State Farm car insurance Florida quote offers a unique opportunity to explore personalized coverage options tailored to the Sunshine State’s unique driving environment. State Farm, a household name in insurance, has a long-standing presence in Florida, known for its customer-centric approach and commitment to providing competitive rates. This comprehensive guide delves into the factors that influence car insurance costs in Florida, outlining the steps to obtain a quote, and highlighting the key features that make State Farm a top choice for many Floridian drivers.

Navigating the complexities of car insurance in Florida can be overwhelming, but understanding the nuances of State Farm’s offerings can empower you to make informed decisions. From exploring the various coverage options to identifying potential discounts, this guide provides a roadmap to secure the best car insurance for your needs and budget. Whether you’re a seasoned driver or a new Floridian, understanding the intricacies of State Farm car insurance in Florida can unlock a world of savings and peace of mind.

State Farm in Florida

State Farm, a household name in the insurance industry, has a strong presence in Florida, serving the state’s diverse population with various insurance products. The company’s long history and commitment to customer satisfaction have made it a trusted choice for Floridians.

State Farm’s History and Presence in Florida

State Farm entered the Florida market in 1947, establishing its first office in Jacksonville. Since then, the company has expanded its operations across the state, with a network of agents and offices serving communities throughout Florida. This extensive presence allows State Farm to provide personalized service and support to its policyholders.

State Farm’s Reputation and Customer Satisfaction in Florida

State Farm consistently ranks highly in customer satisfaction surveys and reports. For example, J.D. Power, a leading market research firm, has recognized State Farm for its exceptional customer service in Florida. The company’s commitment to resolving customer issues promptly and fairly has contributed to its positive reputation.

State Farm’s Unique Offerings for Florida Residents, State farm car insurance florida quote

State Farm offers various insurance products tailored to the specific needs of Florida residents. These include:

- Homeowners Insurance: State Farm’s homeowners insurance policies in Florida provide coverage for damage caused by hurricanes, floods, and other natural disasters. The company also offers discounts for hurricane-resistant features, such as impact-resistant windows and roofs.

- Auto Insurance: State Farm’s auto insurance policies in Florida include comprehensive and collision coverage, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. The company also offers discounts for safe driving records, good student discounts, and multi-policy discounts.

- Flood Insurance: Florida is a state prone to flooding, and State Farm offers flood insurance policies to protect homeowners from financial losses caused by floods. The company’s flood insurance policies are available through the National Flood Insurance Program (NFIP).

Car Insurance in Florida

Florida’s unique driving environment and high population density contribute to its distinctive car insurance landscape. Understanding the key factors influencing car insurance rates in Florida is crucial for making informed decisions about your coverage.

Factors Influencing Car Insurance Rates in Florida

Florida’s car insurance rates are influenced by a combination of factors, including:

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, significantly impacts your insurance premiums. A clean driving record translates to lower rates.

- Age and Gender: Younger drivers and males typically face higher premiums due to their higher risk profiles.

- Vehicle Type and Value: The type, make, model, and value of your vehicle influence your insurance costs. Luxury cars and high-performance vehicles generally command higher premiums.

- Location: Areas with high traffic density, crime rates, and accident frequency tend to have higher insurance rates.

- Credit Score: In Florida, insurance companies can use your credit score to assess your risk. A good credit score often translates to lower premiums.

- Coverage Levels: The type and amount of coverage you choose directly affect your insurance costs. Comprehensive and collision coverage are generally more expensive than liability coverage.

Types of Car Insurance Coverage in Florida

Florida law requires all drivers to carry at least a minimum level of liability coverage, known as Personal Injury Protection (PIP) and Property Damage Liability (PDL).

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault, up to a certain limit. In Florida, the minimum PIP coverage is $10,000.

- Property Damage Liability (PDL): This coverage pays for damages to other people’s property if you are at fault in an accident. The minimum PDL coverage in Florida is $10,000.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. It is optional but often required if you have a car loan.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by non-collision events, such as theft, vandalism, fire, and natural disasters. It is optional but often required if you have a car loan.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It pays for your medical expenses and property damage up to your coverage limits.

Florida’s Driving Environment and Insurance Costs

Florida’s unique driving environment, characterized by high traffic volumes, diverse road conditions, and a significant number of tourists, contributes to higher insurance costs.

- High Traffic Volumes: Florida’s high population density and tourist influx lead to heavy traffic congestion, increasing the likelihood of accidents.

- Diverse Road Conditions: Florida’s diverse road network, including urban highways, rural roads, and coastal highways, presents varying driving challenges and potential hazards.

- Tourist Influx: The influx of tourists, often unfamiliar with local traffic patterns and road conditions, contributes to a higher risk of accidents.

- High Number of Claims: The combination of these factors leads to a higher number of insurance claims in Florida, which, in turn, drives up insurance rates.

Obtaining a Quote

Getting a car insurance quote from State Farm in Florida is a straightforward process. You can request a quote online, over the phone, or by visiting a local agent.

Information Required for a Quote

State Farm requires certain information to provide you with an accurate car insurance quote. This information helps them assess your risk and determine the appropriate premium.

- Your personal information, such as your name, address, and date of birth.

- Your driving history, including any accidents or violations.

- Details about your vehicle, including the make, model, year, and VIN (Vehicle Identification Number).

- Your desired coverage options, such as liability, collision, and comprehensive coverage.

- Any discounts you may qualify for, such as safe driver discounts or multi-policy discounts.

Channels for Obtaining a Quote

State Farm offers several convenient channels for obtaining a car insurance quote.

- Online: State Farm’s website provides an online quote tool where you can enter your information and receive an instant quote. This option allows you to compare different coverage options and get a quote at your convenience.

- Phone: You can call State Farm’s customer service line to speak with a representative who can help you obtain a quote. This option allows you to ask questions and get personalized guidance.

- Agent: Visiting a local State Farm agent is another way to get a quote. This option allows you to discuss your needs in person and get tailored advice.

Factors Affecting Quotes

Your car insurance quote in Florida is determined by various factors that assess your risk as a driver. These factors are carefully considered by insurance companies to ensure premiums accurately reflect the likelihood of you filing a claim.

Driving History

Your driving history plays a crucial role in determining your car insurance premiums. A clean driving record with no accidents or violations will generally result in lower premiums. However, any incidents involving accidents, traffic violations, or DUI convictions can significantly increase your rates.

For example, a speeding ticket can lead to a higher premium, while a DUI conviction could result in a substantial increase in your insurance costs.

Vehicle Type

The type of vehicle you drive is another significant factor influencing your insurance quote. Certain vehicles are considered higher risk due to their safety features, repair costs, or likelihood of theft.

- Luxury vehicles: These cars often have higher repair costs, making them more expensive to insure.

- Sports cars: These vehicles are often associated with higher speeds and aggressive driving, increasing the risk of accidents.

- Older vehicles: Older vehicles may have outdated safety features, making them more prone to accidents.

Coverage Levels

The level of coverage you choose also affects your car insurance premiums. Comprehensive and collision coverage provide greater protection but come at a higher cost.

- Liability coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property.

- Collision coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault.

- Comprehensive coverage: This coverage protects you from damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters.

Discounts

Several discounts can help lower your car insurance premiums in Florida.

- Good student discount: This discount is available to students who maintain a certain GPA.

- Safe driver discount: This discount is awarded to drivers with a clean driving record.

- Multi-car discount: This discount is offered to policyholders who insure multiple vehicles with the same insurance company.

- Multi-policy discount: This discount is available to policyholders who bundle their car insurance with other types of insurance, such as homeowners or renters insurance.

Comparing Quotes

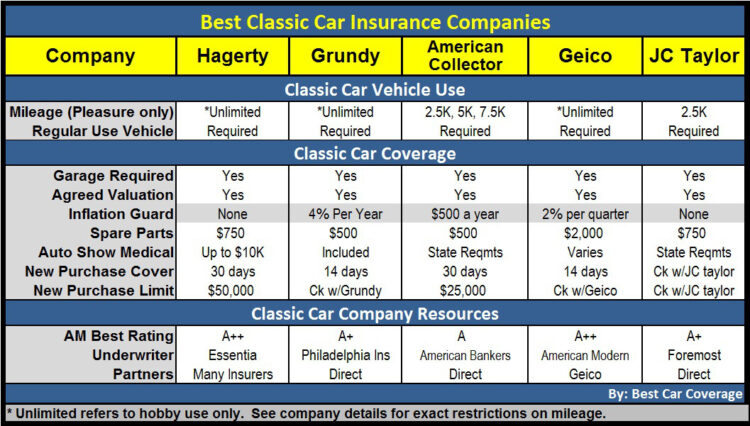

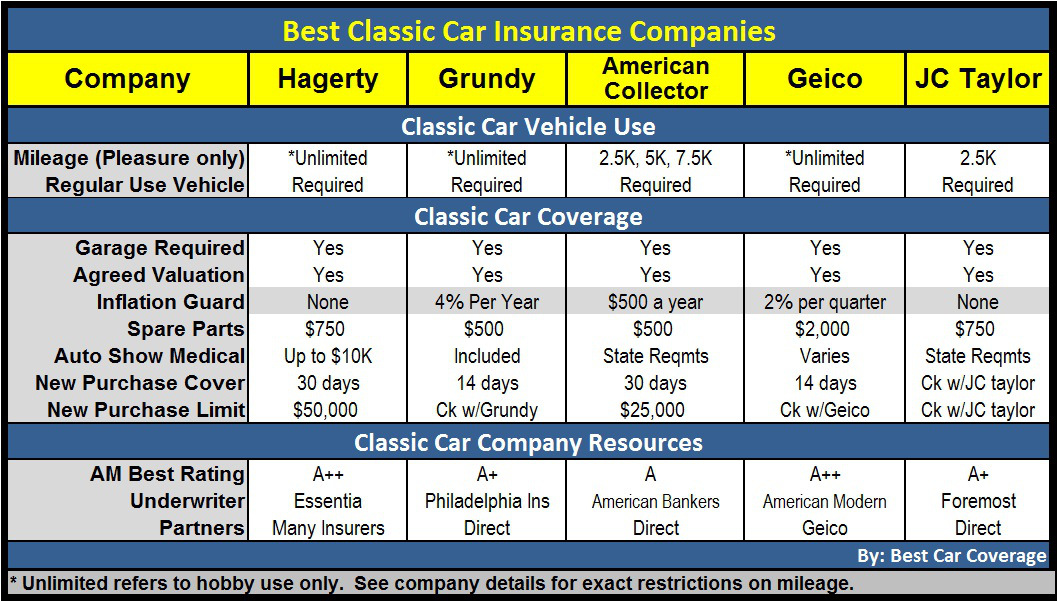

When searching for car insurance in Florida, it’s crucial to compare quotes from multiple providers to find the best value. This involves evaluating coverage options, pricing, and the reputation of each insurer. This section delves into comparing State Farm with other major insurance providers in Florida.

Comparison of Car Insurance Quotes

The table below provides a structured comparison of car insurance quotes from State Farm and other major insurers in Florida. This includes key features, coverage levels, and pricing, allowing you to understand the differences between providers and identify the most suitable option for your needs.

| Insurer | Coverage Levels | Key Features | Average Annual Premium (Estimated) |

|---|---|---|---|

| State Farm | Comprehensive, Collision, Liability, Personal Injury Protection (PIP), Uninsured/Underinsured Motorist (UM/UIM) | Accident Forgiveness, Drive Safe & Save Program, 24/7 Customer Support, Mobile App | $1,800 – $2,200 |

| Geico | Comprehensive, Collision, Liability, PIP, UM/UIM | Easy Online Quote Process, 24/7 Customer Support, Mobile App, Discounts | $1,700 – $2,100 |

| Progressive | Comprehensive, Collision, Liability, PIP, UM/UIM | Name Your Price Tool, Snapshot Program, 24/7 Customer Support, Mobile App | $1,650 – $2,050 |

| Allstate | Comprehensive, Collision, Liability, PIP, UM/UIM | Drive Safe & Save Program, Accident Forgiveness, 24/7 Customer Support, Mobile App | $1,750 – $2,150 |

| USAA | Comprehensive, Collision, Liability, PIP, UM/UIM | Military Discounts, 24/7 Customer Support, Mobile App, Excellent Customer Service | $1,600 – $2,000 |

Advantages and Disadvantages of Choosing State Farm

Choosing State Farm offers several advantages and disadvantages compared to competitors. It’s crucial to weigh these factors to determine if State Farm aligns with your specific requirements and preferences.

Advantages

- Strong Financial Stability: State Farm is a highly financially stable company with a strong track record of paying claims. This provides peace of mind knowing your insurer can fulfill its obligations in case of an accident.

- Wide Coverage Options: State Farm offers a comprehensive range of coverage options, including optional add-ons, allowing you to tailor your policy to meet your specific needs.

- Excellent Customer Service: State Farm is known for its excellent customer service, providing prompt and helpful assistance through various channels, including phone, email, and online chat.

- Discounts and Rewards Programs: State Farm offers various discounts and rewards programs, such as the Drive Safe & Save Program, which can help reduce your premium based on your driving behavior.

- Extensive Agent Network: State Farm has a vast network of agents across Florida, making it convenient to access local support and personalized assistance.

Disadvantages

- Potentially Higher Premiums: In some cases, State Farm’s premiums might be slightly higher compared to other insurers, especially for drivers with a less-than-perfect driving history.

- Limited Online Capabilities: While State Farm offers online quote tools, it might not be as comprehensive or user-friendly as some competitors, requiring more interaction with an agent for certain tasks.

- Variable Agent Experience: While State Farm strives for consistent customer service, the quality of service can vary depending on the individual agent you work with. It’s essential to research and choose an agent with a positive reputation.

Customer Experience

State Farm is known for its strong customer service reputation, and this extends to its operations in Florida. The company strives to provide a seamless and positive experience for its policyholders, from the initial quote request to claim processing and beyond.

Customer Service Experience

State Farm offers a comprehensive suite of customer service channels, catering to various preferences. These include:

- Phone Support: Policyholders can reach dedicated customer service representatives through a toll-free number, available 24/7. These representatives are trained to handle a wide range of inquiries, from policy changes to claim filing.

- Online Portal: State Farm’s user-friendly online portal allows customers to manage their policies, view documents, and submit claims conveniently from any device with internet access.

- Mobile App: The State Farm mobile app provides a convenient way to access account information, file claims, and communicate with customer service representatives on the go.

- Local Agents: State Farm has a vast network of local agents across Florida, offering personalized support and guidance. These agents are knowledgeable about local regulations and can provide tailored advice.

Ease of Filing Claims

State Farm aims to simplify the claims process for its policyholders in Florida. The company provides various methods for reporting claims, including:

- Phone: Policyholders can report claims through a dedicated phone line, accessible 24/7.

- Online Portal: The State Farm online portal allows customers to submit claims directly, providing detailed information and uploading supporting documents.

- Mobile App: The State Farm mobile app enables customers to report claims, upload photos of damages, and track claim progress in real-time.

- Local Agents: Policyholders can report claims through their local State Farm agent, who can assist with the process and answer any questions.

Responsiveness to Customer Inquiries

State Farm prioritizes prompt and effective communication with its policyholders. The company strives to address customer inquiries and concerns within a reasonable timeframe, ensuring timely responses and resolution.

Real-World Examples of Customer Interactions

- Example 1: A Florida resident named Sarah experienced a car accident and reported the claim through the State Farm mobile app. She received a prompt response from a claims adjuster who guided her through the process. The adjuster was responsive to her questions and kept her informed throughout the claim resolution. Sarah was impressed by the ease and efficiency of the process.

- Example 2: John, a State Farm policyholder in Miami, had a question about his policy coverage. He contacted the customer service line and was connected to a representative who provided clear and concise answers. John appreciated the representative’s patience and expertise in addressing his concerns.

Additional Considerations: State Farm Car Insurance Florida Quote

Before finalizing your decision, it’s crucial to carefully review the policy terms and conditions. Understanding the coverage details, limitations, and exclusions is vital to ensure the policy meets your specific needs.

State Farm Car Insurance in Florida: Benefits and Drawbacks

State Farm is a well-established insurance company with a strong presence in Florida. However, like any insurance provider, it has its own set of advantages and disadvantages. It’s essential to weigh these factors before making a decision.

Benefits

- Strong Financial Stability: State Farm is known for its financial strength, providing confidence in its ability to meet claims obligations.

- Wide Range of Coverage Options: The company offers a comprehensive range of coverage options to cater to different needs, including liability, collision, comprehensive, and uninsured motorist coverage.

- Customer Service Reputation: State Farm has generally received positive feedback for its customer service, with agents available to answer questions and assist with claims.

- Discounts: State Farm offers various discounts, such as good driver, safe driver, and multi-policy discounts, which can help lower your premiums.

Drawbacks

- Potential for Higher Premiums: While State Farm offers discounts, premiums can vary depending on factors like your driving history, vehicle type, and location. It’s important to compare quotes from multiple insurers to ensure you’re getting the best value.

- Claims Processing Time: Like any insurance company, State Farm may experience delays in processing claims, especially during busy periods. It’s essential to understand the claims process and be prepared for potential wait times.

Ensuring Comprehensive and Affordable Coverage

To maximize your coverage and affordability, consider these strategies:

- Compare Quotes: Obtain quotes from multiple insurance providers to compare prices and coverage options. Online comparison tools can streamline this process.

- Review Coverage Options: Carefully review the coverage options offered by each insurer and choose the ones that best align with your needs and budget. Consider factors like your driving habits, vehicle value, and financial situation.

- Explore Discounts: Inquire about available discounts, such as good driver, safe driver, and multi-policy discounts. Taking advantage of these discounts can significantly reduce your premiums.

- Consider Deductibles: Higher deductibles generally lead to lower premiums. Determine a deductible level that you can comfortably afford in case of an accident.

- Review Policy Regularly: Periodically review your policy to ensure it still meets your needs and that you’re taking advantage of all available discounts. You may need to adjust your coverage as your circumstances change.

Epilogue

In conclusion, securing a State Farm car insurance Florida quote is a crucial step towards finding the right coverage for your individual needs and budget. By understanding the factors that influence rates, exploring different coverage options, and comparing quotes, you can confidently choose the best car insurance policy for your situation. Remember, a personalized approach is key to securing the most comprehensive and affordable coverage, ensuring peace of mind on Florida’s roads.

Essential FAQs

How can I get a State Farm car insurance quote in Florida?

You can get a quote online, over the phone, or by visiting a local State Farm agent.

What factors affect my State Farm car insurance quote in Florida?

Factors like your driving history, age, vehicle type, coverage levels, and location all influence your quote.

Does State Farm offer discounts in Florida?

Yes, State Farm offers various discounts, including safe driver, good student, and multi-policy discounts.

How does State Farm’s customer service in Florida compare to other insurers?

State Farm is known for its strong customer service, with positive reviews for its responsiveness and claim handling processes.