- Understanding Health Insurance Companies

- Top 5 Health Insurance Companies in the United States

- Factors Influencing Company Rankings

- Considerations for Choosing a Health Insurance Company

- Trends in the Health Insurance Industry: What Are The Top 5 Health Insurance Companies

- Final Summary

- Clarifying Questions

What are the top 5 health insurance companies? It’s a question that’s on everyone’s mind, especially when navigating the wild world of healthcare costs. Choosing the right health insurance company can be a real head-scratcher, like trying to find the perfect pair of jeans – you want coverage that fits your needs, budget, and lifestyle. Let’s dive into the top 5 companies, see what they’re all about, and figure out which one might be your perfect match.

We’ll be looking at the big players in the game, the ones who have the most market share, and who are known for their strengths and weaknesses. Think of it like a health insurance popularity contest, where we’re crowning the kings and queens of coverage.

Understanding Health Insurance Companies

Navigating the world of health insurance can feel like trying to decipher a foreign language. But don’t worry, we’re here to break it down and make it all clear. This guide will help you understand the different types of plans, key factors to consider when choosing a company, and give you a glimpse into the US health insurance landscape.

Types of Health Insurance Plans

Health insurance plans are designed to cover different types of medical expenses. They come in various flavors, each with its own set of rules and costs. Knowing the differences is key to finding the right plan for your needs.

- Health Maintenance Organization (HMO): HMOs typically have lower premiums, but they require you to choose a primary care physician (PCP) within their network. You need a referral from your PCP to see specialists. HMOs emphasize preventative care and often offer lower copayments.

- Preferred Provider Organization (PPO): PPOs offer more flexibility than HMOs. You can see specialists without a referral, and you have access to a broader network of providers. However, PPOs usually have higher premiums and copayments than HMOs.

- Exclusive Provider Organization (EPO): EPOs are similar to HMOs, but they often have a wider network of providers. They usually require you to choose a PCP within their network and need referrals to see specialists.

- Point of Service (POS): POS plans combine features of HMOs and PPOs. They require you to choose a PCP, but you can go outside the network for care if you’re willing to pay higher costs.

- High Deductible Health Plan (HDHP): HDHPs have low premiums but high deductibles. This means you pay more out of pocket before your insurance kicks in. HDHPs are often paired with a Health Savings Account (HSA), which allows you to save pre-tax money to pay for healthcare expenses.

Key Factors to Consider When Choosing a Health Insurance Company

With so many plans available, it can be overwhelming to choose the right one. Here are some crucial factors to consider:

- Coverage: Make sure the plan covers the services you need, such as doctor visits, hospital stays, prescription drugs, and mental health care.

- Cost: Compare premiums, deductibles, copayments, and coinsurance. Don’t just focus on the lowest premium, consider the overall cost of the plan.

- Network: Check if your doctors, hospitals, and pharmacies are in the plan’s network. Out-of-network care can be significantly more expensive.

- Customer Service: Read reviews and ask friends and family for recommendations. You want a company that is responsive and helpful.

- Financial Stability: Choose a company with a strong financial track record. This ensures they’ll be there to cover your claims in the long run.

Overview of the Health Insurance Industry in the United States

The US health insurance industry is a complex ecosystem with various players, including private insurance companies, government programs, and employers.

The Affordable Care Act (ACA), also known as Obamacare, was a landmark piece of legislation passed in 2010 that aimed to expand health insurance coverage and make it more affordable.

The ACA created health insurance marketplaces where individuals and families can shop for plans. It also expanded Medicaid eligibility and provided subsidies to help people afford coverage. Despite some controversies, the ACA has significantly increased the number of Americans with health insurance.

Top 5 Health Insurance Companies in the United States

The health insurance industry is a significant part of the U.S. economy, with millions of Americans relying on these companies for their healthcare needs. Understanding the landscape of the top players is essential for individuals and families making informed decisions about their health insurance coverage.

Top 5 Health Insurance Companies, What are the top 5 health insurance companies

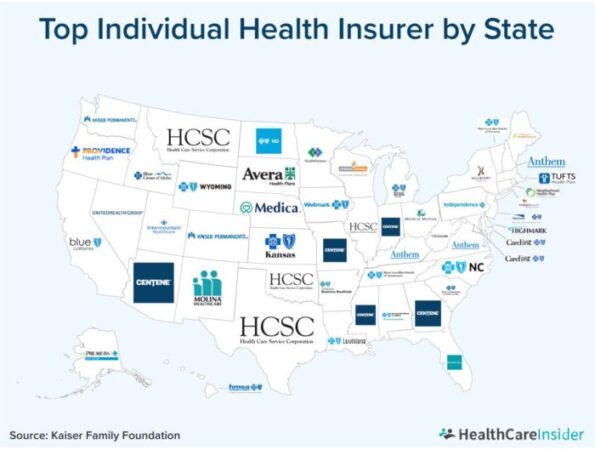

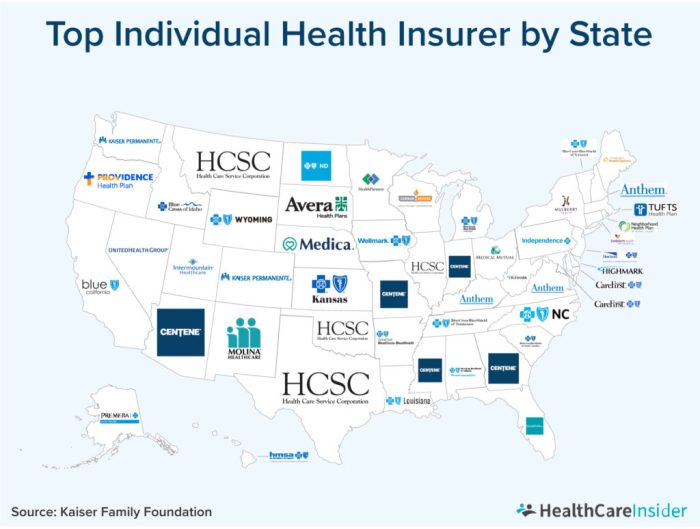

The following table lists the top 5 health insurance companies in the United States, based on market share as of 2022, according to the National Association of Insurance Commissioners (NAIC):

| Company Name | Market Share | Description |

|---|---|---|

| UnitedHealth Group | 14.7% | UnitedHealth Group is the largest health insurer in the U.S., offering a wide range of health insurance plans, including individual, employer-sponsored, and Medicare Advantage. They also have a large presence in the pharmacy benefits management (PBM) industry through OptumRx. |

| Anthem, Inc. | 9.8% | Anthem is the second-largest health insurer in the U.S., known for its Blue Cross and Blue Shield plans. They provide coverage to individuals, families, and employers, and also have a strong presence in the Medicare Advantage market. |

| Cigna | 6.3% | Cigna is a global health services company that offers a wide range of health insurance products, including individual, family, and employer-sponsored plans. They are known for their focus on health and wellness programs. |

| Humana Inc. | 5.4% | Humana is a leading provider of Medicare Advantage and prescription drug plans. They also offer individual and employer-sponsored health insurance plans. |

| Centene Corporation | 4.7% | Centene is a large health insurer focused on providing coverage to low-income individuals and families through Medicaid and CHIP programs. They also offer commercial health insurance plans. |

Strengths and Weaknesses

Each of these top health insurance companies has its own strengths and weaknesses. For example, UnitedHealth Group is known for its large network of providers and its innovative health management programs. However, they have also faced criticism for their high premiums and complex claims processes. Anthem is known for its strong financial performance and its focus on customer service, but they have also been criticized for their high deductibles and limited provider networks in some areas. Cigna is known for its focus on health and wellness, but they have also been criticized for their high premiums and limited coverage options. Humana is known for its strong Medicare Advantage offerings, but they have also been criticized for their limited coverage options for individuals outside of Medicare. Centene is known for its focus on providing coverage to low-income individuals and families, but they have also been criticized for their limited provider networks in some areas.

Factors Influencing Company Rankings

So, you’re ready to dive into the world of health insurance, but you’re wondering how these companies get ranked, right? It’s not just a random draw, folks. It’s a complex system with factors that play a major role in determining which health insurance companies come out on top. Buckle up, because we’re about to break down the key elements that influence these rankings.

Customer Satisfaction

You know how it goes – a happy customer is a loyal customer. This applies to health insurance too. When it comes to ranking companies, customer satisfaction is a big deal. Think of it as the “people’s choice” award for health insurance. Companies that have happy customers tend to climb higher in the rankings.

- Customer service: How responsive are they when you need help? Do they make it easy to file claims? These are just a couple of things customers consider.

- Transparency: Are they clear and upfront about their policies and costs? Customers want to know what they’re getting into.

- Claims processing: This is a big one. How quickly and efficiently do they handle claims? Nobody wants to deal with a long, drawn-out process when they need healthcare.

Financial Stability

You wouldn’t want to trust your health insurance to a company that’s about to go belly up, would you? Financial stability is a key factor in ranking health insurance companies. It’s about making sure they’re financially sound and able to cover your healthcare costs, no matter what.

- Credit ratings: These ratings, like those from Moody’s or Standard & Poor’s, give a snapshot of a company’s financial health. Higher ratings generally indicate greater financial stability.

- Reserves: Companies need to set aside money to cover future claims. The more reserves they have, the better equipped they are to handle unexpected expenses.

- Profitability: A profitable company is a good sign. It shows they’re managing their finances well and can likely continue to provide coverage.

Network Size

The bigger the network, the better, right? This is another crucial factor in ranking health insurance companies. A wide network means you have more choices when it comes to doctors, hospitals, and other healthcare providers. It’s all about having options.

- Geographic reach: Does the network cover your area? This is important if you’re moving or traveling. A wider network means more options no matter where you are.

- Specialty providers: Do they have a good selection of specialists? This is especially important if you have a chronic condition or need specialized care.

- In-network vs. out-of-network costs: It’s crucial to know how much more you’ll pay for care outside the network. This can impact your overall costs.

Regulatory Compliance

Health insurance companies have to play by the rules. That’s where regulatory compliance comes in. This is about making sure they meet the standards set by government agencies like the Centers for Medicare & Medicaid Services (CMS).

- State and federal regulations: Companies have to comply with laws that govern health insurance, including things like coverage requirements and consumer protections.

- Transparency and accountability: Regulatory compliance helps ensure that companies are transparent about their policies and accountable for their actions. This is crucial for protecting consumers.

- Penalties for non-compliance: If a company doesn’t follow the rules, they can face fines and other penalties. This keeps them in line and encourages them to do the right thing.

Industry Reputation

Think of industry reputation as the “word-of-mouth” effect in the health insurance world. It’s about how well a company is perceived by industry experts, other insurance companies, and even consumers. A good reputation is a valuable asset.

- Awards and recognition: Have they won awards for customer satisfaction or financial performance? This can give them a leg up in the rankings.

- Industry publications: What do industry experts say about them? Do they get positive reviews in magazines and journals? This can be a good indicator of their standing in the industry.

- Public perception: What do consumers think about them? Are they known for being reliable and trustworthy? This can play a big role in how they’re ranked.

Considerations for Choosing a Health Insurance Company

Choosing the right health insurance company is a crucial decision that can significantly impact your financial well-being and access to healthcare. It’s not just about finding the cheapest option; it’s about finding a plan that meets your individual needs and provides comprehensive coverage when you need it most.

Essential Considerations

Before diving into the selection process, it’s essential to assess your individual healthcare needs and preferences. Consider factors like your age, health status, lifestyle, and budget.

- Coverage Needs: Determine the types of medical services you anticipate needing, such as preventive care, hospitalization, prescription drugs, mental health services, and maternity care.

- Network Size: Evaluate the size and scope of the insurance company’s network. A larger network typically offers more healthcare providers and hospitals to choose from.

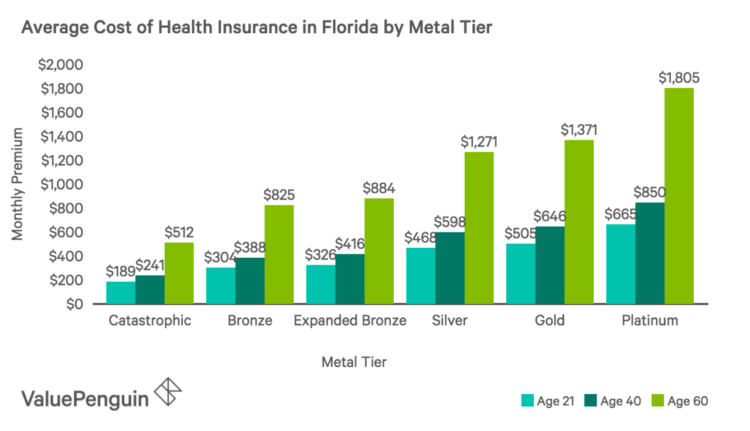

- Premium Costs: Compare monthly premiums across different plans and providers. Consider the trade-offs between lower premiums and higher deductibles or co-pays.

- Deductibles and Co-pays: Understand the financial responsibility you’ll bear before insurance kicks in (deductible) and the percentage you’ll pay for covered services (co-pay).

- Out-of-Pocket Maximums: Familiarize yourself with the maximum amount you’ll be responsible for paying out-of-pocket in a given year.

- Prescription Drug Coverage: Assess the formulary (list of covered medications) and the co-pay amounts for prescription drugs you take.

- Customer Service and Claims Processing: Research the insurance company’s reputation for customer service and claims processing efficiency.

Questions to Ask Potential Providers

When contacting insurance companies, it’s essential to ask insightful questions to gain a clear understanding of their plans and services.

- What is the network size and scope in my geographic area? This question helps you determine if your preferred doctors and hospitals are included in the network.

- What are the co-pay amounts for common medical services, such as doctor visits, hospital stays, and prescription drugs? This information allows you to compare the cost of care across different plans.

- What is the process for filing claims and how long does it typically take to receive reimbursement? Understanding the claims process can help you anticipate potential delays or complications.

- What are the customer service options available, such as phone, email, or online chat? Knowing the available support channels ensures you can easily reach out for assistance.

- Does the plan cover preventive care services, such as annual checkups and screenings? Preventive care can help detect health issues early and potentially reduce the need for more expensive treatments later.

- What are the limitations or exclusions of the plan? Knowing the plan’s limitations can help you avoid unexpected costs and ensure you have the coverage you need.

Tips for Navigating the Selection Process

Choosing the right health insurance plan can feel overwhelming, but by following these tips, you can make a well-informed decision.

- Start Early: Don’t wait until the last minute to research and compare plans. Allow ample time to thoroughly evaluate your options.

- Utilize Online Resources: Take advantage of online resources, such as insurance company websites, comparison tools, and government websites, to gather information and compare plans.

- Consult a Broker: Consider consulting with an independent insurance broker who can provide impartial advice and help you navigate the selection process.

- Read the Fine Print: Carefully review the policy documents, including the Summary of Benefits and Coverage (SBC), to understand the plan’s details and limitations.

- Ask for Clarification: If you have any questions or uncertainties, don’t hesitate to ask for clarification from the insurance company or broker.

- Consider Your Long-Term Needs: While your current health status is important, think about your future healthcare needs and choose a plan that provides adequate coverage for the long term.

Trends in the Health Insurance Industry: What Are The Top 5 Health Insurance Companies

The health insurance industry is constantly evolving, driven by technological advancements, shifting consumer preferences, and evolving healthcare policies. Several trends are shaping the future of health insurance, impacting how consumers access and manage their healthcare.

Technology’s Impact on Health Insurance

Technology plays a pivotal role in transforming the health insurance landscape, driving efficiency, enhancing customer experiences, and creating new opportunities for innovation.

- Telemedicine and Virtual Care: The rise of telehealth has revolutionized healthcare delivery, enabling patients to consult with healthcare providers remotely via video conferencing or phone calls. This trend is particularly prominent in health insurance, with many insurers offering telehealth benefits as part of their plans. Telemedicine reduces healthcare costs, improves access to care, and provides convenience for consumers. For example, in 2020, during the COVID-19 pandemic, telehealth utilization surged dramatically, demonstrating its potential to bridge gaps in healthcare access.

- Artificial Intelligence (AI): AI is being increasingly used in the health insurance industry to automate processes, personalize customer experiences, and improve fraud detection. AI-powered chatbots can answer customer inquiries, analyze medical claims to identify potential fraud, and provide personalized health recommendations. The application of AI in health insurance is still in its early stages, but its potential to enhance efficiency and improve decision-making is significant.

- Data Analytics and Predictive Modeling: Health insurance companies are leveraging data analytics to gain insights into consumer behavior, risk factors, and healthcare trends. This data-driven approach enables insurers to develop more personalized and cost-effective plans. For instance, by analyzing data on health history, lifestyle, and genetic factors, insurers can predict future healthcare needs and offer customized plans based on individual risk profiles.

- Wearable Technology: Wearable devices like fitness trackers and smartwatches are becoming increasingly popular, collecting data on health metrics such as heart rate, sleep patterns, and activity levels. Health insurance companies are incorporating data from wearables into their plans, offering discounts or rewards for healthy behaviors. By tracking health data, insurers can incentivize healthy lifestyles and potentially reduce healthcare costs.

Final Summary

So, there you have it, the top 5 health insurance companies in the US, ready to take on the challenge of keeping you healthy and financially sound. Remember, choosing the right company is a personal decision, so do your research, compare plans, and ask questions until you find the perfect fit. You’re in the driver’s seat when it comes to your health, so make sure you’re covered, and let’s keep those healthcare costs under control!

Clarifying Questions

What is the difference between HMO and PPO health insurance plans?

HMOs (Health Maintenance Organizations) typically have lower premiums but require you to choose a primary care physician within their network. PPOs (Preferred Provider Organizations) offer more flexibility, allowing you to see providers outside their network, but often come with higher premiums.

How can I find out if a specific doctor is in a health insurance company’s network?

Most health insurance companies have online directories where you can search for doctors by name, specialty, and location. You can also contact the insurance company directly to confirm network participation.

What are some common health insurance terms I should know?

Some common terms include deductible (the amount you pay before insurance kicks in), co-pay (a fixed amount you pay for each doctor visit or prescription), and co-insurance (the percentage of the cost you pay after the deductible is met).