- Introduction to Pay-Per-Mile Car Insurance in Florida

- How Pay-Per-Mile Insurance Works in Florida

- Benefits of Pay-Per-Mile Car Insurance in Florida

- Drawbacks of Pay-Per-Mile Car Insurance in Florida

- Factors to Consider When Choosing Pay-Per-Mile Car Insurance in Florida

- The Future of Pay-Per-Mile Car Insurance in Florida: Pay Per Mile Car Insurance Florida

- Closing Notes

- FAQ Insights

Pay per mile car insurance Florida is a new and innovative approach to car insurance that is gaining traction in the Sunshine State. This type of insurance, unlike traditional policies, bases your premiums on the number of miles you drive, not just factors like your age, driving history, or car model. This means that if you drive less, you could potentially save a significant amount on your car insurance premiums. In a state like Florida, where traffic congestion and high gas prices are common, pay per mile car insurance could be a compelling option for many drivers, especially those who commute short distances or use public transportation frequently.

Florida’s car insurance market is known for its competitive nature, with numerous insurance providers offering a wide range of coverage options. This competitive landscape has encouraged the emergence of innovative insurance models, including pay per mile insurance. The state’s diverse driving population, with a mix of urban and rural areas, presents a unique opportunity for pay per mile insurance to cater to specific driving needs. The appeal of this type of insurance lies in its potential for cost savings, particularly for individuals who drive less than the average driver. This makes it an attractive option for commuters, retirees, and individuals who rely on alternative modes of transportation.

Introduction to Pay-Per-Mile Car Insurance in Florida

Pay-per-mile car insurance, also known as usage-based insurance, is a relatively new type of car insurance that charges premiums based on the number of miles driven. This contrasts with traditional car insurance, where premiums are typically calculated based on factors such as the driver’s age, driving history, vehicle type, and location.

Florida’s car insurance market is highly competitive, with numerous insurance companies vying for customers. The state is also home to a significant number of drivers who commute long distances, making pay-per-mile insurance a potentially attractive option for some.

Factors Making Pay-Per-Mile Insurance Attractive in Florida

Pay-per-mile insurance can be a particularly appealing option for Florida drivers who:

- Drive fewer miles than the average driver.

- Work from home or have a flexible work schedule that allows them to minimize driving.

- Are concerned about rising car insurance premiums.

- Are looking for ways to save money on their car insurance.

How Pay-Per-Mile Insurance Works in Florida

Pay-per-mile insurance, also known as usage-based insurance, is a relatively new type of car insurance in Florida that bases your premium on how much you drive. This innovative approach can potentially save you money if you drive less than the average driver.

Policy Structure

Pay-per-mile insurance policies in Florida typically consist of two components: a base premium and a per-mile charge. The base premium covers basic coverage like liability and property damage, while the per-mile charge is calculated based on your actual mileage.

Mileage Tracking

Insurance companies use various methods to track your mileage, including:

- Telematics Devices: These small devices plug into your car’s diagnostic port and record your driving data, such as speed, acceleration, braking, and mileage.

- Smartphone Apps: Some insurance companies offer smartphone apps that use your phone’s GPS to track your mileage.

You can choose the method that best suits your preferences and privacy concerns.

Premium Calculation

The premium for pay-per-mile insurance is calculated based on several factors, including:

- Base Premium: This is determined by factors like your driving history, age, location, and the type of car you drive.

- Per-Mile Charge: This is typically a fixed rate per mile driven, which varies depending on the insurance company and your coverage.

- Mileage Threshold: Some policies have a mileage threshold, which means you pay a fixed premium up to a certain mileage limit. After exceeding this limit, you pay an additional per-mile charge.

For example, a pay-per-mile policy might have a base premium of $50 per month and a per-mile charge of $0.05. If you drive 1,000 miles in a month, your total premium would be $100 ($50 base premium + $50 per-mile charge).

Benefits of Pay-Per-Mile Car Insurance in Florida

Pay-per-mile car insurance, also known as usage-based insurance, presents a unique opportunity for Florida drivers to potentially save money and reduce their environmental impact. This type of insurance policy calculates premiums based on the number of miles driven, offering a compelling alternative to traditional policies that rely primarily on factors like vehicle type, age, and driving history.

Cost Savings for Low-Mileage Drivers, Pay per mile car insurance florida

Low-mileage drivers in Florida can significantly benefit from pay-per-mile insurance. Traditional car insurance policies often charge a flat premium regardless of how much a driver uses their vehicle. This means that drivers who rarely drive may end up paying more than necessary for coverage. Pay-per-mile insurance addresses this disparity by charging premiums based on actual mileage, allowing low-mileage drivers to potentially save money on their insurance premiums.

For instance, a driver who commutes to work via public transportation and only uses their car for weekend errands might see substantial savings with pay-per-mile insurance compared to a traditional policy.

Environmental Benefits of Reduced Driving

Pay-per-mile insurance can indirectly contribute to environmental sustainability by encouraging reduced driving. The economic incentive to minimize driving, driven by lower premiums for lower mileage, can lead to a reduction in greenhouse gas emissions. By reducing their reliance on personal vehicles, drivers can contribute to cleaner air and a healthier environment.

According to the Environmental Protection Agency (EPA), transportation accounts for the largest share of greenhouse gas emissions in the United States. Pay-per-mile insurance can potentially play a role in reducing this contribution by encouraging more efficient driving habits.

Comparison with Traditional Car Insurance

While pay-per-mile insurance offers potential cost savings and environmental benefits, it’s important to understand its coverage options and limitations compared to traditional car insurance.

Coverage Options

- Pay-per-mile insurance typically covers the same basic types of coverage as traditional policies, including liability, collision, comprehensive, and uninsured motorist coverage.

- However, the specific coverage options and limits available may vary between insurance providers. It’s essential to compare different policies carefully before making a decision.

Limitations

- Pay-per-mile insurance might not be suitable for all drivers, especially those who drive frequently or have high mileage needs.

- Some providers may have mileage limits or caps on how much coverage is available under a pay-per-mile policy. Drivers should carefully review the terms and conditions of their policy to understand these limitations.

Drawbacks of Pay-Per-Mile Car Insurance in Florida

While pay-per-mile car insurance offers potential savings for low-mileage drivers, it’s crucial to understand its potential drawbacks.

Limitations on Mileage or Coverage

Pay-per-mile insurance policies often come with limitations on the number of miles you can drive each year. If you exceed this limit, you may face higher premiums or even be subject to coverage restrictions. For instance, some policies might cap your coverage at a certain number of miles, meaning you could be responsible for a larger portion of repair costs if you exceed this limit.

Data Privacy Concerns

One of the biggest concerns associated with pay-per-mile insurance is data privacy. These policies require you to install a device in your car that tracks your mileage and driving habits. This data collection raises concerns about the potential misuse of your personal information, especially as insurance companies may share this data with third parties.

Cost Comparison for High-Mileage Drivers

While pay-per-mile insurance can be beneficial for low-mileage drivers, it may not be the best option for those who drive frequently. In some cases, traditional car insurance policies might offer more competitive rates for high-mileage drivers. It’s essential to compare quotes from different insurance companies and consider your individual driving habits before making a decision.

Factors to Consider When Choosing Pay-Per-Mile Car Insurance in Florida

Choosing the right pay-per-mile car insurance policy in Florida requires careful consideration of various factors to ensure you secure the most suitable plan for your needs and driving habits.

Comparison of Pay-Per-Mile Insurance Providers in Florida

To aid in your decision-making process, the table below compares key features and benefits of different pay-per-mile insurance providers in Florida.

| Provider | Coverage Options | Pricing Structure | Mileage Tracking Method | Other Features |

|—|—|—|—|—|

| Provider A | Comprehensive, Collision, Liability | Base rate + per-mile charge | Mobile app, OBD-II device | Discounts for safe driving, telematics |

| Provider B | Comprehensive, Collision, Liability | Base rate + tiered mileage pricing | Mobile app, manual reporting | Discounts for good driving history, bundling |

| Provider C | Comprehensive, Collision, Liability | Base rate + per-mile charge | Mobile app, OBD-II device | Discounts for eco-friendly driving, safe driving |

Checklist for Choosing a Pay-Per-Mile Insurance Policy

Before making a decision, consider the following checklist to ensure you select a policy that aligns with your driving habits and financial goals:

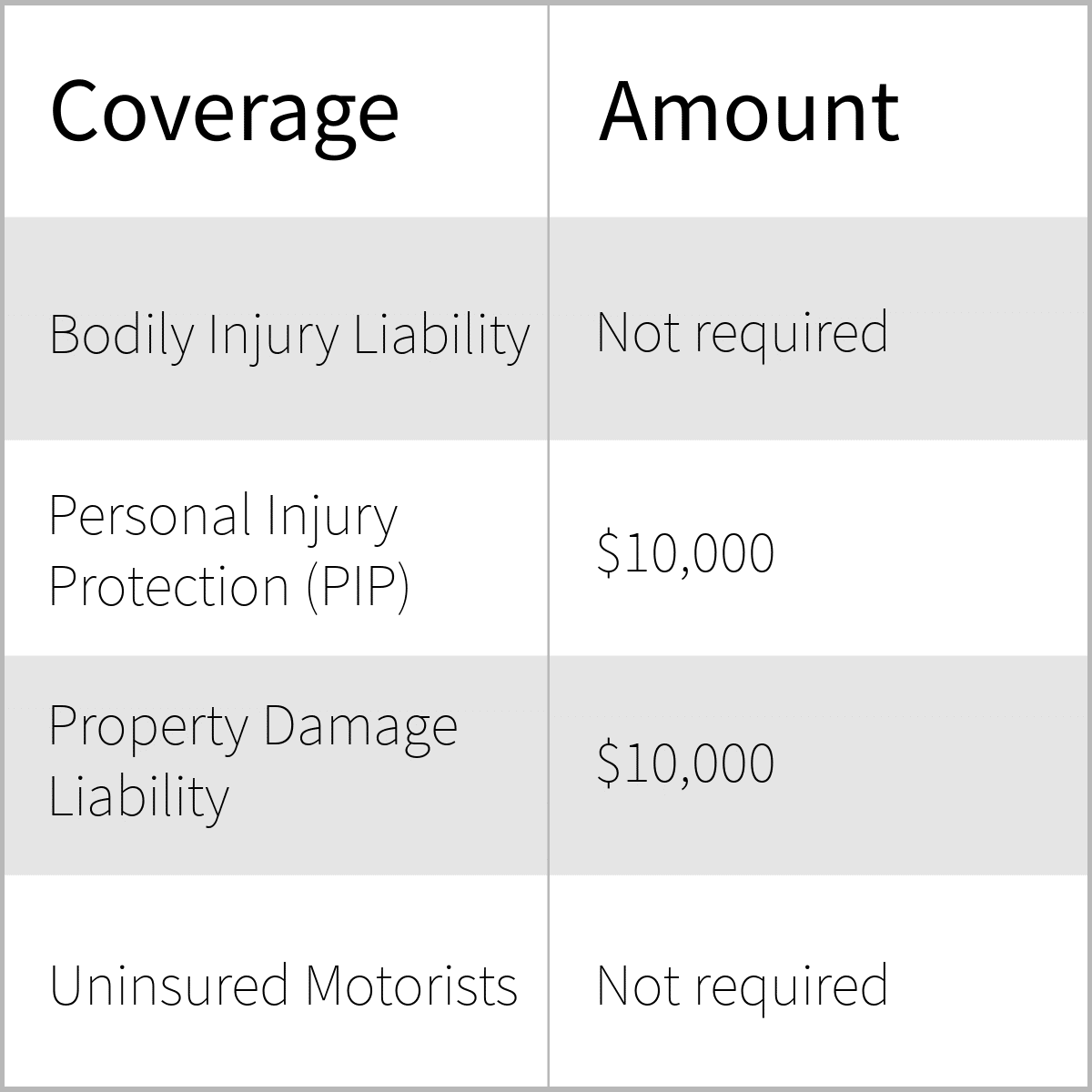

- Coverage Limits: Determine the minimum coverage limits required by Florida law and assess your individual needs for additional coverage, such as comprehensive or collision.

- Pricing: Compare the base rate and per-mile charges of different providers to determine the most cost-effective option based on your estimated annual mileage.

- Mileage Tracking Methods: Evaluate the accuracy and convenience of the available mileage tracking methods, such as mobile apps, OBD-II devices, or manual reporting.

- Discounts: Inquire about available discounts for safe driving, good driving history, bundling, or other factors that may reduce your premium.

- Customer Service: Consider the provider’s reputation for customer service, responsiveness, and ease of communication.

Tips for Finding the Best Pay-Per-Mile Insurance Plan

To find the best pay-per-mile insurance plan, consider the following tips:

- Estimate Your Annual Mileage: Accurately estimate your annual mileage to compare quotes from different providers based on your driving habits.

- Shop Around: Obtain quotes from multiple providers to compare prices, coverage options, and features.

- Read Reviews: Consult online reviews and ratings to assess the provider’s reputation and customer satisfaction.

- Ask Questions: Don’t hesitate to ask questions about the policy details, pricing structure, and mileage tracking methods to ensure you understand all aspects of the plan.

The Future of Pay-Per-Mile Car Insurance in Florida: Pay Per Mile Car Insurance Florida

Pay-per-mile car insurance in Florida is a relatively new concept, but it is gaining traction as more drivers seek ways to save money on their insurance premiums. As the market evolves, the future of pay-per-mile insurance in Florida is promising, with the potential for significant growth and innovation.

The Potential Impact of Emerging Technologies

Emerging technologies, such as autonomous vehicles, are expected to have a significant impact on the pay-per-mile insurance model. The widespread adoption of autonomous vehicles could lead to a dramatic decrease in car accidents, potentially reducing the need for traditional liability coverage. Pay-per-mile insurance models could evolve to focus on factors like mileage, driving behavior, and vehicle maintenance data, offering more personalized and data-driven insurance premiums.

Closing Notes

Pay per mile car insurance Florida is a compelling alternative to traditional car insurance, particularly for drivers who log fewer miles. While it offers potential cost savings and environmental benefits, it’s crucial to carefully consider its drawbacks and limitations. Ultimately, the decision of whether pay per mile insurance is right for you depends on your individual driving habits, insurance needs, and budget. With careful research and comparison, you can determine if this innovative insurance model is the best fit for your driving profile in Florida.

FAQ Insights

How do I know if pay per mile insurance is right for me?

Pay per mile insurance is ideal for drivers who drive significantly less than the average driver. If you commute short distances, use public transportation often, or have a primarily local driving pattern, this type of insurance could save you money. Consider your annual mileage and compare quotes from both traditional and pay per mile insurance providers to determine which option is more cost-effective for you.

Is my privacy protected with pay per mile insurance?

Data privacy is a valid concern with any type of insurance that involves mileage tracking. Reputable pay per mile insurance providers should have robust privacy policies in place. They should clearly explain how they collect, store, and use your mileage data. Look for providers that are transparent about their data practices and ensure your privacy is respected.