- Understanding Florida’s Unique Insurance Landscape

- Key Factors to Consider When Choosing Car Insurance in Florida

- Top Car Insurance Companies in Florida

- Getting the Best Rates for Car Insurance in Florida

- Understanding Florida’s No-Fault Law

- Navigating the Claims Process in Florida: The Best Car Insurance In Florida

- Resources for Florida Drivers

- Final Review

- Popular Questions

The best car insurance in Florida isn’t just about finding the cheapest rates; it’s about finding the right coverage that protects you and your loved ones. Florida’s unique insurance landscape presents a unique set of challenges for drivers, with high rates, hurricane risks, and a high number of uninsured drivers. Navigating this complex market requires careful consideration of factors like coverage options, deductibles, discounts, and the financial stability of the insurer.

This guide will delve into the key factors to consider when choosing car insurance in Florida, highlighting the top companies and strategies to secure the most competitive rates. We’ll also explain Florida’s no-fault law and guide you through the claims process, ensuring you’re equipped to make informed decisions about your car insurance.

Understanding Florida’s Unique Insurance Landscape

Florida’s car insurance market stands out for its unique challenges and complexities. Unlike many other states, Florida faces a combination of factors that contribute to higher insurance premiums and a more difficult environment for finding the best coverage.

High Insurance Rates

Florida boasts the highest average car insurance premiums in the nation, significantly exceeding the national average. Several factors contribute to this trend, including:

* High frequency of accidents: Florida’s high population density and large number of tourists contribute to a higher frequency of accidents, leading to increased claims for insurers.

* High number of uninsured drivers: A significant portion of Florida drivers operate without car insurance, increasing the risk for insured drivers who may be involved in accidents with uninsured individuals.

* High legal costs: Florida’s legal system is known for its high litigation costs, particularly in personal injury cases, which drives up insurance premiums to cover potential payouts.

* Hurricane risk: Florida’s vulnerability to hurricanes necessitates comprehensive coverage, including windstorm insurance, which adds to the overall cost of car insurance.

Impact on Finding the Best Car Insurance

The unique characteristics of Florida’s insurance market make finding the best car insurance a more complex endeavor. Drivers must consider several factors to navigate the challenges:

* Comparison shopping is crucial: Due to the wide range of premiums, comparing quotes from multiple insurers is essential to secure the most competitive rates.

* Understanding coverage options: Florida’s specific insurance requirements, such as personal injury protection (PIP) and uninsured motorist coverage (UM), require careful consideration to ensure adequate protection.

* Considering discounts: Drivers should explore available discounts, such as good driver discounts, safe driving courses, and multi-policy discounts, to reduce their premiums.

Comparison with Other States

Florida’s insurance regulations differ significantly from those in other states, particularly regarding:

* No-fault insurance: Florida operates under a no-fault insurance system, where drivers are primarily responsible for their own medical expenses following an accident, regardless of fault.

* PIP coverage: Florida requires all drivers to carry PIP coverage, which covers medical expenses and lost wages for the policyholder and passengers in an accident.

* UM coverage: Florida mandates UM coverage, which protects drivers from uninsured or underinsured motorists who cause an accident.

| Feature | Florida | Other States |

|---|---|---|

| No-fault insurance | Yes | Varying regulations |

| PIP coverage | Mandatory | Optional in some states |

| UM coverage | Mandatory | Optional in some states |

Key Factors to Consider When Choosing Car Insurance in Florida

Choosing the right car insurance policy in Florida is crucial, as it can significantly impact your financial well-being in the event of an accident. Navigating the complex insurance landscape requires careful consideration of several key factors.

Coverage Options

Understanding the different types of coverage available is essential for making an informed decision. Florida law requires all drivers to carry a minimum level of liability insurance, but you may need additional coverage depending on your individual circumstances.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects you financially if you are at fault in an accident, covering the other driver’s medical expenses, property damage, and lost wages. |

| Collision Coverage | Covers damage to your vehicle in a collision, regardless of fault. |

| Comprehensive Coverage | Covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are involved in an accident with a driver who has no or insufficient insurance. |

Deductibles

Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, but you will have to pay more in the event of a claim. Consider your financial situation and risk tolerance when choosing a deductible.

Discounts, The best car insurance in florida

Many insurance companies offer discounts to reduce your premiums. These discounts can be based on factors such as:

- Good driving record

- Safety features in your vehicle

- Multiple policies with the same insurer

- Membership in certain organizations

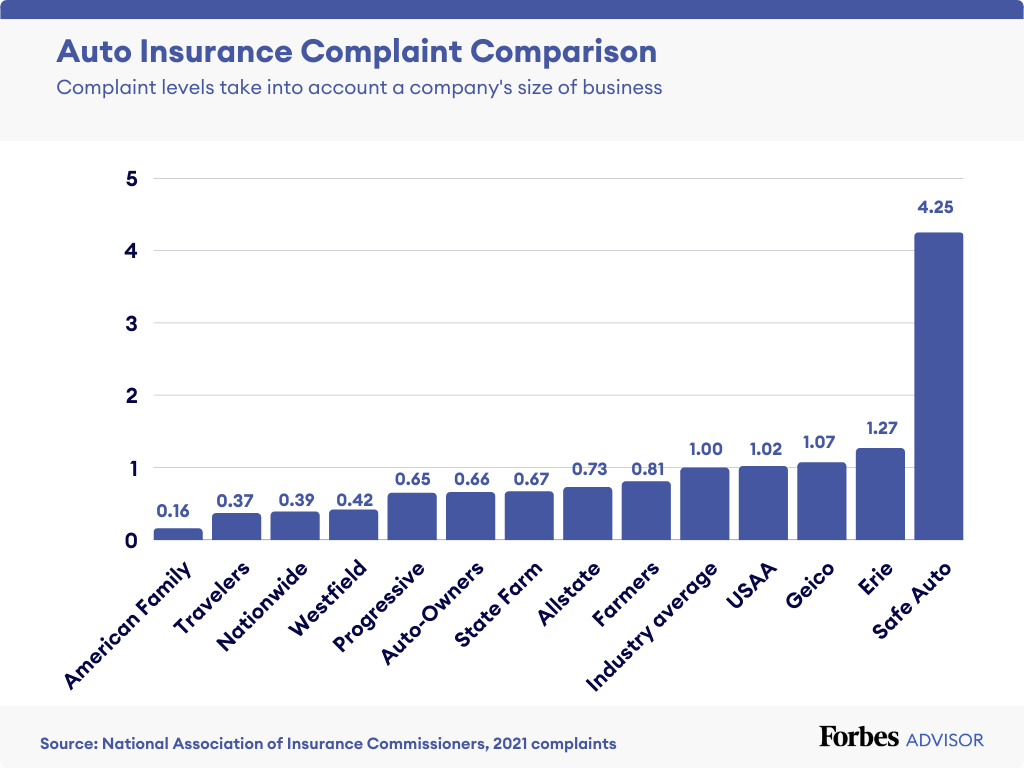

Customer Service

Good customer service is essential, especially if you need to file a claim. Consider factors such as:

- Availability of 24/7 customer support

- Responsiveness to inquiries

- Friendliness and professionalism of representatives

Financial Stability of the Insurer

It is crucial to choose an insurer that is financially stable and likely to be able to pay out claims in the event of a major disaster or economic downturn. You can check the financial strength ratings of insurance companies from independent rating agencies like AM Best or Standard & Poor’s.

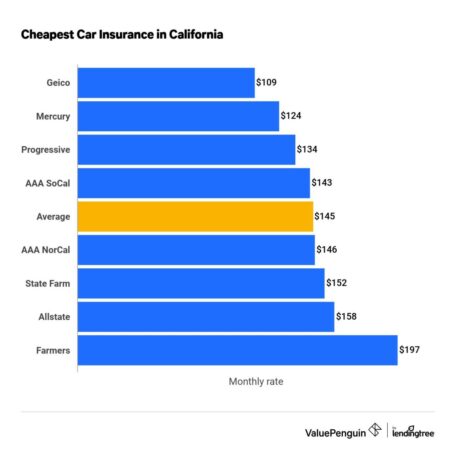

Top Car Insurance Companies in Florida

Choosing the right car insurance company is crucial in Florida, a state known for its high insurance rates and unique risks. To help you navigate this complex landscape, we’ve compiled a list of top car insurance companies in Florida, considering factors like customer satisfaction, financial strength, and coverage options.

Top Car Insurance Companies in Florida

| Company Name | Average Annual Premium | Customer Satisfaction Rating (J.D. Power) | Key Coverage Features |

|---|---|---|---|

| State Farm | $2,100 | 4 out of 5 | Comprehensive, collision, liability, personal injury protection (PIP), uninsured/underinsured motorist (UM/UIM) coverage, discounts for good drivers, safe vehicles, and bundling. |

| GEICO | $1,900 | 3.5 out of 5 | Similar coverage options to State Farm, known for its competitive pricing and online convenience. |

| Progressive | $2,000 | 3 out of 5 | Offers a wide range of coverage options, including specialized policies for high-risk drivers and unique vehicles. |

| USAA | $1,800 | 4.5 out of 5 | Exclusively for military members and their families, known for its excellent customer service and competitive rates. |

| Allstate | $2,200 | 3.5 out of 5 | Provides a comprehensive suite of coverage options and offers various discounts. |

State Farm:

* Strengths: State Farm is known for its extensive network of agents, strong financial stability, and a wide range of discounts.

* Weaknesses: May have higher premiums compared to some competitors.

GEICO:

* Strengths: GEICO offers competitive rates, a user-friendly online platform, and a strong reputation for customer service.

* Weaknesses: May not have as many physical locations as some other companies.

Progressive:

* Strengths: Progressive is known for its innovative products, including its Name Your Price tool and its ability to customize policies.

* Weaknesses: May have higher premiums for high-risk drivers.

USAA:

* Strengths: USAA provides exceptional customer service, competitive rates, and a wide range of discounts for military members and their families.

* Weaknesses: Only available to active and retired military personnel and their families.

Allstate:

* Strengths: Allstate offers a wide range of coverage options, including accident forgiveness and ride-sharing coverage.

* Weaknesses: May have higher premiums compared to some competitors.

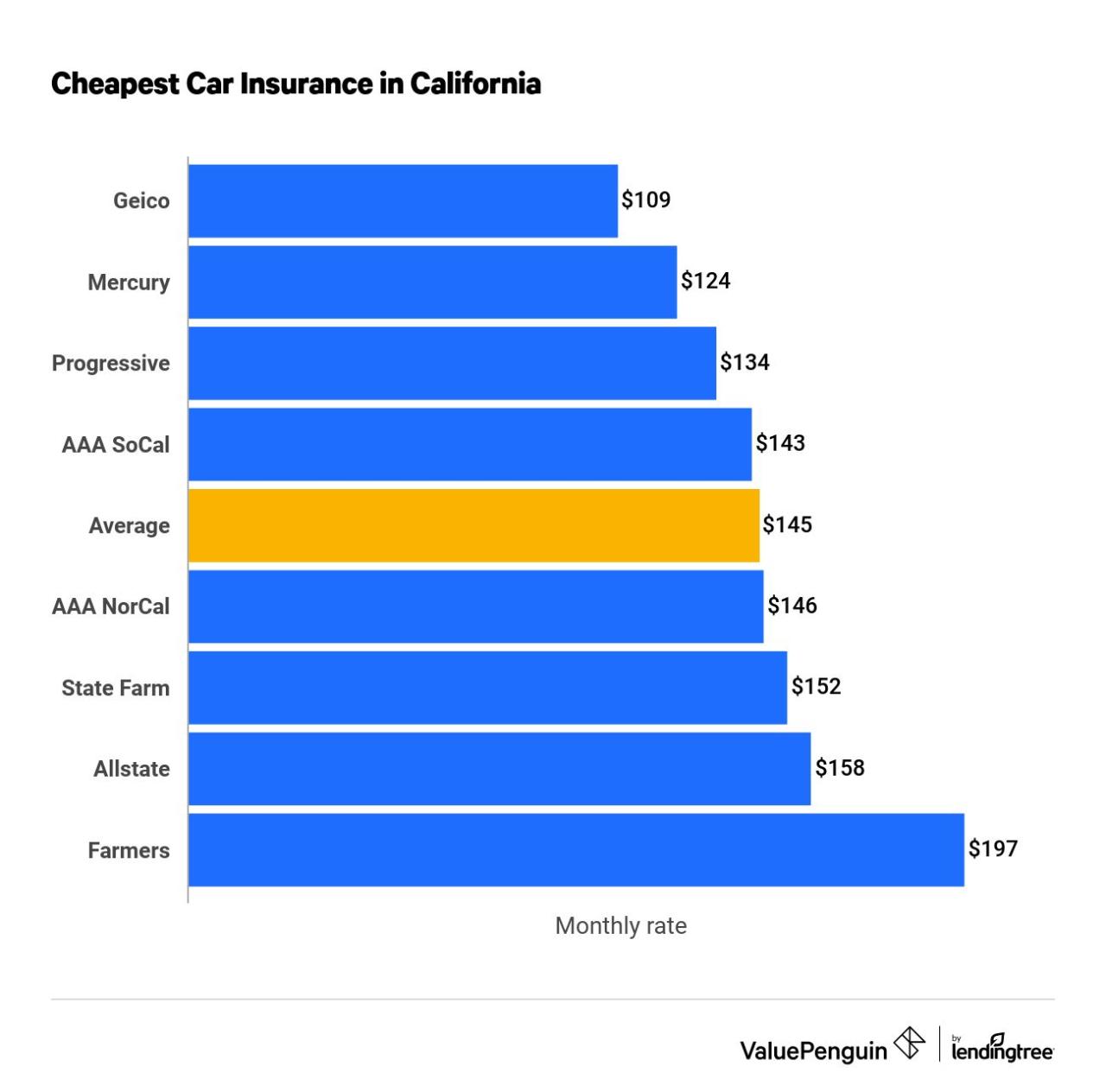

Getting the Best Rates for Car Insurance in Florida

Securing the most competitive car insurance rates in Florida requires a proactive approach. Florida’s unique insurance landscape, with its high-risk factors and regulations, makes it crucial to understand how to optimize your insurance premiums. By implementing effective strategies and leveraging available resources, you can significantly reduce your insurance costs.

Comparing Quotes from Multiple Companies

It is essential to compare quotes from multiple car insurance companies to find the best rates. Different insurers use varying algorithms and consider different factors when calculating premiums, leading to significant price discrepancies. By comparing quotes, you can identify the most competitive rates and select the policy that best meets your needs.

- Utilize online comparison tools: Several online platforms allow you to compare quotes from multiple insurers simultaneously, simplifying the process and saving time.

- Contact insurers directly: Reach out to insurance companies directly to request quotes and discuss your specific needs. This allows for personalized conversations and a deeper understanding of the coverage options available.

- Consider different coverage levels: Explore various coverage options, including liability, collision, comprehensive, and uninsured motorist coverage, to find the best balance between cost and protection.

Negotiating Discounts

Car insurance companies offer a variety of discounts to incentivize safe driving habits and responsible financial behavior. By understanding and leveraging these discounts, you can significantly reduce your premiums.

- Safe driver discounts: Maintaining a clean driving record with no accidents or traffic violations is crucial for securing lower rates. Most insurers offer discounts for drivers with a history of safe driving.

- Good student discounts: Insurers often provide discounts to students with good academic standing. This incentivizes responsible behavior and academic achievement, reflecting a lower risk profile.

- Multi-car discounts: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount. This discount recognizes the reduced risk associated with insuring multiple vehicles with the same insurer.

- Other discounts: Explore other discounts such as bundling insurance policies, installing anti-theft devices, and completing defensive driving courses.

Impact of Factors on Insurance Premiums

Several factors influence car insurance premiums in Florida. Understanding these factors can help you make informed decisions to minimize your costs.

- Driving history: Your driving history, including accidents, traffic violations, and driving record, significantly impacts your premiums. A clean driving record with no accidents or violations will generally lead to lower rates.

- Vehicle type: The type of vehicle you drive affects your insurance premiums. High-performance vehicles, luxury cars, and expensive vehicles generally attract higher premiums due to their increased repair costs and higher risk of theft.

- Location: Your location in Florida influences your insurance premiums. Areas with higher crime rates, traffic congestion, and accident frequency typically have higher insurance rates.

- Age and gender: Age and gender can also influence your premiums. Younger drivers, particularly those under 25, are generally considered higher risk due to their lack of experience. In some states, gender can also play a role in pricing, although this practice is becoming less common.

- Credit score: In some states, including Florida, insurers may consider your credit score when determining your premiums. A good credit score can often lead to lower rates, as it indicates responsible financial behavior.

Understanding Florida’s No-Fault Law

Florida’s no-fault insurance law is a unique system that impacts how car accident claims are handled. Unlike many other states, Florida requires drivers to carry Personal Injury Protection (PIP) coverage, which covers their own medical expenses and lost wages after an accident, regardless of who is at fault. This system aims to streamline the claims process and reduce the number of lawsuits.

Personal Injury Protection (PIP) Coverage

PIP coverage is a mandatory component of car insurance in Florida. It provides benefits to the policyholder, regardless of who caused the accident. PIP coverage typically covers:

- Medical Expenses: PIP covers 80% of reasonable and necessary medical expenses up to a limit of $10,000. This includes costs for doctors, hospitals, and other healthcare providers.

- Lost Wages: PIP can also cover lost wages due to an accident. This benefit is typically limited to 60% of the policyholder’s average weekly wage, up to a maximum of $2,000 per month.

- Death Benefits: PIP can also provide death benefits to the beneficiaries of a policyholder who dies as a result of a car accident.

Filing a Claim Under Florida’s No-Fault System

When an accident occurs, the policyholder must first file a claim with their own insurance company. The PIP coverage will then cover the policyholder’s medical expenses and lost wages. The insurance company will review the claim and determine if it is eligible for benefits.

- Report the Accident: The policyholder must notify their insurance company of the accident as soon as possible. This can usually be done by phone or online.

- Seek Medical Attention: It is crucial to seek medical attention promptly after an accident, even if injuries seem minor. This will help ensure proper documentation of injuries and treatment.

- Submit a Claim: The policyholder must submit a claim to their insurance company, providing all necessary documentation, including medical bills, lost wage statements, and a police report.

- Review and Payment: The insurance company will review the claim and determine if it is eligible for benefits. Once approved, PIP benefits will be paid directly to the policyholder or their healthcare providers.

Navigating the Claims Process in Florida: The Best Car Insurance In Florida

Filing a car insurance claim in Florida can be a complex process, especially given the state’s unique no-fault laws. Understanding the steps involved and your rights as a policyholder can help ensure a smooth and successful claim resolution.

Reporting the Accident

Promptly reporting the accident to your insurance company is crucial. This should be done as soon as possible, ideally within 24 hours of the incident. Most insurers have dedicated phone lines or online portals for reporting accidents. During the reporting process, provide accurate details about the accident, including:

- Date, time, and location of the accident

- Description of the accident and the circumstances surrounding it

- Names, addresses, and contact information of all parties involved

- Details of any injuries sustained

- Information about any witnesses

- Details of any damage to vehicles

It’s also advisable to document the accident with photos and videos, if possible.

Gathering Documentation

After reporting the accident, gather necessary documentation to support your claim. This includes:

- A copy of your insurance policy

- Police report (if applicable)

- Photos and videos of the accident scene and damage

- Medical bills and records (if applicable)

- Repair estimates from qualified mechanics

- Witness statements

Communicating with the Insurer

Maintain open and clear communication with your insurer throughout the claims process. This includes:

- Responding promptly to requests for information

- Providing all necessary documentation in a timely manner

- Following up regularly to check on the status of your claim

- Expressing your concerns and questions clearly

It’s important to be patient and persistent during the claims process, as it can take time to resolve.

Maximizing Claim Resolution

To maximize your chances of a successful claim resolution, consider these tips:

- Be honest and accurate: Provide truthful information about the accident and your circumstances.

- Document everything: Keep detailed records of all communications, documentation, and deadlines.

- Seek legal advice: If you’re facing difficulties with your insurer, consult with a qualified attorney specializing in insurance claims.

- Understand your rights: Familiarize yourself with Florida’s no-fault law and your rights as a policyholder.

Common Claim Denial Scenarios

Insurance companies may deny claims for various reasons, including:

- Lack of coverage: The accident may not be covered under your policy.

- Policy violations: You may have violated the terms of your insurance policy.

- Fraudulent claims: The claim may be deemed fraudulent or based on false information.

- Pre-existing conditions: The damage may be attributed to pre-existing conditions, not the accident.

Appealing Denied Claims

If your claim is denied, you have the right to appeal the decision. The appeal process typically involves submitting a formal request for reconsideration, providing additional documentation, and potentially engaging in mediation or arbitration. It’s crucial to understand the appeal process and deadlines Artikeld in your insurance policy.

Resources for Florida Drivers

Navigating the complex world of car insurance in Florida can be daunting, but several resources are available to help drivers make informed decisions and ensure they have the coverage they need. This section explores some of the most valuable resources for Florida drivers seeking car insurance information, including government agencies, consumer advocacy groups, and online tools.

Government Agencies

Government agencies play a crucial role in regulating the insurance industry and protecting consumers’ rights. The Florida Department of Financial Services (DFS) is the primary agency responsible for overseeing insurance companies and investigating consumer complaints. The DFS website offers a wealth of information on car insurance, including:

- Consumer guides and brochures

- Information on insurance company ratings and financial stability

- A directory of insurance companies licensed to operate in Florida

- Forms and applications for filing complaints

The National Association of Insurance Commissioners (NAIC) is a non-profit organization that represents state insurance regulators. The NAIC website provides a variety of resources for consumers, including:

- Information on insurance regulations and laws

- Consumer guides and brochures on various insurance topics

- Tools for comparing insurance rates and coverage

Consumer Advocacy Groups

Consumer advocacy groups play a vital role in protecting consumers’ interests and advocating for fair insurance practices. These groups often provide free resources and support to consumers who are facing insurance-related issues. Some notable consumer advocacy groups in Florida include:

- The Florida Consumer Action Network (FCAN)

- The Florida Public Interest Research Group (PIRG)

- The National Consumer League

Online Tools

The internet offers a wide range of online tools that can help Florida drivers compare insurance rates, research companies, and understand their coverage options. Some popular online tools include:

- Insurance comparison websites

- Online insurance calculators

- Consumer review websites

Key Contact Details

Florida Department of Financial Services:

- Website: https://www.fldfs.com/

- Phone: (877) 693-5237

Florida Office of Insurance Regulation:

- Website: https://www.floir.com/

- Phone: (850) 413-3000

National Association of Insurance Commissioners:

- Website: https://www.naic.org/

- Phone: (816) 783-8600

Final Review

Finding the best car insurance in Florida can be a daunting task, but by understanding the unique factors at play and carefully considering your needs, you can secure the right coverage at a competitive price. Remember to compare quotes from multiple companies, leverage discounts, and maintain a good driving record to minimize your premiums. With a little research and planning, you can find the peace of mind knowing you have the best car insurance in Florida to protect you and your family.

Popular Questions

What are some common discounts offered by car insurance companies in Florida?

Common discounts include safe driver, good student, multi-car, and bundling discounts. You may also be eligible for discounts for anti-theft devices, driver training courses, and other safety features.

How can I file a car insurance claim in Florida?

Contact your insurance company immediately after an accident. They will guide you through the claims process, which typically involves reporting the accident, gathering documentation, and providing a statement.

What is the role of Personal Injury Protection (PIP) coverage in Florida?

PIP coverage pays for your medical expenses and lost wages after an accident, regardless of fault. It’s mandatory in Florida, and you can choose different coverage limits.