Progressive Car Insurance Florida Phone Number is your key to accessing a range of services, from getting a quote to reporting a claim. Progressive, a leading insurance provider, boasts a strong presence in Florida, offering competitive rates and comprehensive coverage options tailored to the Sunshine State. This guide will equip you with the essential phone numbers you need, along with insights into how to utilize Progressive’s online resources and customer service channels.

Navigating the insurance world can be daunting, especially when you’re looking for specific information or need to resolve an issue. Understanding the various phone numbers available for Progressive car insurance in Florida can make a world of difference in your experience. From general inquiries to claims reporting, policy changes, and payment assistance, Progressive offers dedicated lines for each purpose, ensuring efficient and personalized support.

Understanding Progressive Car Insurance in Florida

Progressive Car Insurance is a major player in the US auto insurance market, offering a wide range of coverage options and services. The company is known for its innovative approach to insurance, including its use of technology to provide personalized quotes and streamline the claims process. Progressive has a significant presence in Florida, serving a large number of drivers across the state.

Progressive’s History and Presence in Florida

Progressive Insurance was founded in 1937 in Cleveland, Ohio. The company began by offering auto insurance directly to consumers, bypassing traditional insurance agents. This direct-to-consumer model allowed Progressive to offer competitive rates and flexible policies. Progressive expanded its operations to Florida in the 1970s and has since become one of the largest auto insurers in the state. Today, Progressive employs thousands of people in Florida and has a network of agents and claims centers across the state.

Benefits of Choosing Progressive Car Insurance in Florida

Progressive offers a number of benefits to Florida drivers, including:

- Competitive Rates: Progressive is known for its competitive rates, which are often lower than those offered by other major insurers. The company’s direct-to-consumer model and use of technology allow it to keep costs down and pass those savings on to its customers.

- Wide Range of Coverage Options: Progressive offers a variety of coverage options to meet the needs of different drivers. This includes standard coverage like liability, collision, and comprehensive, as well as optional coverage like uninsured/underinsured motorist, rental car reimbursement, and roadside assistance.

- Convenient Online and Mobile Services: Progressive makes it easy for customers to manage their policies online or through its mobile app. Customers can get quotes, make payments, file claims, and access other services through their online account or the Progressive mobile app.

- Excellent Customer Service: Progressive has a reputation for providing excellent customer service. The company offers 24/7 customer support by phone, email, and chat, and its claims representatives are known for their responsiveness and helpfulness.

- Discounts and Savings: Progressive offers a variety of discounts to help customers save money on their car insurance premiums. These discounts include safe driver discounts, multi-car discounts, and discounts for good students and seniors.

Finding the Right Phone Number for Your Needs

Progressive offers a variety of phone numbers for different purposes, making it easy for you to connect with the right department.

To ensure a smooth and efficient experience, understanding the different phone numbers available for specific needs is crucial. Whether you have a general inquiry, need to report a claim, or require assistance with policy changes, Progressive provides dedicated phone lines to cater to your specific needs.

Common Phone Numbers

Progressive provides dedicated phone lines for various purposes, ensuring efficient customer service. Below is a list of common phone numbers for various needs:

| Phone Number | Purpose | Availability Hours |

|---|---|---|

| 1-800-PROGRESSIVE (1-800-776-4737) | General Inquiries, Policy Information, Quotes | 24/7 |

| 1-800-776-4737 | Claims Reporting | 24/7 |

| 1-877-776-4737 | Customer Service | Monday-Friday, 8:00 AM – 8:00 PM ET |

| 1-800-776-4737 | Policy Changes, Renewals, Payments | Monday-Friday, 8:00 AM – 8:00 PM ET |

| 1-800-776-4737 | Payment Assistance | Monday-Friday, 8:00 AM – 8:00 PM ET |

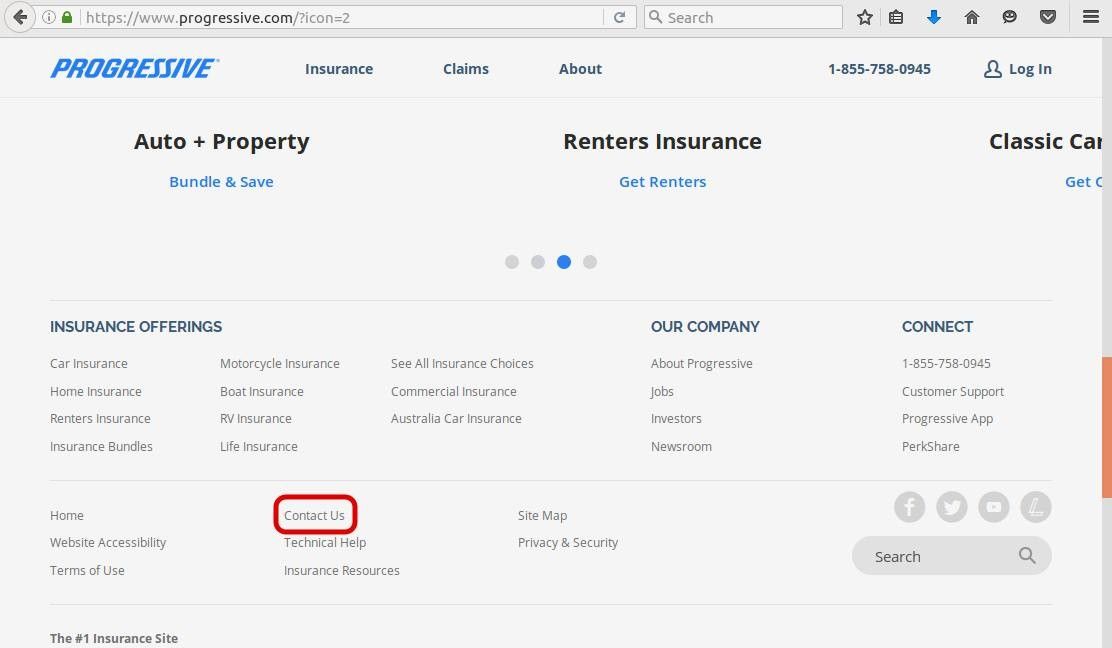

Utilizing Progressive’s Online Resources

Progressive offers a comprehensive suite of online resources to manage your car insurance policy, including its website and mobile app. These platforms provide a convenient and efficient way to access policy information, make payments, and file claims.

Accessing Policy Information

Progressive’s website and mobile app allow you to access your policy information anytime, anywhere. You can view your policy details, including coverage limits, deductibles, and payment history. You can also download your insurance card and update your contact information.

Managing Payments

You can make payments on your policy online through Progressive’s website or mobile app. You can set up automatic payments, view payment history, and manage payment methods. This provides a convenient and secure way to keep your policy current.

Filing Claims

Progressive makes it easy to file a claim online through its website or mobile app. You can submit a claim, track its progress, and communicate with your claims adjuster. The online claims process is typically faster and more efficient than traditional methods.

Benefits of Using Online Resources

Using Progressive’s online resources offers several benefits:

- Convenience: Access your policy information, make payments, and file claims anytime, anywhere.

- Speed: Online processes are typically faster than traditional methods.

- Security: Progressive’s online platforms are secure and protected.

- Efficiency: Streamline your insurance management tasks and save time.

Customer Service and Support

Progressive prioritizes customer satisfaction and offers various channels to assist policyholders in Florida. Whether you have a question about your policy, need to report a claim, or require assistance with a billing issue, Progressive provides multiple options for reaching out to their dedicated customer service team.

Contacting Progressive’s Customer Service

Progressive offers a comprehensive range of customer service options to address your needs. These include:

- Phone: The most direct and often fastest way to reach Progressive is by phone. Dialing the dedicated Florida phone number ensures you connect with a representative specifically trained to address Florida-specific policies and regulations. The typical wait time for phone support can vary depending on the time of day and the volume of calls. During peak hours, you may experience a longer wait, but Progressive aims to connect you with a representative within a reasonable timeframe.

- Email: For less urgent inquiries or to provide detailed information, sending an email is a viable option. Progressive offers a dedicated email address for Florida customers, ensuring your message reaches the appropriate team. Response times for emails typically range from 24 to 48 hours, though it can take longer during busy periods.

- Live Chat: Progressive’s website offers a live chat feature, providing real-time assistance with basic inquiries. This option is particularly useful for quick questions or for obtaining general information about your policy. Live chat availability may vary depending on the time of day, but it’s generally available during business hours.

Navigating Specific Issues, Progressive car insurance florida phone number

Progressive’s customer service representatives are equipped to handle a wide range of inquiries. When contacting them, it’s helpful to have your policy information readily available, including your policy number and contact information. This allows for faster and more efficient service. Here’s a breakdown of how to contact Progressive for specific issues:

- Policy Changes: To make changes to your policy, such as adding a driver or vehicle, modifying coverage, or updating your contact information, you can reach out to Progressive through any of the available channels. Be prepared to provide the necessary details for the requested changes.

- Billing Inquiries: For questions regarding your bill, payment options, or payment history, contact Progressive’s customer service team. They can assist with resolving billing issues, explaining charges, and providing payment options.

- Claim Reporting: If you need to report an accident or other covered event, contact Progressive immediately. They have a dedicated claims department that can guide you through the process, provide necessary documentation, and assist with the investigation.

Progressive’s Commitment to Customer Service

Progressive is committed to providing excellent customer service and resolving any issues promptly. They offer a variety of resources and tools to assist policyholders, including:

- Online Account Access: Policyholders can access their policy information, manage payments, and submit claims through their online account.

- Mobile App: The Progressive mobile app offers convenient access to policy information, claims management, and other services.

- 24/7 Roadside Assistance: Progressive provides roadside assistance services for policyholders, available 24 hours a day, seven days a week.

Florida-Specific Considerations

Florida presents a unique landscape for car insurance, with factors like hurricane risk and high population density impacting pricing and coverage options. Progressive, like other insurance providers, adapts its offerings to meet these specific needs.

Progressive’s Florida-Specific Offerings

Progressive offers several features tailored to Florida drivers, such as:

* Hurricane Coverage: Progressive offers comprehensive hurricane coverage, including windstorm and flood damage, to protect against the significant risks associated with hurricane season in Florida.

* Florida-Specific Discounts: Progressive provides various discounts for Florida residents, including discounts for good driving records, safety features in vehicles, and affiliations with certain organizations.

* Optional Coverage: Progressive offers optional coverage for things like rental reimbursement, personal injury protection (PIP), and uninsured/underinsured motorist coverage, which can be crucial in a state with a high volume of traffic.

Progressive’s Rates and Coverage Compared to Other Providers

Progressive’s rates and coverage options are competitive in the Florida market. However, it’s essential to compare quotes from multiple insurers to find the best value.

* Rate Comparison: Progressive’s rates may be lower than other providers for some drivers, especially those with good driving records and newer vehicles. However, rates can vary significantly depending on factors like location, age, and driving history.

* Coverage Comparison: Progressive offers a range of coverage options, but it’s crucial to compare these options with those provided by other insurers to ensure you’re getting the most comprehensive coverage at a competitive price.

* Factors Affecting Rates: Factors like driving history, age, vehicle type, location, and credit score all influence car insurance rates in Florida.

Florida Regulations and Requirements

Florida has specific regulations that apply to car insurance policies. These regulations impact the coverage offered by Progressive and other insurers.

* Personal Injury Protection (PIP): Florida requires all drivers to carry PIP coverage, which pays for medical expenses and lost wages after an accident, regardless of fault. Progressive offers various PIP coverage options.

* Uninsured/Underinsured Motorist Coverage: Florida law requires all drivers to carry uninsured/underinsured motorist coverage, which protects drivers in case of an accident with a driver who lacks sufficient insurance. Progressive provides this coverage as well.

* Financial Responsibility: Florida law requires drivers to demonstrate financial responsibility, which typically means carrying insurance. Progressive policies comply with these requirements.

Last Recap: Progressive Car Insurance Florida Phone Number

Whether you’re a new customer or a long-time policyholder, knowing where to turn for information and assistance is crucial. Progressive car insurance in Florida offers a comprehensive suite of services, accessible through a variety of channels, including phone, online platforms, and dedicated customer support. By utilizing these resources effectively, you can navigate the insurance process with ease, ensuring a seamless and satisfying experience.

Commonly Asked Questions

What are the different phone numbers for Progressive car insurance in Florida?

Progressive offers dedicated phone numbers for various purposes, including general inquiries, claims reporting, customer service, policy changes, and payment assistance. You can find a list of these numbers on their website or by contacting their customer service department.

How do I file a claim with Progressive car insurance in Florida?

You can file a claim with Progressive car insurance in Florida by calling their dedicated claims reporting number or by submitting a claim online through their website or mobile app. The process is straightforward and requires you to provide details about the incident.

What are the typical wait times for Progressive’s customer service?

Wait times for Progressive’s customer service vary depending on the time of day and the volume of calls. You can expect to wait on hold for a few minutes, but they also offer online chat and email support for faster responses.