Required car insurance in florida – Navigating the world of car insurance in Florida can feel like driving through a maze, but understanding the required coverage is crucial for every driver. Florida law mandates that all drivers carry liability insurance, ensuring financial protection in case of accidents. This means that if you cause an accident, your insurance will cover the other driver’s damages and injuries. However, the minimum coverage limits required by Florida law are often insufficient to fully cover the costs of a serious accident. This is where exploring additional coverage options, such as collision, comprehensive, and personal injury protection (PIP), becomes essential. By understanding the various types of car insurance available, you can tailor a policy that meets your individual needs and protects you financially in the event of an unexpected incident.

This comprehensive guide will delve into the intricacies of Florida’s car insurance requirements, exploring the mandatory coverage, optional add-ons, and factors that influence your premium. We’ll also provide valuable insights on finding the best car insurance quotes, filing claims, and navigating the state’s unique no-fault system.

Florida’s Mandatory Car Insurance Requirements

In Florida, driving without the required car insurance is not only illegal but also carries significant consequences. To ensure financial protection for yourself and others on the road, the state mandates all drivers to carry liability insurance.

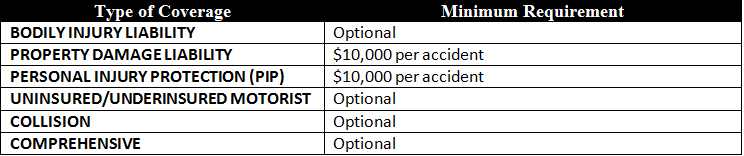

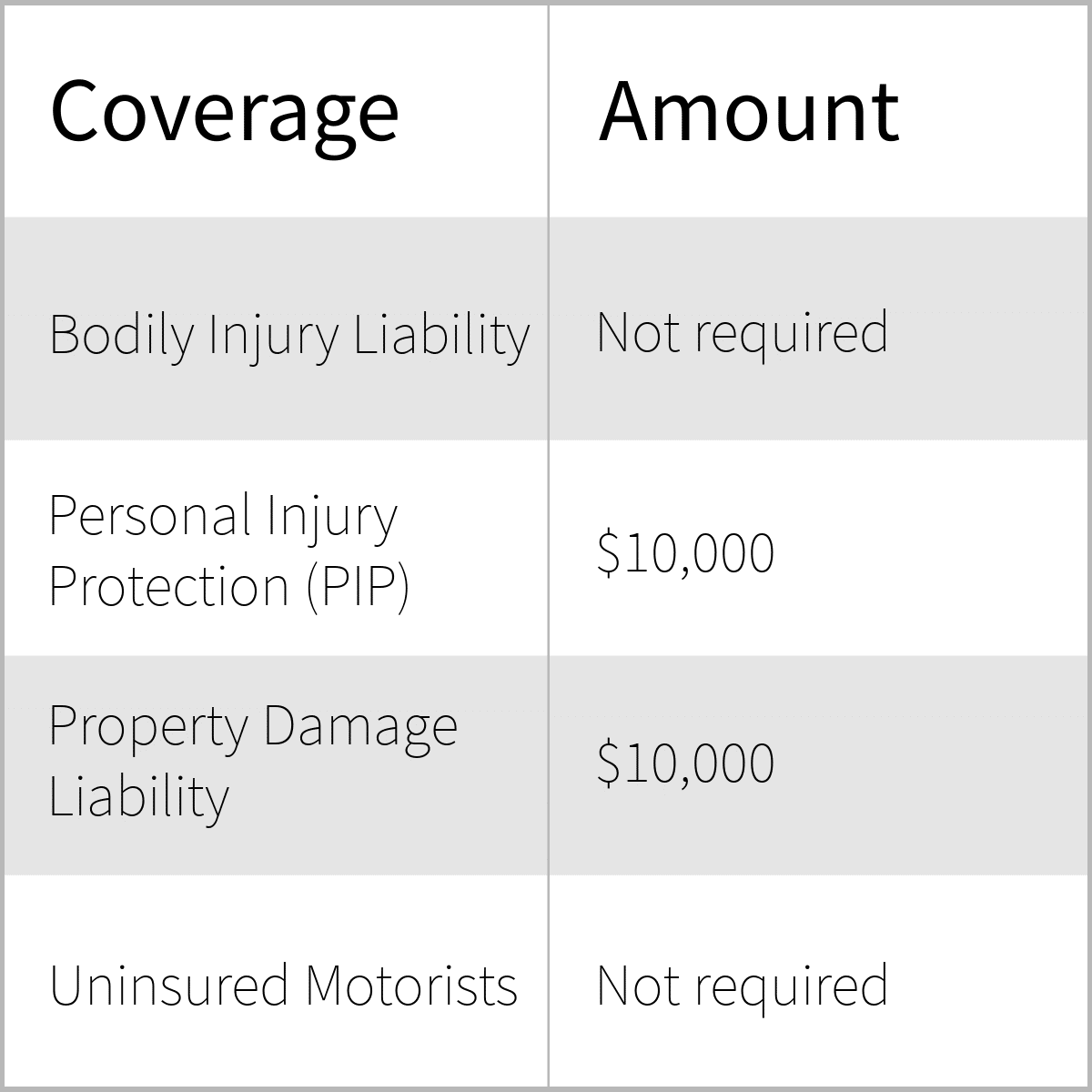

Minimum Coverage Limits

Florida law requires all drivers to carry a minimum amount of liability insurance, which covers damages to other people and their property in case of an accident. The minimum coverage limits are:

* Bodily Injury Liability: $10,000 per person, $20,000 per accident

* Property Damage Liability: $10,000 per accident

These limits represent the maximum amount your insurance company will pay for bodily injuries or property damage caused by you in an accident.

Penalties for Driving Without Insurance, Required car insurance in florida

Driving without the required minimum liability insurance in Florida can lead to severe penalties, including:

- Fines: A first offense can result in a fine of up to $1,000. Subsequent offenses can lead to even higher fines.

- License Suspension: Your driver’s license may be suspended for up to three years.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Jail Time: In some cases, you may face jail time for driving without insurance.

- Higher Insurance Rates: Even after you obtain insurance, your premiums may be significantly higher due to your previous violation.

In addition to these penalties, you could be held personally liable for all damages and injuries caused in an accident if you are uninsured. This could result in significant financial hardship, including the loss of your home or other assets.

Summary

Understanding Florida’s car insurance requirements is essential for every driver. By being informed about the mandatory coverage, exploring additional options, and comparing quotes from different insurers, you can ensure you have the right protection for your vehicle and financial well-being. Remember, driving without the required car insurance can result in significant penalties, including fines, license suspension, and even vehicle impoundment. So, prioritize your safety and financial security by securing the necessary insurance coverage and driving responsibly.

Helpful Answers: Required Car Insurance In Florida

What are the minimum liability coverage limits required in Florida?

Florida law mandates a minimum of $10,000 for personal injury protection (PIP), $10,000 for property damage liability, and $10,000 for bodily injury liability per person, with a $20,000 limit per accident.

What is the difference between collision and comprehensive coverage?

Collision coverage protects you against damage to your own vehicle caused by an accident, regardless of fault. Comprehensive coverage covers damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters.

Can I get a discount on my car insurance in Florida?

Yes, many insurers offer discounts for factors such as good driving history, safe driving courses, multiple vehicles insured, and bundling insurance policies.

What should I do if I get into an accident in Florida?

If you’re involved in an accident, stay calm, prioritize safety, and exchange information with the other driver(s). Contact your insurance company to report the accident and follow their instructions for filing a claim.