What are some car insurance companies? You know, those lifesavers that protect you from the unexpected, like a fender bender or a runaway squirrel. But with so many options out there, how do you choose the right one? It’s like trying to pick the perfect pizza topping – you want something that’s gonna satisfy your needs and your budget.

Car insurance is like a safety net, protecting you from financial disaster if you’re in an accident. There are different types of coverage, like liability, collision, and comprehensive, each with its own purpose. The price you pay for your insurance, or your premium, depends on factors like your driving history, your car, and where you live. It’s a bit like a game of car insurance bingo – the more risks you have, the higher your chances of winning a big premium.

Car Insurance: Your Safety Net on the Road

Car insurance is like your trusty sidekick, always ready to lend a helping hand when you need it most. It’s a financial safety net that protects you from the unexpected costs of accidents, theft, and other perils that can happen on the road. Whether you’re a seasoned driver or just starting out, understanding car insurance is crucial for peace of mind and financial stability.

Types of Car Insurance Coverage

Car insurance comes in different flavors, each offering a specific type of protection. Here’s a breakdown of the common types of coverage:

- Liability Coverage: This is the bread and butter of car insurance, covering the costs of damages or injuries you cause to others in an accident. It’s usually required by law and includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your car if it’s damaged in a collision, regardless of who’s at fault. It’s often optional, but it’s worth considering if you have a newer car or a loan on it.

- Comprehensive Coverage: This coverage protects your car against damage caused by non-collision events, such as theft, vandalism, natural disasters, or falling objects. It’s also usually optional, but it’s a good idea if you have a newer or more expensive car.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re hit by an uninsured or underinsured driver. It covers your medical expenses and property damage, even if the other driver doesn’t have enough insurance to cover the costs.

- Personal Injury Protection (PIP): This coverage helps pay for your medical expenses, lost wages, and other expenses if you’re injured in an accident, regardless of who’s at fault. It’s usually required in some states.

Factors Influencing Car Insurance Premiums

The cost of car insurance is influenced by a variety of factors. Understanding these factors can help you make informed decisions and potentially lower your premiums.

- Driving Record: Your driving history, including accidents, traffic violations, and DUI convictions, significantly impacts your premiums. A clean record translates to lower premiums.

- Age and Gender: Younger drivers, especially those under 25, typically pay higher premiums due to their higher risk of accidents. Gender also plays a role, with males generally paying more than females.

- Location: Where you live affects your premiums. Areas with higher crime rates or more traffic congestion tend to have higher insurance costs.

- Vehicle Type: The type of car you drive influences your premiums. Sports cars and luxury vehicles often have higher premiums due to their higher repair costs and potential for more severe accidents.

- Credit Score: In some states, your credit score can be used to determine your insurance rates. A higher credit score generally translates to lower premiums.

- Coverage Options: The type and amount of coverage you choose directly impact your premiums. More coverage generally means higher premiums.

Major Car Insurance Companies

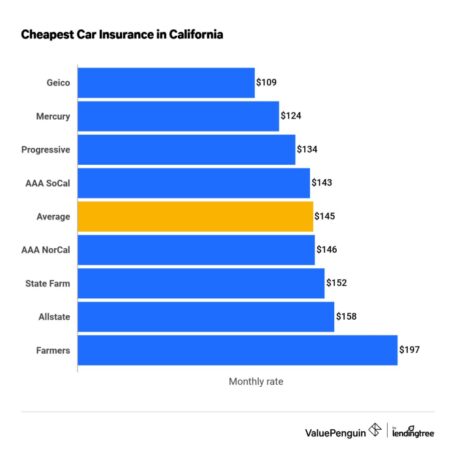

Choosing the right car insurance company is crucial for protecting yourself financially in case of an accident or other unforeseen events. Understanding the major players in the market can help you make an informed decision.

Top Car Insurance Companies in the United States

The insurance industry is a dynamic landscape, and the top players often shift based on factors like market share, financial performance, and customer satisfaction. However, consistently among the largest car insurance companies in the United States are:

- State Farm

- GEICO

- Progressive

- Allstate

- Liberty Mutual

- USAA

- Farmers Insurance

- Nationwide

- American Family Insurance

- Travelers

Market Share and Geographic Presence

These companies dominate the market, with varying degrees of presence across different states. For example, State Farm boasts the largest market share, with a strong presence in most states, while USAA primarily serves military personnel and their families.

Key Features Comparison

Each company offers a unique set of features, including coverage options, discounts, customer service ratings, and financial stability. A quick comparison table can help you quickly understand their strengths:

| Company | Coverage Options | Discounts | Customer Service Rating (J.D. Power) | Financial Strength Rating (A.M. Best) |

|---|---|---|---|---|

| State Farm | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | Safe Driver, Good Student, Multi-Policy, Anti-theft Devices, Homeowner | Above Average | A++ |

| GEICO | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | Safe Driver, Good Student, Multi-Policy, Anti-theft Devices, Military | Above Average | A++ |

| Progressive | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | Safe Driver, Good Student, Multi-Policy, Anti-theft Devices, Usage-Based Insurance | Above Average | A+ |

| Allstate | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | Safe Driver, Good Student, Multi-Policy, Anti-theft Devices, Homeowner | Average | A+ |

| Liberty Mutual | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | Safe Driver, Good Student, Multi-Policy, Anti-theft Devices, Homeowner | Above Average | A+ |

| USAA | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | Safe Driver, Good Student, Multi-Policy, Anti-theft Devices, Military | Excellent | A++ |

| Farmers Insurance | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | Safe Driver, Good Student, Multi-Policy, Anti-theft Devices, Homeowner | Average | A+ |

| Nationwide | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | Safe Driver, Good Student, Multi-Policy, Anti-theft Devices, Homeowner | Average | A+ |

| American Family Insurance | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | Safe Driver, Good Student, Multi-Policy, Anti-theft Devices, Homeowner | Above Average | A+ |

| Travelers | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | Safe Driver, Good Student, Multi-Policy, Anti-theft Devices, Homeowner | Average | A+ |

Factors to Consider When Choosing a Company

Choosing the right car insurance company is like picking the perfect soundtrack for your life’s adventures on the road. You want something that fits your style, protects you from the unexpected, and doesn’t break the bank. But with so many options out there, how do you find the right fit?

The key is to consider your individual needs and driving history. It’s like choosing the right outfit for a big event: you wouldn’t wear a tuxedo to a beach party, and you shouldn’t settle for a basic policy if you need comprehensive coverage.

Factors Influencing Premiums

Your car insurance premium is the price you pay for the safety net that protects you from financial ruin in case of an accident. Several factors influence this price, making it crucial to understand how they affect your bottom line.

- Vehicle Type: A fancy sports car, like a Ferrari or Lamborghini, is a magnet for attention (and sometimes accidents). This translates to higher premiums compared to a humble Honda Civic.

- Age: Younger drivers are statistically more likely to be involved in accidents, which means higher premiums. However, as you age and gain experience, your rates often decrease.

- Location: Big cities, with their dense traffic and higher accident rates, often have higher premiums than rural areas.

Comparing Quotes

Now that you understand the factors that influence your premium, it’s time to get quotes from different companies. Think of it like shopping for the best deal on a new pair of sneakers: you wouldn’t buy the first pair you see, would you?

- Use Comparison Websites: These online tools, like Kayak or Google Flights for insurance, let you compare quotes from multiple companies in one place.

- Check for Discounts: Many companies offer discounts for good driving records, safety features in your car, or even for being a member of certain organizations.

- Read the Fine Print: Don’t just focus on the price; pay attention to the coverage details, deductibles, and exclusions.

Key Features and Benefits: What Are Some Car Insurance Companies

Car insurance is not just a legal requirement; it’s your safety net on the road, providing financial protection against unexpected events. Understanding the different types of coverage and available discounts can help you choose a policy that fits your needs and budget.

Types of Coverage

Car insurance policies typically include a range of coverage options, each designed to protect you in specific situations.

- Liability Coverage: This is the most basic type of coverage, legally required in most states. It covers damages to other people’s property or injuries you cause in an accident. Liability coverage is usually expressed as a limit, such as 100/300/100, which means $100,000 per person for bodily injury, $300,000 per accident for bodily injury, and $100,000 for property damage.

- Collision Coverage: This covers damage to your own vehicle if you’re involved in an accident, regardless of fault. Collision coverage helps pay for repairs or replacement of your vehicle, minus your deductible.

- Comprehensive Coverage: This protects your vehicle against damage from non-collision events, such as theft, vandalism, fire, or natural disasters. Comprehensive coverage can help pay for repairs or replacement of your vehicle, minus your deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It can help pay for your medical expenses, lost wages, and property damage.

Discounts

Car insurance companies often offer discounts to lower your premiums. Here are some common discounts:

- Safe Driving Discount: This is awarded to drivers with a clean driving record, typically for a certain number of years without accidents or traffic violations.

- Good Student Discount: This discount is available to students who maintain a certain GPA.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you can qualify for a multi-car discount.

Coverage Options

| Coverage | Advantages | Disadvantages |

|---|---|---|

| Liability | Legally required in most states, protects you from financial responsibility for damages caused to others | Doesn’t cover damage to your own vehicle |

| Collision | Covers damage to your own vehicle in an accident, regardless of fault | Higher premiums, may not be necessary for older vehicles with low value |

| Comprehensive | Covers damage to your vehicle from non-collision events | Higher premiums, may not be necessary if you have a newer vehicle with low value |

| Uninsured/Underinsured Motorist | Protects you from drivers without insurance or insufficient coverage | Higher premiums, may not be necessary if you live in an area with low uninsured motorist rates |

Customer Service and Claims Process

Navigating the world of car insurance can be a bit like driving through rush hour – stressful and unpredictable. But, just like having a reliable GPS, a great customer service experience and a smooth claims process can make all the difference in your journey. When you need to file a claim, the last thing you want is to feel like you’re stuck in a bureaucratic maze. This is where customer service and claims handling efficiency become your ultimate safety net on the road.

Evaluating Customer Service and Claims Process, What are some car insurance companies

Choosing a car insurance company based solely on the lowest premium can be a risky move. It’s crucial to consider the overall experience you’ll have, especially when you need to file a claim. This is where customer service and claims handling efficiency come into play.

- Online Resources and Accessibility: Look for companies that offer user-friendly websites and mobile apps. These platforms should provide clear information on policy details, claims procedures, and contact information. Easy access to resources can significantly reduce stress and confusion.

- Customer Reviews and Ratings: Check independent review sites and consumer reports to see what other customers have to say about a company’s customer service. Look for consistent positive feedback regarding responsiveness, helpfulness, and resolution of issues.

- Claims Handling Timelines: Research the company’s average processing time for claims. A company that prioritizes prompt claim handling can make a significant difference during a stressful time.

- Communication and Transparency: Look for companies that are transparent about their claims process and keep you informed every step of the way. Regular updates and clear communication can ease your worries and build trust.

Examples of Companies Known for Excellent Customer Service and Claims Handling

Several companies are known for their exceptional customer service and claims handling, and they stand out from the crowd by prioritizing customer satisfaction and providing a smooth experience.

- USAA: Known for its dedicated service to military members and their families, USAA consistently receives high marks for its customer service and claims handling. They often rank among the top performers in customer satisfaction surveys.

- Amica Mutual Insurance: Amica is a mutual insurance company that prides itself on its personalized service and commitment to customer satisfaction. They are often recognized for their responsive and helpful claims process.

- Erie Insurance: Erie Insurance is a regional company known for its strong focus on customer service and its dedication to providing a positive experience. They are known for their prompt claims handling and their commitment to resolving issues quickly and fairly.

Additional Considerations

Choosing the right car insurance company isn’t just about finding the cheapest price. You need to consider the long-term stability and reliability of the company you’re entrusting with your financial well-being.

Financial Stability and Company Ratings

Think of it like this: you wouldn’t invest your hard-earned cash in a company that’s about to go belly up, right? The same logic applies to car insurance. You want a company that’s financially strong and can pay out claims when you need them. Here’s how to check:

* Look for financial ratings: Independent agencies like AM Best, Moody’s, and Standard & Poor’s provide financial strength ratings for insurance companies. A high rating indicates a company is financially stable and can handle claims.

* Check the company’s history: Look for companies with a long track record of paying claims promptly and fairly. You can find this information online or through consumer reports.

Using an Insurance Broker or Agent

Let’s face it, navigating the world of car insurance can be overwhelming. That’s where insurance brokers and agents come in. They’re like your personal insurance superheroes, helping you find the best coverage at the best price.

* Brokers and agents act as your representatives: They work with multiple insurance companies and can compare quotes from different providers, saving you time and effort.

* They offer expert advice: They can explain different insurance policies, help you choose the right coverage, and answer any questions you might have.

* They can help you with claims: They can handle the claims process for you, making it smoother and less stressful.

Avoiding Insurance Scams

Sadly, there are scammers out there who prey on unsuspecting car insurance customers. Here’s how to protect yourself:

* Be wary of unsolicited offers: If you receive a call or email offering you a suspiciously low car insurance quote, don’t fall for it. Legitimate insurance companies don’t cold-call or email with unsolicited offers.

* Don’t give out personal information: Never give your personal information, such as your Social Security number, to someone you don’t know or trust.

* Verify the company’s legitimacy: If you’re unsure about a company’s legitimacy, check with your state insurance department or the Better Business Bureau.

Conclusive Thoughts

So, how do you find the best car insurance company for you? It’s all about knowing your needs, comparing quotes, and choosing the right coverage. Think of it like picking the perfect outfit for a big event – you want something that fits, looks good, and makes you feel confident. With a little research and planning, you can find a car insurance company that’s a perfect match for you and your wallet.

Questions Often Asked

What is the difference between liability and collision insurance?

Liability insurance covers damage you cause to other people’s property or injuries you cause to others in an accident. Collision insurance covers damage to your own vehicle in an accident, regardless of who is at fault. Think of it like this: liability insurance is for when you’re the bad guy, and collision insurance is for when you’re the victim.

How do I get a lower car insurance premium?

There are a few ways to get a lower premium. First, maintain a good driving record – avoid speeding tickets and accidents. Second, consider a safe car with safety features – this can lower your premium. Third, ask about discounts – many companies offer discounts for good students, safe drivers, and multiple cars.

What happens if I get into an accident and don’t have insurance?

Ouch! Not having insurance can be a big financial risk. You could be held personally liable for any damages or injuries caused in the accident. Plus, you might face fines and penalties. It’s like playing a game of car insurance roulette – you never know what the consequences will be.