USAA car insurance stands out as a top choice for military members and their families, offering a unique blend of competitive rates, comprehensive coverage, and dedicated customer service. Established in 1922 to serve the financial needs of military officers, USAA has grown into a trusted financial institution, extending its services to include car insurance, home insurance, and banking. USAA’s commitment to its members is evident in its personalized approach, offering discounts tailored to military service and a claims process designed for convenience and efficiency.

USAA’s car insurance policies cater to the specific needs of military personnel, recognizing the unique challenges and lifestyle associated with military service. Whether you’re stationed overseas, frequently relocating, or simply looking for reliable and affordable coverage, USAA aims to provide a seamless experience. Their coverage options include liability, collision, comprehensive, and other essential protections, ensuring that your vehicle and financial well-being are safeguarded.

USAA Car Insurance Overview

USAA is a financial services company that primarily serves active-duty military personnel, veterans, and their families. Founded in 1922 by a group of Army officers, USAA has grown into a major financial institution offering a wide range of products, including car insurance.

Target Audience

USAA car insurance is specifically designed for members of the military community. This includes active-duty military personnel, veterans, their spouses, and their dependents. The company’s focus on this specific target audience allows it to tailor its services and benefits to the unique needs and lifestyles of military families.

Key Features and Benefits

USAA car insurance offers a variety of features and benefits that are designed to meet the needs of its target audience.

- Military Discounts: USAA offers significant discounts to active-duty military personnel and veterans. These discounts can vary depending on factors such as rank, branch of service, and deployment status.

- Competitive Rates: USAA is known for offering competitive rates, particularly for members of the military community. The company’s focus on this specific target audience allows it to offer more affordable premiums compared to other insurance providers.

- Excellent Customer Service: USAA is renowned for its exceptional customer service. The company has a dedicated team of representatives who are trained to understand the unique needs of military families and provide personalized support.

- Comprehensive Coverage Options: USAA offers a wide range of coverage options to meet the needs of its customers. These options include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

- Convenient Online and Mobile Services: USAA provides convenient online and mobile services that allow customers to manage their insurance policies, pay premiums, and file claims from anywhere at any time.

- Financial Stability: USAA is a financially stable company with a strong track record of paying claims and providing excellent customer service. This financial stability gives customers peace of mind knowing that they can rely on USAA in the event of an accident or other unexpected event.

Coverage Options and Features

USAA offers a comprehensive range of coverage options designed to protect you and your vehicle in various situations. These options are tailored to meet the specific needs of military members and their families. Understanding these options is crucial to ensuring you have adequate coverage for your individual circumstances.

Liability Coverage

Liability coverage is a crucial aspect of car insurance, protecting you financially if you are found at fault in an accident that causes injury or damage to another person or their property. USAA offers different levels of liability coverage to suit your needs, with higher limits providing greater financial protection.

Collision Coverage

Collision coverage is essential for repairing or replacing your vehicle if it’s damaged in an accident, regardless of who is at fault. USAA provides collision coverage with a deductible, meaning you pay a set amount out of pocket before the insurance kicks in. This coverage is optional, and you may choose to waive it if you have an older vehicle with lower value.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Similar to collision coverage, it comes with a deductible, and you can choose to waive it if you have an older vehicle.

Uninsured/Underinsured Motorist Coverage

This coverage provides protection if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. USAA offers this coverage to ensure you are financially protected in such situations.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault coverage, covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident. This coverage is mandatory in some states and optional in others. USAA offers various levels of PIP coverage to meet your needs.

Other Coverage Options

USAA offers additional coverage options to further enhance your protection, such as:

- Roadside Assistance: This coverage provides assistance with flat tires, jump starts, towing, and other roadside emergencies.

- Rental Reimbursement: This coverage helps cover the cost of a rental car while your vehicle is being repaired after an accident.

- Gap Coverage: This coverage helps bridge the gap between the actual cash value of your vehicle and the amount you owe on your loan if your vehicle is totaled.

- Custom Equipment Coverage: This coverage provides protection for aftermarket modifications or customizations made to your vehicle.

Unique USAA Features and Benefits

USAA stands out from other insurers with its commitment to providing exceptional service and benefits tailored to the needs of military members and their families. These features include:

- Military Discounts: USAA offers significant discounts on car insurance premiums to active-duty military personnel, veterans, and their families.

- Accident Forgiveness: This program allows you to avoid a premium increase after your first at-fault accident. It is a valuable benefit that helps protect your driving record.

- Priority Claims Service: USAA prioritizes claims from military members, ensuring they receive prompt and efficient service, even while deployed.

- 24/7 Customer Support: USAA provides 24/7 customer support through phone, email, and online chat, ensuring you can reach them whenever you need assistance.

Pricing and Cost Factors: Usaa Car Insurance

USAA’s car insurance premiums are calculated based on a variety of factors, reflecting a comprehensive assessment of risk. These factors are designed to create a fair and accurate pricing structure for all policyholders.

Factors Influencing USAA Car Insurance Premiums

USAA considers a wide range of factors when determining your car insurance premium. Here are some key elements that play a significant role:

- Driving History: Your driving record is a crucial factor. A clean driving history with no accidents or traffic violations will generally lead to lower premiums. Conversely, a history of accidents or citations will likely result in higher premiums.

- Location: The area where you live significantly impacts your insurance cost. Higher-risk areas with more frequent accidents or theft tend to have higher premiums.

- Vehicle Type: The type of vehicle you drive plays a role. Luxury cars or high-performance vehicles are often more expensive to insure due to their higher repair costs and potential for higher claims.

- Age and Gender: Generally, younger and inexperienced drivers face higher premiums due to their higher risk of accidents. Similarly, certain gender demographics may also influence pricing based on historical claims data.

- Credit Score: In some states, USAA may use your credit score as a factor in determining your premium. A good credit score can indicate financial responsibility, which may lead to lower rates.

- Coverage Options: The type and amount of coverage you choose directly impact your premium. Comprehensive and collision coverage provide more protection but will generally increase your premium compared to liability-only coverage.

- Discounts: USAA offers a range of discounts that can significantly reduce your premium. These include discounts for good driving records, multiple policy bundling, safety features in your vehicle, and military affiliation.

Comparison with Other Major Car Insurance Providers, Usaa car insurance

While USAA is known for its competitive pricing, it’s important to compare quotes from other major car insurance providers to ensure you’re getting the best value. Factors like your individual profile, location, and coverage needs can influence which provider offers the most competitive rates. You can use online comparison tools or contact insurance agents directly to get quotes from various providers.

It’s crucial to remember that insurance pricing is highly personalized and can vary greatly depending on your specific circumstances.

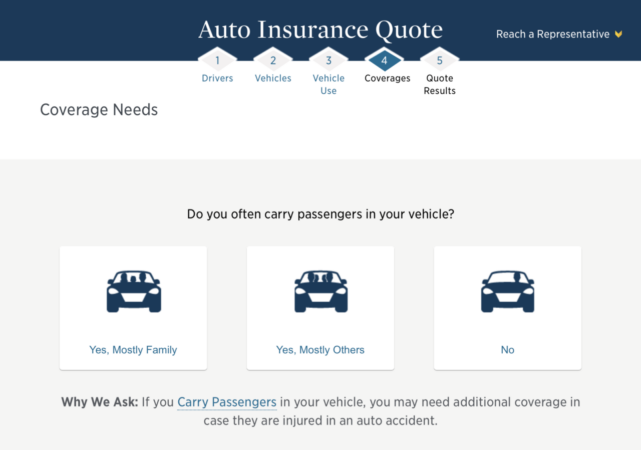

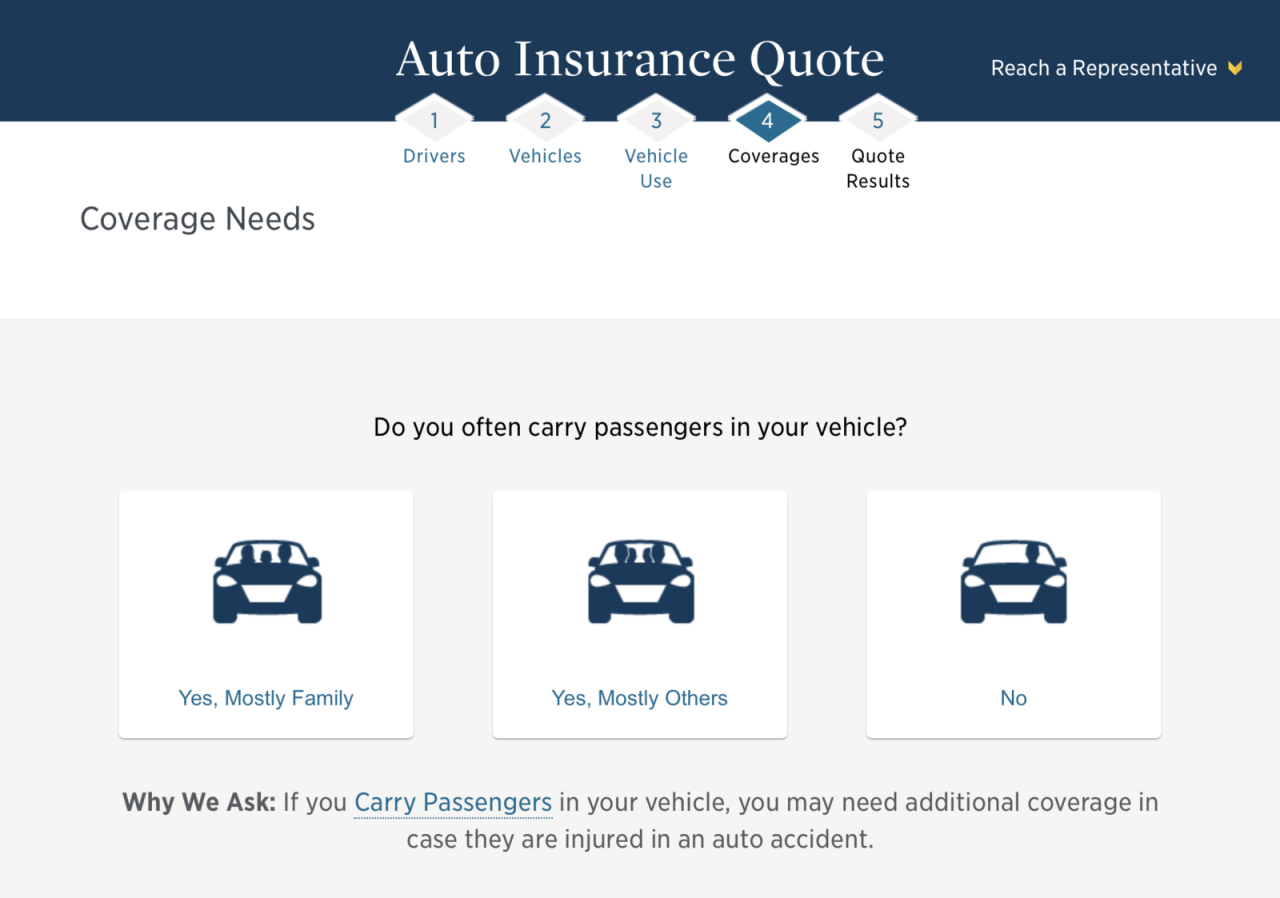

Customer Service and Claims Process

USAA is renowned for its exceptional customer service and streamlined claims process, which are integral parts of its commitment to providing a positive experience for its members. This section will delve into the various customer service channels, the claims process, and real-life experiences shared by USAA members.

Customer Service Channels

USAA offers a comprehensive range of customer service channels to cater to the diverse needs of its members.

- Phone Support: USAA provides 24/7 phone support, allowing members to reach a representative at any time, day or night. This ensures prompt assistance and immediate resolution of inquiries or concerns.

- Online Services: USAA’s user-friendly online platform offers a wealth of self-service options, including policy management, claims filing, and account information access. This empowers members to manage their insurance needs conveniently and efficiently.

- Mobile App: The USAA mobile app provides a seamless and accessible platform for managing insurance policies, reporting claims, and accessing essential information on the go. The app’s intuitive design and comprehensive features make it a valuable tool for members.

- Social Media: USAA actively engages with its members on social media platforms like Facebook and Twitter, providing timely updates, addressing inquiries, and fostering a sense of community.

Claims Process

USAA’s claims process is designed to be simple and efficient, minimizing stress for members during challenging times.

- Reporting a Claim: Members can report a claim through various channels, including phone, online, or the mobile app. This flexibility ensures convenience and accessibility for members.

- Claim Assessment: Upon reporting a claim, USAA promptly assesses the situation, gathering necessary information and determining the extent of the damage. This ensures a comprehensive understanding of the claim and facilitates a swift resolution.

- Claim Processing: USAA strives to process claims efficiently, aiming to provide timely payments and support to members. The company employs experienced adjusters who work diligently to expedite the claims process and ensure a fair outcome.

- Claim Resolution: Once the claim is assessed and processed, USAA communicates the resolution to the member, providing clear explanations and addressing any questions or concerns. This transparency and communication build trust and satisfaction.

Customer Testimonials and Reviews

USAA consistently receives positive feedback from its members regarding its customer service and claims experience.

“USAA’s customer service is top-notch. I had a minor accident and the claims process was incredibly smooth. The adjuster was very helpful and kept me informed every step of the way.” – John S., USAA Member

“I’ve been a USAA member for over 20 years and have always been impressed with their service. Their claims process is efficient and their representatives are always friendly and professional.” – Mary L., USAA Member

USAA vs. Other Car Insurance Providers

Choosing the right car insurance provider can be a complex decision, especially when considering the wide range of options available. USAA, a well-respected provider, stands out for its focus on serving military members and their families. However, comparing USAA with other major insurers like Geico and State Farm is essential to determine the best fit for your individual needs. This section will explore the key advantages and disadvantages of choosing USAA over its competitors.

USAA vs. Competitors: A Comparative Overview

| Factor | USAA | Geico | State Farm |

|---|---|---|---|

| Coverage Options | Comprehensive, Collision, Liability, Personal Injury Protection, Uninsured/Underinsured Motorist, and more | Similar to USAA, with additional options like rental car reimbursement and roadside assistance | Comprehensive coverage options, including optional add-ons like accident forgiveness and custom equipment coverage |

| Pricing | Often competitive, especially for military members and families | Known for competitive rates, particularly for drivers with good driving records | Pricing varies by location and individual risk factors |

| Customer Service | Highly rated for its personalized service and responsiveness | Generally well-regarded for its customer service, with a focus on convenience and accessibility | Offers strong customer service, with a network of local agents for in-person assistance |

| Features | Military-specific benefits, including discounts and support programs | Digital-focused features, including online quotes, mobile app management, and telematics programs | Wide range of features, including accident forgiveness, usage-based discounts, and various digital tools |

Advantages of Choosing USAA

USAA offers several advantages, particularly for military members and their families:

- Exclusive Discounts and Benefits: USAA provides unique discounts and benefits specifically tailored to military personnel, such as discounts for deployments and military service, as well as access to specialized support programs.

- Exceptional Customer Service: USAA consistently receives high marks for its personalized and responsive customer service. The company has a strong reputation for going the extra mile to assist its members.

- Strong Financial Stability: USAA is a financially stable company with a long history of providing reliable insurance products.

Disadvantages of Choosing USAA

While USAA offers many advantages, it also has some drawbacks:

- Limited Eligibility: USAA’s membership is restricted to active military personnel, veterans, and their families. This can limit its appeal to individuals who do not meet these criteria.

- Potentially Higher Rates: While USAA often offers competitive rates, it may not always be the cheapest option, especially for individuals with poor driving records or who live in high-risk areas.

- Limited Availability: USAA’s services are not available in all states, which can be a drawback for individuals living in certain regions.

Pros and Cons of USAA Car Insurance

USAA car insurance is a popular choice for military members, veterans, and their families. It’s known for its competitive rates, excellent customer service, and a wide range of coverage options. However, it’s important to weigh the pros and cons before deciding if USAA is the right fit for you.

Advantages of USAA Car Insurance

USAA offers several advantages that make it an attractive option for many drivers.

- Competitive Rates: USAA consistently ranks among the top insurers for offering competitive rates, especially for members with good driving records. This is due to its focus on a specific customer base and its efficient operations. For example, a 2023 study by ValuePenguin found that USAA had the lowest average annual premium for full coverage car insurance in the US.

- Excellent Customer Service: USAA is renowned for its exceptional customer service, consistently receiving high ratings for its responsiveness, helpfulness, and ease of communication. This is a result of its commitment to serving its members and its strong focus on building long-term relationships. For example, USAA has consistently ranked high in J.D. Power’s customer satisfaction surveys.

- Wide Range of Coverage Options: USAA offers a comprehensive range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It also offers several optional add-ons, such as roadside assistance, rental car reimbursement, and gap insurance. This ensures that members can customize their coverage to meet their specific needs and budget.

- Discounts and Perks: USAA offers various discounts to its members, including good driver, multi-car, and military discounts. These discounts can significantly reduce the cost of insurance, making it even more affordable.

- Strong Financial Stability: USAA has a strong financial rating, indicating its stability and ability to meet its obligations to policyholders. This is an important consideration for drivers who want to ensure their insurer will be there for them in the event of a claim.

Disadvantages of USAA Car Insurance

While USAA offers many advantages, there are also some drawbacks to consider.

- Limited Availability: USAA membership is restricted to active military personnel, veterans, and their families. This means that not everyone is eligible for USAA insurance.

- Higher Rates for Some Drivers: While USAA generally offers competitive rates, some drivers may find that they pay higher premiums compared to other insurers, especially those with poor driving records or who live in high-risk areas.

- Limited Online Tools: Compared to some other insurers, USAA’s online tools and mobile app may be less comprehensive. This can make it more difficult for some customers to manage their policies and file claims online.

- Potential Trade-offs: Choosing USAA may involve trade-offs, such as sacrificing broader coverage options or lower rates for the convenience of a membership-based insurer. It’s essential to compare rates and coverage options from multiple insurers to ensure you’re getting the best value for your needs.

Last Recap

USAA car insurance emerges as a strong contender for military members and their families, offering a combination of competitive pricing, comprehensive coverage, and exceptional customer service. By prioritizing its members’ needs and providing tailored solutions, USAA has established itself as a trusted name in the insurance industry. While it’s important to compare rates and coverage options from various providers, USAA’s dedication to its members makes it a compelling choice for those seeking financial security and peace of mind.

Commonly Asked Questions

Is USAA car insurance only for active duty military personnel?

While USAA was originally founded to serve active duty military, their membership has expanded to include veterans, retirees, and their families. Eligibility requirements vary, but generally include having served in the U.S. military or being a family member of a qualifying individual.

What discounts are available for USAA car insurance?

USAA offers a variety of discounts, including those for good driving records, safe driving courses, multiple vehicle insurance, and military service. Specific discounts may vary based on your location and individual circumstances.

How do I file a claim with USAA?

You can file a claim online, over the phone, or through the USAA mobile app. USAA’s claims process is designed for ease and efficiency, with dedicated claims representatives available to assist you every step of the way.