What car insurance companies offer sr22 – What car insurance companies offer SR-22? It’s a question that pops up when you’ve got a less-than-perfect driving record. Think of it like this: SR-22 insurance is like a “proof of responsibility” for the state, showing that you’re financially covered if you cause an accident. If you’ve got a DUI, a serious ticket, or a revoked license, you might need to get this special insurance. It’s like having a safety net for yourself and others on the road.

But don’t sweat it! There are plenty of insurance companies that offer SR-22 coverage, and finding the right one can be easier than you think. We’ll break down the ins and outs of SR-22 insurance, from what it is to how to get it, and even how much it’ll cost you. Buckle up, because we’re diving into the world of SR-22 insurance!

SR-22 Insurance: What Car Insurance Companies Offer Sr22

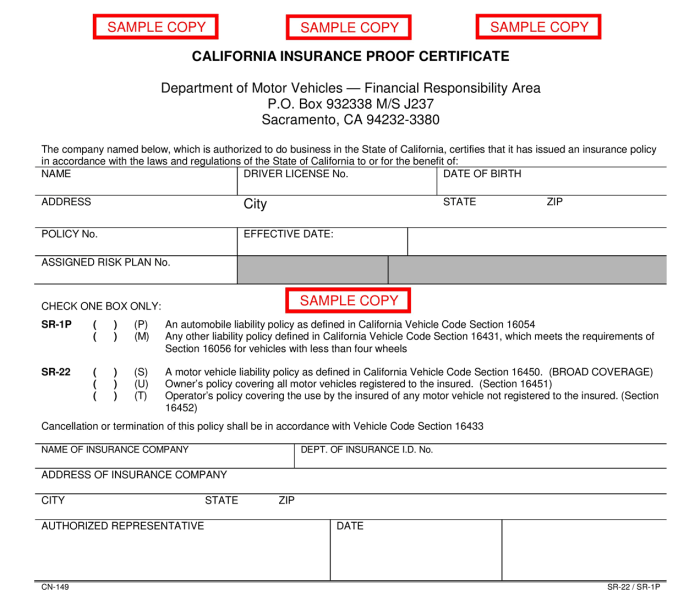

Think of SR-22 insurance as a little extra something you need to show the state that you’re a responsible driver, especially if you’ve had a few slip-ups in the past. It’s not a separate type of insurance, but more like a document that acts as a promise to the state. This promise ensures you’ll maintain the minimum required car insurance coverage in case you get into an accident.

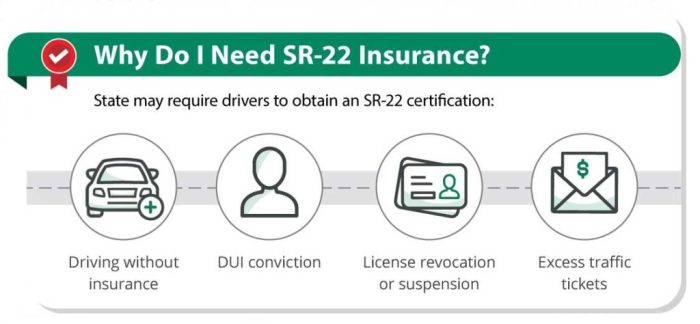

Why You Might Need SR-22 Insurance

You’ll need SR-22 insurance if you’ve been caught with a serious driving violation. These violations can include things like:

- Driving without insurance

- Driving under the influence (DUI/DWI)

- Hit and run accidents

- Multiple speeding tickets

- Reckless driving

How Long You’ll Need SR-22 Insurance

The duration of your SR-22 requirement depends on the severity of your violation and the state you live in. Generally, it can last anywhere from a few months to a couple of years. Think of it like a probation period for your driving privileges. You’ll need to keep your SR-22 insurance active during this time to ensure you’re maintaining the required coverage. Once you’ve completed your probationary period, you can usually cancel the SR-22.

Finding Car Insurance Companies Offering SR-22

Finding the right car insurance company that offers SR-22 insurance can feel like trying to find a needle in a haystack, especially when you’re already dealing with the stress of a driving violation. But don’t worry, we’re here to help you navigate the insurance jungle and find the perfect fit for your needs.

SR-22 Insurance Companies

Many car insurance companies offer SR-22 insurance, but not all of them are created equal. Some companies are known for their competitive pricing, while others excel in customer service or offer a wider range of coverage options. It’s important to shop around and compare quotes from different companies to find the best deal. Here’s a list of some reputable car insurance companies that offer SR-22 insurance:

- Geico: Geico is a popular choice for SR-22 insurance due to its competitive pricing and user-friendly online platform.

- Progressive: Progressive is another well-known insurance company that offers SR-22 insurance. They are known for their wide range of discounts and personalized insurance options.

- State Farm: State Farm is a large and reputable insurance company that offers SR-22 insurance with a focus on customer service and personalized coverage.

- Allstate: Allstate offers SR-22 insurance and is known for its comprehensive coverage options and discounts for safe driving.

- USAA: USAA is a military-focused insurance company that offers SR-22 insurance to active duty military personnel, veterans, and their families.

Comparing SR-22 Insurance Features and Pricing

When comparing SR-22 insurance quotes, it’s essential to consider more than just the price. You’ll want to compare the features and benefits offered by each company to ensure you’re getting the best value for your money. Here are some key factors to consider:

- Coverage Options: Some companies offer more comprehensive coverage options than others. Be sure to compare the different coverage levels available and choose the one that best suits your needs.

- Discounts: Many insurance companies offer discounts for safe driving, good grades, and other factors. Make sure to ask about available discounts when you’re getting quotes.

- Customer Service: Look for a company with a strong reputation for customer service. You’ll want to be able to easily contact them if you have any questions or need assistance.

- Financial Stability: It’s also important to consider the financial stability of the insurance company. Look for companies with strong ratings from independent agencies.

SR-22 Insurance Comparison Table

Here’s a table that compares some key factors of SR-22 insurance across different companies:

| Company | Coverage Options | Discounts | Customer Service Rating |

|---|---|---|---|

| Geico | Comprehensive, collision, liability, uninsured/underinsured motorist | Safe driver, good student, multi-car | 4.5/5 stars |

| Progressive | Comprehensive, collision, liability, uninsured/underinsured motorist | Safe driver, good student, multi-car, homeowner | 4/5 stars |

| State Farm | Comprehensive, collision, liability, uninsured/underinsured motorist | Safe driver, good student, multi-car, homeowner | 4.5/5 stars |

| Allstate | Comprehensive, collision, liability, uninsured/underinsured motorist | Safe driver, good student, multi-car, homeowner | 4/5 stars |

| USAA | Comprehensive, collision, liability, uninsured/underinsured motorist | Safe driver, good student, multi-car, military discounts | 4.7/5 stars |

How to Obtain SR-22 Insurance

You’ve been in a car accident or gotten a DUI, and now you need SR-22 insurance. Don’t worry, you’re not alone! Many drivers find themselves in this situation, and obtaining SR-22 insurance is actually a pretty straightforward process. Let’s break down the steps involved in securing your SR-22 insurance and ensure you’re back on the road in no time.

The SR-22 Form Submission Process

The SR-22 form is a document that proves you have the required liability insurance coverage. It’s filed with your state’s Department of Motor Vehicles (DMV) by your insurance company, demonstrating that you’re meeting the legal requirements to drive.

Steps to Obtain SR-22 Insurance

- Contact your insurance company: The first step is to contact your current insurance company and inform them about your need for SR-22 insurance. They will guide you through the process and let you know if they offer SR-22 coverage. If your current insurer doesn’t offer SR-22, you’ll need to find a new insurance company that does.

- Provide necessary information: Your insurance company will need some information from you, such as your driving record, the reason you need SR-22 insurance, and your vehicle information. Be prepared to provide this information to ensure a smooth application process.

- Complete the application: Your insurance company will provide you with an application for SR-22 insurance. Make sure you complete all the required fields accurately and thoroughly. Review your application before submitting it to avoid any delays.

- Pay the premium: SR-22 insurance usually comes with a higher premium than standard car insurance. Be prepared to pay the premium upfront, as this will ensure your coverage is active.

- Receive your SR-22 form: Once your application is approved and the premium is paid, your insurance company will file the SR-22 form with your state’s DMV. You’ll receive a copy of the form for your records.

Tips for a Smooth Application Process

- Be honest and upfront: Be honest with your insurance company about your driving history and the reason you need SR-22 insurance. This will help them determine the best coverage options for you and avoid any potential issues later on.

- Gather all necessary documents: Before contacting your insurance company, gather all the relevant documents, such as your driver’s license, proof of previous insurance, and any court orders related to your driving violation. Having these documents readily available will streamline the application process.

- Shop around for the best rates: Don’t settle for the first SR-22 insurance quote you receive. Get quotes from multiple insurance companies to compare rates and coverage options. This will help you find the most affordable and suitable policy for your needs.

- Maintain a clean driving record: Once you have SR-22 insurance, it’s crucial to maintain a clean driving record. Any further violations could result in higher premiums or even the cancellation of your policy.

SR-22 Insurance Costs and Factors Affecting Pricing

You might be thinking, “Okay, I need SR-22 insurance, but how much is this going to cost me?” Well, buckle up, because the price of SR-22 insurance can be a wild ride. It’s not like your regular car insurance; it’s a bit more expensive, and that’s because you’re basically saying, “Hey, insurance company, I’ve got a history of driving shenanigans, and I need you to keep an eye on me.”

The cost of SR-22 insurance can vary depending on several factors, including your driving history, the state you live in, and the insurance company you choose. It’s like trying to find the perfect pair of jeans: You need to shop around and compare prices to find the best deal.

Factors Affecting SR-22 Insurance Premiums, What car insurance companies offer sr22

Several factors can influence the price of your SR-22 insurance. Think of it like a game of “insurance roulette” where each spin of the wheel adds or subtracts from your premium. Here’s what you need to know:

- Your Driving History: This is the big kahuna. If you’ve got a history of traffic violations, accidents, or even DUI convictions, your SR-22 insurance will be more expensive. It’s like saying, “Hey, insurance company, I’m a bit of a hothead on the road.”

- Your State: Each state has its own set of regulations for SR-22 insurance, so the cost can vary depending on where you live. Think of it like a state-specific “SR-22 tax.”

- The Insurance Company: Just like you wouldn’t buy the same brand of jeans from every store, different insurance companies offer different rates for SR-22 insurance. So, it’s important to shop around and compare prices. It’s like saying, “Let’s see who’s got the best deal on this SR-22 insurance.”

- Your Vehicle: The type of car you drive can also affect the cost of your SR-22 insurance. If you’re driving a high-performance sports car, expect to pay more. It’s like saying, “Hey, insurance company, I’m a bit of a speed demon.”

- Your Age and Gender: Believe it or not, your age and gender can also play a role in the cost of your SR-22 insurance. Younger drivers and males often pay higher premiums. It’s like saying, “Hey, insurance company, I’m a bit of a risk.”

Impact of Driving History and State Regulations

Your driving history is like your “SR-22 report card.” The better your driving record, the lower your premium. Think of it like a reward system: Be a good driver, and you’ll be rewarded with lower insurance costs.

- Traffic Violations: If you’ve been caught speeding, running a red light, or committing other traffic violations, your SR-22 insurance will be more expensive. It’s like saying, “Hey, insurance company, I’m a bit of a rule-breaker.”

- Accidents: If you’ve been involved in an accident, even if it wasn’t your fault, your SR-22 insurance will likely be more expensive. It’s like saying, “Hey, insurance company, I’m a bit of a klutz.”

- DUI Convictions: If you’ve been convicted of DUI, your SR-22 insurance will be significantly more expensive. It’s like saying, “Hey, insurance company, I’m a bit of a party animal.”

State regulations can also affect the cost of your SR-22 insurance. Each state has its own rules about how long you need to maintain SR-22 insurance and how much you have to pay. Think of it like a state-specific “SR-22 playbook.”

SR-22 Insurance and Your Driving Record

Think of your SR-22 as a little shadow that follows you around, a constant reminder of your past driving mishaps. It’s a bit like a scarlet letter, except it’s not quite as dramatic. Basically, it lets the state know you’re a high-risk driver and you’ve got to prove you’re taking responsibility for your actions.

SR-22 Insurance and Your Driving Record

So, how does this whole SR-22 thing affect your driving record? Well, it’s like a “special” mark on your record that says, “Hey, this driver needs to be watched!” It doesn’t actually change your driving record itself, but it’s definitely a red flag for insurance companies. They’ll see that you’ve had some trouble in the past and that you’re required to carry SR-22 insurance.

Consequences of Failing to Maintain SR-22 Insurance

Now, let’s talk about the consequences of failing to maintain SR-22 insurance. This is where things get serious. It’s like a game of “keep away” with the state. If you drop your SR-22, you’re basically saying, “I’m not taking this seriously!” And the state is not going to be happy. Here’s what could happen:

* You’ll face a fine: Think of it as a “you’re in trouble” fee for not following the rules.

* Your license could be suspended: That means no driving for you! It’s like being grounded, but on a much larger scale.

* You might even be required to go to court: That’s like having to explain yourself to a judge, and it can be a real hassle.

Improving Your Driving Record

Okay, so you’ve got this SR-22, and you’re probably thinking, “How do I get rid of this thing?” Well, the good news is, you can improve your driving record and eventually get off the SR-22. It’s like turning over a new leaf, showing everyone that you’re a responsible driver. Here are some tips:

* Drive safely and obey traffic laws: This is the most important thing. No speeding, no texting while driving, and no drinking and driving. It’s like playing by the rules and showing everyone that you’re serious about being a safe driver.

* Take a defensive driving course: Think of it as driver’s ed 2.0. You’ll learn about safe driving techniques and how to avoid accidents. It’s like getting a refresher course in being a good driver.

* Maintain a clean driving record: This is like staying out of trouble. Avoid any more traffic violations or accidents. It’s like proving to everyone that you’ve learned your lesson.

* Keep your SR-22 insurance in place: This is the most important thing. Don’t let it lapse. It’s like staying on top of your game and showing the state that you’re serious about taking responsibility for your driving.

Conclusion

Getting SR-22 insurance can feel like a bit of a hassle, but it’s a necessary step to get back on the road. By understanding what it is, how to get it, and how much it costs, you can navigate the process with confidence. Remember, it’s all about showing the state you’re taking responsibility for your driving, and that you’re committed to being a safe driver. So, go ahead and find a reputable insurance company, get your SR-22 in place, and get back to cruising!

Essential FAQs

What if I don’t get SR-22 insurance?

If you’re required to have SR-22 insurance and you don’t get it, you could face serious consequences. Your license could be suspended, and you might even have to pay fines. It’s important to take care of this requirement to avoid legal trouble.

How long do I have to have SR-22 insurance?

The length of time you need SR-22 insurance depends on your state and the specific reason you need it. It can range from a few months to several years. Your insurance company will be able to give you more details about your specific situation.

Can I get SR-22 insurance if I have a bad driving record?

While a bad driving record can make it more expensive, it’s not impossible to get SR-22 insurance. Many insurance companies offer this type of coverage, and they’ll assess your situation to determine your rates. Just be prepared to pay higher premiums than you would with a clean driving record.

How can I improve my driving record?

There are a few things you can do to improve your driving record, which can help lower your insurance costs in the long run. Drive safely, avoid traffic violations, and consider taking a defensive driving course. These steps can show insurance companies that you’re taking responsibility for your driving and are committed to being safe on the road.