- Florida’s Unique Insurance Landscape: Top Car Insurance In Florida

- Essential Coverage Considerations

- Key Factors Influencing Premiums

- Top Car Insurance Providers in Florida

- Strategies for Finding the Best Rates

- Understanding Discounts and Savings

- Navigating Claims and Disputes

- Conclusive Thoughts

- Frequently Asked Questions

Top car insurance in Florida is a critical consideration for drivers in the Sunshine State, where unique factors like hurricane risk and strict regulations influence insurance costs. Florida’s unique insurance landscape presents a distinct set of challenges and opportunities for drivers, requiring a strategic approach to securing the best coverage at the most affordable rates. This guide delves into the essential aspects of car insurance in Florida, helping you navigate the complexities and find the best policy to meet your individual needs.

From understanding essential coverages to identifying key factors that impact premiums, this guide provides a comprehensive overview of the Florida car insurance market. We’ll explore top car insurance providers, strategies for finding the best rates, and valuable tips for navigating claims and disputes. By the end, you’ll be equipped with the knowledge and tools to make informed decisions about your car insurance in Florida.

Florida’s Unique Insurance Landscape: Top Car Insurance In Florida

Florida’s car insurance market stands out as a distinct entity compared to other states, primarily due to a confluence of factors that shape its pricing, regulations, and overall dynamics. These factors, including the state’s susceptibility to hurricanes and other natural disasters, coupled with its unique legal framework, create a complex and often challenging environment for both insurers and policyholders.

Hurricane Risk and Natural Disasters

The prevalence of hurricanes and other natural disasters in Florida significantly influences car insurance premiums. The state experiences a higher frequency and intensity of hurricanes compared to other parts of the country, leading to substantial property damage and increased claims. Insurance companies factor in this risk by incorporating hurricane-related costs into their premium calculations. This means that Florida drivers often pay higher premiums than their counterparts in other states, even for the same level of coverage.

Florida’s Unique Legal Framework

Florida’s car insurance laws and regulations are distinct from those in other states. One notable aspect is the state’s “no-fault” insurance system, where drivers are required to have Personal Injury Protection (PIP) coverage. PIP covers medical expenses and lost wages following an accident, regardless of fault. This system aims to reduce lawsuits and expedite claims processing.

Key Regulations and Laws

Florida’s car insurance market is governed by a comprehensive set of regulations and laws designed to protect consumers and ensure fair market practices. These regulations include:

- Minimum Coverage Requirements: Florida law mandates specific minimum coverage levels for all drivers, including bodily injury liability, property damage liability, personal injury protection (PIP), and uninsured motorist coverage.

- Rate Regulation: The Florida Office of Insurance Regulation (OIR) oversees insurance rates and has the authority to review and approve rate increases. This regulatory framework aims to ensure that rates are fair and reasonable.

- Consumer Protection Laws: Florida has several consumer protection laws in place to safeguard policyholders from unfair or deceptive practices by insurers. These laws address issues such as rate discrimination, claims handling, and policy cancellation.

Essential Coverage Considerations

Navigating Florida’s unique insurance landscape requires a thorough understanding of essential car insurance coverages. These coverages provide financial protection in case of an accident or other unforeseen events, safeguarding you from significant financial burdens.

Liability Coverage

Liability coverage is the most basic and legally required car insurance in Florida. It covers damages to other people’s property and injuries to other people if you are at fault in an accident. This coverage protects you from lawsuits and financial liabilities that could arise from an accident.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and pain and suffering for injuries you cause to others in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement costs for damage you cause to other people’s vehicles or property.

Collision Coverage

Collision coverage is optional but highly recommended. It covers damages to your own vehicle in case of an accident, regardless of who is at fault. If you are in an accident with another vehicle or hit an object, collision coverage helps pay for repairs or replacement costs.

- Deductible: Collision coverage typically has a deductible, which is the amount you pay out-of-pocket before your insurance company covers the remaining costs.

Comprehensive Coverage

Comprehensive coverage is another optional coverage that protects your vehicle against damages from events other than accidents. This coverage helps pay for repairs or replacement costs for damages caused by:

- Theft

- Vandalism

- Fire

- Hail

- Flooding

Personal Injury Protection (PIP)

PIP coverage, also known as “no-fault” insurance, is mandatory in Florida. It covers your medical expenses, lost wages, and other related expenses, regardless of who is at fault in an accident.

- PIP Coverage Limit: Florida law requires a minimum PIP coverage of $10,000. However, you can choose higher coverage limits.

- 80/20 Rule: In Florida, the 80/20 rule applies to PIP coverage. This means that your PIP coverage will pay 80% of your medical expenses, and you are responsible for the remaining 20%.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is crucial in Florida, where a significant number of drivers are uninsured or underinsured. This coverage protects you if you are involved in an accident with a driver who does not have adequate insurance or no insurance at all.

- Uninsured Motorist Coverage (UM): This coverage pays for your medical expenses, lost wages, and other damages if you are injured by an uninsured driver.

- Underinsured Motorist Coverage (UIM): This coverage pays for the difference between the other driver’s insurance coverage and your actual damages if you are injured by an underinsured driver.

Key Factors Influencing Premiums

Car insurance companies in Florida, like in other states, use a complex system to calculate premiums. This system takes into account various factors, including your driving history, age, vehicle type, location, and credit score. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history is a significant factor in determining your car insurance premium. A clean driving record with no accidents, violations, or claims will generally lead to lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your insurance rates.

For instance, a driver with a recent DUI conviction might see their premium increase by 50% or more.

Age

Your age plays a crucial role in determining your insurance premium. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk translates to higher insurance premiums. As you age and gain more experience, your premiums typically decrease.

For example, a 20-year-old driver might pay significantly more than a 40-year-old driver with the same driving history.

Vehicle Type

The type of vehicle you drive also influences your insurance premium. Luxury cars, high-performance vehicles, and SUVs are generally more expensive to repair or replace in case of an accident. As a result, insurance companies charge higher premiums for these vehicles.

For example, insuring a new BMW X5 might cost more than insuring a used Toyota Corolla.

Location

The location where you live and drive can also affect your car insurance premium. Areas with higher crime rates, traffic congestion, and a greater number of accidents tend to have higher insurance premiums.

For instance, drivers in Miami might face higher premiums than those in more rural areas of Florida.

Credit Score

While it may seem unusual, your credit score can impact your car insurance premium in Florida. Insurance companies believe that individuals with good credit scores are more financially responsible and less likely to file claims.

For example, a driver with a credit score of 750 might pay lower premiums than a driver with a score of 550.

Driving Record

Your driving record is closely tied to your driving history. A clean driving record with no accidents, violations, or claims will result in lower premiums. However, any traffic violations, accidents, or claims can significantly increase your insurance costs.

For instance, a driver with multiple speeding tickets might see their premium increase by 20% or more.

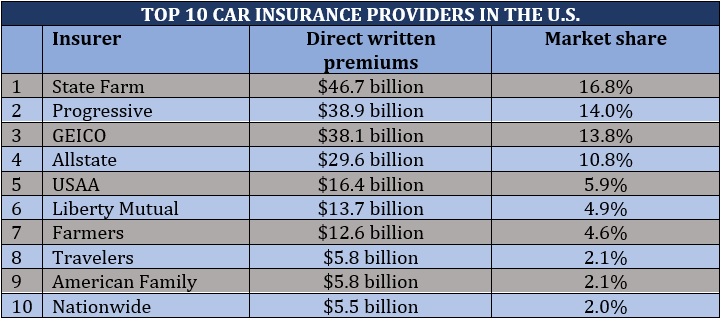

Top Car Insurance Providers in Florida

Choosing the right car insurance provider in Florida can significantly impact your financial well-being. It’s essential to consider factors like price, coverage options, customer service, and financial stability when making your decision.

Top Car Insurance Companies in Florida

Here’s a list of top car insurance companies in Florida based on market share and customer satisfaction ratings:

| Company | Strengths | Weaknesses | Website |

|---|---|---|---|

| State Farm | Wide coverage options, competitive pricing, strong financial stability, excellent customer service. | Can be more expensive in certain areas, limited discounts for certain drivers. | https://www.statefarm.com/ |

| GEICO | Highly competitive pricing, extensive online resources, 24/7 customer service, strong financial stability. | Limited coverage options compared to some competitors, customer service can be challenging at times. | https://www.geico.com/ |

| Progressive | Wide range of discounts, innovative features like Snapshot program, strong online presence, excellent customer service. | Can be more expensive than some competitors, customer service can be challenging at times. | https://www.progressive.com/ |

| Allstate | Comprehensive coverage options, strong financial stability, excellent customer service, wide range of discounts. | Can be more expensive than some competitors, customer service can be challenging at times. | https://www.allstate.com/ |

| USAA | Excellent customer service, highly competitive pricing, wide range of discounts, strong financial stability. | Only available to military members and their families. | https://www.usaa.com/ |

| Florida Peninsula Insurance Company | Specializes in Florida-specific coverage, competitive pricing, strong financial stability. | Limited coverage options compared to some competitors, customer service can be challenging at times. | https://www.floridapeninsula.com/ |

| Auto-Owners Insurance | Strong financial stability, excellent customer service, wide range of discounts, competitive pricing. | Limited availability in certain areas. | https://www.auto-owners.com/ |

| Nationwide | Comprehensive coverage options, strong financial stability, excellent customer service, wide range of discounts. | Can be more expensive than some competitors, customer service can be challenging at times. | https://www.nationwide.com/ |

Strategies for Finding the Best Rates

Finding the most affordable car insurance in Florida requires a strategic approach. By understanding your options, comparing quotes, and negotiating effectively, you can secure the best possible coverage at a price that fits your budget.

Comparing Car Insurance Quotes

Comparing quotes from multiple insurance companies is crucial to finding the best rates. By doing so, you can identify the most competitive offers and ensure you’re not overpaying for coverage. Here’s a step-by-step guide to compare quotes:

- Gather your information. Before you start comparing quotes, gather all the necessary information, including your driving history, vehicle information, and personal details. This will expedite the quoting process and ensure you receive accurate estimates.

- Use online comparison tools. Several online comparison websites allow you to enter your information once and receive quotes from multiple insurers simultaneously. This saves time and effort compared to contacting each company individually.

- Contact insurance companies directly. In addition to using online comparison tools, reach out to insurance companies directly to get personalized quotes. This can be particularly beneficial if you have specific coverage needs or want to discuss your options in detail.

- Review the quotes carefully. Once you receive quotes from multiple insurers, compare them side-by-side to identify the best rates and coverage options. Pay attention to deductibles, coverage limits, and any additional features included in the policy.

Negotiating Lower Premiums

Once you’ve compared quotes and identified a potential insurer, you can negotiate for a lower premium. Here are some tips for successful negotiations:

- Shop around for discounts. Many insurance companies offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling insurance policies. Research these discounts and see if you qualify for any.

- Ask about payment options. Some insurers offer discounts for paying your premium annually or semi-annually instead of monthly. Consider if this option is financially feasible and inquire about any potential savings.

- Be prepared to switch insurers. Having quotes from other insurers can strengthen your negotiating position. If your current insurer isn’t willing to match or beat a competitor’s offer, you can consider switching to a different provider.

Bundling Car Insurance with Other Types of Insurance

Bundling your car insurance with other types of insurance, such as home or renters insurance, can often lead to significant discounts. This is because insurance companies reward customers who bundle multiple policies with them.

Bundling insurance policies can lead to substantial savings on your premiums, making it a worthwhile strategy to explore.

By bundling your car insurance with other types of insurance, you can enjoy lower premiums and simplify your insurance management.

Understanding Discounts and Savings

Car insurance discounts can significantly reduce your premiums, making it crucial to understand the various discounts available in Florida. These discounts can apply to different aspects of your driving habits, vehicle, and personal circumstances, offering substantial savings.

Common Car Insurance Discounts in Florida

Discounts are a significant factor in reducing your car insurance premiums. They can be applied to various aspects of your driving habits, vehicle, and personal circumstances. Here’s a table outlining some common discounts in Florida:

| Discount Type | Eligibility Criteria | Example Savings |

|---|---|---|

| Good Driver Discount | Clean driving record with no accidents or violations for a specified period. | 10-20% reduction in premium |

| Safe Driver Discount | Completion of a defensive driving course recognized by the state. | 5-15% reduction in premium |

| Multi-Car Discount | Insuring multiple vehicles with the same insurer. | 10-25% reduction in premium |

| Multi-Policy Discount | Bundling home, renters, or other insurance policies with the same insurer. | 5-15% reduction in premium |

| Anti-theft Device Discount | Installation of an anti-theft device approved by the insurer. | 5-10% reduction in premium |

| Good Student Discount | Maintaining a certain GPA or academic standing. | 5-10% reduction in premium |

| Paid-in-Full Discount | Paying your annual premium in full upfront. | 2-5% reduction in premium |

| Loyalty Discount | Maintaining a continuous policy with the same insurer for a specified period. | 5-10% reduction in premium |

| Military Discount | Active duty military personnel or veterans. | 5-10% reduction in premium |

Navigating Claims and Disputes

Filing a car insurance claim in Florida can be a complex process, especially if you are dealing with a dispute with your insurance company. Understanding your rights and the process can help you navigate these situations effectively.

Filing a Car Insurance Claim

It is crucial to understand the steps involved in filing a claim in Florida.

- Report the Accident: Immediately report the accident to your insurance company, usually within 24 hours. Provide them with all the necessary details, including the date, time, location, and the parties involved.

- File a Claim: Your insurance company will provide you with a claim form, which you need to complete and submit. Ensure you provide all the required information accurately and thoroughly.

- Provide Documentation: Be prepared to provide supporting documentation, such as a police report, photos of the damage, and medical records, to support your claim.

- Cooperate with the Insurance Company: It is important to cooperate with your insurance company throughout the process. Respond to their requests promptly and provide them with the necessary information.

- Understand the Claim Process: Familiarize yourself with the claims process and timelines set by your insurance company. This will help you manage your expectations and ensure your claim is processed smoothly.

Handling Disputes with Insurance Companies, Top car insurance in florida

Disputes with insurance companies can arise for various reasons, such as disagreements about coverage, the amount of compensation, or the handling of the claim. Here’s how to handle these situations:

- Communicate Effectively: Clearly communicate your concerns and expectations to your insurance company. Keep detailed records of all communication, including dates, times, and the content of the conversations.

- Understand Your Policy: Review your insurance policy carefully to understand your coverage and rights. Familiarize yourself with the terms and conditions, especially those related to claims and disputes.

- Seek Legal Advice: If you feel your insurance company is not treating you fairly, consider seeking legal advice from an experienced insurance attorney. They can help you understand your rights and navigate the legal process.

- File a Complaint: If you are unable to resolve the dispute with your insurance company, you can file a complaint with the Florida Department of Financial Services. This can help bring attention to your issue and potentially lead to a resolution.

Documenting Damages and Protecting Your Rights

Proper documentation is crucial in any insurance claim.

- Take Photos and Videos: Document the damage to your vehicle and any injuries you sustained with clear photos and videos. Capture the damage from multiple angles and include any relevant details, such as skid marks or debris.

- Get Witness Statements: If there were witnesses to the accident, gather their contact information and ask them to provide written statements about what they observed.

- Keep Detailed Records: Maintain a detailed record of all expenses related to the accident, including medical bills, repair costs, and lost wages. Keep receipts and invoices for all expenses.

- Consult with Professionals: Get estimates for repairs from reputable mechanics and seek medical attention for any injuries. This will help ensure you are compensated fairly for your losses.

Conclusive Thoughts

Securing the right car insurance in Florida is a vital step in protecting yourself and your finances. By understanding the unique characteristics of the state’s insurance market, comparing quotes from top providers, and taking advantage of available discounts, you can find a policy that provides comprehensive coverage at a price that fits your budget. Remember to review your policy regularly, stay informed about changes in insurance regulations, and don’t hesitate to seek professional advice if needed. With a little effort, you can navigate the Florida car insurance landscape and find the peace of mind that comes with knowing you have the right protection in place.

Frequently Asked Questions

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). However, it’s highly recommended to have more coverage to protect yourself financially in case of an accident.

How does my credit score affect my car insurance rates in Florida?

Florida insurance companies are allowed to use credit scores as a factor in determining premiums. A higher credit score generally translates to lower insurance rates.

What are some common discounts available for car insurance in Florida?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for safety features like anti-theft devices and airbags.

What should I do if I have a car insurance claim in Florida?

Immediately contact your insurance company to report the claim. Gather all necessary documentation, including photos of the damage, police reports, and witness statements. Follow your insurance company’s instructions for filing the claim and be prepared to provide any requested information.