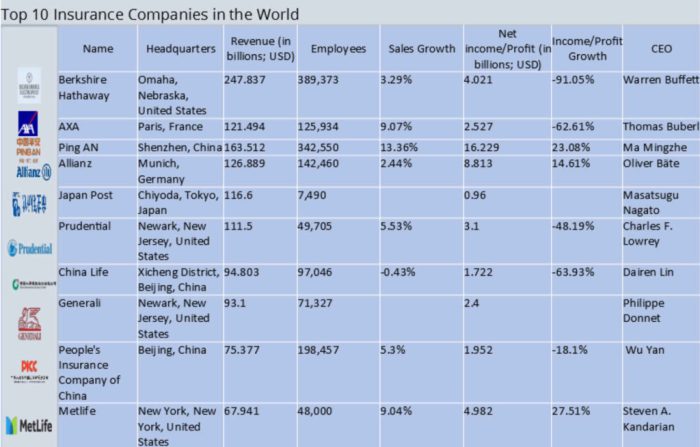

What are the top 10 insurance companies? It’s a question that pops up when you’re thinking about protecting your future. Insurance is like that safety net you need when life throws you a curveball. But with so many companies out there, figuring out who’s the MVP can be a total mind-boggler.

This article breaks down the biggest players in the insurance game, giving you the lowdown on their strengths, weaknesses, and what makes them stand out from the crowd. We’ll dive into the factors that make a company top-tier, from their financial muscle to their customer service skills. Get ready to learn about the insurance giants who are shaping the industry and find the perfect fit for your needs.

Insurance Companies: Ranking the Titans of Risk Management

Insurance companies are like the superheroes of the financial world, swooping in to save the day when life throws you a curveball. They offer financial protection against unexpected events, like accidents, illnesses, or natural disasters. Think of them as your safety net, providing peace of mind and financial stability in times of uncertainty. But with so many insurance companies out there, how do you choose the best one for your needs? That’s where rankings come in.

Ranking insurance companies is crucial for consumers and businesses alike. It helps identify the most reliable and financially sound companies, ensuring you’re not just getting a policy, but a guarantee of support when you need it most. These rankings are like a guide to the best insurance players, helping you navigate the complex world of financial protection.

Factors Influencing Insurance Company Rankings

Several factors contribute to an insurance company’s ranking. These factors are like the ingredients in a recipe, each playing a crucial role in determining the overall quality and reliability of the company. Here’s a breakdown of some key factors:

- Financial Strength: This measures the company’s ability to pay claims and remain financially stable. Think of it like a company’s financial health report card, indicating its capacity to handle unexpected challenges.

- Customer Satisfaction: This reflects how satisfied customers are with the company’s services, including claim processing, customer service, and policy options. It’s like a customer feedback survey, providing insights into the company’s customer experience.

- Claims Handling: This assesses the company’s efficiency and fairness in handling claims. It’s like a performance review for claims processing, measuring how quickly and smoothly claims are resolved.

- Policy Options: This considers the variety and flexibility of insurance policies offered. It’s like a menu of insurance options, showcasing the company’s ability to cater to diverse needs.

- Pricing: This evaluates the competitiveness and transparency of the company’s insurance premiums. It’s like a price comparison tool, helping consumers find the best value for their money.

Criteria for Ranking Insurance Companies: What Are The Top 10 Insurance Companies

Ranking insurance companies is like trying to choose the best superhero for a particular mission: You need to consider a variety of factors to make the right decision. While some companies might be known for their financial strength, others might be recognized for their customer service. There are a lot of things to consider, and the way different ranking organizations weigh these factors can change the results.

Financial Stability

Financial stability is a crucial factor for ranking insurance companies. It’s important to know if a company has the resources to pay out claims, especially during times of economic uncertainty or natural disasters. Several indicators can help determine a company’s financial health:

- A.M. Best Rating: A.M. Best is a global credit rating agency that specializes in the insurance industry. Their ratings are based on an insurer’s financial strength, operating performance, and business profile. A higher rating indicates a stronger financial position. For example, an A++ rating means the company is considered “Superior” and has a very strong ability to meet its financial obligations.

- Moody’s Rating: Moody’s is another well-known credit rating agency that assesses the creditworthiness of insurance companies. Their ratings are based on a similar set of factors as A.M. Best, including financial strength, operating performance, and risk management practices. A higher rating from Moody’s also indicates a more stable financial position.

- S&P Global Ratings: S&P Global Ratings is a leading credit rating agency that provides ratings for insurance companies. They consider factors like financial strength, operating performance, and the company’s overall risk profile. A higher rating from S&P Global Ratings suggests a greater ability to meet its financial obligations.

Customer Satisfaction

Customers are the heart of any business, and insurance companies are no exception. High customer satisfaction is a sign that a company is meeting its customers’ needs and providing a positive experience. Several sources can be used to assess customer satisfaction:

- J.D. Power: J.D. Power is a well-known research and consulting firm that conducts customer satisfaction surveys for various industries, including insurance. Their rankings are based on customer feedback on factors like claims handling, policy communication, and overall customer experience. A higher J.D. Power rating indicates a greater level of customer satisfaction.

- Consumer Reports: Consumer Reports is a non-profit organization that conducts independent testing and research on various products and services, including insurance. Their ratings are based on factors like claims handling, customer service, and policy transparency. A higher Consumer Reports rating suggests a more positive customer experience.

- N.A.I.C. (National Association of Insurance Commissioners): The N.A.I.C. collects and publishes data on consumer complaints related to insurance companies. A lower number of complaints indicates a better customer experience and a greater focus on resolving customer issues.

Claims Handling

Claims handling is a critical aspect of the insurance experience. A company’s ability to handle claims fairly and efficiently can make a big difference in customer satisfaction. Several factors are considered when evaluating claims handling:

- Claims Processing Time: A shorter claims processing time indicates a more efficient and responsive claims handling process. Customers want to get their claims settled quickly and without unnecessary delays.

- Claims Settlement Ratio: The claims settlement ratio measures the percentage of claims that are paid out compared to the total number of claims received. A higher claims settlement ratio suggests a more favorable claims handling experience.

- Customer Feedback on Claims: Customer feedback on claims handling can provide valuable insights into a company’s performance. Reviews, surveys, and online forums can offer valuable insights into how customers perceive the claims handling process.

Product Innovation

Insurance companies are constantly innovating to meet the changing needs of their customers. Companies that offer innovative products and services are more likely to attract and retain customers. Some examples of product innovation in the insurance industry include:

- Telematics: Telematics devices, often found in connected cars, can track driving behavior and provide discounts for safe driving habits.

- Usage-Based Insurance: Usage-based insurance programs allow drivers to pay premiums based on their actual driving habits. This can be a more equitable pricing model for those who drive less or drive more safely.

- Digital Platforms: Many insurance companies are developing digital platforms that make it easier for customers to manage their policies, file claims, and communicate with their insurer.

Social Responsibility

Social responsibility is becoming increasingly important for consumers. Customers want to support companies that are committed to ethical business practices and giving back to their communities. Some examples of social responsibility in the insurance industry include:

- Environmental Sustainability: Some insurance companies are taking steps to reduce their environmental impact by investing in renewable energy sources and reducing their carbon footprint.

- Community Involvement: Many insurance companies are actively involved in their communities by sponsoring local events, supporting charities, and volunteering their time.

- Diversity and Inclusion: Insurance companies are working to create more diverse and inclusive workplaces by promoting equal opportunities and fostering a sense of belonging for all employees.

Industry Trends and Future Outlook

The insurance industry is undergoing a period of rapid transformation, driven by technological advancements, changing customer expectations, and evolving regulatory landscapes. These trends are reshaping the competitive landscape, forcing insurance companies to adapt and innovate to remain relevant. This section explores the key industry trends and their potential impact on the top 10 insurance companies.

Digitalization

Digitalization is revolutionizing the insurance industry, from how products are developed and distributed to how claims are processed and customer service is delivered. Insurance companies are increasingly leveraging technology to streamline operations, enhance customer experiences, and develop innovative products and services.

- Insurtech: The emergence of insurtech startups is disrupting the traditional insurance model. These companies are using technology to offer more personalized and flexible insurance products, often at lower prices.

- Artificial Intelligence (AI): AI is being used to automate tasks, improve risk assessment, personalize pricing, and detect fraud. For example, AI-powered chatbots can provide instant customer support, while AI algorithms can analyze large datasets to identify patterns and predict risk.

- Internet of Things (IoT): IoT devices are generating vast amounts of data that can be used to improve risk assessment and pricing. For example, telematics devices in cars can track driving behavior and provide discounts to safe drivers.

The top 10 insurance companies are investing heavily in digitalization to stay competitive. They are acquiring insurtech startups, developing their own digital platforms, and partnering with technology companies to enhance their offerings.

Importance of Choosing the Right Insurance Company

Picking the right insurance company is like choosing the right outfit for a big event – you want something that fits perfectly, protects you, and makes you feel confident. Just like a bad outfit can ruin your night, the wrong insurance company can leave you vulnerable and financially exposed when you need it most.

Factors to Consider When Choosing an Insurance Company

Selecting the right insurance company is crucial for ensuring you have adequate protection when you need it. Here are some key factors to consider:

- Coverage: The coverage offered by an insurance company should align with your specific needs and risks. For example, if you own a home, you’ll need a homeowner’s insurance policy that provides sufficient coverage for your property and liability.

- Price: Insurance premiums can vary significantly between companies. It’s essential to compare quotes from multiple insurers to find the best value for your money. Remember, the cheapest option isn’t always the best, as it might offer limited coverage.

- Customer Service: When you need to file a claim, you’ll want an insurance company with a reputation for excellent customer service. Look for companies with responsive claims departments, clear communication processes, and positive customer reviews.

- Financial Stability: It’s crucial to choose an insurance company that is financially sound. A financially stable company is more likely to be able to pay claims in the event of a disaster or major loss. You can check the company’s financial ratings from agencies like A.M. Best and Standard & Poor’s.

Researching and Comparing Insurance Companies, What are the top 10 insurance companies

Once you know what factors are important to you, it’s time to start researching and comparing different insurance companies. Here are some tips:

- Use online comparison tools: Many websites allow you to compare quotes from multiple insurance companies simultaneously. This can save you time and effort.

- Read reviews: Check online reviews from other customers to get an idea of a company’s reputation for customer service and claims handling.

- Ask for recommendations: Talk to friends, family, and colleagues to see if they have any recommendations for insurance companies.

- Contact multiple companies directly: Don’t be afraid to contact insurance companies directly to ask questions and get personalized quotes.

Epilogue

So, there you have it! The top 10 insurance companies are a mix of established giants and rising stars, each with its own unique strengths. Whether you’re looking for life insurance, health coverage, or protection for your assets, this list gives you a head start on finding the right fit. Remember, the best insurance company for you is the one that provides the coverage you need, at a price you can handle, and with a customer service team that’s got your back. Do your research, compare options, and choose wisely!

User Queries

What is the difference between life insurance and health insurance?

Life insurance provides a financial payout to your beneficiaries upon your death, while health insurance covers medical expenses for illnesses and injuries.

How do I choose the right insurance company for me?

Consider your individual needs, such as the type of coverage you require, your budget, and your preferred level of customer service. Compare quotes, read reviews, and talk to an insurance agent to find the best fit.

What are the main factors that influence insurance company rankings?

Factors such as financial stability, customer satisfaction, claims handling, product innovation, and social responsibility all play a role in determining a company’s ranking.