- Factors Influencing Auto Insurance Costs

- Comparing Auto Insurance Quotes

- Understanding Insurance Coverage Options

- Discounts and Savings Opportunities

- Evaluating Insurance Companies

- Tips for Saving Money on Auto Insurance

- Final Conclusion: What Company Has Cheapest Auto Insurance

- Commonly Asked Questions

What company has cheapest auto insurance – What company has the cheapest auto insurance? It’s a question that’s on every driver’s mind, especially when you’re trying to keep your budget in check. Finding the right car insurance company can feel like navigating a maze, with tons of different factors influencing your rates. Think of it like finding the best deal on a new phone – you gotta shop around, compare prices, and make sure you’re getting the coverage you need without breaking the bank.

From your driving history to the kind of car you drive, a bunch of things play a role in determining your insurance premiums. But don’t worry, this guide will walk you through the process, so you can find the most affordable auto insurance without sacrificing coverage.

Factors Influencing Auto Insurance Costs

Auto insurance premiums are calculated based on various factors, and understanding these factors can help you make informed decisions to potentially lower your costs.

Age

Your age is a significant factor in determining your insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher insurance rates. However, as you gain experience and age, your premiums tend to decrease. This is because insurance companies view older drivers as having a lower risk profile. For example, a 20-year-old driver might pay significantly more than a 40-year-old driver with a similar driving record.

Driving History

Your driving history plays a crucial role in determining your insurance premiums. Drivers with a clean record, free of accidents, tickets, or violations, are considered low-risk and typically enjoy lower rates. Conversely, drivers with a history of accidents, speeding tickets, or DUI convictions are considered high-risk and may face significantly higher premiums. Insurance companies use a system called a “risk score” to evaluate your driving history, and this score directly impacts your insurance rates. For instance, a driver with a recent DUI conviction might see their premiums increase by 50% or more compared to a driver with a clean record.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Some vehicles are considered more expensive to repair or replace, or they are more likely to be involved in accidents. These factors contribute to higher insurance rates. For example, a luxury sports car might have higher insurance premiums than a basic sedan due to its higher repair costs and potentially higher performance capabilities. Additionally, vehicles with safety features, such as anti-lock brakes or airbags, may qualify for discounts, leading to lower premiums.

Location

The location where you live can impact your insurance premiums. Areas with higher crime rates, traffic congestion, or a greater number of accidents tend to have higher insurance rates. This is because insurance companies assess the risk of accidents and claims based on geographical location. For instance, drivers living in a densely populated urban area might face higher premiums compared to drivers living in a rural area with lower traffic density.

Coverage Levels

The level of coverage you choose for your auto insurance policy directly affects your premiums. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, typically result in higher premiums. This is because you are paying for more protection in case of an accident or damage to your vehicle. Conversely, choosing lower coverage limits, such as minimum liability coverage or opting out of comprehensive and collision coverage, can lead to lower premiums. However, it is crucial to balance coverage levels with your financial needs and risk tolerance to ensure adequate protection.

Comparing Auto Insurance Quotes

You’ve got your factors, you’ve got your knowledge, but now it’s time to get down to brass tacks and actually compare those auto insurance quotes. Think of it like picking out a new phone – you wouldn’t just grab the first one you see, right? You’d compare prices, features, and customer reviews to make sure you’re getting the best deal. Same goes for auto insurance!

Comparing Auto Insurance Quotes

It’s time to roll up your sleeves and get those quotes rolling in! Here’s the lowdown on how to compare auto insurance companies like a pro:

Finding the Best Deals

- Use a comparison website: Websites like Compare.com, Policygenius, and The Zebra are your one-stop shop for comparing quotes from multiple insurance companies. You just plug in your info, and they do the rest. It’s like having your own personal insurance broker, but without the fancy office.

- Contact insurance companies directly: Don’t just rely on comparison websites – sometimes you can get a better deal by contacting companies directly. This lets you ask specific questions and get a personalized quote tailored to your needs.

- Consider your coverage options: Not all insurance companies offer the same coverage options. Some might have lower premiums but offer less protection. Make sure you’re comparing apples to apples by looking at the same coverage levels.

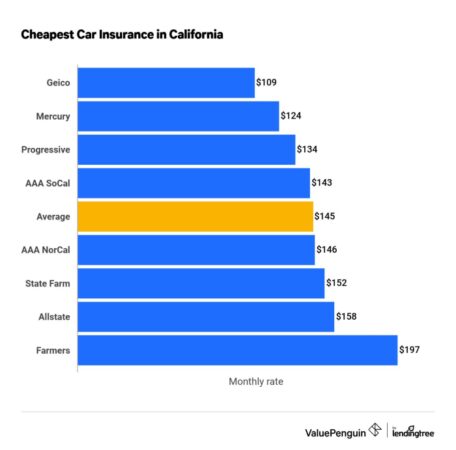

Table of Cheapest Auto Insurance Companies

| Company | Average Premium | Customer Satisfaction | Coverage Options |

|---|---|---|---|

| Geico | $1,500 | 85% | Comprehensive, collision, liability, personal injury protection, uninsured/underinsured motorist coverage |

| Progressive | $1,600 | 80% | Comprehensive, collision, liability, personal injury protection, uninsured/underinsured motorist coverage, roadside assistance |

| State Farm | $1,700 | 90% | Comprehensive, collision, liability, personal injury protection, uninsured/underinsured motorist coverage, rental car reimbursement |

| USAA | $1,400 | 95% | Comprehensive, collision, liability, personal injury protection, uninsured/underinsured motorist coverage, roadside assistance, accident forgiveness |

Note: These figures are estimates and can vary based on factors like driving history, location, and vehicle type. Always check with individual insurance companies for accurate quotes.

The Importance of Comparing Quotes

Think of it like this: You wouldn’t buy the first pair of sneakers you see, would you? You’d shop around to find the best price and style. The same goes for auto insurance. Comparing quotes from multiple companies helps you:

- Find the lowest premiums: Insurance companies compete for your business, and comparing quotes helps you take advantage of that competition. You might be surprised at the difference in price between companies.

- Get the best coverage for your needs: Not all insurance companies are created equal. Some might offer more coverage options or better customer service than others. Comparing quotes helps you find the company that best fits your needs and budget.

- Avoid hidden fees: Some insurance companies might have hidden fees or charges that aren’t immediately obvious. Comparing quotes helps you spot these fees and avoid getting stuck with a bad deal.

Understanding Insurance Coverage Options

Choosing the right auto insurance coverage is like picking the right outfit for a night out. You want something that fits your needs and protects you from unexpected situations. Let’s break down the different types of coverage so you can choose the right fit for your budget and peace of mind.

Liability Coverage

Liability coverage is the most basic type of auto insurance and is required in most states. This coverage protects you financially if you’re at fault in an accident and cause damage to another person’s property or injure someone.

Liability coverage has two main components:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and pain and suffering for the other driver and passengers in the other vehicle if you are at fault in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle and any other property damage you cause in an accident.

Liability coverage limits are typically expressed as a combination of numbers, such as 100/300/50. This means your policy will cover up to $100,000 per person for bodily injury, up to $300,000 total for bodily injury per accident, and up to $50,000 for property damage.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault.

- Scenario: Imagine you’re driving to work and someone runs a red light, causing a collision. With collision coverage, your insurance company will pay for the repairs to your vehicle, even if you were not at fault.

If you have a loan on your car, your lender will likely require you to have collision coverage.

Comprehensive Coverage

Comprehensive coverage pays for repairs or replacement of your vehicle if it’s damaged by something other than a collision, such as theft, vandalism, fire, or hail.

- Scenario: Imagine you park your car in your driveway and a tree branch falls on it, causing damage to the roof. With comprehensive coverage, your insurance company will pay for the repairs.

You can choose to waive comprehensive coverage if your vehicle is older or has a lower value.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re injured in an accident caused by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your injuries.

- Scenario: You’re stopped at a red light when a driver runs into the back of your car. The driver doesn’t have insurance or only has the minimum required coverage, which isn’t enough to cover your medical expenses. With UM/UIM coverage, your insurance company will pay for your medical bills and other related expenses.

It’s important to have UM/UIM coverage, even if you have a clean driving record, because you never know when you might be involved in an accident with an uninsured or underinsured driver.

Discounts and Savings Opportunities

Saving money on your auto insurance is a no-brainer, right? Who doesn’t love a little extra cash in their pocket? Well, buckle up, because there are tons of discounts out there waiting to be claimed. We’re talking about those secret weapons that can shave dollars off your premium, leaving you with more moolah to spend on, well, whatever your heart desires. So, let’s dive into the world of auto insurance discounts and discover how to make your wallet sing!

Common Auto Insurance Discounts

Knowing about these discounts is like having a cheat sheet for saving money on your auto insurance. These are the most common discounts that insurance companies offer, so it’s definitely worth checking them out. You might be surprised at how much you can save!

- Safe Driver Discounts: If you’ve got a clean driving record, you’re basically a rockstar in the insurance world. These discounts reward you for being a responsible driver and not having any accidents or traffic violations. It’s like getting a high five from your insurance company for being a good boy or girl.

- Good Student Discounts: Brains are beautiful, and insurance companies know it. This discount is offered to students who maintain good grades, proving they’re responsible and smart. So, if you’re acing your classes, make sure to let your insurance company know, because they’ll be happy to give you a discount for your smarts.

- Multi-Policy Discounts: Bundling your auto insurance with other types of insurance, like homeowners or renters insurance, can save you a bundle. It’s like a two-for-one deal, but for insurance. This is a great way to maximize your savings and keep your wallet happy.

- Anti-theft Device Discounts: Having a car alarm, GPS tracking system, or other anti-theft devices can make your car less attractive to thieves. Insurance companies recognize this and reward you with a discount for taking extra precautions to protect your ride.

- Vehicle Safety Features Discounts: Cars with safety features like anti-lock brakes, airbags, and electronic stability control are less likely to be involved in accidents. Insurance companies know this, so they offer discounts for cars that are equipped with these safety features. It’s like getting a reward for choosing a safe car.

- Loyalty Discounts: Sticking with the same insurance company for a long time can pay off. Many companies offer loyalty discounts to customers who have been with them for a certain period of time. It’s like getting a bonus for being a loyal customer, which is always a good thing.

Strategies for Maximizing Discounts

Once you know about the discounts, it’s time to put your detective hat on and start maximizing your savings. Here are some strategies to help you get the most out of those sweet, sweet discounts.

- Shop Around: Don’t just settle for the first insurance quote you get. Compare quotes from different companies to see who offers the best discounts. It’s like trying on different shoes to find the perfect fit, but for insurance. Don’t be afraid to switch companies if you find a better deal.

- Ask Questions: Don’t be shy about asking your insurance agent about all the available discounts. They’re there to help you save money, so don’t be afraid to ask about everything. It’s like asking for a free sample at the grocery store, but for insurance.

- Keep a Clean Driving Record: This is a no-brainer. Avoiding accidents and traffic violations will not only save you money on your insurance, but it’ll also keep you safe on the road. It’s like being a responsible adult and avoiding trouble. Who doesn’t love that?

- Maintain Good Grades: If you’re a student, keep those grades up! Good grades mean good discounts, which means more money in your pocket. It’s like getting a reward for being a good student, and who doesn’t love a little extra cash?

- Bundle Your Policies: Combining your auto insurance with other types of insurance, like homeowners or renters insurance, can lead to significant savings. It’s like a two-for-one deal, but for insurance. This is a great way to maximize your savings and keep your wallet happy.

Finding Hidden Discounts

Sometimes, those hidden discounts are like the secret menu at your favorite restaurant. They’re not always advertised, but they can be incredibly rewarding. Here are some tips for uncovering those hidden gems.

- Check Your Insurance Company’s Website: Many insurance companies have online resources that list all of their available discounts. It’s like having a treasure map to your savings. Just explore their website and see what you can find.

- Talk to Your Agent: Your insurance agent is your best friend when it comes to finding discounts. They know the ins and outs of the insurance world and can help you find those hidden gems that you might have missed. It’s like having a personal shopper for your insurance.

- Ask About Special Promotions: Insurance companies often run special promotions and discounts, so it’s worth asking your agent about them. It’s like finding a coupon for your favorite store, but for insurance.

Negotiating Lower Rates

Sometimes, you might need to negotiate with your insurance company to get the best rate. It’s like haggling at a flea market, but for insurance. Here are some tips for negotiating lower rates.

- Be Prepared: Before you start negotiating, make sure you know your current rates, your driving record, and the discounts you’re eligible for. It’s like going into a meeting with a well-prepared presentation, but for insurance.

- Be Polite and Persistent: Don’t be afraid to ask for a lower rate, but be polite and persistent. Insurance companies are more likely to negotiate with customers who are polite and persistent. It’s like asking for a discount at a restaurant, but for insurance.

- Be Willing to Switch Companies: If your current insurance company isn’t willing to negotiate, be willing to switch companies. There are plenty of other insurance companies out there that are willing to offer you a better deal. It’s like shopping around for a new car, but for insurance.

Evaluating Insurance Companies

Choosing the right auto insurance company can feel like navigating a jungle of options. But don’t worry, you don’t need to be a financial guru to make a smart decision. By evaluating companies based on their financial strength, customer service, and claims handling processes, you can find the best fit for your needs.

Financial Stability

It’s important to choose a company that’s financially sound. This means they have enough money to pay out claims if you need them. Here are some ways to assess a company’s financial stability:

- AM Best Rating: This independent agency rates insurance companies based on their financial strength and ability to pay claims. Look for companies with an A or higher rating.

- Financial Reports: Check out the company’s annual reports to see how they’ve been performing financially. Look for consistent profits and a healthy capital reserve.

Customer Service

You’ll want an insurance company that’s responsive and helpful when you need them. Here are some ways to gauge customer service:

- Customer Reviews: Check online reviews on sites like Consumer Reports, J.D. Power, and the Better Business Bureau. These can provide insights into customer experiences.

- Customer Satisfaction Scores: Look for companies with high customer satisfaction scores. These are often published by independent organizations.

- Availability of Resources: Does the company offer online resources, mobile apps, or 24/7 customer support? These features can make it easier to manage your insurance.

Claims Handling Process

How smoothly a company handles claims can make a big difference in your experience. Here are some key factors to consider:

- Claims Process Transparency: Does the company provide clear and concise information about its claims process? This will help you understand what to expect.

- Claims Settlement Speed: How quickly does the company typically process and settle claims? Look for companies with a reputation for fast and efficient claims handling.

- Claims Handling Reviews: Check online reviews and independent reports to see how other customers have rated the company’s claims handling process.

Tips for Saving Money on Auto Insurance

Saving money on auto insurance is a goal many drivers share. Fortunately, there are several strategies you can use to lower your premiums and keep more money in your pocket. By understanding how insurance rates are calculated and making informed choices, you can potentially reduce your costs significantly.

Maintaining a Good Driving Record

A clean driving record is your biggest asset when it comes to saving on auto insurance. Insurance companies consider you a lower risk if you haven’t been involved in accidents or received traffic violations.

- Drive Safely: This might sound obvious, but avoiding accidents and traffic violations is essential. Every incident on your record can increase your premium.

- Take Defensive Driving Courses: These courses can teach you safe driving techniques and help you avoid accidents. Some insurance companies offer discounts for completing these courses.

- Be Aware of Points: Each traffic violation can add points to your driving record. These points can accumulate and significantly impact your insurance rates.

Increasing Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lead to lower premiums.

- Understand the Trade-off: While a higher deductible means you pay more in the event of an accident, it can also save you money on your monthly premiums.

- Assess Your Risk Tolerance: Consider your financial situation and how much you’re willing to pay out of pocket if an accident occurs.

- Calculate the Savings: Compare premium quotes with different deductible amounts to see how much you can save.

Bundling Policies, What company has cheapest auto insurance

Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

- Contact Your Current Insurer: Ask about their bundling options and see if you can save by combining your policies.

- Compare Quotes: Get quotes from other insurance companies to see if they offer better bundling discounts.

- Explore Different Bundles: Consider bundling your policies with the same insurer, even if you’re currently insured with different companies.

Negotiating with Insurance Agents

Don’t be afraid to negotiate with your insurance agent to try and secure a lower rate.

- Be Prepared: Before you call, gather information about your driving record, vehicle details, and any potential discounts you qualify for.

- Be Polite but Firm: Explain that you’re looking for the best possible rate and are willing to shop around if they can’t offer a competitive price.

- Highlight Your Strengths: Emphasize your good driving record, any safety features in your vehicle, and any relevant discounts you might be eligible for.

Finding Hidden Discounts

Insurance companies often offer a wide range of discounts that many drivers don’t even know about.

- Ask About Available Discounts: Don’t assume you know all the discounts you qualify for. Ask your insurance agent about specific discounts like good student, safe driver, or multi-car discounts.

- Check Your Policy: Review your current policy documents to see if you’re already taking advantage of all available discounts.

- Explore Online Resources: Many insurance companies have websites that list their available discounts.

Comparing Quotes

Shopping around for quotes from multiple insurance companies is crucial to finding the most affordable option.

- Use Online Comparison Tools: Websites like Insurance.com and NerdWallet allow you to compare quotes from various insurers quickly and easily.

- Contact Insurers Directly: Get quotes from several insurance companies directly to ensure you’re getting the best possible rates.

- Be Consistent: When comparing quotes, make sure you’re using the same information for each insurer, such as your vehicle details, driving history, and coverage levels.

Final Conclusion: What Company Has Cheapest Auto Insurance

Navigating the world of auto insurance can feel like a wild ride, but by understanding the factors that influence your rates and taking advantage of discounts, you can find the best deal for your needs. Remember, comparing quotes from multiple companies is key to finding the cheapest auto insurance. So, buckle up, do your research, and get ready to save some serious cash on your car insurance.

Commonly Asked Questions

What are some common auto insurance discounts?

Many companies offer discounts for safe drivers, good students, multi-policy holders, and even for having safety features in your car.

How can I lower my auto insurance premiums?

You can lower your premiums by maintaining a good driving record, increasing your deductible, bundling policies, and even parking your car in a garage.

What is the difference between liability and collision coverage?

Liability coverage protects you if you’re at fault in an accident, while collision coverage covers damage to your car in an accident, regardless of who is at fault.