What companies offer Aetna insurance? This question is top-of-mind for many individuals seeking quality healthcare coverage. Aetna, a leading health insurance provider, boasts a diverse range of plans designed to meet various needs. From individual plans to employer-sponsored coverage, Aetna has a plan for you.

Aetna insurance is prevalent across numerous industries, offering a wide selection of plans that cater to diverse employee populations. Companies choose Aetna for its reputation for quality coverage, comprehensive benefits, and robust network of healthcare providers.

Companies Offering Aetna Insurance: What Companies Offer Aetna Insurance

Aetna is a leading health insurance provider in the United States, offering a wide range of health plans to individuals and employers. They provide coverage for medical, dental, vision, and other health-related services. Understanding which companies offer Aetna insurance as a benefit to their employees can provide valuable insights into the prevalence of Aetna in different industries.

Prevalence of Aetna Insurance Across Industries

Aetna’s presence in various industries reflects its commitment to providing comprehensive health insurance solutions to a diverse range of employers. The company has established a strong foothold in several key sectors, demonstrating its adaptability and appeal across different business models.

- Healthcare: This sector naturally has a high concentration of Aetna insurance plans. Hospitals, clinics, and healthcare providers often choose Aetna for their own employees due to its extensive network and comprehensive coverage options. Examples include:

- Cleveland Clinic: A renowned academic medical center offering a wide range of medical services.

- HCA Healthcare: One of the largest healthcare providers in the United States, with a vast network of hospitals and clinics.

- Financial Services: Aetna’s insurance offerings are also prevalent in the financial services industry. Banks, insurance companies, and investment firms often choose Aetna for its reputation for stability and financial strength. Examples include:

- Bank of America: A major financial institution with a global reach, providing a variety of financial products and services.

- Wells Fargo: Another large financial institution, offering banking, investment, and mortgage services.

- Technology: The technology industry, characterized by its rapid growth and innovative nature, often prioritizes employee benefits. Aetna’s plans cater to the diverse needs of tech companies, attracting them as clients. Examples include:

- Microsoft: A leading software and cloud computing company, known for its innovative products and services.

- Google: A multinational technology company, known for its search engine and other online services.

- Education: Educational institutions, including universities and colleges, also rely on Aetna insurance plans to provide comprehensive coverage for their employees. Aetna’s offerings cater to the specific needs of educators and researchers. Examples include:

- Harvard University: A prestigious Ivy League institution known for its academic excellence.

- Stanford University: Another leading research university with a strong focus on innovation.

Companies Offering Aetna Insurance by Size

Aetna’s reach extends across companies of all sizes, reflecting its commitment to providing health insurance solutions for businesses of various scales.

- Large Enterprises: Companies with over 500 employees often have the resources to negotiate favorable terms with insurance providers like Aetna. They often opt for self-funded plans or customized group plans. Examples include:

- Walmart: A multinational retail corporation, employing millions of people worldwide.

- Amazon: A global e-commerce and cloud computing giant, known for its rapid growth and innovation.

- Small and Medium-Sized Businesses (SMBs): Aetna also caters to the needs of smaller businesses. They offer a variety of plans specifically designed for SMBs, providing affordable and comprehensive coverage. Examples include:

- Local Restaurants: These businesses often rely on Aetna’s plans to provide health insurance to their employees.

- Small Technology Startups: These companies often choose Aetna for its flexible and affordable plans.

Factors Influencing Aetna Insurance Availability

Aetna insurance is a major player in the health insurance market, offering a wide range of plans for individuals and employers. However, not all companies have access to Aetna insurance, and the availability of Aetna plans can vary based on several factors.

Aetna’s decision to offer insurance plans to a company is influenced by a combination of factors, including the company’s size, industry, and location.

Company Size

The size of a company can significantly impact Aetna’s decision to offer insurance plans. Larger companies, with a significant number of employees, are generally more attractive to Aetna. This is because larger companies can offer Aetna a greater pool of potential customers, leading to economies of scale and increased profitability for Aetna.

Larger companies, with a significant number of employees, are generally more attractive to Aetna.

Industry

Aetna’s willingness to offer insurance plans to a company can also be influenced by the company’s industry. Some industries, such as healthcare and finance, may be more attractive to Aetna due to their stable employment and predictable healthcare costs. Other industries, such as construction or manufacturing, may be considered riskier, and Aetna may be less likely to offer plans to companies in these industries.

Location, What companies offer aetna insurance

Aetna’s geographic footprint also plays a role in its decision to offer insurance plans to a company. Aetna has a strong presence in certain regions of the country, and companies located in those areas may be more likely to have access to Aetna plans. However, companies located in less densely populated areas may have limited access to Aetna insurance.

Employee Perspective on Aetna Insurance

Aetna insurance is a major player in the healthcare market, offering a variety of plans to individuals and employers. While Aetna aims to provide comprehensive coverage and quality care, it’s essential to understand how employees perceive the insurance they receive through their employers. This section delves into employee feedback, testimonials, and insights regarding the pros and cons of Aetna insurance.

Employee Feedback on Aetna Insurance Coverage

Employee feedback provides valuable insights into the effectiveness and user experience of Aetna insurance plans. To better understand employee perspectives, a table summarizing common feedback points is presented below:

| Feedback Area | Common Feedback |

|—|—|

| Coverage | – Wide range of coverage options.

– Concerns about specific procedures or medications not being covered.

– Limited network of providers in some areas. |

| Cost | – Premiums and deductibles can be high for some plans.

– Concerns about out-of-pocket costs for specific services. |

| Customer Service | – Generally positive experiences with customer service representatives.

– Occasional delays or difficulty reaching representatives. |

| Claims Processing | – Generally efficient claims processing.

– Some delays or issues with specific claims. |

| Digital Tools | – User-friendly mobile app and online portal.

– Some concerns about website functionality or navigation. |

Employee Testimonials Regarding Aetna Insurance

Employee testimonials offer real-life perspectives on their experiences with Aetna insurance. These firsthand accounts can provide valuable insights into the strengths and weaknesses of Aetna plans:

“I’ve been with Aetna for several years, and I’m generally happy with the coverage. The network of providers is extensive, and I haven’t had any issues with claims processing. However, I do wish the premiums were a bit lower.” – Sarah, a Marketing Manager

“I’ve had some frustrating experiences with Aetna’s customer service. It can be difficult to get through to a representative, and sometimes they don’t seem to understand my questions. Overall, I’m satisfied with the coverage, but the customer service needs improvement.” – Michael, a Software Engineer

Pros and Cons of Aetna Insurance from an Employee’s Perspective

From an employee’s perspective, Aetna insurance presents both advantages and disadvantages:

Pros:

* Wide Coverage: Aetna offers a variety of plans with comprehensive coverage options, including medical, dental, vision, and prescription drug benefits.

* Extensive Network: Aetna has a vast network of providers, giving employees access to a wide range of healthcare professionals.

* Digital Tools: Aetna provides user-friendly mobile apps and online portals for managing health information, scheduling appointments, and filing claims.

Cons:

* Cost: Premiums and deductibles can be high for some Aetna plans, potentially impacting employee budgets.

* Network Limitations: While Aetna has a broad network, coverage may be limited in some areas, making it challenging to find in-network providers.

* Customer Service: While generally positive, some employees have reported issues with customer service, including delays or difficulty reaching representatives.

Aetna Insurance Market Trends

The market for Aetna insurance is constantly evolving, influenced by various factors, including healthcare reform, technological advancements, and changing consumer preferences.

Impact of Healthcare Reform on Aetna Insurance Plans

The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted the health insurance market, including Aetna. The ACA aimed to expand health insurance coverage and regulate the industry, leading to changes in Aetna insurance plans.

- Increased Coverage: The ACA mandated that health insurance plans cover essential health benefits, such as preventive care, maternity care, and prescription drugs. This resulted in Aetna offering plans with broader coverage than before.

- Marketplaces and Subsidies: The ACA established health insurance marketplaces where individuals and families could compare and purchase plans. Aetna participates in these marketplaces, offering plans eligible for government subsidies to lower premiums for eligible individuals.

- Individual Mandate: The ACA required most individuals to have health insurance or face a penalty. This led to an increase in the number of people enrolling in health insurance plans, including those offered by Aetna.

- Premium Increases: While the ACA aimed to control costs, it also led to some premium increases. This is partly due to the expansion of coverage and the requirement for plans to cover essential health benefits.

Emerging Trends and Future Predictions for Aetna Insurance

The health insurance market is constantly evolving, and Aetna is adapting to these changes. Several emerging trends will shape the future of Aetna insurance.

- Focus on Value-Based Care: Aetna is increasingly emphasizing value-based care models that reward providers for delivering high-quality care at lower costs. This trend is driven by the need to control healthcare spending and improve patient outcomes.

- Telehealth and Virtual Care: Telehealth and virtual care are becoming increasingly popular, offering patients convenient access to healthcare services. Aetna is incorporating these technologies into its plans, offering telehealth benefits and virtual care options.

- Data Analytics and Personalized Care: Aetna is using data analytics to personalize care and identify patients at risk of developing chronic conditions. This allows Aetna to provide targeted interventions and improve patient outcomes.

- Consumer Engagement and Transparency: Aetna is increasing its focus on consumer engagement and transparency, providing patients with more information about their coverage and healthcare costs. This trend is driven by the increasing demand for consumer empowerment in healthcare.

Concluding Remarks

Choosing the right health insurance plan can be a complex process. By understanding the factors influencing a company’s decision to offer Aetna insurance, employees can make informed choices that align with their individual needs. Ultimately, Aetna insurance offers a valuable resource for both employers and employees seeking comprehensive healthcare coverage and peace of mind.

FAQ Summary

What are the main types of Aetna insurance plans?

Aetna offers various plans, including HMOs, PPOs, POS, and individual plans, each with its own features and benefits.

How can I find out if my company offers Aetna insurance?

Contact your company’s Human Resources department to inquire about their health insurance offerings.

What are the advantages of offering Aetna insurance for employers?

Offering Aetna insurance can attract and retain top talent, enhance employee satisfaction, and potentially lower healthcare costs.

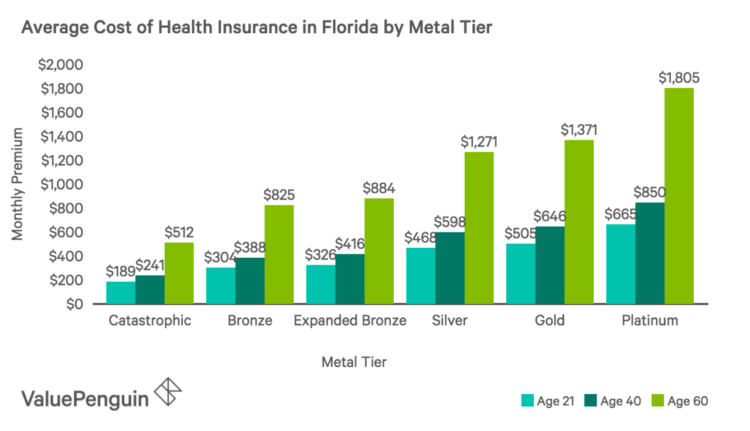

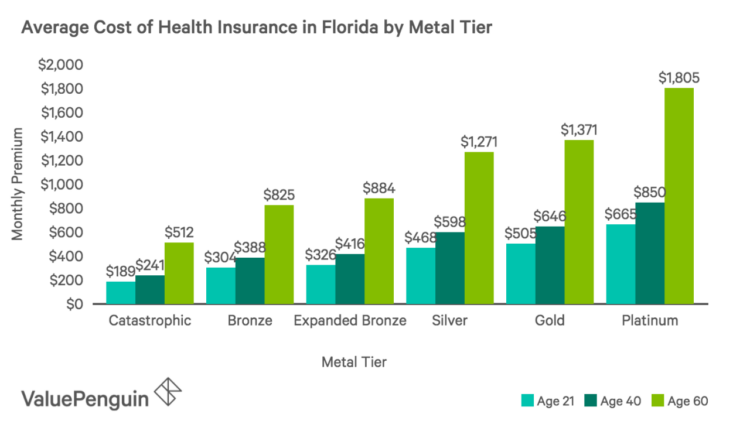

What are the typical costs associated with Aetna insurance?

The cost of Aetna insurance varies depending on the plan, coverage, and individual factors. Contact Aetna directly for personalized quotes.