State minimum car insurance Florida is a legal requirement for all drivers, but understanding its intricacies is crucial. While it may seem straightforward, navigating the complexities of Florida’s unique no-fault system and its impact on insurance costs can be overwhelming. This guide will demystify these aspects, empowering you to make informed decisions about your car insurance coverage.

Florida mandates specific types of coverage for all drivers, including bodily injury liability, property damage liability, and personal injury protection (PIP). These coverages provide financial protection in the event of an accident, but understanding the limitations and benefits of each is essential. We’ll delve into the details of these requirements, shedding light on real-world scenarios where minimum coverage might be insufficient.

Florida’s Minimum Car Insurance Requirements

Florida is a no-fault insurance state, meaning drivers are primarily responsible for covering their own medical expenses after an accident, regardless of fault. However, the state also mandates certain minimum car insurance coverage to protect against financial losses resulting from accidents. Understanding these requirements is crucial for all drivers in Florida.

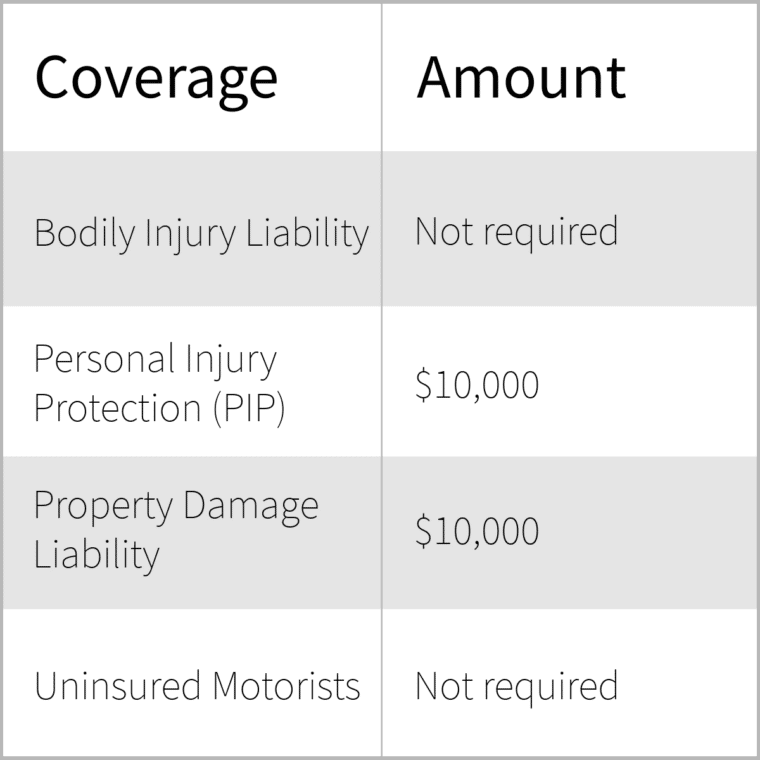

Minimum Coverage Requirements, State minimum car insurance florida

Florida law requires all drivers to carry the following minimum car insurance coverage:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault. The minimum PIP coverage required in Florida is $10,000 per person.

- Property Damage Liability (PDL): This coverage protects you from financial liability if you damage another person’s property, such as their vehicle or other possessions. The minimum PDL coverage required in Florida is $10,000 per accident.

It is important to note that Florida’s minimum car insurance requirements are just that – minimums. In many cases, these limits may not be sufficient to cover all of your expenses after an accident.

Examples of Insufficient Minimum Coverage

Here are some real-world scenarios where Florida’s minimum car insurance coverage might be inadequate:

- High Medical Expenses: If you or a passenger sustain serious injuries in an accident, your $10,000 PIP coverage might not be enough to cover all medical bills, especially if there are lengthy hospital stays or extensive rehabilitation required.

- Significant Property Damage: In the event of a collision causing substantial damage to another vehicle or property, the $10,000 PDL limit might not cover all repair costs, leaving you responsible for the difference.

- Multiple Passengers Injured: If multiple passengers are injured in an accident, the $10,000 PIP limit per person could be quickly exhausted, leaving you with substantial out-of-pocket expenses.

- Hit-and-Run Accidents: If you are involved in a hit-and-run accident and the other driver is uninsured or underinsured, your minimum coverage might not be enough to compensate for your losses.

It is crucial to remember that minimum car insurance coverage is designed to meet basic legal requirements, not necessarily to protect you from all financial risks associated with driving.

Understanding Florida’s No-Fault System

Florida operates under a no-fault insurance system, which means that drivers involved in accidents are primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system aims to simplify the claims process and reduce the number of lawsuits related to car accidents.

Personal Injury Protection (PIP)

Florida’s no-fault system revolves around Personal Injury Protection (PIP) coverage, which is mandatory for all drivers in the state. PIP coverage provides benefits for medical expenses and lost wages incurred as a result of a car accident, regardless of fault.

PIP Coverage Limitations

PIP coverage in Florida has limitations, including:

- Coverage Limit: The minimum PIP coverage required in Florida is $10,000 per person. This means that your PIP coverage will only pay up to $10,000 for your medical expenses and lost wages, regardless of the severity of your injuries.

- 80% Rule: PIP coverage will only pay 80% of your medical expenses, and you are responsible for the remaining 20%. This rule applies to all medical expenses, including doctor’s visits, hospital stays, and rehabilitation.

- Lost Wages: PIP coverage also provides benefits for lost wages, but these benefits are limited to 60% of your average weekly wage. This means that you will only receive 60% of your regular income for the time you are unable to work due to your injuries.

- Deductible: Some PIP policies include a deductible, which you are responsible for paying before your PIP coverage kicks in.

Benefits Provided by PIP

Despite the limitations, PIP coverage provides several benefits to Florida drivers:

- Prompt Payment: PIP coverage is designed to provide prompt payment for medical expenses and lost wages, regardless of who caused the accident. This helps to ensure that you receive the financial assistance you need to recover from your injuries.

- Reduced Litigation: The no-fault system aims to reduce the number of lawsuits related to car accidents by making drivers responsible for their own expenses. This can help to streamline the claims process and reduce legal costs.

- Access to Medical Care: PIP coverage provides access to medical care for all drivers involved in a car accident, regardless of fault. This ensures that you receive the necessary medical treatment to recover from your injuries.

Comparison with Other States’ Insurance Models

Florida’s no-fault system differs significantly from other states’ insurance models. For example, some states operate under a “tort” system, where drivers who are at fault for an accident are responsible for all damages caused. Other states use a combination of no-fault and tort systems.

Advantages and Disadvantages of No-Fault

The no-fault system has both advantages and disadvantages:

- Advantages:

- Faster claims processing.

- Reduced litigation.

- Guaranteed access to medical care.

- Disadvantages:

- Limited coverage benefits.

- Potential for higher insurance premiums.

- Difficulty recovering damages for pain and suffering.

Ultimate Conclusion

Navigating Florida’s car insurance market requires careful consideration of your individual needs and circumstances. By understanding the state’s minimum requirements, the unique aspects of its no-fault system, and the factors that influence insurance costs, you can make informed decisions that provide adequate protection while minimizing your expenses. Remember, exceeding minimum coverage requirements can offer peace of mind and comprehensive financial protection in the face of unforeseen events. Armed with this knowledge, you can confidently choose the right insurance coverage and find a reputable provider that meets your specific needs.

Essential FAQs: State Minimum Car Insurance Florida

What happens if I get into an accident and only have the minimum coverage?

If you only have the minimum coverage and are at fault for an accident, you may be liable for damages exceeding your coverage limits, leaving you personally responsible for the difference.

Can I choose to opt out of PIP coverage?

No, PIP coverage is mandatory in Florida. However, you can choose to reduce your PIP coverage limit from $10,000 to $2,500.

What are some tips for finding affordable car insurance in Florida?

Shop around and compare quotes from multiple insurers, consider increasing your deductible, maintain a clean driving record, and bundle your car insurance with other policies like homeowners or renters insurance.