Top car insurance Florida: Navigating the Sunshine State’s unique insurance landscape can feel like driving through a maze, but with the right guidance, finding the best coverage for your needs can be a smooth ride. Florida’s weather patterns, demographics, and legal considerations all influence car insurance costs, creating a distinct environment for drivers. This guide delves into the intricacies of Florida’s car insurance market, offering insights on crucial factors like coverage options, discounts, and claims processes.

From understanding Florida’s no-fault insurance laws to comparing top providers and their strengths, we’ll equip you with the knowledge to make informed decisions about your car insurance. We’ll also explore ways to minimize costs, navigate the claims process effectively, and ensure you’re protected in the event of an accident.

Understanding Florida’s Car Insurance Landscape

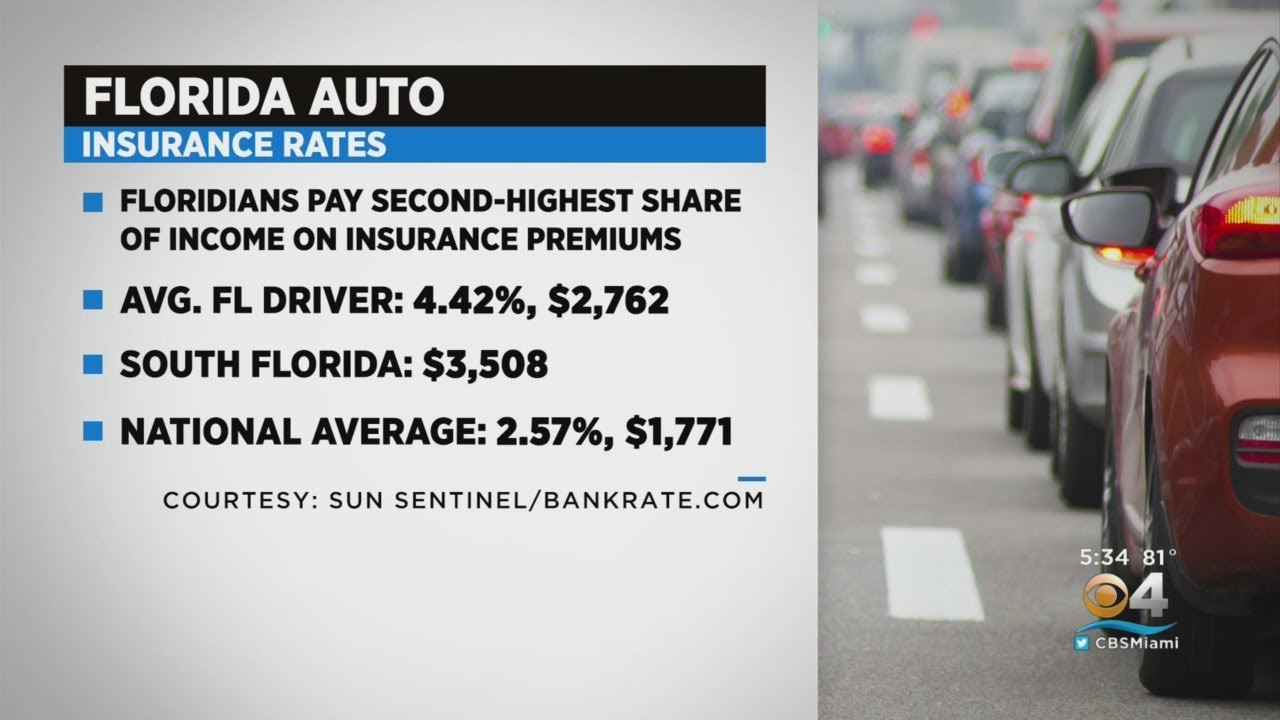

Florida’s car insurance landscape is a complex and unique environment, shaped by a confluence of factors that influence the cost of coverage. Understanding these factors is crucial for drivers seeking affordable and comprehensive insurance.

Factors Influencing Car Insurance Costs, Top car insurance florida

The cost of car insurance in Florida is influenced by a variety of factors, including weather patterns, demographics, and legal considerations.

- Weather Patterns: Florida’s susceptibility to hurricanes and other severe weather events significantly impacts insurance costs. Insurance companies factor in the increased risk of damage and claims associated with these events, resulting in higher premiums for Florida drivers.

- Demographics: The state’s large population and diverse demographics contribute to the high volume of vehicles on the road, increasing the likelihood of accidents. This, in turn, influences insurance premiums.

- Legal Considerations: Florida’s “no-fault” insurance system, which requires drivers to be covered by personal injury protection (PIP) regardless of fault, can impact insurance costs. This system aims to reduce litigation but can also lead to higher premiums due to increased claims.

Florida’s Insurance Regulations

Florida’s insurance regulations differ significantly from those in other states.

- No-Fault System: Florida’s no-fault system requires drivers to carry PIP coverage, which covers medical expenses and lost wages regardless of who is at fault in an accident. This system aims to reduce litigation and expedite claims processing but can lead to higher premiums.

- Minimum Coverage Requirements: Florida mandates minimum coverage requirements for all drivers, including bodily injury liability, property damage liability, PIP, and uninsured motorist coverage. These requirements ensure basic protection for drivers and passengers.

- Rate Regulation: Florida has a regulated insurance market, meaning that insurance rates are subject to review and approval by the state’s Office of Insurance Regulation. This regulation aims to ensure fair and competitive rates.

Types of Car Insurance Coverage

Florida drivers have access to various types of car insurance coverage, each designed to provide specific protection in different situations.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident and cause injury or damage to others. It includes bodily injury liability and property damage liability.

- Personal Injury Protection (PIP): This coverage covers medical expenses and lost wages for you and your passengers, regardless of fault. It is mandatory in Florida.

- Uninsured Motorist Coverage: This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. It covers medical expenses and property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by events other than accidents, such as theft, vandalism, or natural disasters.

Finding the Best Car Insurance for Your Needs

Navigating the Florida car insurance market can feel overwhelming, with numerous companies offering a wide range of coverage options and prices. However, finding the right car insurance policy for your needs doesn’t have to be a daunting task. By understanding the key factors involved and following a structured approach, you can ensure you secure the best coverage at a competitive price.

Factors to Consider When Choosing Car Insurance in Florida

Choosing the right car insurance policy involves weighing several factors to determine the best fit for your individual circumstances.

| Factor | Description |

|---|---|

| Coverage Options |

|

| Deductibles | The amount you pay out of pocket before your insurance kicks in for covered incidents. A higher deductible generally means lower premiums, while a lower deductible means higher premiums. |

| Discounts | Car insurance companies offer various discounts to lower your premiums. Some common discounts include:

|

| Customer Service |

|

Common Car Insurance Discounts in Florida

Several discounts can help you save money on your car insurance premiums in Florida. Understanding the eligibility criteria for these discounts is crucial for maximizing your savings.

- Good Driver Discount: This discount is typically offered to drivers with a clean driving record for a specific period, usually three to five years, without any accidents or traffic violations.

- Safe Driver Discount: This discount is available to drivers who have completed a defensive driving course approved by the Florida Department of Highway Safety and Motor Vehicles (FLHSMV). These courses typically cover safe driving practices, traffic laws, and accident prevention strategies.

- Multi-Car Discount: This discount applies when you insure multiple vehicles with the same insurance company. The discount percentage varies depending on the insurer and the number of vehicles insured.

- Multi-Policy Discount: This discount is offered when you bundle your car insurance with other insurance policies, such as home, renters, or life insurance, from the same company.

- Good Student Discount: This discount is typically available to students with a good academic record, usually a GPA of 3.0 or higher.

- Anti-theft Device Discount: This discount is offered to vehicle owners who have installed anti-theft devices, such as alarms, immobilizers, or tracking systems, that reduce the risk of theft.

- Other Discounts: Some insurance companies offer additional discounts based on factors like your occupation, military service, or membership in certain organizations.

Steps to Compare and Choose the Best Car Insurance Policy

Comparing car insurance quotes from different companies is crucial for finding the best policy for your needs. Here’s a step-by-step guide to effectively compare and choose the right car insurance policy:

- Determine Your Coverage Needs: Start by assessing your individual needs and risk tolerance. Consider factors such as the value of your vehicle, your driving history, and your financial situation. This will help you decide which coverage options are essential and which you can potentially forgo.

- Gather Information: Once you’ve determined your coverage needs, gather information about your vehicle, including its make, model, year, and VIN. You’ll also need to provide information about your driving history, including your age, address, and any accidents or traffic violations.

- Get Quotes from Multiple Companies: Request quotes from several insurance companies to compare prices and coverage options. You can use online comparison websites, contact companies directly, or work with an insurance broker.

- Review and Compare Quotes: Carefully review the quotes you receive, paying close attention to the coverage options, deductibles, discounts, and premium amounts. Make sure you understand what each quote includes and what is excluded.

- Ask Questions: Don’t hesitate to ask questions if you’re unclear about any aspect of the quotes or the insurance company’s policies. This will help you make an informed decision.

- Choose the Best Policy: Once you’ve compared quotes and asked any necessary questions, select the policy that best meets your needs and budget. Consider factors like coverage options, premium cost, customer service reputation, and claims handling process.

Key Considerations for Florida Drivers

Navigating Florida’s car insurance landscape requires understanding its unique regulations and practices. This section delves into crucial considerations for Florida drivers, covering no-fault insurance laws, cost-saving strategies, and the role of the state’s insurance regulator.

Understanding Florida’s No-Fault Insurance Laws

Florida operates under a no-fault insurance system, meaning drivers are primarily responsible for covering their own injuries and damages after an accident, regardless of fault. This system aims to expedite claims processing and reduce litigation. However, it’s essential to understand its implications:

- Personal Injury Protection (PIP): This coverage, mandated in Florida, pays for medical expenses, lost wages, and other related costs incurred by the insured, regardless of fault. The coverage limit is typically $10,000.

- Fault Determination: While PIP covers your own expenses, you can still pursue a claim against the at-fault driver for additional damages exceeding your PIP coverage, such as pain and suffering, property damage, and lost wages exceeding the PIP limit.

- Threshold for Seeking Fault: To pursue a claim against the at-fault driver for additional damages, you must meet certain thresholds. These thresholds vary based on the severity of your injuries.

Minimizing Car Insurance Costs in Florida

Florida’s high insurance rates can be a significant financial burden. Several strategies can help you reduce your car insurance premiums:

- Maintain a Good Driving Record: A clean driving history is crucial for lower premiums. Avoid traffic violations and accidents, as these significantly increase your insurance costs.

- Choose Safe Vehicles: Cars with safety features like anti-theft systems, airbags, and electronic stability control often qualify for discounts.

- Explore Alternative Coverage Options: Consider increasing your deductible to lower your premium. You can also explore options like higher deductibles for comprehensive and collision coverage, as these can result in lower premiums.

- Bundle Your Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can lead to significant discounts.

- Shop Around for Quotes: Compare quotes from multiple insurance companies to find the best rates for your needs.

Role of the Florida Office of Insurance Regulation (OIR)

The Florida Office of Insurance Regulation (OIR) plays a vital role in protecting consumers and ensuring fair insurance practices. The OIR:

- Regulates Insurance Companies: The OIR oversees insurance companies operating in Florida, ensuring they comply with state laws and regulations.

- Investigates Consumer Complaints: The OIR investigates complaints from consumers regarding insurance practices and helps resolve disputes.

- Provides Information and Resources: The OIR offers valuable information and resources to consumers on insurance topics, including car insurance.

Top Car Insurance Providers in Florida: Top Car Insurance Florida

Choosing the right car insurance provider in Florida is crucial, as rates can vary significantly based on factors like your driving history, vehicle type, and location. Navigating the vast array of options can be overwhelming, so understanding the strengths and weaknesses of different providers is essential.

Factors Influencing a Provider’s Reputation and Trustworthiness

A car insurance provider’s reputation and trustworthiness are built upon a combination of factors. Florida residents prioritize several key aspects when selecting a provider:

- Financial Stability: A provider’s financial strength is paramount. Companies with strong financial ratings are more likely to be able to pay claims in a timely manner, even in the event of a major catastrophe. You can assess a provider’s financial health by checking their ratings from agencies like A.M. Best, Standard & Poor’s, and Moody’s.

- Customer Satisfaction: Positive customer experiences are crucial. Look for providers with high customer satisfaction scores from organizations like J.D. Power and Consumer Reports. These ratings reflect how well a company handles claims, customer service interactions, and overall satisfaction with the policyholder experience.

- Claims Handling: A provider’s claims handling process is a key indicator of trustworthiness. Seek companies known for prompt and fair claim settlements. Investigate their claim-handling procedures, average processing times, and customer feedback regarding claim resolution.

- Transparency and Communication: Clear and concise communication is vital. Choose a provider that provides clear policy terms and conditions, offers accessible customer service channels, and keeps you informed throughout the entire insurance process.

Comparing Customer Service Experiences

Customer service is a crucial differentiator among car insurance companies in Florida. While many providers strive to offer excellent service, notable differences exist in how they handle inquiries, claim processing, and overall communication:

- Accessibility: Providers with multiple communication channels, such as phone, email, and online chat, tend to score higher in customer satisfaction. The availability of 24/7 customer service is also highly valued by policyholders.

- Response Time: Prompt responses to inquiries and claim notifications are essential. Companies with shorter wait times for customer service representatives and quicker claim processing are generally preferred.

- Personalized Service: Providers that offer personalized service, such as dedicated account managers or personalized communication, tend to build stronger relationships with their customers.

- Complaint Resolution: A provider’s ability to effectively resolve customer complaints is a significant factor in customer satisfaction. Look for companies with established complaint resolution processes and a track record of addressing customer concerns fairly.

Top Car Insurance Providers in Florida

Here is a table highlighting some of the top car insurance providers in Florida, including their key features, strengths, and weaknesses:

| Provider | Key Features | Strengths | Weaknesses |

|---|---|---|---|

| State Farm | Wide range of coverage options, strong financial stability, extensive agent network | Excellent customer service, strong financial rating, widespread availability | Can be expensive for some drivers, limited online tools |

| GEICO | Competitive rates, easy online quoting and policy management, strong brand recognition | Affordable premiums, user-friendly website and mobile app, strong financial rating | Limited agent network, fewer coverage options than some competitors |

| Progressive | Innovative features like Name Your Price, customizable coverage options, strong online presence | Wide range of discounts, user-friendly online platform, strong financial rating | Can be expensive for high-risk drivers, some customers report issues with claims handling |

| Allstate | Wide range of coverage options, strong financial stability, dedicated customer service representatives | Excellent customer service, strong financial rating, extensive agent network | Can be expensive for some drivers, limited online tools |

| USAA | Exclusive to military members and their families, excellent customer service, strong financial stability | Highly rated for customer satisfaction, strong financial rating, excellent claims handling | Limited availability, only available to military members and their families |

Navigating the Claims Process

In the unfortunate event of an accident, navigating the car insurance claims process in Florida can seem daunting. However, understanding the steps involved and your rights as a policyholder can help ensure a smoother and fairer resolution.

Filing a Car Insurance Claim

Filing a claim promptly after an accident is crucial. The following steps Artikel the process:

- Contact Your Insurance Company: Immediately notify your insurance company about the accident. Provide them with the details, including the date, time, location, and any injuries sustained. This initial notification is crucial for initiating the claims process.

- File a Police Report: If the accident involved property damage or injuries, file a police report. The police report serves as official documentation of the incident, which is often required by your insurance company.

- Gather Evidence: Collect all relevant evidence, including photographs of the damage, witness contact information, and medical records if applicable. This documentation helps support your claim and provides a detailed account of the accident.

- Complete the Claim Form: Your insurance company will provide a claim form to complete. Fill it out accurately and completely, providing all the necessary information. Review the form carefully before submitting it.

- Submit Supporting Documentation: Along with the claim form, submit all the supporting documentation you have gathered, including the police report, photographs, and medical records.

Types of Car Insurance Claims

Florida law requires drivers to carry Personal Injury Protection (PIP) coverage and Property Damage Liability (PDL) coverage. Understanding the different types of car insurance claims can help you navigate the process effectively:

- Collision Claims: These claims cover damage to your vehicle resulting from a collision with another vehicle or an object. You can file a collision claim regardless of who is at fault for the accident.

- Comprehensive Claims: These claims cover damage to your vehicle from events other than collisions, such as theft, vandalism, natural disasters, or animal strikes.

- Liability Claims: If you are at fault for an accident causing damage to another person’s vehicle or property, their insurance company may file a liability claim against you.

Communicating with Your Insurance Company

Effective communication with your insurance company is vital throughout the claims process. Here are some tips for ensuring a smooth and fair resolution:

- Be Prompt and Responsive: Respond to your insurance company’s requests for information promptly and provide all the necessary documentation. Delays can hinder the claims process.

- Be Clear and Concise: When communicating with your insurance company, be clear and concise in your explanations. Avoid using jargon or technical terms that they may not understand.

- Be Patient and Persistent: The claims process can take time, so be patient and persistent in following up with your insurance company. Keep track of all communications and document any issues or concerns you may have.

- Know Your Rights: Familiarize yourself with your rights as a policyholder. Florida law provides specific protections for consumers in insurance claims.

Last Recap

Armed with this knowledge, you’re ready to confidently navigate the Florida car insurance landscape. Remember, finding the right coverage isn’t just about price; it’s about peace of mind knowing you have the protection you need. Take your time, compare options, and choose a policy that fits your individual needs and driving habits. By doing so, you’ll be well-equipped to handle the road ahead, knowing you have the right insurance partner by your side.

FAQ Explained

What are the minimum car insurance requirements in Florida?

Florida requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident.

How can I get a discount on my car insurance in Florida?

Common discounts include safe driving records, bundling insurance policies, having safety features in your car, and maintaining good credit.

What should I do if I get into an accident in Florida?

Call the police, exchange information with the other driver(s), and contact your insurance company to report the accident.