Progressive car insurance quotes are a vital starting point for anyone seeking affordable and comprehensive coverage. Understanding the factors that influence your quote, from your driving history to your vehicle type, empowers you to make informed decisions about your insurance needs. Progressive’s reputation for innovation and customer-centricity shines through in its quote process, offering a variety of methods to get a personalized estimate.

Whether you prefer the convenience of an online quote, the personalized touch of a phone call, or the in-person guidance of an agent, Progressive provides a seamless experience. By leveraging their unique features like the Name Your Price tool and Snapshot device, you can potentially unlock significant savings and optimize your coverage.

Progressive Car Insurance Overview

Progressive Insurance is a leading provider of auto insurance in the United States, known for its innovative approach and customer-centric services. Founded in 1937, Progressive has evolved from a small Ohio-based company to a national powerhouse, driven by its mission to provide affordable and accessible insurance solutions.

Progressive’s Services

Progressive offers a comprehensive range of insurance products, including:

- Auto Insurance: Progressive’s core offering, providing coverage for liability, collision, comprehensive, and other essential protection for vehicles. The company is known for its personalized pricing based on individual driving habits and risk profiles.

- Home Insurance: Progressive provides coverage for homeowners against various perils, including fire, theft, and natural disasters. Their policies are designed to offer comprehensive protection and peace of mind.

- Other Financial Products: Progressive also offers a variety of financial products, including motorcycle insurance, renters insurance, commercial auto insurance, and boat insurance. These products cater to diverse insurance needs, ensuring comprehensive protection for various assets and situations.

Progressive’s Unique Selling Propositions, Progressive car insurance quote

Progressive distinguishes itself from competitors through its unique selling propositions, including:

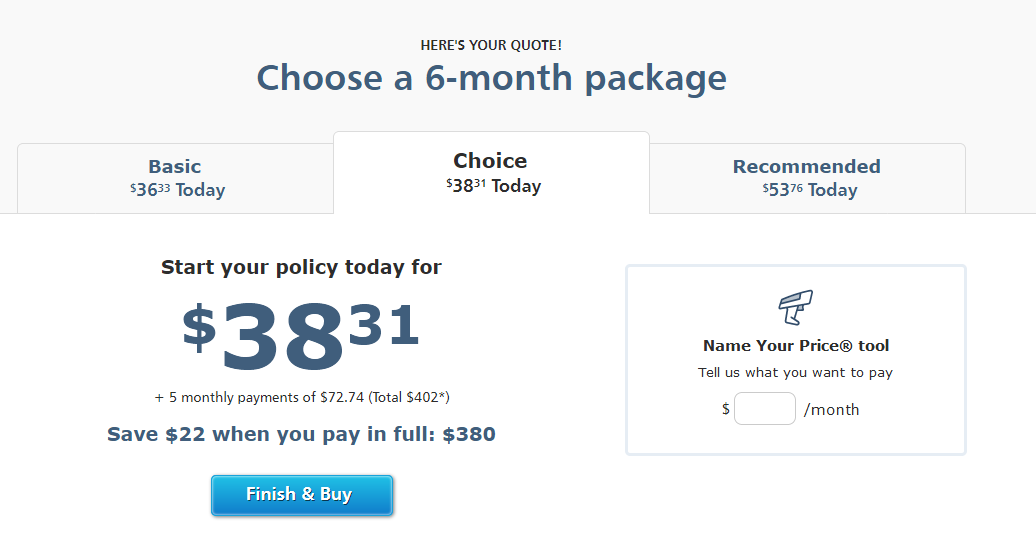

- Name Your Price Tool: This innovative feature allows customers to set their desired price for auto insurance and receive personalized quotes based on their budget and coverage needs.

- Snapshot Program: Progressive’s Snapshot program uses telematics technology to track driving habits and reward safe drivers with discounts. This data-driven approach allows for more accurate pricing and incentivizes responsible driving.

- 24/7 Customer Service: Progressive offers round-the-clock customer support through multiple channels, including phone, email, and online chat. This commitment to accessibility ensures customers receive assistance whenever they need it.

- Digital Convenience: Progressive’s online platform and mobile app allow customers to manage their policies, make payments, file claims, and access various services with ease. This digital-first approach streamlines the insurance experience and provides convenience.

Understanding Car Insurance Quotes

A car insurance quote is an estimate of the cost of your car insurance policy. It’s crucial to understand car insurance quotes because they help you compare different insurance companies and find the best coverage for your needs and budget.

Factors Influencing Car Insurance Quotes

Several factors can affect the cost of your car insurance quote. Understanding these factors can help you make informed decisions about your coverage and potentially save money.

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, significantly influences your insurance premiums. A clean driving record generally leads to lower rates.

- Vehicle Type: The type of vehicle you drive plays a crucial role in determining your insurance costs. Sports cars, luxury vehicles, and high-performance cars are often more expensive to insure due to their higher repair costs and potential for higher risk.

- Location: Where you live can impact your insurance rates. Areas with higher crime rates, traffic congestion, and the frequency of accidents typically have higher insurance premiums.

- Coverage Options: The type and amount of coverage you choose can affect your quote. Comprehensive and collision coverage, which protect against damage to your vehicle, are generally more expensive than liability coverage, which covers damages to other vehicles or property.

Progressive Car Insurance Coverage Options

Progressive offers a range of coverage options to meet your specific needs. Here’s a table comparing different types of car insurance coverage:

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects you financially if you cause an accident that injures someone or damages their property. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of who is at fault. |

| Comprehensive Coverage | Protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Provides financial protection if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault. |

Obtaining a Progressive Car Insurance Quote

Getting a car insurance quote from Progressive is a straightforward process. You can choose the method that best suits your preferences, whether it’s online, over the phone, or in person.

Methods for Obtaining a Quote

Progressive offers various ways to obtain a car insurance quote, ensuring convenience and flexibility for potential customers.

- Online Quote: This method is the most popular and convenient, allowing you to obtain a quote anytime, anywhere, at your own pace. You can access Progressive’s website and complete a simple online form to receive an instant quote. This method is particularly appealing due to its speed and transparency.

- Phone Quote: For those who prefer a more personalized experience, you can contact Progressive’s customer service team by phone. They will guide you through the quote process, answer any questions you may have, and provide a quote based on your specific needs.

- In-Person Quote: You can also visit a local Progressive insurance agent to obtain a quote in person. This method allows for a more comprehensive discussion about your insurance needs and provides the opportunity to receive personalized advice from a knowledgeable agent.

Information Required for a Quote

To provide you with an accurate car insurance quote, Progressive will need some basic information about you, your vehicle, and your coverage preferences.

- Personal Details: This includes your name, address, date of birth, and contact information. This information helps Progressive identify you and verify your identity.

- Vehicle Information: Progressive needs details about your car, such as the make, model, year, and vehicle identification number (VIN). This information helps determine the value of your car and the associated risks.

- Coverage Preferences: You will need to specify the type of coverage you require, such as liability, collision, comprehensive, and uninsured motorist coverage. You can also indicate your desired coverage limits and deductibles.

- Driving History: Progressive will ask about your driving history, including any accidents, violations, or driving experience. This information helps assess your risk profile and determine your premium.

Step-by-Step Guide to Obtaining a Quote Online

Getting a car insurance quote online through Progressive’s website is a simple and straightforward process.

- Visit Progressive’s website: Go to Progressive’s official website, which is usually progressive.com.

- Select “Get a Quote”: Look for the “Get a Quote” button or link, typically located prominently on the homepage or navigation menu.

- Enter your zip code: Provide your zip code to identify your location and ensure you receive quotes relevant to your area.

- Provide your personal information: Fill out the online form with your name, address, date of birth, and contact information.

- Enter your vehicle information: Provide details about your car, such as the make, model, year, and VIN.

- Choose your coverage options: Select the type of coverage you require and indicate your desired coverage limits and deductibles.

- Review your quote: Once you have entered all the necessary information, Progressive will provide you with a personalized quote. Review the details carefully to ensure it meets your needs.

- Get a quote: After reviewing your quote, you can choose to accept it or adjust your coverage options to find a more suitable plan.

Analyzing Progressive Car Insurance Quotes

Now that you have a basic understanding of Progressive car insurance quotes, let’s delve into analyzing them to see how they stack up against the competition and what makes them attractive to certain customers.

Comparing Progressive Quotes to Other Providers

To make an informed decision, it’s crucial to compare Progressive’s quotes with those from other major car insurance providers. This allows you to identify the best value for your specific needs. Here’s how you can approach this comparison:

- Use a car insurance comparison website: Websites like Policygenius, The Zebra, and Insurance.com allow you to enter your information once and receive quotes from multiple insurers, including Progressive. This streamlines the comparison process.

- Contact insurers directly: Reach out to each insurer you’re interested in and request a quote. This provides an opportunity to ask specific questions about coverage and pricing.

- Consider your individual circumstances: Factors like your driving history, age, location, vehicle type, and coverage needs influence the price of insurance. Compare quotes based on your specific situation to get a realistic picture.

Pros and Cons of Progressive’s Pricing and Coverage Options

Progressive offers a range of pricing and coverage options, which can be both advantageous and disadvantageous depending on your individual circumstances.

Pros

- Name Your Price Tool: Progressive’s Name Your Price tool allows you to set your desired premium and see what coverage options fit within your budget. This provides flexibility and control over your insurance costs.

- Discounts: Progressive offers various discounts, including safe driver, good student, and multi-car discounts, which can significantly reduce your premium.

- Coverage Options: Progressive provides a comprehensive selection of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage, to cater to diverse needs.

Cons

- Higher Premiums in Some Cases: While Progressive offers competitive rates, their premiums can be higher than those of other insurers in certain situations, especially for high-risk drivers.

- Limited Customer Service Availability: Some customers have reported challenges reaching Progressive’s customer service representatives, especially during peak hours.

Key Features Attracting Certain Customer Segments

Progressive’s offerings appeal to specific customer segments due to their unique features.

- Tech-Savvy Customers: Progressive’s user-friendly website and mobile app, coupled with its Name Your Price tool, cater to tech-savvy customers who value convenience and control over their insurance experience.

- Budget-Conscious Customers: Progressive’s discounts and flexible coverage options make it attractive to budget-conscious customers seeking to minimize their insurance costs.

- Drivers with Good Records: Drivers with clean driving histories often benefit from Progressive’s competitive rates and discounts, making it a suitable option for those with low-risk profiles.

Progressive Car Insurance Features and Benefits

Progressive offers a range of features designed to enhance the customer experience and provide potential cost savings. These features, such as the Name Your Price tool, Snapshot device, and online account management, cater to diverse customer needs and preferences.

Name Your Price Tool

The Name Your Price tool allows customers to set a budget for their car insurance and receive personalized quotes based on their desired price range. This feature empowers customers to take control of their insurance costs and find a policy that fits their financial needs.

Snapshot Device

Progressive’s Snapshot device is a small plug-in device that tracks driving habits, such as time of day, distance driven, and braking patterns. Based on this data, Progressive can offer personalized discounts to safe drivers. This feature incentivizes good driving behavior and potentially leads to lower premiums.

Online Account Management

Progressive provides a comprehensive online account management portal where customers can access their policy information, make payments, manage their coverage, and file claims. This feature offers convenience and flexibility, allowing customers to manage their insurance needs anytime and anywhere.

Progressive Car Insurance Features and Benefits Comparison

| Feature | Advantages | Disadvantages |

|---|---|---|

| Name Your Price Tool |

|

|

| Snapshot Device |

|

|

| Online Account Management |

|

|

Customer Experiences with Progressive

Progressive Car Insurance boasts a large customer base and has received a diverse range of feedback, encompassing both positive and negative experiences. It’s essential to consider these perspectives to gain a comprehensive understanding of the company’s strengths and areas for improvement.

Customer Testimonials: A Glimpse into Real-Life Experiences

To understand customer sentiment, it’s beneficial to explore real-life testimonials from individuals who have interacted with Progressive. These testimonials provide valuable insights into the company’s performance across various aspects, such as pricing, customer service, and claims handling.

Pricing

Pricing is a significant factor for many car insurance customers. Here are some customer experiences related to Progressive’s pricing:

- Positive: “I was pleasantly surprised by how affordable my Progressive car insurance quote was. I compared it to other companies and found it to be the most competitive option.” – John S.

- Negative: “My Progressive car insurance premiums have been increasing steadily over the past few years. I’m starting to question if it’s worth staying with them.” – Sarah M.

Customer Service

Excellent customer service is crucial for a positive insurance experience. Here’s a look at customer feedback regarding Progressive’s customer service:

- Positive: “I recently had a question about my policy and the customer service representative was incredibly helpful and patient. They answered all my questions clearly and resolved the issue quickly.” – David L.

- Negative: “I had a difficult time getting through to a customer service representative on the phone. I waited on hold for over an hour before giving up.” – Emily R.

Claims Handling

Claims handling is a critical aspect of insurance, and customers often judge an insurer based on their claims experience. Here are some examples of customer feedback regarding Progressive’s claims handling:

- Positive: “After my car accident, Progressive’s claims process was seamless. They were prompt, professional, and kept me informed every step of the way.” – Michael B.

- Negative: “I was disappointed with how Progressive handled my claim. They initially denied it and I had to fight to get it approved. The process was stressful and time-consuming.” – Jessica P.

Final Wrap-Up

Navigating the world of car insurance quotes can feel overwhelming, but Progressive simplifies the process with its user-friendly platform and transparent pricing. By carefully considering your needs, exploring your options, and leveraging Progressive’s tools, you can secure a quote that aligns with your budget and provides the protection you deserve. Ultimately, a thorough understanding of Progressive’s offerings empowers you to make confident decisions and drive with peace of mind.

Commonly Asked Questions

What is the minimum coverage required for car insurance in my state?

Minimum coverage requirements vary by state. It’s essential to check your state’s regulations to ensure you meet the legal minimums.

How often should I review my car insurance policy?

It’s a good idea to review your policy at least annually, or whenever there’s a significant life change, such as a new vehicle, a change in your driving record, or a move to a different location.

What discounts are available from Progressive?

Progressive offers a wide range of discounts, including good driver discounts, multi-car discounts, and safe driver discounts. Be sure to inquire about the discounts you may qualify for.