- Pay-Per-Mile Car Insurance in Florida

- Eligibility and Requirements

- Cost Comparison and Savings Potential

- Choosing the Right Pay-Per-Mile Plan

- Mileage Tracking and Reporting

- Pay-Per-Mile Insurance and Florida Regulations

- Case Studies and Real-World Examples: Pay-per-mile Car Insurance Florida

- Final Conclusion

- Essential Questionnaire

Pay-per-mile car insurance Florida is gaining traction as a cost-effective alternative for drivers who rack up fewer miles. This innovative insurance model, also known as usage-based insurance, calculates premiums based on the actual distance driven, offering potential savings for those who stay close to home. Instead of traditional car insurance, which charges a flat rate regardless of mileage, pay-per-mile plans use telematics devices or smartphone apps to track your driving habits and adjust your premium accordingly.

The concept is simple: drive less, pay less. This approach can be particularly advantageous for individuals who commute short distances, work from home, or frequently rely on public transportation. However, it’s important to consider factors such as driving history, vehicle type, and coverage options before making a decision. We’ll delve into the intricacies of pay-per-mile insurance in Florida, exploring its advantages, disadvantages, and how it compares to traditional insurance plans.

Pay-Per-Mile Car Insurance in Florida

Pay-per-mile car insurance, also known as usage-based insurance (UBI), is a type of car insurance where your premium is calculated based on the number of miles you drive. This alternative to traditional car insurance can be a more cost-effective option for drivers who drive less than the average Floridian.

How Pay-Per-Mile Insurance Works in Florida

Pay-per-mile insurance in Florida typically works in the following way:

* Mileage Tracking: You’ll need to install a device in your car, such as a small plug-in device or a smartphone app, to track your mileage. This device will record your driving habits, including the time, distance, and speed of your trips.

* Premium Calculation: Insurance companies use the collected mileage data to calculate your premium. The lower your mileage, the lower your premium will be.

* Premium Structure: Pay-per-mile insurance typically has a base premium that covers liability coverage and a per-mile rate. Your total premium is calculated by adding the base premium to the per-mile rate multiplied by your total mileage.

* Examples:

* For instance, if the base premium is $50 per month, and the per-mile rate is $0.05, and you drive 500 miles in a month, your total premium would be $75 ($50 + ($0.05 x 500)).

* If you only drive 250 miles in a month, your total premium would be $62.50 ($50 + ($0.05 x 250)).

Advantages of Pay-Per-Mile Car Insurance

- Lower Premiums: Drivers who drive less than average can potentially save money on their car insurance premiums.

- Flexibility: You can adjust your driving habits and potentially reduce your premium.

- Rewards for Safe Driving: Some pay-per-mile insurance programs offer discounts for safe driving habits, such as avoiding hard braking or speeding.

Disadvantages of Pay-Per-Mile Car Insurance

- Mileage Tracking: Some drivers may find the need to track their mileage intrusive or inconvenient.

- Limited Availability: Not all insurance companies offer pay-per-mile insurance in Florida.

- Potential for Higher Premiums: If you drive more than average, you may end up paying more than with traditional car insurance.

Eligibility and Requirements

Pay-per-mile car insurance in Florida is not as widely available as traditional insurance plans. However, it’s gaining traction as a cost-effective option for certain drivers. To determine if you qualify, you need to understand the specific requirements set by insurance companies.

Eligibility Criteria for Pay-Per-Mile Car Insurance in Florida, Pay-per-mile car insurance florida

Insurance companies in Florida offering pay-per-mile plans typically have specific criteria for eligibility. These criteria are designed to ensure that the program is suitable for drivers who truly benefit from a pay-per-mile structure.

- Driving Habits: Pay-per-mile plans are generally best suited for drivers who have low annual mileage. This is because the cost savings are directly tied to the number of miles driven. If you drive a lot, a traditional insurance plan may be more cost-effective.

- Credit History: Most insurance companies consider your credit history as a factor in determining your eligibility for pay-per-mile plans. A good credit score generally improves your chances of approval.

- Driving Record: A clean driving record with no recent accidents or violations is typically a requirement for pay-per-mile insurance. Insurance companies want to ensure that drivers are responsible and safe on the road.

- Vehicle Type: Pay-per-mile plans may not be available for all types of vehicles. For example, commercial vehicles or high-performance cars might not be eligible.

Requirements for Drivers, Vehicles, and Mileage Limits

- Driver Requirements: Most pay-per-mile insurance plans in Florida require drivers to be at least 18 years old. Additionally, some insurers may have age restrictions for younger drivers or those with limited driving experience.

- Vehicle Requirements: Vehicles eligible for pay-per-mile insurance are typically newer models and in good condition. The specific requirements may vary depending on the insurance company.

- Mileage Limits: Pay-per-mile plans often have a maximum mileage limit per year. If you exceed this limit, you may be switched to a traditional insurance plan. The mileage limit can vary significantly between insurance companies.

Examples of Pay-Per-Mile Insurance Companies in Florida

- Metromile: Metromile is a well-known pay-per-mile insurance provider in Florida. They offer flexible plans with various mileage options and have a strong focus on technology and customer service. They use a telematics device to track mileage accurately.

- Drive Safe: Drive Safe is another insurance company offering pay-per-mile plans in Florida. They focus on safe driving and offer discounts for drivers who maintain a good driving record.

- Other Companies: Some other insurance companies in Florida may offer pay-per-mile plans, but they might not advertise them as prominently as Metromile or Drive Safe. It’s always best to contact multiple insurance providers to compare quotes and find the best option for your needs.

Cost Comparison and Savings Potential

Pay-per-mile car insurance can be a more affordable option compared to traditional car insurance, especially for drivers who have low mileage. This type of insurance allows you to pay only for the miles you drive, which can result in significant savings, particularly if you drive less than the average Floridian.

To determine if pay-per-mile insurance is right for you, it’s crucial to compare its cost with traditional car insurance plans, considering your driving habits.

Cost Comparison for Different Driving Habits

Understanding the cost differences between pay-per-mile and traditional car insurance requires examining various driving scenarios. Let’s compare the estimated annual costs for a hypothetical driver in Florida, using both types of insurance plans:

- Low-Mileage Driver: This driver drives around 5,000 miles per year, primarily for commuting and local errands. With pay-per-mile insurance, they might pay around $500 per year, while traditional car insurance could cost $1,000 or more.

- Average-Mileage Driver: This driver drives around 10,000 miles per year, a common driving pattern for many Floridians. Pay-per-mile insurance might cost $800 per year, while traditional insurance could range from $1,500 to $2,000.

- High-Mileage Driver: This driver drives over 15,000 miles per year, possibly due to a long commute or frequent road trips. Pay-per-mile insurance might cost $1,200 per year, while traditional insurance could cost around $2,500 or more.

Estimated Savings for Low-Mileage Drivers

For drivers who drive significantly less than the average Floridian, pay-per-mile insurance can offer substantial savings. For instance, a low-mileage driver who typically drives 5,000 miles per year might save $500 or more annually by opting for pay-per-mile insurance instead of a traditional plan.

Factors Influencing Pay-Per-Mile Insurance Cost

Several factors can influence the cost of pay-per-mile insurance, including:

- Vehicle Type: The type of vehicle you drive, such as a small sedan or a large SUV, can affect the cost of insurance.

- Driving History: Your driving record, including any accidents or traffic violations, can influence your insurance premiums.

- Coverage Options: The level of coverage you choose, such as liability, collision, and comprehensive coverage, will also impact the cost of your pay-per-mile insurance.

- Location: Your location in Florida can influence the cost of pay-per-mile insurance, as rates can vary based on factors like traffic density and accident rates.

Choosing the Right Pay-Per-Mile Plan

In Florida, pay-per-mile car insurance offers a unique way to save money on your premiums. However, selecting the right plan requires careful consideration of various factors. By understanding the nuances of these plans, you can make an informed decision that aligns with your driving habits and financial goals.

Comparing Pay-Per-Mile Insurance Plans

To find the best pay-per-mile insurance plan for your needs, it’s essential to compare different options. Here’s a guide to help you navigate the process:

Pricing

- Base Rate: Pay-per-mile plans often have a lower base rate compared to traditional policies. This initial rate covers the cost of insurance for basic coverage, regardless of mileage.

- Per-Mile Rate: The cost per mile driven varies between insurers and plans. It’s crucial to compare these rates to determine which plan offers the best value for your expected mileage.

- Minimum Mileage Fee: Some insurers impose a minimum mileage fee, even if you drive less than the stipulated threshold. It’s essential to understand this fee and factor it into your calculations.

Coverage

- Coverage Options: Pay-per-mile plans typically offer standard coverage options like liability, collision, and comprehensive. However, it’s important to ensure the plan includes the specific coverage you require.

- Deductibles: Compare deductibles across different plans, as higher deductibles may lead to lower per-mile rates.

- Exclusions: Some plans may have specific exclusions or limitations, such as mileage caps or restrictions on usage. Carefully review these terms to avoid surprises.

Mileage Tracking Methods

- Automatic Mileage Tracking: Some insurers use telematics devices or smartphone apps to automatically track your mileage. This method is typically more accurate but may raise privacy concerns.

- Manual Mileage Reporting: Other insurers require you to manually record and submit your mileage. This approach provides greater control over your data but may be more prone to errors.

- Hybrid Approach: Some insurers combine automatic and manual tracking, allowing you to choose the method that best suits your preferences.

Mileage Tracking and Reporting

Pay-per-mile car insurance requires accurate mileage tracking to determine your premium. This means you’ll need to keep track of how many miles you drive and report that information to your insurance company. Several methods are available for mileage tracking, and each has its advantages and disadvantages.

Mileage Tracking Methods

The process of tracking your mileage is essential for pay-per-mile car insurance. Here are some methods you can use:

- Manual Logging: This involves manually recording your mileage using a notebook, spreadsheet, or other method. While simple, it can be time-consuming and prone to errors.

- Smartphone Apps: Many apps specifically designed for mileage tracking can automatically record your mileage using your phone’s GPS. These apps can also provide detailed reports and summaries of your driving data.

- Onboard Vehicle Systems: Some vehicles have built-in systems that can track mileage automatically. These systems typically provide more accurate readings than manual logging or smartphone apps.

- Telematics Devices: These devices are plugged into your car’s diagnostic port and transmit data to your insurance company. They can track mileage, driving behavior, and other data.

Reporting Mileage

Once you’ve tracked your mileage, you’ll need to report it to your insurance company. The reporting process varies depending on the insurer and the chosen mileage tracking method.

- Manual Reporting: You might need to submit a mileage log or spreadsheet to your insurance company at regular intervals, such as monthly or annually.

- App-Based Reporting: Some insurance companies allow you to report your mileage directly through their app, often with automatic data transfer from the app you use for tracking.

- Telematics Device Reporting: Data from telematics devices is automatically transmitted to your insurance company, eliminating the need for manual reporting.

Tips for Accurate Mileage Tracking

Accurate mileage tracking is crucial for ensuring you’re paying the correct premium. Here are some tips for avoiding errors:

- Start and End Readings: Always record both the starting and ending mileage for each trip. This helps ensure accuracy and makes it easier to reconcile data.

- Regular Checks: Review your mileage records regularly, especially if you use manual logging, to catch any discrepancies or missing data.

- Data Backup: Back up your mileage data regularly to prevent loss or damage. This is especially important if you use manual logging or a smartphone app.

- Use a Dedicated Device: If possible, use a dedicated device for mileage tracking, such as a GPS-enabled tracker or telematics device. This can help ensure accuracy and minimize potential errors.

Pay-Per-Mile Insurance and Florida Regulations

Florida’s insurance market is dynamic, and pay-per-mile insurance, a relatively new concept, is gradually gaining traction. The state’s regulatory landscape is evolving to accommodate this innovative approach to car insurance.

Florida’s Regulatory Framework for Pay-Per-Mile Insurance

Florida’s Department of Financial Services (DFS) is the primary regulatory body for insurance in the state. The DFS oversees the licensing and operation of insurance companies, including those offering pay-per-mile plans. The DFS ensures that pay-per-mile insurance providers comply with state regulations and offer fair and transparent pricing.

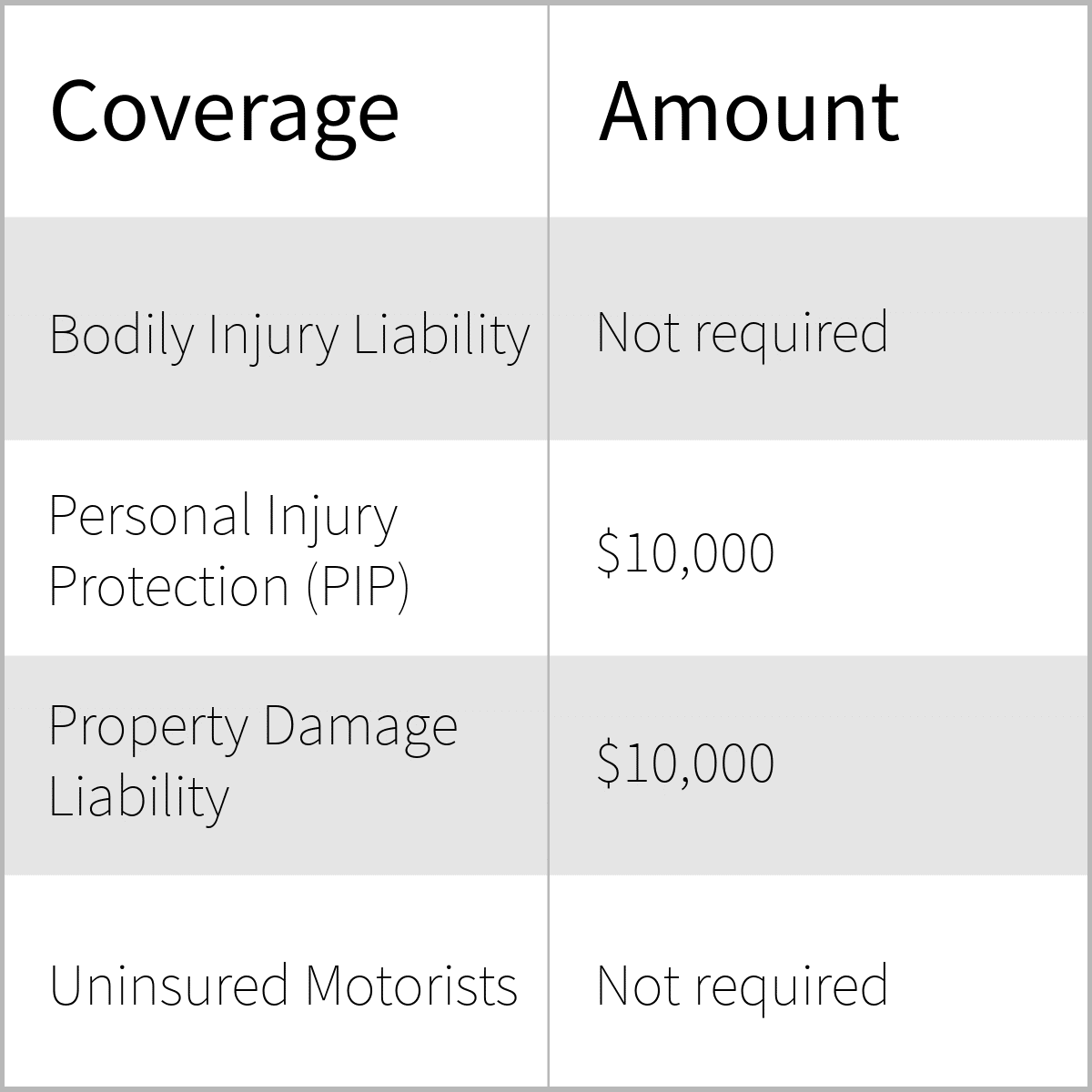

Specific Laws and Guidelines for Pay-Per-Mile Plans

Florida’s insurance laws do not explicitly mention pay-per-mile insurance. However, several existing regulations apply to this type of coverage. These regulations aim to ensure consumer protection and fair competition within the insurance market.

- Rate Filing and Approval: Insurance companies must file their rates with the DFS for approval. This process ensures that rates are actuarially sound and do not discriminate against specific groups of policyholders.

- Transparency and Disclosure: Insurance companies must provide clear and concise information about their pay-per-mile plans, including the pricing structure, mileage tracking methods, and any applicable fees.

- Consumer Protection Measures: Florida has several consumer protection laws in place that apply to all insurance policies, including pay-per-mile plans. These laws cover areas such as unfair claims practices, bad faith, and the right to cancel a policy.

Consumer Protection Measures in Florida

Florida prioritizes consumer protection in its insurance market. The DFS has several measures in place to safeguard policyholders’ rights and interests, including:

- Consumer Complaint Resolution: The DFS maintains a dedicated consumer complaint system to address grievances related to insurance companies, including pay-per-mile providers.

- Insurance Consumer Helpline: The DFS operates a toll-free helpline for consumers to seek assistance with insurance-related issues, including inquiries about pay-per-mile plans.

- Education and Outreach: The DFS conducts educational campaigns to inform consumers about their rights and responsibilities under Florida’s insurance laws.

Case Studies and Real-World Examples: Pay-per-mile Car Insurance Florida

Pay-per-mile car insurance, also known as usage-based insurance (UBI), has gained traction in Florida as a potential cost-saving option for drivers. To illustrate its real-world impact, let’s delve into case studies and examples of individuals and families who have benefited from this innovative insurance model.

Pay-Per-Mile Savings for Low-Mileage Drivers

Pay-per-mile insurance can significantly benefit individuals who drive less than the average Floridian. Consider Sarah, a retired teacher who primarily uses her car for local errands and occasional visits to her grandchildren. With traditional insurance, Sarah was paying a premium based on an average driver’s mileage, even though she only drove around 5,000 miles per year. By switching to pay-per-mile insurance, Sarah’s annual premium dropped by nearly 30%, saving her hundreds of dollars.

Final Conclusion

Pay-per-mile car insurance in Florida presents a unique opportunity for drivers who prioritize affordability and flexibility. By embracing this innovative insurance model, you can potentially reduce your premiums and enjoy greater control over your car insurance costs. However, it’s essential to carefully evaluate your driving habits and compare plans to ensure you choose the most suitable option for your needs. As the insurance landscape continues to evolve, pay-per-mile insurance is likely to play an increasingly prominent role, offering a compelling alternative for savvy drivers in Florida.

Essential Questionnaire

What are the benefits of pay-per-mile car insurance in Florida?

Pay-per-mile car insurance in Florida offers several advantages, including potential savings for low-mileage drivers, flexibility in premium payments, and the ability to track your driving habits and make adjustments to improve your driving score.

Is pay-per-mile car insurance available for all types of vehicles in Florida?

The availability of pay-per-mile car insurance plans may vary depending on the insurance company and the type of vehicle. It’s best to contact individual insurance providers to inquire about specific coverage options.

How do I track my mileage for pay-per-mile insurance in Florida?

Most pay-per-mile insurance plans utilize telematics devices or smartphone apps to track your mileage. These devices automatically record your driving data, which is then used to calculate your premiums.

Is pay-per-mile car insurance right for me?

Whether pay-per-mile car insurance is suitable for you depends on your individual driving habits and needs. If you drive a low number of miles, this insurance model could offer significant savings compared to traditional car insurance.