What are best car insurance companies – Looking for the best car insurance companies? It’s like trying to find the perfect pizza topping – everyone has their own taste! But with a little digging, you can find the perfect coverage for your ride and your budget.

You gotta think about your driving habits, what kind of car you’re rockin’, and how much you’re willing to spend. And don’t forget about those pesky premiums! Age, driving history, and even where you live can make a big difference in your rates.

Understanding Car Insurance Needs: What Are Best Car Insurance Companies

Choosing the right car insurance is like picking the perfect outfit for a big event: you want something that fits your style, protects you, and doesn’t break the bank. Just like your wardrobe, your car insurance needs are unique and depend on a few key factors.

You wouldn’t wear a ball gown to a casual picnic, right? Similarly, your car insurance should be tailored to your individual needs. This means considering your driving habits, the type of vehicle you own, and your financial situation. Think of it like this: if you’re a seasoned driver with a reliable car, you might not need as much coverage as someone who’s just starting out or has a brand new luxury vehicle.

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is like knowing the different pieces of a puzzle – each one plays a crucial role in building your protection.

Here’s a breakdown of the most common types of coverage and what they cover:

- Liability Coverage: This is the most basic type of car insurance and is usually required by law. It protects you financially if you’re at fault in an accident that causes damage to someone else’s property or injuries to another person. It’s like having a safety net for the other driver, covering their medical bills and car repairs.

- Collision Coverage: This covers damage to your own car if you’re involved in an accident, regardless of who’s at fault. It’s like having a personal insurance policy for your car, protecting you from the financial burden of repairs. Imagine getting into a fender bender with a deer – collision coverage would help you get your car back on the road.

- Comprehensive Coverage: This protects your car from damage caused by things other than accidents, such as theft, vandalism, or natural disasters. It’s like having an umbrella for your car, shielding it from unexpected events. Imagine a hail storm damaging your car – comprehensive coverage would cover the repairs.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by someone who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s like having a backup plan in case the other driver doesn’t have enough coverage. Imagine getting hit by a driver who’s uninsured – this coverage would step in to help you.

- Personal Injury Protection (PIP): This covers your medical expenses and lost wages if you’re injured in an accident, regardless of who’s at fault. It’s like having a personal health insurance policy for car accidents, ensuring you get the medical care you need without worrying about the costs.

Factors Influencing Insurance Premiums

Insurance premiums are like the price tag on your car insurance – they’re the amount you pay for coverage. Just like the price of a product can vary depending on its features and quality, your insurance premiums can be influenced by several factors.

Here are some of the most common factors that can affect your car insurance premiums:

- Age: Younger drivers are generally considered riskier, as they have less experience behind the wheel. This can result in higher premiums. As you gain experience and age, your premiums may decrease.

- Driving History: Your driving record, including accidents and traffic violations, can have a significant impact on your premiums. A clean driving record is like having a good credit score – it shows you’re a responsible driver and can lead to lower premiums.

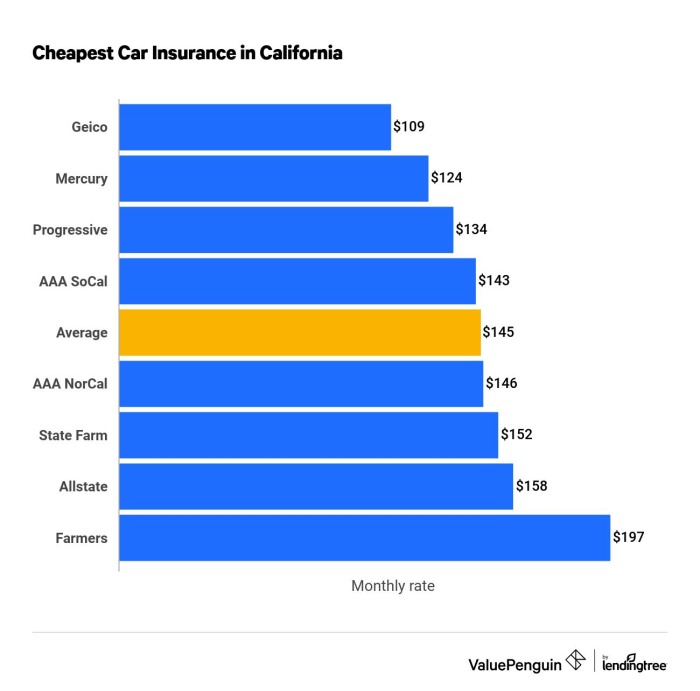

- Location: The area where you live can affect your premiums. Areas with higher rates of accidents or crime may have higher insurance rates. It’s like paying more for insurance in a high-risk neighborhood.

- Vehicle Type: The type of car you drive also plays a role in your premiums. Sports cars and luxury vehicles are often more expensive to repair, which can lead to higher insurance costs. It’s like having a fancy car that’s more expensive to maintain.

- Credit Score: Believe it or not, your credit score can also affect your insurance premiums. Insurance companies may use your credit score as an indicator of your financial responsibility. A good credit score can help you get lower premiums. It’s like having a good credit score that opens doors to better financial opportunities.

Key Factors to Consider

So you’re ready to ditch the old car insurance policy and find something that’s more “you.” But with so many options out there, how do you know which one is the real deal? Don’t worry, we’re here to help you navigate the car insurance jungle and find the perfect fit.

Let’s dive into the key factors you need to consider when comparing car insurance companies. Think of it as your own personal car insurance “cheat sheet” for winning the game.

Coverage Options and Features

The first step in your car insurance quest is to figure out what kind of coverage you need. It’s like choosing your car’s “power-up” options – you want to make sure you’re covered for the unexpected. But don’t just go for the fanciest features; you need to find the right balance of protection and price.

Here’s a breakdown of some key coverage options:

- Liability Coverage: This is the “must-have” for any driver. It protects you financially if you cause an accident that injures someone or damages their property. Think of it as your “safety net” for those “oops” moments.

- Collision Coverage: This covers damage to your car if you’re involved in an accident, regardless of who’s at fault. It’s like having a “shield” for your car.

- Comprehensive Coverage: This covers damage to your car from things like theft, vandalism, or natural disasters. It’s your car’s “invisible armor” against the unexpected.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough coverage. It’s like having a “backup plan” when someone else messes up.

- Roadside Assistance: This provides help with things like flat tires, dead batteries, and towing. It’s your “rescue team” for those roadside emergencies.

Beyond basic coverage, some companies offer additional features like accident forgiveness, rental car reimbursement, and discounts for good driving records. These extras can be like “power-ups” for your insurance, making it even better.

Customer Service and Claims Handling

You know how it is – you’re stressed out after an accident, and the last thing you want is a frustrating insurance experience. That’s why customer service and claims handling are crucial factors to consider.

- Ease of Contact: Can you easily reach a representative by phone, email, or online chat? Do they have convenient hours of operation?

- Responsiveness: How quickly do they respond to your inquiries? Do they keep you updated on the status of your claim?

- Claims Processing: How straightforward is the claims process? Are they known for fair and timely payouts?

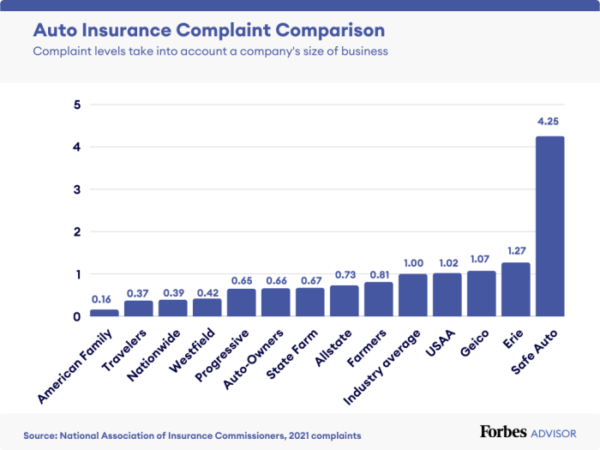

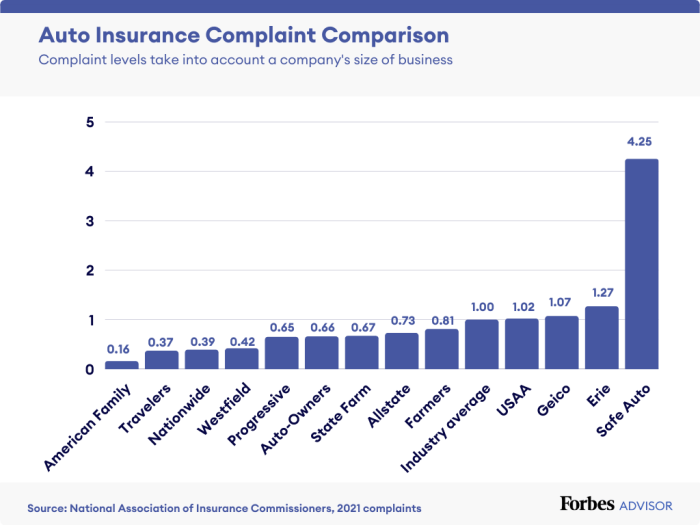

- Customer Satisfaction Ratings: Check out customer reviews and ratings from independent organizations to get a sense of how others have experienced the company’s customer service and claims handling.

Financial Stability and Ratings

You want to make sure your insurance company is a solid bet, right? That’s where financial stability comes in. Think of it like checking the “health” of the company before you commit.

- Financial Strength Ratings: Look for ratings from reputable organizations like AM Best, Moody’s, and Standard & Poor’s. These ratings reflect the company’s financial stability and ability to pay claims.

- Claims Paying History: Check how consistently the company has paid claims in the past. This gives you a good idea of their track record.

Top-Rated Car Insurance Companies

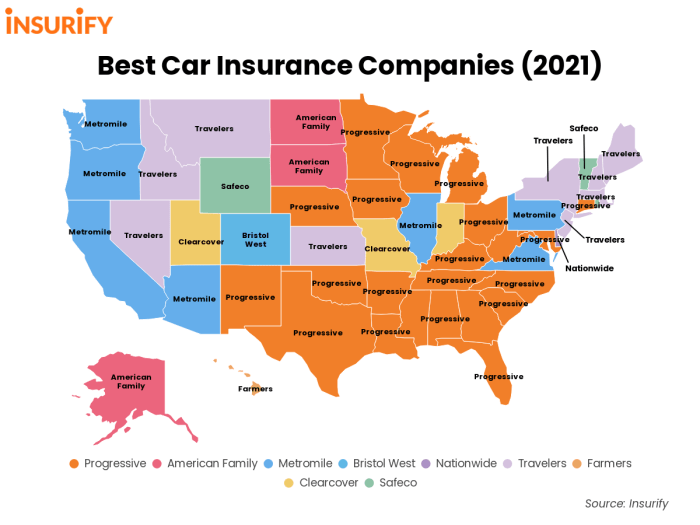

Choosing the right car insurance company can feel like navigating a jungle of options. With so many choices, it’s tough to know who to trust. But fear not! We’ve got you covered with a breakdown of some of the top-rated car insurance companies in the US. These companies have consistently impressed with their coverage, pricing, and customer service.

Top-Rated Car Insurance Companies, What are best car insurance companies

Finding the best car insurance company for you depends on your specific needs and priorities. We’ve gathered a list of top-rated companies based on independent reviews and ratings from reputable sources like J.D. Power and Consumer Reports. These companies offer a range of coverage options and pricing, so you can find a plan that fits your budget and risk tolerance.

| Company Name | Coverage Options | Pricing | Customer Satisfaction |

|---|---|---|---|

| USAA | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection | Generally considered affordable, especially for military members and their families | High customer satisfaction ratings, consistently ranked among the best |

| State Farm | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, rental car reimbursement | Competitive pricing, often offering discounts for good driving records and safety features | Strong customer satisfaction ratings, known for its reliable service |

| Geico | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, roadside assistance | Known for its affordable rates, often offering discounts for bundling policies | High customer satisfaction ratings, praised for its ease of use and online services |

| Progressive | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, accident forgiveness | Offers personalized pricing based on individual risk factors, known for its “Name Your Price” tool | Strong customer satisfaction ratings, known for its innovative features and customer-friendly approach |

| Liberty Mutual | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, accident forgiveness, new car replacement | Offers a range of discounts, including safe driver, multi-policy, and good student discounts | High customer satisfaction ratings, known for its strong financial stability and reliable service |

Getting Quotes and Comparing Options

You’ve got your car, now you need to protect it. That’s where car insurance comes in. But with so many companies out there, how do you find the best deal? The answer is simple: Get quotes from multiple companies and compare them!

Obtaining Quotes

Before you start comparing, gather your information. This includes your driver’s license, vehicle registration, and any relevant insurance history. Having this information handy will make the process smoother and quicker.

- Online Quote Tools: Most car insurance companies have user-friendly websites where you can get a quick quote in minutes. Just input your details, and they’ll provide you with a personalized estimate.

- Phone Calls: If you prefer a more personal touch, you can call insurance companies directly. Be prepared to answer their questions and provide your information.

- Insurance Agents: If you’re overwhelmed by all the options, consider reaching out to an insurance agent. They can help you understand different policies and compare quotes from various companies.

Comparing Quotes

Once you have quotes from several companies, it’s time to compare. Look at the coverage options, deductibles, premiums, and any discounts offered. Don’t just focus on the lowest premium; ensure the coverage meets your needs.

For example, if you have a newer car, you might want to consider comprehensive and collision coverage to protect against damage.

Negotiating Premiums

Don’t be afraid to negotiate! Car insurance companies are often willing to work with you to find a price that works for both of you.

- Shop Around: Getting quotes from multiple companies can put pressure on them to offer you a competitive price.

- Ask About Discounts: Most companies offer discounts for good driving records, safe driving courses, and even bundling insurance policies.

- Consider Increasing Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can also lower your premium.

Additional Considerations

You’ve got your car insurance needs sorted, you’ve compared quotes, and you’re ready to choose the best company. But before you hit that “buy” button, there are a few more things to consider. These extra steps can save you money in the long run and make sure you’re truly covered.

Bundling Insurance Products

Bundling your car insurance with other types of insurance, like home or renters insurance, can be a real money-saver. Most insurance companies offer discounts for bundling policies, so you can save a significant amount of money on your premiums. Think of it as a two-for-one deal on peace of mind.

Bundling can save you money on premiums, especially if you have multiple policies with the same insurer.

Maintaining a Good Driving Record

Keeping a clean driving record is like having a secret weapon against high insurance premiums. Avoid getting tickets, accidents, or driving under the influence, and you’ll be rewarded with lower rates.

A good driving record is like having a golden ticket to lower insurance premiums.

Here are some tips to help you maintain a good driving record:

- Obey traffic laws and drive defensively.

- Take a defensive driving course to learn safe driving techniques.

- Avoid distractions while driving, such as using your phone or eating.

- Get regular car maintenance to ensure your vehicle is in good working order.

Technology and Car Insurance

Technology is changing the car insurance game, and it’s a good thing for drivers. Telematics and usage-based insurance programs are becoming increasingly popular, allowing you to pay for insurance based on your actual driving habits.

Think of it like a fitness tracker for your car.

Here’s how it works:

- You install a device in your car that tracks your driving behavior, such as speed, braking, and mileage.

- Based on your driving data, you can earn discounts on your premiums if you drive safely and responsibly.

- Some insurers even offer rewards programs for good driving habits.

Closing Summary

So, buckle up, do your research, and find the car insurance company that’s right for you. Remember, you’re not just protecting your ride, you’re protecting yourself and your wallet!

FAQ Insights

What are the most common types of car insurance coverage?

The most common types of car insurance coverage include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. These coverages protect you from different risks, like accidents, theft, and damage to your car.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least once a year, or even more often if your driving habits or vehicle changes. You may be able to find better rates or coverage options as your needs evolve.

What are some tips for getting the best car insurance rates?

Shop around for quotes from multiple companies, maintain a good driving record, consider bundling your car insurance with other types of insurance, and look for discounts offered by your insurer.