Progressive car insurance quote, the name that’s practically synonymous with saving money on your car insurance. But with so many options and factors to consider, getting the best quote can feel like navigating a maze. Don’t worry, we’re here to help you unlock the secrets of getting a great deal with Progressive.

We’ll break down the key factors that influence your quote, explain the various coverage options, and guide you through the process of getting a quote online, over the phone, or in person. You’ll learn how to compare quotes, negotiate for the best price, and make an informed decision that fits your needs and budget.

Understanding Progressive Car Insurance Quotes

Getting a car insurance quote from Progressive is like getting a custom-made outfit – it’s tailored to your specific needs. You’re not just getting a generic price tag; you’re getting a quote that reflects your driving history, the car you drive, and where you live.

Factors Influencing Progressive Car Insurance Quotes

The factors that influence your car insurance quote are pretty straightforward. They’re the things that affect your risk of getting into an accident.

- Driving History: Your driving record is like your resume – it tells Progressive how responsible you are behind the wheel. If you have a clean record, you’ll likely get a better rate. But if you’ve got some traffic violations or accidents, your quote might be a little higher.

- Vehicle Information: Your car’s make, model, year, and safety features all play a role. A sporty car might be more expensive to insure than a family sedan, and a car with advanced safety features might get you a discount.

- Location: Where you live matters. If you live in a high-traffic area with a lot of accidents, your insurance might be more expensive than someone living in a quieter neighborhood.

- Coverage Options: The type of coverage you choose also affects the cost. More coverage means more protection, but it also means a higher premium.

- Age and Gender: Believe it or not, your age and gender can also impact your quote. Younger drivers are statistically more likely to get into accidents, so they might pay a little more.

Progressive Car Insurance Coverage Options

Progressive offers a range of coverage options to fit your needs.

- Liability Coverage: This is the most basic type of car insurance. It covers damages to other people’s property or injuries to other people if you’re at fault in an accident.

- Collision Coverage: This covers damages to your own car if you’re involved in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This protects you from damage to your car from things like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This helps protect you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers, regardless of who’s at fault in an accident.

- Rental Car Coverage: This provides you with a rental car if your car is being repaired after an accident.

Progressive Car Insurance Quote Process

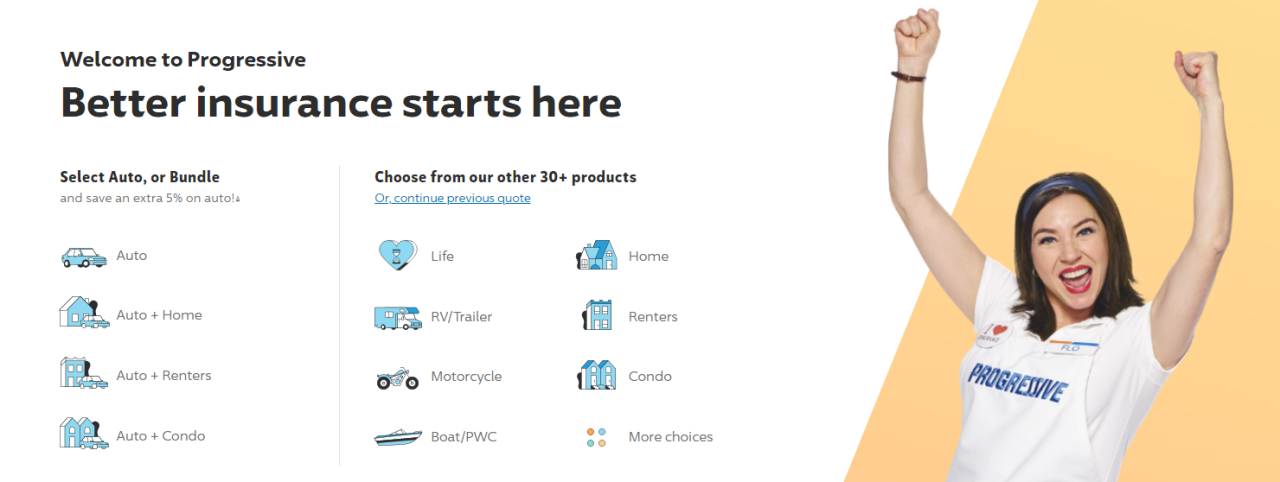

Getting a quote from Progressive is easy and can be done online, over the phone, or through an agent.

- Provide Basic Information: You’ll need to provide some basic information about yourself and your car, like your name, address, date of birth, driving history, and vehicle information.

- Choose Coverage Options: You’ll be asked to select the coverage options you want. Be sure to consider your individual needs and budget.

- Get Your Quote: Once you’ve provided all the necessary information, Progressive will generate a quote for you. You can then compare this quote to other insurance companies to find the best deal.

Benefits of Getting a Progressive Quote

Getting a quote from Progressive is a smart move for anyone looking for car insurance. It’s like getting a free taste of the best pizza in town – you might just find your new favorite! Progressive offers a variety of benefits that can save you money and give you peace of mind.

Progressive’s Rates Compared to Other Major Providers

Progressive is known for its competitive rates, often beating out other major insurance providers. You might be surprised to see how much you could save by switching. Think of it like finding a hidden treasure – you never know what you’ll discover until you start digging.

| Insurance Provider | Average Annual Premium |

|---|---|

| Progressive | $1,200 |

| Geico | $1,300 |

| State Farm | $1,400 |

| Allstate | $1,500 |

*Note: These rates are just estimates and may vary depending on factors like your driving history, location, and vehicle.*

Key Features and Benefits Offered by Progressive

Progressive offers a ton of great features and benefits that can make your life easier and your wallet happier. Let’s break it down:

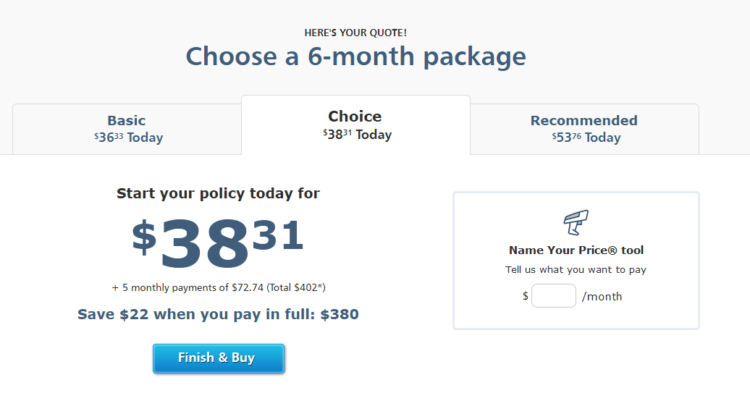

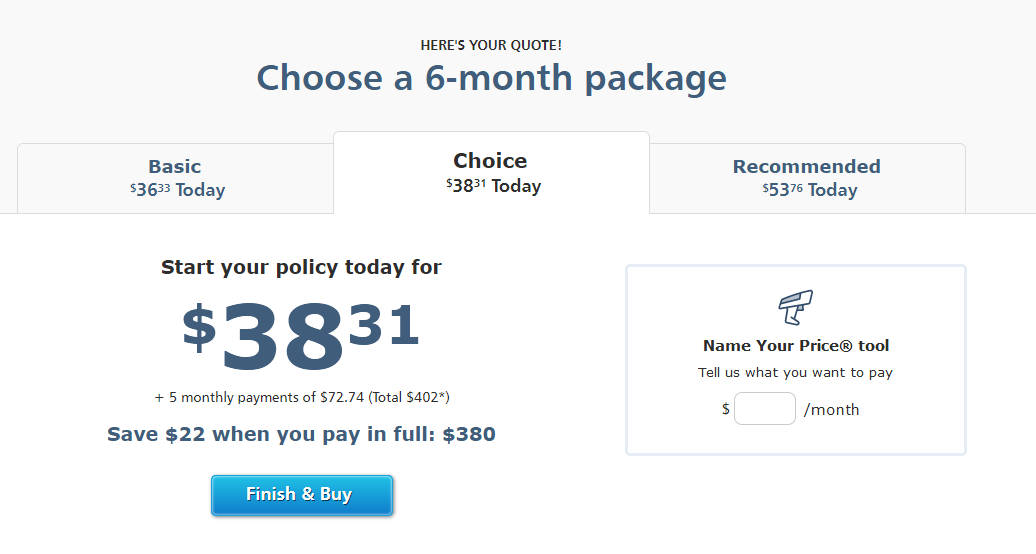

- Name Your Price Tool: This tool lets you set your desired monthly premium and Progressive will find you a policy that fits your budget. It’s like having a personal shopper for your insurance – they do all the work so you don’t have to.

- 24/7 Customer Service: Need help? Progressive has your back, day or night. Their customer service team is always available to answer your questions and provide support. It’s like having a friend who’s always there to lend a helping hand, even when you’re stuck in a sticky situation.

- Discounts: Progressive offers a variety of discounts that can help you save money on your premiums. From good driver discounts to multi-car discounts, there’s a discount for almost everyone. It’s like finding a secret coupon code for your insurance – who doesn’t love saving a few bucks?

- Online and Mobile Access: Manage your policy, make payments, and file claims all from the comfort of your couch. Progressive makes it easy to stay on top of your insurance needs, whether you’re a tech-savvy guru or just getting started. It’s like having your insurance in your pocket, ready to go whenever you need it.

Progressive’s Commitment to Customer Satisfaction

Progressive is dedicated to providing exceptional customer service and ensuring your satisfaction. They understand that choosing insurance can be a big decision, so they want to make the process as smooth and stress-free as possible. It’s like having a trusted partner by your side, always there to support you.

Factors Affecting Progressive Quotes

Progressive uses a variety of factors to determine your car insurance quote. They analyze your driving history, the type of vehicle you drive, and your location to calculate the risk you pose and determine the price you’ll pay for coverage.

Driving History

Your driving history is a significant factor in determining your car insurance quote. This includes your past driving record, such as accidents, traffic violations, and claims.

- Accidents: A history of accidents, especially those involving at-fault collisions, can significantly increase your insurance premium. This is because insurance companies perceive drivers with a history of accidents as higher risks.

- Traffic Violations: Traffic violations, such as speeding tickets or reckless driving citations, can also lead to higher premiums. These violations demonstrate a pattern of risky driving behavior.

- Claims History: The number of claims you’ve filed in the past also plays a role. Even if you weren’t at fault, filing multiple claims can still increase your premium, as insurance companies see this as an indicator of potential future claims.

Vehicle Type

The type of vehicle you drive also influences your insurance quote. Insurance companies consider factors like the vehicle’s make, model, year, and safety features.

- Make and Model: Some vehicle models are known to be more expensive to repair or replace in case of an accident, leading to higher insurance premiums. Sports cars, luxury vehicles, and high-performance models often fall into this category.

- Year: Newer vehicles typically have more advanced safety features, which can lower your insurance premium. Older vehicles, on the other hand, might have fewer safety features and may be more prone to breakdowns, leading to higher premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, can qualify for discounts, lowering your insurance premium. These features demonstrate a commitment to safety and can reduce the risk of accidents.

Location

Your location, including your zip code and the state you reside in, also plays a role in your insurance quote. Insurance companies consider factors like the crime rate, population density, and the frequency of accidents in your area.

- Crime Rate: Areas with high crime rates are often associated with a higher risk of vehicle theft or vandalism, leading to higher insurance premiums.

- Population Density: Urban areas with high population densities often have more traffic congestion, increasing the risk of accidents and leading to higher insurance premiums.

- Accident Frequency: Areas with a high frequency of accidents, such as those with busy highways or intersections, may also have higher insurance premiums due to the increased risk of claims.

Impact of Factors on Quotes

The following table illustrates the potential impact of different factors on your final insurance quote:

| Factor | Impact on Quote | Example |

|---|---|---|

| Clean Driving History | Lower Premium | A driver with no accidents or violations in the past 5 years may qualify for a good driver discount. |

| Multiple Accidents | Higher Premium | A driver with 2 accidents in the past 3 years may face a significant increase in their premium. |

| Luxury Vehicle | Higher Premium | A driver with a new Mercedes-Benz may have a higher premium compared to someone driving a Toyota Corolla. |

| High-Safety Features | Lower Premium | A driver with a vehicle equipped with advanced safety features, such as automatic emergency braking, may qualify for a discount. |

| Urban Area | Higher Premium | A driver living in a densely populated city like New York City may have a higher premium compared to someone living in a rural area. |

Obtaining a Progressive Car Insurance Quote

Getting a car insurance quote from Progressive is as easy as pie, and you can do it in a few different ways. Whether you’re a tech-savvy individual who prefers online methods or someone who enjoys the personal touch of a phone call, Progressive has got you covered.

Obtaining a Progressive Car Insurance Quote Online

The online method is a quick and convenient way to get a quote. Here’s a step-by-step guide:

- Visit Progressive’s website.

- Click on the “Get a Quote” button, which is usually prominently displayed on the homepage.

- Enter your basic information, including your zip code, date of birth, and driving history.

- Provide details about your vehicle, such as the year, make, and model.

- Select your desired coverage options and answer a few questions about your driving habits.

- Review your quote and make any necessary adjustments.

- Once you’re satisfied with the quote, you can choose to purchase your policy online.

Obtaining a Progressive Car Insurance Quote Over the Phone

If you prefer speaking with a representative, you can call Progressive’s customer service line.

- Dial Progressive’s toll-free number, which you can find on their website or through a quick Google search.

- Be prepared to provide the same information you would online, including your personal details, vehicle information, and desired coverage options.

- A Progressive representative will guide you through the process and answer any questions you may have.

- Once you’ve received your quote, you can decide whether to purchase the policy over the phone.

Obtaining a Progressive Car Insurance Quote In Person

You can also get a quote by visiting a Progressive insurance agency.

- Find a Progressive agency near you using their online locator tool or by calling their customer service line.

- Schedule an appointment with an insurance agent.

- During your appointment, the agent will ask you questions about your personal details, vehicle, and coverage preferences.

- The agent will then provide you with a quote and explain the different coverage options available.

- If you decide to purchase a policy, you can do so in person at the agency.

Tips for Securing the Most Competitive Quote

Getting the best possible quote from Progressive requires a bit of effort and planning.

- Shop around: Don’t just settle for the first quote you get. Compare quotes from multiple insurance providers, including Progressive, to ensure you’re getting the best deal.

- Bundle your policies: If you have multiple insurance policies, such as car insurance and homeowners insurance, bundling them with Progressive can often result in significant discounts.

- Improve your driving record: A clean driving record is a major factor in determining your insurance premium. Avoid traffic violations and accidents to keep your rates low.

- Consider safety features: Vehicles equipped with safety features, such as anti-theft devices or airbags, may qualify for discounts.

- Ask about discounts: Progressive offers a variety of discounts, such as good student discounts, safe driver discounts, and multi-car discounts. Be sure to inquire about these discounts when you’re getting your quote.

Importance of Comparing Quotes from Multiple Providers

In today’s competitive insurance market, it’s crucial to compare quotes from multiple providers before making a decision.

- Different insurance companies use different factors to determine your rates, so you may find that one company offers a more competitive price than another.

- Comparing quotes allows you to identify the best coverage options at the most affordable price.

- It’s a simple and straightforward process, and you can easily compare quotes online or over the phone.

Understanding the Quote Details

So you’ve gotten a quote from Progressive, and now you’re ready to dive into the nitty-gritty. Let’s break down what you’re looking at.

A Progressive car insurance quote is like a personalized menu for your car’s safety. It’s a breakdown of what you’d pay for coverage, but remember, it’s just an estimate. Your final bill might be a little different based on your actual driving record and other factors.

Coverage Options and Costs

Progressive offers a bunch of coverage options, each with its own price tag. Think of it like a build-your-own-burger. You choose the toppings you want, and your price goes up with each one. Here’s a rundown of the most common coverage options:

- Liability Coverage: This is the bread and butter of car insurance. It covers damage or injuries you cause to others in an accident. It’s usually the most expensive part of your policy.

- Collision Coverage: Think of this as the cheese on your burger. It covers damage to your car if you’re in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This is the lettuce and tomato. It covers damage to your car from things like theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: This is the ketchup. It protects you if you’re hit by someone without insurance or not enough insurance to cover your losses.

- Personal Injury Protection (PIP): This is the onion rings. It covers your medical bills and lost wages if you’re injured in an accident, even if you’re at fault.

- Rental Reimbursement: This is the pickle. It covers the cost of a rental car if your car is damaged in an accident and needs repairs.

Quote Terms and Conditions, Progressive car insurance quote

Your quote is like a contract, so it’s important to read the fine print. Here’s what you should look out for:

- Deductibles: This is the amount you pay out-of-pocket before your insurance kicks in. Think of it as your share of the cost. The higher your deductible, the lower your premium, and vice versa.

- Coverage Limits: This is the maximum amount your insurance will pay for a claim. It’s like a ceiling on how much you can get reimbursed.

- Exclusions: These are things that aren’t covered by your insurance. For example, most policies don’t cover damage caused by wear and tear.

- Discounts: These are special offers that can lower your premium. Progressive offers a bunch of discounts, like good driver discounts, safe driver discounts, and multi-policy discounts.

Making a Decision

You’ve got your Progressive car insurance quote, and it’s time to decide if it’s the right fit for you. Think of it like choosing the perfect outfit for a big night out – you want something that looks good, feels good, and fits your budget. Let’s break down the factors to consider and how to get the best deal possible.

Factors to Consider

When deciding whether to accept a Progressive quote, consider these key factors:

- Coverage: Make sure the quote includes all the coverage you need, like liability, collision, comprehensive, and uninsured/underinsured motorist. You don’t want to be caught short if you’re in an accident.

- Price: Compare the Progressive quote to other quotes you’ve received. Remember, the cheapest option isn’t always the best. Look for a quote that balances affordability with the coverage you need.

- Discounts: Progressive offers a variety of discounts, such as good driver, multi-car, and safe driver. See if you qualify for any of these to potentially lower your premium.

- Customer Service: Research Progressive’s reputation for customer service. Read reviews and see what others have to say about their experiences. You want to make sure you’ll be in good hands if you need to file a claim.

Negotiating the Quote

Don’t be afraid to negotiate with Progressive to get the best possible deal. Here are a few tips:

- Shop around: Get quotes from other insurance companies and use them as leverage during negotiations. Show Progressive that you’re serious about getting the best price.

- Ask about discounts: Make sure you’re getting all the discounts you’re eligible for. Don’t be shy about asking about specific discounts, like those for bundling insurance policies or for being a good driver.

- Be polite and professional: A respectful tone can go a long way. Explain your needs and be open to finding a solution that works for both of you.

Purchasing a Policy

Once you’ve decided to go with Progressive, the process of purchasing a policy is usually straightforward.

- Provide your information: You’ll need to provide personal information, such as your driver’s license, Social Security number, and vehicle details.

- Choose your payment method: Progressive typically offers a variety of payment options, such as credit card, debit card, or bank account.

- Review your policy: Carefully review your policy documents before you sign. Make sure you understand the coverage, limits, and exclusions.

Summary

So, buckle up and get ready to take control of your car insurance. By understanding the ins and outs of Progressive car insurance quotes, you can feel confident in your choices and save money in the process. Remember, it’s all about finding the right coverage at the right price, and with a little bit of knowledge, you can drive off with a smile knowing you’ve got the best deal possible.

Quick FAQs: Progressive Car Insurance Quote

What if I have a bad driving record?

Don’t worry! Progressive offers various programs for drivers with less-than-perfect records, so you can still get a competitive quote. They might offer discounts for defensive driving courses or other programs.

How often should I get a new quote?

It’s a good idea to get a new quote at least once a year, or even more often if your driving situation changes (like getting a new car or moving to a new location).

Can I bundle my car and home insurance with Progressive?

Yes, you can! Bundling your insurance policies can often lead to significant savings. Ask Progressive about their bundling options.