- Types of Companies Buying Life Insurance

- Key Considerations for Company Life Insurance Purchases: What Companies Buy Life Insurance Policies

- Benefits of Life Insurance for Companies

- Common Life Insurance Policy Types for Companies

- The Life Insurance Purchase Process for Companies

- Case Studies of Companies Using Life Insurance

- Ending Remarks

- Key Questions Answered

What companies buy life insurance policies? It’s a question that might seem strange at first. We usually think of individuals buying life insurance to protect their families, but businesses need protection too. Imagine a small bakery losing its head baker, or a tech startup losing its visionary founder. These are the situations where life insurance for companies comes into play, ensuring the business can weather the storm and keep going.

Companies purchase life insurance for a variety of reasons, from safeguarding against financial losses due to the death of a key employee to providing employee benefits and ensuring business continuity. Understanding the different types of companies that buy life insurance, the policies they choose, and the benefits they gain can be crucial for businesses of all sizes.

Types of Companies Buying Life Insurance

Life insurance isn’t just for individuals. Companies also purchase life insurance policies for various reasons, often as a strategic tool to manage risk and ensure financial stability.

Companies Buying Life Insurance

Companies acquire life insurance policies to safeguard their financial interests and protect against potential losses. Here are the most common types of companies that purchase life insurance:

- Private Companies: Private companies may purchase life insurance on key employees, such as CEOs, founders, or other essential personnel. This coverage protects the company from financial repercussions if a key employee unexpectedly passes away. This ensures continuity in leadership and operations, preventing potential disruption and loss of valuable expertise. For instance, a tech startup might insure its CEO, whose departure could significantly impact the company’s future.

- Public Companies: Public companies also buy life insurance to mitigate the risk of losing a crucial executive. This helps maintain shareholder value and ensures the company’s long-term stability. For example, a publicly traded manufacturing company might insure its CEO, whose loss could affect stock prices and investor confidence.

- Partnerships: Partnerships, like law firms or accounting firms, often insure their partners to provide financial support to the surviving partners and the firm itself in the event of a partner’s death. This helps maintain the firm’s operations and financial stability. For example, a law firm with multiple partners might insure each partner, ensuring the firm’s continued operation if one partner unexpectedly passes away.

- Non-Profit Organizations: Non-profit organizations might purchase life insurance on key personnel, such as executive directors or program directors, to protect their mission and ensure the continuity of their programs. This ensures the organization’s financial stability and helps maintain its impact. For example, a non-profit organization focusing on environmental conservation might insure its executive director, whose loss could disrupt the organization’s fundraising and program execution.

- Financial Institutions: Financial institutions, like banks and insurance companies, often buy life insurance to protect themselves against the loss of valuable employees or to secure loans. This helps maintain their financial stability and ensures their ability to fulfill their obligations. For example, a bank might insure its loan officers to protect itself against the loss of revenue from outstanding loans.

Reasons for Purchasing Life Insurance

Companies purchase life insurance for a variety of reasons, each tailored to their specific needs and circumstances:

- Key Person Insurance: This type of insurance covers the loss of a key employee who plays a critical role in the company’s success. It helps the company compensate for the loss of expertise, leadership, and potential revenue. For instance, a company might insure its chief technology officer, whose loss could significantly impact the company’s innovation and development.

- Business Continuation: Life insurance can provide financial resources to help a company continue operating after the death of a key employee. This can help cover expenses, maintain operations, and prevent disruption. For example, a company might purchase life insurance to cover the cost of hiring a replacement for a deceased employee or to fund the purchase of the deceased employee’s shares in the company.

- Debt Repayment: Companies may use life insurance to repay outstanding debts, such as loans or mortgages, if a key employee passes away. This protects the company’s financial stability and prevents potential default. For example, a company might purchase life insurance to repay a loan used to purchase a new piece of equipment.

- Estate Planning: Life insurance can be used as part of a company’s estate planning strategy, ensuring a smooth transition of ownership and assets. For example, a company might use life insurance to purchase the deceased employee’s shares in the company, preventing a potential power struggle among surviving shareholders.

- Tax Advantages: In some cases, life insurance premiums may be tax-deductible, making it a financially advantageous option for companies. For example, a company might deduct the premiums for key person insurance as a business expense.

Key Considerations for Company Life Insurance Purchases: What Companies Buy Life Insurance Policies

Deciding whether or not to purchase life insurance for your company is a big decision. You’re not just thinking about protecting your business, but also about safeguarding the financial well-being of your employees and their families. To make the right choice, you need to weigh a variety of factors, from the type of policy to the potential financial implications.

Factors Companies Consider When Buying Life Insurance

Companies weigh several factors when considering life insurance. These factors help determine the need for life insurance, the type of policy, and the coverage amount.

- Key Employee Protection: Companies might purchase life insurance to protect themselves from the financial impact of losing a key employee. This can be someone with unique skills, knowledge, or relationships that are crucial to the business’s success. The death benefit from the policy can help cover the costs of replacing that employee, such as recruitment, training, and lost productivity.

- Business Continuity: Life insurance can help ensure business continuity in the event of the death of a key stakeholder, like a founder or CEO. The death benefit can provide the funds needed to keep the business running smoothly during a transition period, potentially preventing financial hardship or even bankruptcy.

- Debt Repayment: Companies often use life insurance to cover outstanding debt obligations, such as loans or mortgages. This ensures that the business can continue to operate and repay its debts even if a key individual passes away.

- Tax Advantages: Life insurance premiums are generally tax-deductible as a business expense, and the death benefit is typically tax-free to the beneficiary. These tax benefits can make life insurance a more attractive investment for businesses.

- Employee Benefits: Some companies offer life insurance as a benefit to their employees. This can be a valuable perk that helps attract and retain talent. Additionally, it demonstrates the company’s commitment to the well-being of its workforce.

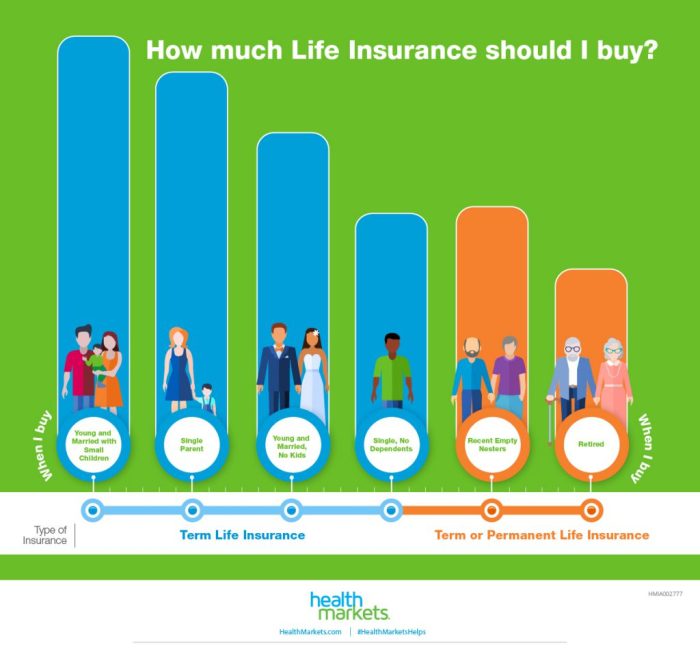

Types of Life Insurance Policies for Companies

There are several types of life insurance policies available for companies. Each type has its own characteristics and suitability for different business needs.

- Term Life Insurance: Term life insurance provides coverage for a specific period, typically 10 to 30 years. It is generally the most affordable option, but it does not build cash value. Companies might choose term life insurance to cover temporary needs, like debt repayment or key employee protection, during a specific period.

- Whole Life Insurance: Whole life insurance provides permanent coverage for the insured’s entire life. It also builds cash value that can be borrowed against or withdrawn. While whole life insurance is more expensive than term life, it can be a valuable investment for businesses that need long-term coverage and a source of cash.

- Universal Life Insurance: Universal life insurance offers flexible premiums and death benefits, allowing businesses to adjust the coverage as their needs change. It also builds cash value, though the growth rate is not guaranteed. Universal life insurance can be a good option for businesses with fluctuating financial needs.

- Group Life Insurance: Group life insurance is typically offered to employees as a benefit. It provides coverage for a set amount, often based on salary or position. Group life insurance is generally more affordable than individual policies and can be a valuable perk for employees.

Financial and Legal Implications of Company Life Insurance

Purchasing life insurance for your company comes with both financial and legal implications. Understanding these implications is essential for making informed decisions.

- Premium Costs: Life insurance premiums can be a significant expense, especially for large policies. Companies need to carefully consider the cost of premiums and factor them into their financial planning.

- Death Benefit Taxation: The death benefit from a life insurance policy is generally tax-free to the beneficiary, but there are some exceptions. For example, if the policy is used for business purposes, the death benefit may be subject to taxation.

- Beneficiary Designation: Companies need to carefully designate the beneficiary of the life insurance policy. This could be the company itself, a shareholder, or a trust. The beneficiary designation should be clearly defined in the policy documents.

- Legal Compliance: Companies need to ensure that their life insurance purchases comply with all applicable laws and regulations. This includes understanding the requirements for disclosure, beneficiary designation, and tax reporting.

Benefits of Life Insurance for Companies

Life insurance can be a valuable tool for businesses of all sizes, offering a range of benefits that contribute to financial stability and overall success.

Financial Security

Life insurance provides financial security for businesses by offering a lump-sum death benefit that can be used to cover various financial obligations and losses. This financial cushion can help companies navigate unexpected challenges, such as:

- Paying off debts, including loans, mortgages, and outstanding bills

- Covering operating expenses, such as rent, utilities, and payroll

- Funding business expansion or acquisition plans

- Protecting against financial hardship caused by the loss of a key employee

By providing financial stability, life insurance can help businesses maintain their operations and continue to thrive even in the face of unexpected events.

Business Continuity

Life insurance plays a vital role in ensuring business continuity by providing the financial resources necessary to:

- Replace a key employee or fill a critical role

- Maintain operations and meet financial obligations

- Provide time for the company to adjust and adapt to the loss

- Secure the future of the business and protect its stakeholders

This can help prevent disruptions and ensure that the business continues to operate smoothly, minimizing the impact of a key employee’s death on the company’s performance.

Key Person Protection

Key person life insurance is a specialized type of policy designed to protect businesses from the financial loss associated with the death of a critical employee. This type of policy provides a death benefit that can be used to:

- Cover the cost of replacing the key employee

- Maintain business operations and profitability

- Protect the company’s investment in the key employee

- Minimize the disruption caused by the loss of a key employee

Key person insurance can be particularly valuable for businesses that rely heavily on the skills and expertise of a few key individuals.

Employee Benefits

Life insurance can also be offered as a valuable employee benefit, attracting and retaining top talent. This can help businesses:

- Improve employee morale and job satisfaction

- Enhance employee loyalty and commitment

- Reduce employee turnover and recruitment costs

- Boost the company’s reputation as a caring and supportive employer

Offering life insurance as an employee benefit demonstrates a commitment to employee well-being and can contribute to a positive and productive work environment.

Common Life Insurance Policy Types for Companies

Businesses can choose from various life insurance policy types to protect their financial interests and ensure continuity in case of a key employee’s death. The selection depends on factors like the company’s size, financial goals, and risk tolerance.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It’s a straightforward and affordable option, ideal for covering short-term needs like debt repayment or replacing a key employee’s income. The premium is usually lower than other types, making it a cost-effective choice for businesses with limited budgets.

Whole Life Insurance

Whole life insurance offers lifelong coverage, providing a death benefit regardless of when the insured individual passes away. It also builds cash value that can be borrowed against or withdrawn. Whole life insurance premiums are typically higher than term life insurance, but they remain fixed throughout the policy’s lifetime.

Universal Life Insurance

Universal life insurance combines death benefit coverage with a flexible cash value component. Policyholders have more control over their premiums and death benefit, allowing them to adjust the policy based on their changing needs. Universal life insurance premiums can fluctuate depending on interest rates and investment performance.

The Life Insurance Purchase Process for Companies

Purchasing life insurance for a company is a crucial step in ensuring financial stability and protecting against unexpected losses. It’s like getting a safety net for your business, especially when it comes to key employees or covering debt obligations. This process involves careful planning and consideration to ensure you choose the right policy that meets your specific needs.

Assessing Insurance Needs

The first step in purchasing life insurance for your company is to determine your specific needs. Think about what you want to achieve with the policy. Do you need to protect against the loss of a key employee? Are you looking to cover business debts or financial obligations? Or perhaps you need to provide a death benefit to the family of a deceased employee? By clearly defining your goals, you can identify the type of life insurance policy that best suits your company.

Obtaining Quotes

Once you have a clear understanding of your needs, you can start obtaining quotes from different life insurance providers. You can compare quotes from various companies to find the best value for your money. This process involves providing information about your company, the insured individuals, and the coverage you need. It’s like shopping around for the best deal on a new car.

Selecting a Policy

After reviewing the quotes, you’ll need to select a policy that meets your company’s needs and budget. Consider factors like the premium amount, the coverage amount, and the policy’s terms and conditions. It’s essential to choose a policy that provides adequate coverage without breaking the bank.

Completing the Application

Once you’ve selected a policy, you’ll need to complete an application with the insurance provider. This application will require information about your company, the insured individuals, and their health history. The insurer will review the application and may request additional information or medical exams.

Paying Premiums

After the application is approved, you’ll need to start paying premiums for the life insurance policy. The premium amount will depend on the coverage amount, the insured individual’s age and health, and other factors. You can choose to pay premiums monthly, quarterly, annually, or in a lump sum.

Consulting with a Financial Advisor or Insurance Broker

Navigating the life insurance purchase process can be complex, especially for businesses. Consulting with a financial advisor or insurance broker can provide valuable guidance and expertise. They can help you assess your needs, compare quotes, select the right policy, and ensure that you’re making informed decisions. It’s like having a trusted friend who knows the ropes and can help you avoid any pitfalls.

Case Studies of Companies Using Life Insurance

Life insurance can be a powerful tool for businesses of all sizes. Here are some case studies that illustrate how different types of companies can use life insurance to achieve their specific goals.

Small Business Using Life Insurance for Key Person Protection, What companies buy life insurance policies

Key person insurance is a type of life insurance policy that is designed to protect a business from the financial loss that could occur if a key employee dies. This type of policy is often used by small businesses that rely heavily on the skills and expertise of a few key individuals.

- Imagine a small bakery that relies heavily on its head baker, who has a unique recipe for their signature cake. If the head baker were to die, the bakery would lose a valuable asset and could potentially face significant financial losses. A key person life insurance policy could provide the bakery with the financial resources it needs to replace the head baker, find a new recipe, or hire a consultant to help them recreate the signature cake. The policy would also provide the bakery with some time to adjust to the loss of their key employee.

Large Corporation Using Life Insurance for Employee Benefits

Large corporations often use life insurance as part of their employee benefits package. This can be a valuable benefit for employees, as it can provide their families with financial security in the event of their death.

- A large technology company may offer a group life insurance policy to all of its employees. This policy would provide a death benefit to the employee’s beneficiaries, such as their spouse or children. The death benefit could be used to cover expenses such as funeral costs, mortgage payments, or college tuition. The company may also offer additional life insurance coverage to employees who have dependents or who are in higher-paying positions.

Startup Using Life Insurance for Business Continuity Planning

Startups often face a number of challenges, including limited resources and a high degree of risk. Life insurance can be a valuable tool for startups that are looking to protect their business in the event of a key employee’s death.

- A startup that has a single founder or a small team of key employees may use life insurance to ensure that the business can continue to operate in the event of a key employee’s death. The death benefit from the life insurance policy could be used to fund the business until a replacement is found or to provide the remaining employees with the resources they need to continue operating the business. The life insurance policy could also be used to cover the cost of training a new employee or to purchase a business interest from the deceased employee’s estate.

Ending Remarks

In a world where businesses face constant challenges and uncertainties, life insurance can be a valuable tool for navigating the unexpected. From small businesses to large corporations, the right life insurance policy can offer peace of mind, financial stability, and the ability to continue operating even in the face of loss. By understanding the reasons why companies buy life insurance and the benefits it provides, businesses can make informed decisions about their risk management strategies and secure their future.

Key Questions Answered

Why would a small business need life insurance?

A small business might need life insurance to protect against the financial loss if a key employee, like the owner or a skilled manager, dies. It can help cover debts, keep the business running, and prevent a sudden closure.

What is key person insurance and how does it work?

Key person insurance is a type of life insurance policy specifically designed to protect a business from the loss of a vital employee. The policy pays out a death benefit to the business, which can be used to replace the lost employee’s skills, knowledge, and contributions.

Is life insurance for companies expensive?

The cost of life insurance for companies varies depending on factors like the size of the policy, the age and health of the insured individuals, and the type of policy. It’s important to get quotes from multiple insurers to compare prices and find the best option.