- Understanding Florida Car Insurance

- Key Considerations for Shopping Car Insurance in Florida

- Finding the Best Car Insurance Deals in Florida

- Essential Tips for Saving on Car Insurance in Florida: Shop Car Insurance Florida

- Understanding Car Insurance Claims in Florida

- Conclusive Thoughts

- Commonly Asked Questions

Shop car insurance Florida and unlock the best deals for your vehicle! Navigating the Florida car insurance market can be tricky, but with a little research and the right strategies, you can find a policy that fits your needs and budget.

Florida’s unique car insurance laws, mandatory coverages, and factors influencing premiums can make it challenging to find the most affordable and comprehensive coverage. Understanding these nuances is crucial when shopping for car insurance in the Sunshine State.

Understanding Florida Car Insurance

Florida’s car insurance landscape is unique and presents specific challenges for drivers. Understanding the state’s unique laws, mandatory coverages, and factors influencing premiums is crucial for making informed decisions about your insurance policy.

Florida’s Unique Car Insurance Laws

Florida has a “no-fault” insurance system, which means that in the event of an accident, drivers are primarily responsible for covering their own medical expenses and property damage, regardless of who caused the accident. However, this system has exceptions, and drivers can pursue legal action against the other party if their injuries meet certain criteria.

- Personal Injury Protection (PIP): This coverage is mandatory in Florida and covers medical expenses, lost wages, and other related costs for the insured and passengers in their vehicle, up to a certain limit. The standard PIP coverage limit is $10,000, but drivers can choose higher limits.

- Property Damage Liability (PDL): This coverage protects drivers against financial losses resulting from damage to another person’s property in an accident. Florida requires a minimum PDL coverage of $10,000.

- Bodily Injury Liability (BIL): This coverage protects drivers against financial losses resulting from injuries caused to another person in an accident. Florida requires a minimum BIL coverage of $10,000 per person and $20,000 per accident.

Factors Influencing Car Insurance Premiums in Florida

Several factors influence car insurance premiums in Florida. Understanding these factors can help drivers make informed decisions about their insurance coverage and potentially save money.

- Driving Record: Drivers with a history of accidents, traffic violations, or DUI convictions will generally pay higher premiums. Maintaining a clean driving record is essential for keeping insurance costs low.

- Vehicle Type: The type of vehicle driven can significantly impact insurance premiums. Higher-performance vehicles, luxury cars, and newer models tend to be more expensive to insure due to their higher repair costs and greater risk of theft.

- Age and Gender: Younger drivers, particularly males, are statistically more likely to be involved in accidents, leading to higher premiums. As drivers age and gain experience, their premiums generally decrease.

- Credit History: In Florida, insurance companies can use credit history as a factor in determining premiums. Drivers with good credit scores may qualify for lower rates.

- Location: The location where a driver resides can influence insurance premiums. Areas with higher crime rates or a greater number of accidents may have higher insurance costs.

Key Considerations for Shopping Car Insurance in Florida

Shopping for car insurance in Florida can feel overwhelming, but understanding the key considerations will help you make informed decisions. This guide will break down the different types of coverage, factors to consider when choosing a provider, and features to look for in a policy.

Types of Car Insurance Coverage

Different types of car insurance coverage provide protection against various risks. Here’s a breakdown of the common types:

- Liability Coverage: This is the most basic type of car insurance, and it’s required by law in Florida. It covers damages to other people’s property and injuries caused by you in an accident. Liability coverage is typically expressed as a limit per person and a limit per accident. For example, 25/50/10 means $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages after an accident, regardless of who was at fault. Florida requires all drivers to carry a minimum of $10,000 in PIP coverage. However, you can choose to purchase higher limits.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of who was at fault. Collision coverage is optional, but it’s typically recommended for newer or financed vehicles.

- Comprehensive Coverage: This coverage pays for damage to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters. Like collision coverage, comprehensive coverage is optional.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. UM/UIM coverage is optional, but it’s highly recommended, especially given the high number of uninsured drivers in Florida.

Factors to Consider When Choosing a Car Insurance Provider

Several factors can influence your car insurance rates and the overall quality of your coverage. Here are some important considerations:

- Driving Record: Your driving history, including accidents, tickets, and DUI convictions, plays a significant role in determining your rates. Maintaining a clean driving record is crucial for securing affordable insurance.

- Age and Gender: Younger drivers and males generally pay higher premiums than older drivers and females. This is due to statistical data showing higher accident rates among younger drivers and males.

- Vehicle Type and Value: The type and value of your vehicle impact your insurance rates. Sports cars and luxury vehicles tend to have higher premiums due to their higher repair costs and risk of theft.

- Location: Your location, including the state and city you live in, can affect your insurance rates. Areas with high traffic density and higher crime rates tend to have higher insurance costs.

- Coverage Needs: Determine the level of coverage you need based on your financial situation, the value of your vehicle, and your risk tolerance. Consider your driving habits, the age of your vehicle, and your overall financial security.

- Discounts: Many insurance providers offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling multiple insurance policies. Research available discounts and see if you qualify for any.

- Customer Service: Read reviews and compare customer service ratings of different insurance providers. Consider factors like responsiveness, ease of filing claims, and overall customer satisfaction.

Key Features to Look for in a Car Insurance Policy

When reviewing car insurance policies, consider these key features:

- Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums, but you’ll pay more if you need to file a claim.

- Coverage Limits: Ensure that the coverage limits are sufficient to cover your potential financial liabilities in case of an accident. Higher limits provide greater protection but also result in higher premiums.

- Exclusions and Limitations: Carefully review the policy’s exclusions and limitations to understand what’s not covered. Some policies may have restrictions on certain types of accidents or coverage for specific situations.

- Renewal Process: Understand the process for renewing your policy and any potential rate changes. Some providers may offer automatic renewal, while others require you to actively renew your policy.

Finding the Best Car Insurance Deals in Florida

Navigating the Florida car insurance market can be a daunting task. With numerous providers offering a wide range of coverage options and pricing structures, finding the most affordable and comprehensive policy can feel like a puzzle. This section provides a step-by-step guide to effectively compare quotes from different insurers, enabling you to secure the best car insurance deal for your needs.

Comparing Car Insurance Quotes, Shop car insurance florida

The key to finding the best car insurance deal lies in comparing quotes from multiple providers. This allows you to identify the most competitive rates and coverage options tailored to your specific circumstances. Follow these steps to effectively compare quotes:

- Gather Your Information: Before you begin, gather essential information about your vehicle, driving history, and personal details. This includes your vehicle’s make, model, year, VIN (Vehicle Identification Number), your driving record, and any relevant details about your driving history, such as any accidents or violations. Additionally, ensure you have your current insurance policy details, including your coverage limits and deductibles.

- Utilize Online Comparison Tools: Leverage online car insurance comparison websites. These platforms allow you to enter your information once and receive quotes from multiple insurers simultaneously. This saves you time and effort compared to contacting each insurer individually. Reputable comparison websites often partner with a wide range of insurance companies, offering a comprehensive overview of the market.

- Contact Insurance Companies Directly: While online comparison tools are valuable, it’s also beneficial to contact insurance companies directly. This allows you to discuss your specific needs in detail and explore potential discounts or unique coverage options that might not be readily available through comparison websites.

- Compare Quotes Carefully: Once you have gathered quotes from multiple providers, carefully compare the coverage options, premiums, and any associated fees. Pay close attention to the deductibles, coverage limits, and any exclusions or limitations. Don’t solely focus on the lowest premium. Consider the overall value and comprehensiveness of the coverage offered.

- Request Clarification: If you have any questions or need clarification on any aspect of the quotes, don’t hesitate to contact the insurance companies directly. Ask about specific coverage details, discounts, and any potential add-ons.

Reputable Car Insurance Companies in Florida

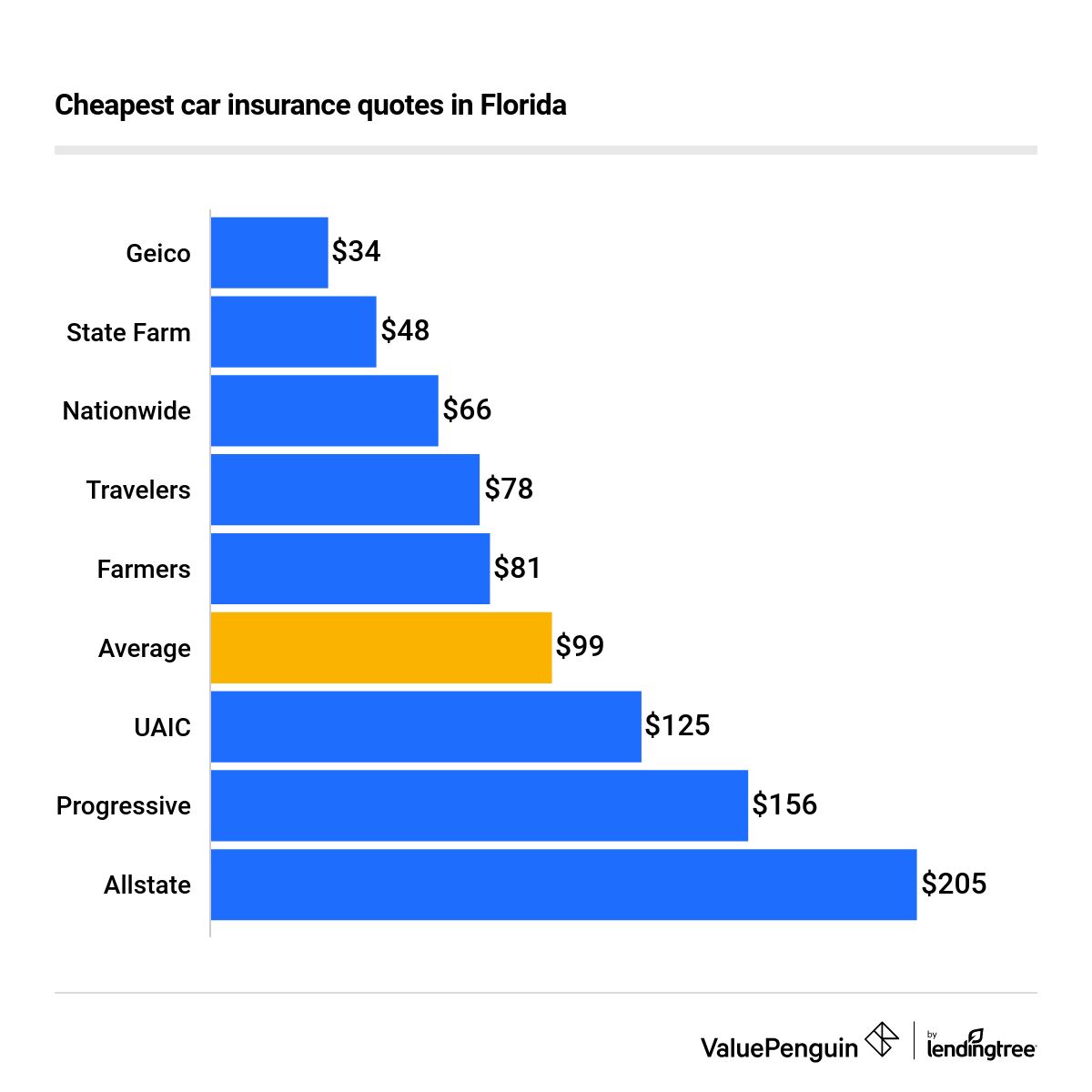

Florida is home to a wide range of car insurance providers, each with its own strengths and offerings. Here is a list of reputable car insurance companies operating in Florida, known for their reliable services and competitive rates:

- State Farm: One of the largest insurance companies in the US, State Farm offers a comprehensive range of insurance products, including car insurance. They are known for their customer service and competitive pricing.

- Geico: Geico is another major insurance provider with a strong presence in Florida. They are known for their affordable rates and convenient online services.

- Progressive: Progressive is a leading provider of car insurance in Florida, offering a variety of coverage options and discounts. They are known for their innovative features, such as their “Name Your Price” tool, which allows you to set your desired premium and find a policy that matches.

- Allstate: Allstate is a well-established insurance company with a strong reputation in Florida. They offer a wide range of car insurance options, including specialized coverage for unique vehicles, such as classic cars or motorcycles.

- USAA: USAA is a highly-rated insurance company that primarily serves military personnel and their families. They offer competitive rates and excellent customer service.

- Florida Peninsula Insurance Company: This company specializes in providing insurance for Florida residents, offering competitive rates and a strong focus on customer satisfaction.

Benefits of Online Car Insurance Comparison Tools

Online car insurance comparison tools offer numerous advantages for Florida drivers seeking the best deals. These tools streamline the quote comparison process, saving you time and effort. Here are some key benefits:

- Convenience: Online comparison tools allow you to compare quotes from multiple insurers in one place, without having to contact each company individually. This eliminates the need for multiple phone calls and emails, saving you valuable time and effort.

- Transparency: Comparison websites typically provide clear and concise information about each insurer’s coverage options, premiums, and any associated fees. This transparency allows you to make informed decisions based on a comprehensive understanding of the available options.

- Objectivity: Online comparison tools are designed to be objective and impartial. They do not favor any particular insurer, ensuring that you receive a fair and unbiased comparison of quotes.

- Access to a Wide Range of Insurers: Reputable comparison websites often partner with a wide range of insurance companies, giving you access to a diverse range of options and potentially uncovering hidden gems that you might not have considered otherwise.

Essential Tips for Saving on Car Insurance in Florida: Shop Car Insurance Florida

Car insurance in Florida can be expensive, but there are several strategies you can employ to lower your premiums. By understanding the factors that influence your rates and taking advantage of available discounts, you can significantly reduce your insurance costs.

Impact of Driving History, Vehicle Type, and Location on Insurance Costs

Your driving history, the type of vehicle you drive, and your location all play a significant role in determining your car insurance premiums.

- Driving History: Your driving record is a major factor in insurance pricing. Accidents, traffic violations, and DUI convictions can significantly increase your premiums. Maintaining a clean driving record is crucial for keeping your insurance costs low. For example, a driver with multiple speeding tickets or an accident on their record will likely face higher premiums compared to a driver with a clean record.

- Vehicle Type: The type of vehicle you drive also influences your insurance costs. Luxury cars, sports cars, and high-performance vehicles are generally more expensive to insure due to their higher repair costs and potential for greater damage in accidents. Conversely, older, less expensive vehicles typically have lower insurance premiums. For instance, a brand-new Tesla Model S will likely have a higher insurance premium than a 10-year-old Honda Civic.

- Location: The location where you live and park your car also impacts your insurance rates. Areas with high crime rates, dense traffic, and a greater number of accidents tend to have higher insurance premiums. For example, a driver residing in a densely populated urban area with a high crime rate may face higher insurance premiums than a driver living in a rural area with low crime rates.

Leveraging Discounts and Special Offers

Florida car insurance companies offer a variety of discounts to help policyholders save money. These discounts can be based on factors such as your driving history, vehicle safety features, and even your profession.

- Safe Driving Discounts: Many insurers offer discounts for drivers with clean driving records, such as those who haven’t had any accidents or traffic violations in a certain period. This discount is often tiered, with larger discounts for longer periods without incidents.

- Good Student Discounts: Students with good grades may qualify for discounts on their car insurance premiums. This is because good students tend to be more responsible drivers.

- Defensive Driving Course Discounts: Completing a defensive driving course can help you become a safer driver and may qualify you for a discount on your car insurance. These courses teach you defensive driving techniques to help you avoid accidents and reduce your risk on the road.

- Multi-Policy Discounts: Insurers often offer discounts if you bundle multiple insurance policies, such as car insurance, home insurance, and renters insurance, with the same company.

- Vehicle Safety Feature Discounts: Vehicles equipped with safety features such as anti-theft devices, airbags, and anti-lock brakes may qualify for discounts. These features can help reduce the likelihood of accidents and the severity of injuries, leading to lower insurance costs.

- Loyalty Discounts: Many insurers offer discounts to customers who have been with them for a certain period. This loyalty discount is a way for insurance companies to reward their long-term customers.

- Occupation Discounts: Some insurance companies offer discounts to certain professions, such as teachers, nurses, and military personnel. These professions are often associated with a lower risk of accidents, which can result in lower insurance premiums.

Understanding Car Insurance Claims in Florida

Navigating the claims process after a car accident can be stressful, especially in Florida, which has its own unique set of rules and regulations. Understanding the process and your rights as a policyholder can help you navigate this challenging situation smoothly.

Filing a Car Insurance Claim

When you’re involved in a car accident, the first step is to contact your insurance company to report the incident. You’ll need to provide them with details about the accident, including the date, time, location, and any injuries sustained.

- Gather all necessary information: This includes the names and contact information of all parties involved, including witnesses, as well as the license plate numbers and insurance information of all vehicles involved.

- Take photos and videos of the accident scene: Documenting the damage to your vehicle and the surrounding area can be helpful in supporting your claim.

- Seek medical attention: If you’ve been injured, seek immediate medical attention and keep detailed records of your treatment.

- File your claim promptly: Most insurance companies have time limits for filing claims, so it’s important to do so as soon as possible.

Navigating the Claims Process

Once you’ve filed your claim, your insurance company will begin an investigation. This may involve reviewing the police report, interviewing witnesses, and inspecting the damaged vehicles.

- Communicate with your insurance company: Keep your insurance company informed of any changes to your situation, such as a change of address or a new medical provider.

- Be patient: The claims process can take time, especially if the accident is complex or there are disputes about liability.

- Keep detailed records: Document all communication with your insurance company, including the date, time, and content of each conversation.

- Understand your policy: Review your insurance policy carefully to understand your coverage limits and any exclusions.

- Consider seeking legal advice: If you’re having difficulty navigating the claims process or if you believe your insurance company is not handling your claim fairly, you may want to consult with an attorney.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) is responsible for regulating the insurance industry in the state. If you have a dispute with your insurance company, you can file a complaint with the DFS.

- DFS can investigate complaints: The DFS will investigate your complaint and attempt to resolve the dispute between you and your insurance company.

- DFS can issue orders: If the DFS finds that your insurance company has violated state law, it can issue an order requiring the company to take corrective action.

- DFS can refer cases to the Office of Insurance Regulation: The DFS can refer cases to the Office of Insurance Regulation (OIR) for further investigation and possible disciplinary action against the insurance company.

Conclusive Thoughts

By understanding Florida’s car insurance landscape, comparing quotes from reputable providers, and implementing smart strategies, you can secure the best car insurance deal. Remember, your car insurance policy is a crucial safety net, protecting you financially in the event of an accident. Take the time to shop around, compare options, and make an informed decision that ensures peace of mind on the road.

Commonly Asked Questions

What are the mandatory car insurance coverages in Florida?

Florida requires all drivers to carry Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. PIP covers medical expenses and lost wages for the insured, while PDL covers damages to other vehicles or property.

How can I lower my car insurance premiums in Florida?

There are several ways to reduce your car insurance premiums in Florida, such as maintaining a good driving record, choosing a higher deductible, bundling your insurance policies, and taking advantage of discounts for safety features or driver training courses.

What are the best car insurance companies in Florida?

Several reputable car insurance companies operate in Florida, including Geico, State Farm, Progressive, Allstate, and USAA. It’s essential to compare quotes from multiple providers to find the best rates and coverage options.