of car insurance in Florida can be overwhelming, but with a bit of effort and knowledge, you can significantly reduce your insurance costs. There are a variety of strategies you can implement to lower your premiums, ensuring you get the coverage you need without breaking the bank.

Maintaining a Good Driving Record, Online car insurance florida

Your driving history is a primary factor in determining your car insurance rates. A clean record with no accidents or traffic violations will earn you lower premiums. Conversely, accidents and citations can lead to substantial increases in your rates.

- Defensive Driving Courses: Completing a defensive driving course can help you improve your driving skills and potentially earn a discount on your insurance. These courses teach safe driving techniques, hazard awareness, and accident avoidance strategies.

- Avoid Traffic Violations: Every traffic violation, from speeding tickets to parking tickets, can negatively impact your insurance premiums. Practice safe driving habits and follow all traffic laws to maintain a clean driving record.

- Reporting Accidents Promptly: In the event of an accident, it’s crucial to report it to your insurance company promptly and accurately. Failure to do so could lead to complications and potentially higher premiums.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can result in lower premiums, as you’re essentially taking on more financial responsibility for smaller claims.

- Assess Your Risk Tolerance: Carefully consider your financial situation and risk tolerance before increasing your deductible. If you’re comfortable paying a higher amount out of pocket in case of an accident, increasing your deductible can save you money on premiums.

- Set Realistic Deductibles: While increasing your deductible can lead to savings, it’s important to set a realistic amount you can afford to pay in case of an accident. Don’t increase your deductible to a point where you’d be financially strained if you needed to file a claim.

Bundling Policies

Insurance companies often offer discounts for bundling multiple policies, such as car insurance with homeowners or renters insurance. This can result in significant savings compared to purchasing these policies separately.

- Compare Bundled Rates: Contact your current insurance provider and other insurers to compare bundled rates. See if you can save money by combining your car insurance with other policies.

- Consider Your Needs: Make sure the bundled policies meet your specific needs. For example, if you’re a renter, bundling your car insurance with renters insurance could be a smart move.

Leveraging Available Discounts

Many insurance companies offer a variety of discounts to their policyholders. These discounts can significantly reduce your premiums, so it’s important to identify and leverage them.

- Good Student Discount: If you have a student with a good academic record, inquire about good student discounts. This discount rewards students for their academic achievements.

- Safe Driver Discount: Maintain a clean driving record and you may qualify for a safe driver discount. This discount recognizes drivers with no accidents or traffic violations.

- Multi-Car Discount: If you have multiple vehicles insured with the same company, you may be eligible for a multi-car discount. This discount incentivizes policyholders to insure all their vehicles with the same provider.

- Other Discounts: Contact your insurance company to inquire about other potential discounts, such as discounts for anti-theft devices, vehicle safety features, or loyalty programs.

Final Thoughts

By understanding the factors that affect online car insurance rates, navigating the quote process, and exploring reputable providers, you can find affordable and comprehensive coverage that meets your specific needs. Remember to compare quotes from multiple providers, leverage available discounts, and consider bundling policies for potential savings. With a little research and effort, you can secure the best online car insurance in Florida.

Expert Answers

What are the minimum car insurance requirements in Florida?

Florida requires drivers to carry Personal Injury Protection (PIP), Property Damage Liability (PDL), and Uninsured Motorist Coverage (UM).

How can I save money on car insurance in Florida?

Consider increasing your deductible, bundling policies, taking a defensive driving course, and exploring discounts for good students, safe drivers, and multi-car households.

What are the best online car insurance providers in Florida?

Popular online providers include Geico, Progressive, State Farm, and USAA. Research each provider to compare coverage options, pricing, and customer service ratings.

Is it safe to buy car insurance online?

Yes, buying car insurance online is safe and convenient. Reputable providers offer secure online platforms and protect your personal information.