- Tesla Car Insurance in Florida

- Eligibility and Requirements

- Coverage Options and Pricing

- Claims Process and Customer Support

- Safety Features and Discounts

- Comparison with Traditional Insurance Providers: Tesla Car Insurance Florida

- Future Trends and Developments

- Final Conclusion

- Key Questions Answered

Tesla Car Insurance Florida: A Comprehensive Guide, delves into the world of insurance for Tesla owners in the Sunshine State. This guide will explore the unique features of Tesla insurance, outlining its benefits and potential drawbacks, as well as providing a comprehensive comparison to traditional insurance options.

From eligibility requirements and coverage options to the claims process and customer support, this guide will provide you with all the information you need to make an informed decision about your Tesla insurance in Florida.

Tesla Car Insurance in Florida

Tesla car insurance is a relatively new offering in Florida, providing coverage specifically tailored for Tesla vehicles. It leverages advanced technology and data analytics to offer competitive rates and unique features.

Features of Tesla Car Insurance

Tesla car insurance stands out from traditional insurance options due to its integration with Tesla’s vehicle technology. This integration enables the insurer to access real-time data about the car’s performance, driving habits, and safety features, leading to personalized pricing and coverage.

Benefits of Tesla Car Insurance

- Lower Premiums: Tesla insurance often offers lower premiums compared to traditional insurers, especially for drivers with good driving records and who utilize Tesla’s advanced safety features. This is due to the insurer’s ability to assess risk more accurately based on real-time data.

- Personalized Coverage: The insurance plan is tailored to the specific features of your Tesla, offering coverage that aligns with your individual needs and driving habits.

- Enhanced Safety Features: Tesla insurance leverages the vehicle’s advanced safety features, such as Autopilot and Enhanced Autopilot, to assess risk and potentially offer discounts for drivers who utilize these features.

- Convenient Claims Process: Tesla insurance provides a streamlined claims process through its mobile app and online platform, allowing for quick and efficient reporting and resolution of claims.

Potential Drawbacks of Tesla Car Insurance

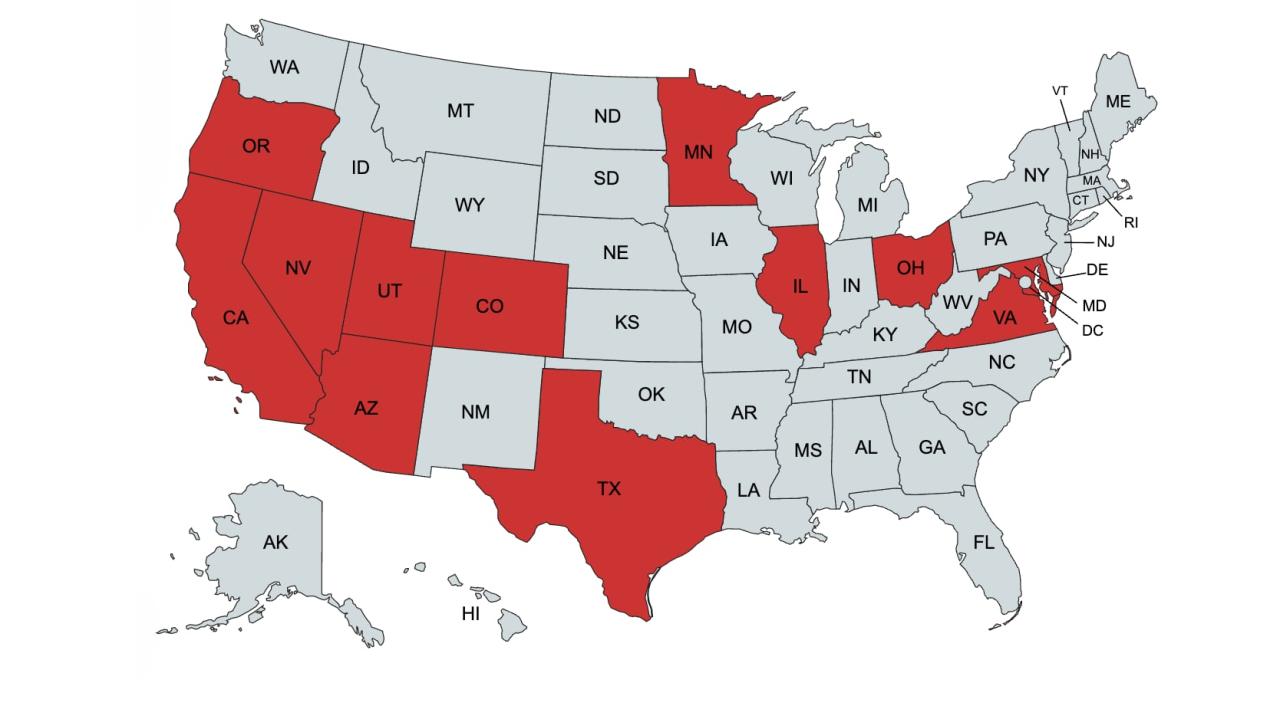

- Limited Availability: Tesla insurance is currently only available in a limited number of states, including Florida, and may not be accessible to all Tesla owners.

- Lack of Established Reputation: As a relatively new offering, Tesla insurance lacks the established reputation and widespread customer base of traditional insurers, which may be a concern for some drivers.

- Data Privacy Concerns: The use of real-time data from Tesla vehicles may raise privacy concerns for some drivers. However, Tesla has implemented measures to protect data privacy and transparency.

Eligibility and Requirements

To be eligible for Tesla car insurance in Florida, you must meet certain requirements. These requirements ensure that Tesla can accurately assess your risk and offer you the most appropriate coverage.

Vehicle Type, Tesla car insurance florida

Tesla car insurance is specifically designed for Tesla vehicles. This means that only owners of Tesla vehicles can apply for this insurance.

Driving History

Your driving history plays a crucial role in determining your eligibility and premium. Tesla will review your driving record, including any accidents, violations, or claims. A clean driving history with no recent incidents will generally lead to lower premiums.

Other Factors

Besides vehicle type and driving history, other factors influence eligibility and premiums. These factors include:

- Age: Younger drivers generally face higher premiums due to their higher risk of accidents.

- Location: The location where you live impacts the risk of accidents and, therefore, your premium. Areas with higher accident rates may have higher premiums.

- Credit Score: Your credit score can be a factor in determining your premium. A good credit score may indicate responsible financial behavior, which can lead to lower premiums.

- Coverage Options: The type and amount of coverage you choose will impact your premium. Comprehensive and collision coverage, for instance, generally result in higher premiums compared to liability-only coverage.

Obtaining a Quote and Applying for Insurance

To get a quote for Tesla car insurance in Florida, you can visit the Tesla website or contact a Tesla insurance agent. You will need to provide information about yourself, your vehicle, and your driving history. Once you have provided this information, Tesla will generate a personalized quote.

Coverage Options and Pricing

Tesla Insurance in Florida offers a range of coverage options designed to meet the diverse needs of Tesla owners. Understanding these options and their associated costs is crucial for making informed decisions about your insurance coverage.

Coverage Options

Tesla Insurance in Florida provides a comprehensive suite of coverage options, including:

- Liability Coverage: This coverage protects you financially if you are found liable for an accident that causes injury or damage to others. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your Tesla if it is damaged in a collision, regardless of fault.

- Comprehensive Coverage: This coverage protects your Tesla against damage from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured.

- Personal Injury Protection (PIP): This coverage, required in Florida, covers medical expenses and lost wages for you and your passengers in the event of an accident.

- Rental Car Coverage: This coverage provides reimbursement for rental car expenses if your Tesla is being repaired due to a covered accident.

- Roadside Assistance: This coverage provides assistance for situations like flat tires, jump starts, and towing.

Pricing Factors

The cost of Tesla car insurance in Florida is influenced by several factors:

- Vehicle Model: Tesla models vary in price and safety features, impacting insurance premiums. Higher-priced and more advanced models often have higher insurance costs.

- Driving History: Your driving record plays a significant role in insurance pricing. Drivers with a history of accidents, speeding tickets, or DUI convictions are likely to face higher premiums.

- Location: Insurance rates vary depending on your location. Areas with higher rates of accidents and crime generally have higher insurance premiums.

- Age and Gender: Younger and inexperienced drivers typically have higher insurance premiums due to a higher risk of accidents. Gender can also influence rates in some cases.

- Credit Score: In some states, including Florida, insurers may consider your credit score when determining insurance premiums. A good credit score can potentially lead to lower premiums.

- Coverage Levels: Choosing higher coverage limits, such as higher liability coverage, will generally result in higher premiums.

- Deductible: A higher deductible, the amount you pay out of pocket before insurance coverage kicks in, typically leads to lower premiums.

Claims Process and Customer Support

Tesla Insurance in Florida offers a straightforward and convenient claims process designed to simplify the experience for policyholders. The company leverages its technology and expertise to expedite claim processing and ensure customer satisfaction.

Filing a Claim

To initiate a claim, policyholders can follow these steps:

- Report the Incident: Contact Tesla Insurance directly through their dedicated phone line or online portal. Provide essential details about the incident, including the date, time, location, and nature of the accident.

- Submit Required Documentation: Tesla Insurance may request supporting documents, such as a police report, photographs of the damage, and medical records, to validate the claim.

- Choose a Repair Facility: Tesla Insurance provides a network of approved repair facilities, ensuring quality repairs and efficient processing.

- Claim Assessment and Approval: Tesla Insurance will review the claim details, assess the damage, and determine the coverage and payout amount.

- Payment Processing: Once the claim is approved, Tesla Insurance will process the payment directly to the repair facility or to the policyholder, depending on the chosen option.

Customer Support Channels

Tesla Insurance offers various customer support channels to ensure accessibility and responsiveness:

- Phone Support: Policyholders can reach a dedicated customer service team via phone, providing immediate assistance and guidance.

- Online Portal: The Tesla Insurance website offers a user-friendly portal for managing policies, filing claims, and accessing account information.

- Email Support: Customers can contact Tesla Insurance through email for inquiries and assistance, receiving timely responses.

Customer Experiences and Feedback

Customer feedback regarding Tesla Insurance’s claims process and customer service is generally positive, highlighting:

- Streamlined and Efficient Claims Process: Many customers appreciate the ease and speed of the online claims process and the prompt responses from Tesla Insurance representatives.

- Responsive and Helpful Customer Support: Customers consistently praise the responsiveness and helpfulness of the customer support team, which provides clear explanations and timely assistance.

- Technology-Driven Solutions: Tesla Insurance’s utilization of technology, such as online portals and mobile apps, simplifies the claims process and enhances customer convenience.

Safety Features and Discounts

Tesla vehicles are renowned for their advanced safety features, which contribute significantly to their overall safety performance. These features are not only designed to enhance driver and passenger safety but also play a crucial role in influencing insurance rates.

Safety Features and Their Impact on Insurance

Tesla insurance in Florida recognizes the value of these safety features and may offer discounts to policyholders who own Tesla vehicles. Here are some notable safety features and how they can impact insurance premiums:

- Autopilot and Full Self-Driving Capability: Tesla’s Autopilot and Full Self-Driving (FSD) features are designed to assist drivers by providing advanced driver-assistance systems (ADAS). These systems can help prevent accidents by monitoring the environment, controlling the vehicle’s speed, and maintaining lane position. The presence of these features can reduce the risk of accidents, potentially leading to lower insurance premiums.

- Automatic Emergency Braking (AEB): AEB systems automatically apply the brakes to avoid or mitigate collisions. The ability of a Tesla to automatically brake in emergency situations can reduce the severity of accidents, leading to lower repair costs and potentially lower insurance premiums.

- Lane Departure Warning (LDW): LDW systems alert drivers when the vehicle drifts out of its lane. By helping drivers stay in their lanes, LDW can prevent accidents and contribute to lower insurance rates.

- Blind Spot Monitoring (BSM): BSM systems warn drivers about vehicles in their blind spots, reducing the risk of accidents when changing lanes. This feature can help prevent accidents and potentially lower insurance premiums.

Discounts Offered by Tesla Insurance

Tesla insurance in Florida offers a variety of discounts to policyholders, which can significantly reduce insurance premiums. These discounts are designed to reward safe driving behavior and promote responsible driving practices. Here are some examples:

- Safe Driving Discount: This discount is offered to drivers with a clean driving record and no accidents or violations. Drivers with a history of safe driving are considered less risky by insurance companies, which can result in lower premiums.

- Loyalty Program: Tesla insurance may offer loyalty programs that reward customers for their long-term commitment. These programs can include discounts on premiums, access to exclusive benefits, and other perks.

- Telematics Discount: Some Tesla insurance policies may offer discounts based on telematics data, which tracks driving behavior. Drivers who demonstrate safe driving habits, such as avoiding speeding or hard braking, can earn discounts.

Comparison with Traditional Insurance Providers: Tesla Car Insurance Florida

Choosing the right car insurance in Florida can be a complex decision, especially with the emergence of Tesla’s insurance program. While traditional insurance providers have been the norm for decades, Tesla’s offering presents a unique alternative. To help you make an informed choice, this section compares and contrasts Tesla insurance with traditional insurance providers in Florida, highlighting key differences in coverage, pricing, and customer service.

Coverage Options

The availability of coverage options can significantly influence your insurance choice. Both Tesla insurance and traditional providers offer a range of coverage options, but there are some notable differences.

- Tesla Insurance: Tesla’s insurance program provides comprehensive coverage, including collision, liability, and comprehensive coverage. It also offers unique features like “Tesla-specific coverage,” which covers repairs for Tesla-exclusive parts and technology. Additionally, Tesla insurance includes benefits like roadside assistance, rental car reimbursement, and emergency medical expense coverage.

- Traditional Insurance Providers: Traditional providers also offer a variety of coverage options, including collision, liability, comprehensive, and uninsured/underinsured motorist coverage. However, they may not offer Tesla-specific coverage or unique features like Tesla’s “Full Self-Driving” coverage, which covers accidents involving the vehicle’s autopilot system.

Pricing

Pricing is a crucial factor for most car insurance buyers. While Tesla insurance claims to offer competitive pricing, its pricing structure and potential savings are worth examining.

- Tesla Insurance: Tesla insurance uses a data-driven approach to pricing, leveraging telematics data from your car’s sensors to assess your driving habits and risk profile. This approach can lead to lower premiums for safe drivers. However, Tesla insurance may not be the most affordable option for drivers with a history of accidents or traffic violations.

- Traditional Insurance Providers: Traditional insurance providers generally base their pricing on factors like your age, driving history, location, and vehicle type. They may offer discounts for safe driving, good credit scores, and bundling multiple insurance policies. While their pricing may not be as dynamic as Tesla’s, they often provide a wider range of discounts and options for comparison.

Customer Service

Customer service is a critical aspect of any insurance experience. Both Tesla and traditional providers offer customer support, but their approaches and accessibility differ.

- Tesla Insurance: Tesla’s customer service is integrated with its mobile app and website, allowing for convenient online claim filing and communication. However, some customers have reported challenges with reaching a live representative for complex issues.

- Traditional Insurance Providers: Traditional providers often offer a more established customer service infrastructure, including dedicated phone lines, physical offices, and 24/7 availability. While they may not offer the same level of app integration as Tesla, they generally provide more traditional customer service channels.

Advantages and Disadvantages

To make the best decision for your needs, consider the advantages and disadvantages of each option.

- Tesla Insurance:

- Advantages: Data-driven pricing, potentially lower premiums for safe drivers, Tesla-specific coverage, integrated app experience, convenient online claim filing.

- Disadvantages: Limited availability, may not be the most affordable option for all drivers, limited customer service options for complex issues.

- Traditional Insurance Providers:

- Advantages: Wide range of coverage options, established customer service infrastructure, multiple discount options, greater availability.

- Disadvantages: Pricing may not be as dynamic, limited Tesla-specific coverage, potentially higher premiums for safe drivers.

Future Trends and Developments

The Tesla car insurance market in Florida is poised for significant growth and evolution, driven by technological advancements, evolving customer preferences, and the increasing adoption of electric vehicles. This dynamic environment presents both opportunities and challenges for Tesla and traditional insurance providers alike.

Impact of Emerging Technologies

The rapid advancement of technology will play a crucial role in shaping the future of Tesla insurance.

- Telematics: Tesla vehicles are equipped with advanced telematics systems that continuously collect data on driving behavior, vehicle performance, and environmental conditions. This data can be used to create personalized insurance premiums based on actual driving habits, fostering a more equitable and accurate pricing model. For example, a driver with a safe driving record and minimal mileage could benefit from lower premiums compared to a driver with a history of accidents or frequent high-speed driving.

- Artificial Intelligence (AI): AI algorithms can analyze vast amounts of data from telematics systems, historical claims data, and other sources to predict future risks and personalize insurance offerings. This enables insurers to develop more accurate risk assessments and offer customized coverage packages tailored to individual needs. For instance, AI-powered risk assessment models can identify drivers with a higher likelihood of accidents based on their driving patterns, allowing insurers to adjust premiums accordingly.

- Autonomous Driving: The increasing adoption of autonomous driving technology in Tesla vehicles has the potential to significantly impact insurance premiums. As self-driving cars become more prevalent, accidents caused by human error are expected to decline, potentially leading to lower insurance costs. However, new risks associated with autonomous driving, such as cyberattacks or software malfunctions, will need to be addressed and factored into insurance policies.

Final Conclusion

Navigating the world of Tesla car insurance in Florida can seem complex, but with a thorough understanding of the available options, you can make an informed decision that best suits your needs and budget. By comparing Tesla insurance to traditional providers and considering the unique features and benefits offered, you can secure the coverage that provides peace of mind and financial protection on the road.

Key Questions Answered

What are the benefits of Tesla car insurance in Florida?

Tesla car insurance offers benefits like potential lower premiums due to Tesla’s safety features, access to a dedicated claims process, and integration with Tesla’s technology.

Is Tesla car insurance available to all Tesla owners in Florida?

Tesla car insurance is not available in all states. Check if it’s offered in Florida and if you meet the eligibility criteria.

How does Tesla car insurance compare to traditional insurance providers in Florida?

Compare Tesla car insurance to traditional providers based on factors like pricing, coverage options, and customer service. Consider your specific needs and preferences.