The cheapest car insurance in Florida is a hot topic for many drivers. Florida’s unique insurance landscape, characterized by high-risk drivers and frequent natural disasters, makes finding affordable coverage a priority. Understanding the factors that influence car insurance costs, comparing different providers, and implementing strategies to lower premiums are crucial for securing the best deal.

Navigating the Florida car insurance market can be challenging, but with the right information and approach, you can find the cheapest car insurance that meets your needs. This guide will explore the key factors influencing car insurance costs, provide tips for getting competitive quotes, and offer strategies to reduce your premiums.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance market is unique and complex, influenced by various factors that contribute to its high cost. This section delves into the intricacies of Florida’s insurance landscape, exploring the key factors that impact insurance premiums and the unique challenges that Florida drivers face.

Factors Influencing Car Insurance Costs in Florida

Several factors contribute to the relatively high cost of car insurance in Florida. These factors include:

- High Number of Accidents: Florida has a high rate of car accidents, which drives up insurance premiums. The state’s large population, extensive road network, and warm weather, which encourages driving, contribute to this high accident rate.

- High-Risk Drivers: Florida is home to a significant number of high-risk drivers, including those with poor driving records, a history of claims, or a lack of insurance. The presence of such drivers increases the likelihood of accidents and claims, resulting in higher premiums for all drivers.

- High Cost of Healthcare: Florida has a high cost of healthcare, which impacts the cost of car insurance. When accidents occur, insurance companies have to cover medical expenses, and the high cost of healthcare in Florida drives up these expenses.

- Frequent Natural Disasters: Florida is prone to hurricanes, tornadoes, and other natural disasters. These events can cause significant damage to vehicles and increase the likelihood of claims, leading to higher premiums.

- Fraudulent Claims: Florida has a higher-than-average rate of fraudulent insurance claims, which can impact the cost of insurance for all drivers. Insurance companies have to factor in the risk of fraudulent claims, leading to higher premiums.

- State Regulations: Florida has specific regulations regarding car insurance, including the requirement for Personal Injury Protection (PIP) coverage, which can affect the cost of insurance.

Unique Aspects of Florida’s Insurance Market

Florida’s car insurance market is unique due to several factors:

- High-Risk Drivers: The state has a large population of high-risk drivers, including those with poor driving records, a history of claims, or a lack of insurance. These drivers contribute to the high cost of car insurance for all drivers.

- Frequent Natural Disasters: Florida’s vulnerability to hurricanes and other natural disasters significantly impacts the insurance market. Insurance companies have to factor in the risk of these events, leading to higher premiums.

- Fraudulent Claims: Florida has a higher-than-average rate of fraudulent insurance claims, which puts a strain on the insurance market. Insurance companies have to factor in the risk of fraudulent claims, leading to higher premiums.

Common Car Insurance Coverage Options in Florida

Florida law requires drivers to carry specific car insurance coverage:

- Personal Injury Protection (PIP): PIP coverage is mandatory in Florida and covers medical expenses and lost wages for the policyholder and passengers in the insured vehicle, regardless of fault.

- Property Damage Liability (PDL): PDL coverage protects the policyholder from financial responsibility for damage to another person’s property in an accident.

- Bodily Injury Liability (BIL): BIL coverage protects the policyholder from financial responsibility for injuries to another person in an accident.

- Uninsured Motorist Coverage (UM): UM coverage protects the policyholder from financial losses if they are injured in an accident caused by an uninsured or hit-and-run driver.

- Underinsured Motorist Coverage (UIM): UIM coverage protects the policyholder if they are injured in an accident caused by a driver with insufficient insurance coverage.

- Collision Coverage: Collision coverage pays for repairs or replacement of the insured vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage pays for repairs or replacement of the insured vehicle if it is damaged by events other than an accident, such as theft, vandalism, or natural disasters.

Finding the Cheapest Car Insurance Options

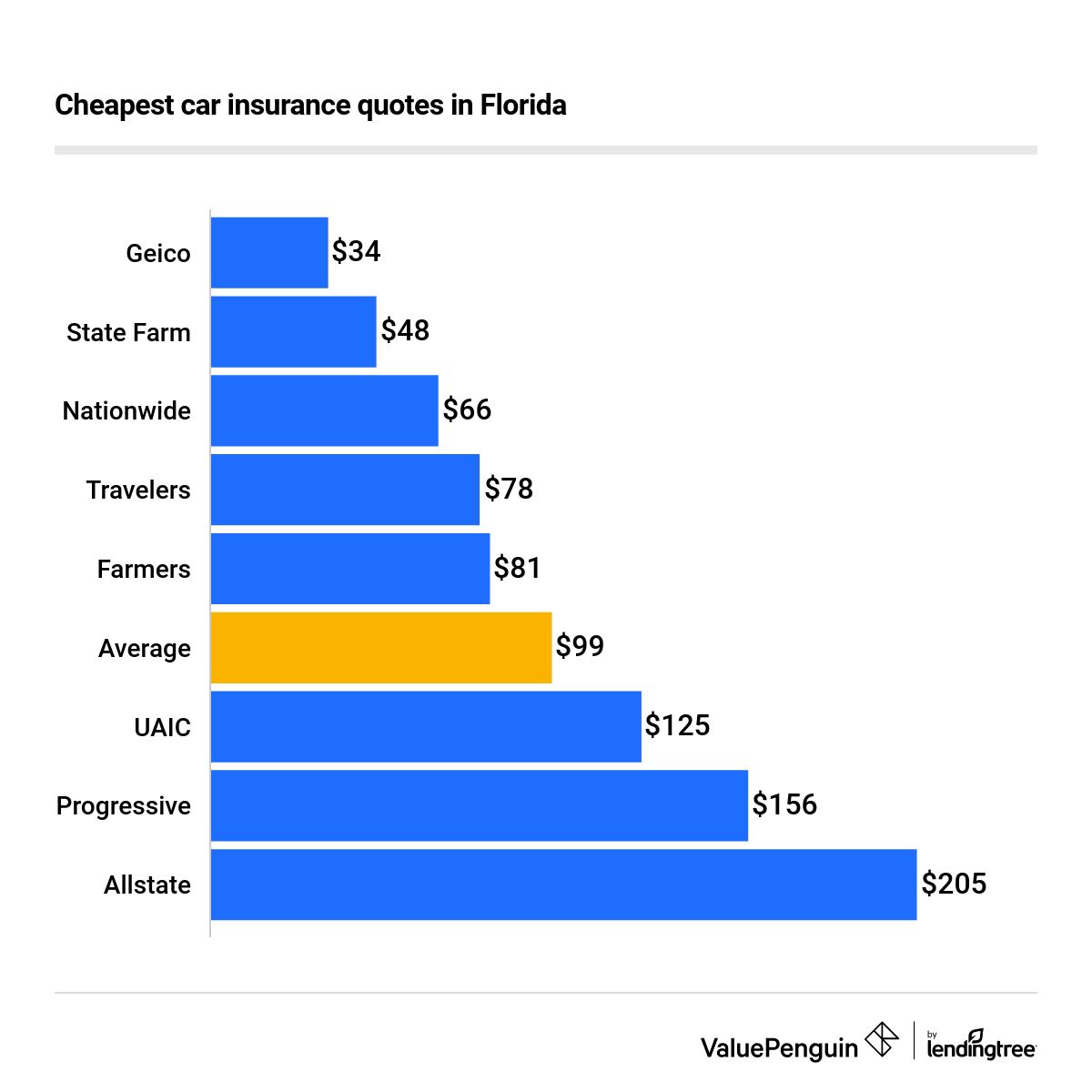

Finding the cheapest car insurance in Florida requires a strategic approach, as rates can vary significantly depending on your individual circumstances and the insurance provider you choose.

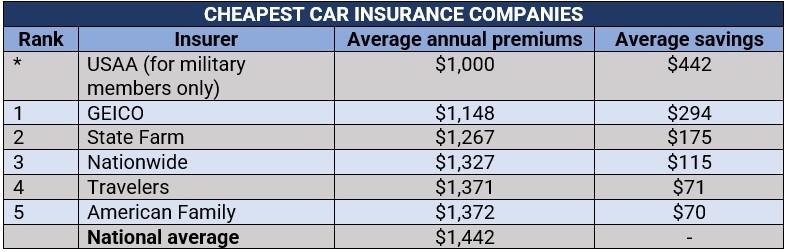

Comparing Car Insurance Providers

Florida’s car insurance market is diverse, offering a range of options from major national insurance companies to regional and online providers. Understanding the pros and cons of each type can help you find the best fit for your needs and budget.

- Major Insurance Companies: These companies, such as State Farm, Geico, and Progressive, have extensive nationwide networks and often offer competitive rates. They typically have a strong financial standing and a wide range of coverage options. However, they might have more stringent underwriting criteria and less flexibility in terms of customization.

- Regional Insurers: These companies focus on specific geographic areas, allowing them to tailor their policies to the local market. They often offer competitive rates and personalized service. However, they may have limited coverage options and a smaller network of agents compared to national companies.

- Online Providers: These companies operate entirely online, simplifying the insurance buying process and often offering competitive rates. They typically use algorithms to assess risk and provide quotes quickly. However, they might lack the personalized service and support offered by traditional insurance companies.

Getting Car Insurance Quotes

To find the cheapest car insurance, it’s essential to get quotes from multiple providers.

- Use Online Comparison Websites: Websites like Insurance.com and Policygenius allow you to compare quotes from various insurance companies simultaneously.

- Contact Insurance Companies Directly: Call or visit the websites of different insurance companies to get personalized quotes.

- Talk to Local Insurance Agents: Independent insurance agents can help you compare quotes from multiple companies and find the best coverage for your needs.

Factors Affecting Car Insurance Premiums

Several factors influence your car insurance premiums in Florida.

- Driving History: A clean driving record with no accidents or traffic violations will result in lower premiums.

- Age and Gender: Younger drivers generally pay higher premiums due to their higher risk of accidents. Gender can also play a role, as statistics show that men tend to have higher accident rates than women.

- Vehicle Type: The make, model, and year of your car can affect your insurance premiums. High-performance vehicles and luxury cars typically have higher insurance costs.

- Location: Your location in Florida can influence your car insurance rates. Areas with higher crime rates or a higher density of traffic tend to have higher insurance premiums.

- Credit Score: In some states, including Florida, insurance companies use credit scores to assess risk and determine premiums. A good credit score can result in lower premiums.

Strategies for Lowering Your Car Insurance Costs

Car insurance in Florida can be expensive, but there are several strategies you can use to lower your premiums. One of the most effective ways is to take advantage of the various discounts offered by insurance companies. Discounts can significantly reduce your insurance costs, making it more affordable to protect yourself and your vehicle.

Discounts Available for Car Insurance in Florida, The cheapest car insurance in florida

Insurance companies in Florida offer a wide range of discounts to their policyholders. These discounts can be based on various factors, such as your driving history, the type of car you drive, and your safety features. By understanding the different types of discounts available, you can maximize your savings and get the most affordable car insurance possible.

- Good Driver Discounts: These discounts are offered to drivers with a clean driving record, meaning they have not been involved in any accidents or received any traffic violations. This discount can be substantial, as it reflects your responsible driving habits.

- Safe Driving Course Discounts: Completing a defensive driving course can demonstrate your commitment to safe driving practices. These courses often teach you about traffic laws, defensive driving techniques, and accident avoidance strategies. Many insurance companies in Florida offer discounts to drivers who have completed an approved safe driving course.

- Bundling Discounts: Many insurance companies offer discounts if you bundle your car insurance with other types of insurance, such as homeowners, renters, or life insurance. This bundling strategy can significantly reduce your overall insurance costs.

- Anti-theft Device Discounts: Installing anti-theft devices in your car, such as alarm systems, immobilizers, or GPS tracking devices, can make your vehicle less attractive to thieves. Insurance companies often reward policyholders with discounts for having these devices installed.

- Vehicle Safety Feature Discounts: Cars with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer to drive. Insurance companies may offer discounts to drivers who own vehicles with these features.

- Good Student Discounts: This discount is typically available to students who maintain a certain GPA or academic standing. Insurance companies view good students as more responsible and less likely to be involved in accidents.

- Multi-Car Discounts: If you have multiple vehicles insured under the same policy, you may qualify for a multi-car discount. This discount reflects the fact that insurance companies have a lower risk of claims with multiple vehicles insured together.

- Loyalty Discounts: Insurance companies often reward long-term customers with loyalty discounts. These discounts can be significant, particularly for policyholders who have been with the same company for several years.

| Discount Type | Benefits | Limitations |

|---|---|---|

| Good Driver Discount | Significant savings for drivers with clean driving records. | Requires a clean driving history, which may not be achievable for all drivers. |

| Safe Driving Course Discount | Demonstrates commitment to safe driving practices and can lead to substantial savings. | Requires completion of an approved safe driving course. |

| Bundling Discount | Reduces overall insurance costs by combining multiple insurance policies. | Requires bundling with other insurance products, which may not be feasible for all policyholders. |

| Anti-theft Device Discount | Rewards policyholders for installing anti-theft devices and can reduce the risk of theft. | Requires installing anti-theft devices, which can be an additional expense. |

| Vehicle Safety Feature Discount | Recognizes the safety features of vehicles and can lead to lower premiums. | Only available for vehicles with specific safety features. |

| Good Student Discount | Available to students with good academic standing and demonstrates responsibility. | Limited to students who meet specific academic requirements. |

| Multi-Car Discount | Provides savings for policyholders with multiple vehicles insured together. | Requires multiple vehicles insured under the same policy. |

| Loyalty Discount | Rewards long-term customers with discounts for their continued business. | Requires being a long-term customer of the same insurance company. |

Last Point

Finding the cheapest car insurance in Florida requires a proactive approach. By understanding the factors that influence premiums, comparing quotes from multiple providers, and implementing cost-saving strategies, you can secure the best possible coverage at an affordable price. Remember, your driving record, vehicle type, and location all play a significant role in determining your insurance rates. Be sure to consider your individual needs and driving habits when selecting a policy to ensure you have adequate protection.

Q&A: The Cheapest Car Insurance In Florida

What is the minimum car insurance coverage required in Florida?

Florida requires all drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage. This is known as the “no-fault” insurance system.

What are some common discounts offered by car insurance companies in Florida?

Common discounts include good driver discounts, safe driving courses, bundling discounts (combining home and auto insurance), and discounts for anti-theft devices.

How can I get multiple car insurance quotes online?

Many online comparison websites allow you to enter your information once and receive quotes from multiple insurance companies. This makes it easy to compare rates and find the best deal.

What happens if I drive without car insurance in Florida?

Driving without car insurance in Florida is illegal and can result in fines, license suspension, and even jail time. Additionally, if you are involved in an accident without insurance, you will be responsible for all damages and injuries.