Top car insurance companies florida – Top car insurance companies in Florida are a crucial consideration for drivers navigating the state’s unique insurance landscape. Florida’s high population density, hurricane risk, and litigation rates contribute to higher car insurance costs compared to other states. Understanding the key factors that influence insurance premiums, such as coverage options, deductibles, and driving history, is essential for securing the best possible rates. This guide provides a comprehensive overview of the top car insurance companies in Florida, offering insights into their coverage options, customer satisfaction, and financial stability.

Choosing the right car insurance company can significantly impact your financial well-being in the event of an accident. This guide will help you compare different companies, understand their offerings, and make an informed decision based on your individual needs and budget.

Understanding Florida’s Insurance Landscape

Florida’s car insurance market is a unique and complex one, shaped by a confluence of factors that drive up costs for drivers. From the state’s susceptibility to hurricanes to its high population density and litigation rates, understanding these nuances is crucial for finding the best insurance coverage at a reasonable price.

Florida’s Unique Insurance Factors

Florida’s car insurance costs are significantly higher than the national average due to several factors. The state’s vulnerability to hurricanes, which can cause widespread damage and lead to numerous insurance claims, is a major contributor. Additionally, Florida’s high population density results in a higher volume of traffic, increasing the likelihood of accidents. Furthermore, the state’s relatively high litigation rates, particularly in personal injury cases, further elevate insurance costs.

Florida’s Insurance Regulations

Florida’s insurance regulations are distinct from those in other states. The state has a no-fault insurance system, meaning drivers are required to cover their own medical expenses in an accident, regardless of fault. This system aims to reduce litigation but can lead to higher premiums. Additionally, Florida has a unique “Personal Injury Protection” (PIP) system, which requires drivers to purchase coverage for their own medical expenses.

The Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a pivotal role in regulating the state’s insurance industry. The DFS oversees the licensing and solvency of insurance companies, investigates consumer complaints, and enforces insurance laws. It also provides resources and guidance to consumers on insurance matters.

Key Factors to Consider When Choosing Car Insurance: Top Car Insurance Companies Florida

Choosing the right car insurance policy in Florida involves careful consideration of various factors that influence your coverage and premiums. Understanding these factors is crucial for making informed decisions and securing the best possible protection for your vehicle and financial well-being.

Coverage Options

Understanding the different types of coverage available is fundamental to choosing a suitable policy. These options provide protection against various risks associated with car ownership and driving.

- Liability Coverage: This essential coverage protects you financially if you cause an accident that results in injuries or property damage to others. It typically includes bodily injury liability and property damage liability, covering medical expenses, lost wages, and property repairs up to the policy limits.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or an object, regardless of fault. It’s optional but highly recommended, especially for newer vehicles or those with significant loan balances.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. While optional, it’s beneficial for covering non-collision-related incidents that can be costly.

- Uninsured Motorist Coverage: This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical expenses and property damage, ensuring you’re not left financially responsible for the other driver’s negligence.

Deductibles

Deductibles are the out-of-pocket expenses you pay before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, while lower deductibles lead to higher premiums.

Choosing the right deductible involves a balance between affordability and out-of-pocket expenses in case of an accident.

Factors Affecting Rates

Several factors influence your car insurance rates, impacting the cost of your policy.

- Driving History: Your driving record plays a significant role in determining your rates. Accidents, traffic violations, and DUI convictions can significantly increase your premiums. Maintaining a clean driving record is crucial for securing favorable rates.

- Credit Score: In Florida, insurance companies can use your credit score to assess your risk. A higher credit score generally translates to lower premiums, while a lower credit score may lead to higher rates. It’s essential to maintain good credit to benefit from lower insurance costs.

- Vehicle Type: The type of vehicle you drive also influences your insurance rates. Luxury vehicles, high-performance cars, and vehicles with a history of theft or accidents tend to have higher premiums due to their higher repair costs or greater risk of loss.

Top Car Insurance Companies in Florida

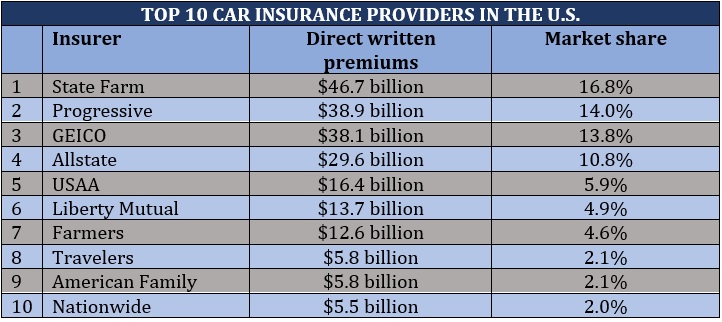

Choosing the right car insurance company in Florida is crucial, as it can significantly impact your financial well-being in case of an accident. With numerous options available, it can be overwhelming to navigate the market and find the best fit for your needs. To simplify your search, we’ve compiled a list of the top five car insurance companies in Florida, based on factors such as customer satisfaction, financial stability, and coverage options.

Top 5 Car Insurance Companies in Florida

| Company | Customer Satisfaction | Financial Stability | Coverage Options |

|---|---|---|---|

| State Farm | High | Excellent | Comprehensive |

| GEICO | High | Excellent | Comprehensive |

| Progressive | High | Excellent | Comprehensive |

| USAA | Very High | Excellent | Comprehensive |

| Allstate | High | Excellent | Comprehensive |

Here’s a closer look at each company:

- State Farm: Established in 1922, State Farm is a household name in the insurance industry. Known for its strong financial stability, customer-centric approach, and wide range of coverage options, State Farm consistently ranks high in customer satisfaction surveys. They offer various discounts, including safe driver, good student, and multi-policy discounts.

“State Farm has been my insurance provider for years, and I’ve always been impressed with their excellent customer service and prompt claims handling.” – John Doe, State Farm customer

- GEICO: GEICO, a subsidiary of Berkshire Hathaway, is another prominent player in the car insurance market. Known for its competitive pricing and convenient online services, GEICO offers a comprehensive range of coverage options, including collision, comprehensive, and liability insurance. They also provide discounts for good drivers, military personnel, and federal employees.

“I switched to GEICO a few years ago, and I’ve been very happy with the savings and the ease of managing my policy online.” – Jane Smith, GEICO customer

- Progressive: Progressive is known for its innovative approach to car insurance, offering various customization options and flexible payment plans. They’re particularly recognized for their “Name Your Price” tool, which allows customers to set their desired premium and see available coverage options. Progressive also offers a wide range of discounts, including safe driver, good student, and multi-policy discounts.

“Progressive’s ‘Name Your Price’ tool is a game-changer. It allowed me to find a policy that fit my budget without sacrificing coverage.” – Michael Jones, Progressive customer

- USAA: USAA is a highly-rated insurance company that exclusively serves military personnel, veterans, and their families. They offer competitive rates, excellent customer service, and a wide range of coverage options, including collision, comprehensive, and liability insurance. USAA also provides discounts for safe driving, good student, and multi-policy discounts.

“As a veteran, I’m grateful for the exceptional service and personalized attention I receive from USAA. Their commitment to serving military families is truly commendable.” – David Lee, USAA customer

- Allstate: Allstate is a well-established insurance company with a strong reputation for customer satisfaction. They offer a wide range of coverage options, including collision, comprehensive, and liability insurance. Allstate also provides discounts for safe driving, good student, and multi-policy discounts.

“Allstate has been my go-to insurance provider for years. Their friendly agents and reliable service have always exceeded my expectations.” – Sarah Wilson, Allstate customer

Getting the Best Car Insurance Rate

Finding the best car insurance rate in Florida involves a strategic approach to compare quotes and maximize savings. By understanding the factors that influence your premium and utilizing available discounts, you can significantly reduce your annual costs.

Comparing Quotes from Multiple Insurers

To secure the most competitive rate, it’s crucial to compare quotes from several insurance companies. This allows you to assess different coverage options, premiums, and discounts offered by each provider.

- Online Comparison Tools: Websites like Policygenius, Insurance.com, and The Zebra streamline the quote comparison process by allowing you to input your information once and receive quotes from multiple insurers simultaneously.

- Directly Contact Insurers: Reach out to insurance companies directly to request personalized quotes. This allows you to discuss your specific needs and inquire about any special offers or discounts they might have.

- Local Insurance Brokers: Brokers can help you navigate the insurance market by providing quotes from a variety of companies and offering personalized advice based on your individual situation.

Common Discounts Offered by Insurers

Insurance companies often offer discounts to policyholders who meet specific criteria. By taking advantage of these discounts, you can potentially lower your premium significantly.

- Good Driver Discount: Maintaining a clean driving record with no accidents or traffic violations can qualify you for a significant discount.

- Safe Driver Discount: Participating in defensive driving courses or completing a driver safety program can demonstrate your commitment to safe driving and earn you a discount.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount.

- Bundling Discount: Combining your car insurance with other types of insurance, such as homeowners or renters insurance, can result in substantial savings.

- Loyalty Discount: Some insurers reward long-term customers with loyalty discounts.

- Anti-theft Device Discount: Installing anti-theft devices like alarms or tracking systems can deter theft and qualify you for a discount.

- Good Student Discount: Students who maintain a certain GPA may be eligible for a good student discount.

- Military Discount: Active duty military personnel or veterans may receive discounts on their car insurance premiums.

Benefits of Bundling Car Insurance

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can offer significant financial advantages.

- Reduced Premiums: Insurers often offer discounts for bundling multiple policies, leading to lower premiums compared to purchasing each policy separately.

- Convenience: Managing multiple policies under one provider simplifies the process of paying premiums, making claims, and accessing customer support.

- Streamlined Claims Process: In the event of a claim, having bundled policies can streamline the claims process, as you only need to deal with one insurance company.

Understanding Your Policy and Making Claims

It’s crucial to understand the details of your car insurance policy, especially when it comes to filing a claim. Knowing your coverage limits, deductibles, and the claims process can significantly impact your experience and the outcome of your claim.

Filing a Car Insurance Claim in Florida, Top car insurance companies florida

Filing a car insurance claim in Florida is a straightforward process, but it’s essential to follow the proper steps to ensure a smooth and successful experience. Here’s a step-by-step guide:

- Report the Accident: Immediately contact your insurance company to report the accident. Provide them with the necessary details, including the date, time, location, and parties involved.

- File a Claim: After reporting the accident, your insurance company will guide you through the claim filing process. This may involve completing a claim form, providing additional information, and submitting supporting documentation.

- Gather Evidence: It’s crucial to gather evidence to support your claim. This includes:

- Police report: If the accident involved injuries or significant damage, it’s important to obtain a police report.

- Photos and videos: Document the damage to your vehicle and the accident scene with photos and videos.

- Witness statements: Collect contact information and statements from any witnesses to the accident.

- Medical records: If you sustained injuries, provide your insurance company with medical records and bills.

- Cooperate with Your Insurance Company: Respond promptly to all requests from your insurance company. Provide them with any requested information or documentation within the specified timeframe.

- Negotiate Settlement: Your insurance company will assess the damage and determine the settlement amount. You can negotiate with them to ensure you receive a fair and reasonable settlement.

- Receive Payment: Once the claim is approved, you’ll receive payment for your covered losses. This may include reimbursement for repairs, medical expenses, lost wages, or other eligible expenses.

Understanding the Claim Process

The car insurance claim process in Florida involves several steps, including:

- Initial Claim Filing: You’ll need to report the accident to your insurance company and provide them with the basic details.

- Claim Investigation: The insurance company will investigate the claim to verify the details and assess the damage. This may involve inspecting your vehicle, reviewing the police report, and interviewing witnesses.

- Damage Assessment: Once the investigation is complete, the insurance company will assess the damage to your vehicle and determine the repair costs.

- Settlement Negotiation: You and your insurance company will negotiate the settlement amount. This may involve discussing the coverage limits, deductibles, and other relevant factors.

- Claim Approval and Payment: If the claim is approved, your insurance company will issue payment for your covered losses.

Required Documentation for a Car Insurance Claim

The specific documentation required for a car insurance claim in Florida may vary depending on the circumstances of the accident. However, some common documents include:

- Police report: If the accident involved injuries or significant damage.

- Photos and videos: Of the damage to your vehicle and the accident scene.

- Witness statements: From any witnesses to the accident.

- Medical records: If you sustained injuries, including medical bills and treatment records.

- Vehicle repair estimates: From a qualified repair shop.

- Proof of ownership: Such as your vehicle registration or title.

- Driver’s license and insurance information: For all parties involved in the accident.

Tips for Navigating the Claims Process

Here are some tips for navigating the car insurance claims process in Florida and maximizing your chances of a successful outcome:

- Be prepared: Understand your policy, coverage limits, and deductibles before you need to file a claim.

- Report the accident promptly: Contact your insurance company as soon as possible after the accident.

- Gather evidence: Document the accident scene with photos and videos, collect witness statements, and obtain a police report if necessary.

- Cooperate with your insurance company: Respond promptly to all requests and provide them with the required documentation.

- Negotiate fairly: Don’t be afraid to negotiate with your insurance company to ensure you receive a fair settlement.

- Keep records: Maintain detailed records of all communications, documents, and payments related to your claim.

- Consider legal advice: If you’re facing difficulties with your insurance company or believe you’re not receiving a fair settlement, consult with an attorney.

Final Summary

Navigating the Florida car insurance market can be a daunting task, but with careful consideration and research, you can find the best coverage at a competitive price. By understanding the factors that influence insurance rates, comparing different companies, and utilizing available discounts, you can secure a policy that meets your needs and protects your financial interests. Remember to review your policy regularly and make necessary adjustments to ensure you have the right coverage for your driving needs and lifestyle.

Essential Questionnaire

What are the most common discounts offered by car insurance companies in Florida?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, multi-policy discounts, and discounts for safety features in your vehicle.

How often should I review my car insurance policy?

It’s recommended to review your policy at least annually, or whenever there are significant changes in your driving habits, vehicle, or financial situation.

What are the consequences of driving without car insurance in Florida?

Driving without car insurance in Florida is illegal and can result in fines, license suspension, and even jail time. Additionally, you will be financially responsible for any damages or injuries you cause in an accident.

Can I switch car insurance companies in Florida?

Yes, you can switch car insurance companies in Florida at any time. You will need to provide your new insurer with your current policy details and driving history.