What company has the best homeowners insurance? That’s a question many homeowners ask themselves, and the answer isn’t always straightforward. Finding the right homeowners insurance policy is like finding the perfect pair of jeans: it needs to fit your specific needs and budget. There’s no one-size-fits-all solution, and what works for your neighbor might not work for you. To find the best fit, you need to consider factors like coverage limits, deductibles, and the types of risks you face. From classic Victorian houses to modern mansions, every home has unique needs, and the right insurance policy can provide peace of mind knowing you’re covered in case of the unexpected.

This guide will help you navigate the world of homeowners insurance, breaking down the key factors to consider, comparing top companies, and providing tips for getting the best possible quotes. Whether you’re a first-time homeowner or a seasoned pro, understanding the ins and outs of homeowners insurance can save you money and protect your biggest investment: your home.

Factors to Consider When Choosing Homeowners Insurance

Choosing the right homeowners insurance policy can be a daunting task, but it’s essential to protect your biggest investment. You want to make sure you have enough coverage to rebuild your home and replace your belongings in the event of a disaster, but you also don’t want to pay more than you need to. Here are some key factors to consider when choosing homeowners insurance.

Coverage Limits and Deductibles, What company has the best homeowners insurance

Coverage limits and deductibles are two crucial aspects of homeowners insurance that significantly impact your premiums and out-of-pocket expenses in case of a claim. Understanding their interplay is vital for making informed decisions.

Coverage limits define the maximum amount your insurance company will pay for covered losses.

For example, if your dwelling coverage limit is $300,000, your insurer will cover up to $300,000 for damage to your home. Deductibles are the amount you pay out-of-pocket before your insurance kicks in. Higher deductibles typically result in lower premiums, while lower deductibles mean higher premiums.

A higher deductible means you pay more upfront but less over time in premiums.

Choosing the right combination of coverage limits and deductibles depends on your individual circumstances, including your home’s value, your risk tolerance, and your budget.

Types of Coverage

Homeowners insurance policies typically offer several types of coverage to protect your home and belongings.

- Dwelling Coverage: This covers damage to the physical structure of your home, including the roof, walls, and foundation. This is the most significant part of your homeowners insurance policy.

- Personal Property Coverage: This protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. The amount of coverage you need depends on the value of your possessions.

- Liability Coverage: This protects you from financial losses if someone is injured on your property or if you cause damage to someone else’s property. This is essential if you have guests over or if you have a pool or other hazardous features on your property.

- Additional Living Expenses: This coverage helps pay for temporary housing and other expenses if your home becomes uninhabitable due to a covered event. This could include hotel costs, food, and other living expenses.

Factors Influencing Premiums

Several factors can influence the cost of your homeowners insurance premiums.

- Location: Homeowners insurance premiums are often higher in areas with a higher risk of natural disasters, such as earthquakes, hurricanes, or floods. Your home’s proximity to fire hydrants, police stations, and other emergency services can also affect your premiums.

- Age of the Home: Older homes may have outdated wiring, plumbing, or roofing, which can increase the risk of damage. Insurers may charge higher premiums for older homes as a result.

- Credit Score: In many states, insurers can use your credit score to determine your premiums. A good credit score generally means lower premiums. This is because people with good credit are statistically less likely to file claims.

- Home Security Features: Homes with security features, such as alarms, smoke detectors, and fire sprinklers, may qualify for discounts on homeowners insurance premiums. This is because these features can help reduce the risk of damage or loss.

- Deductible: As mentioned earlier, a higher deductible means you pay more upfront but less over time in premiums.

Bundling Homeowners Insurance with Other Policies

Bundling homeowners insurance with other policies, such as auto insurance, can often lead to significant discounts. This is because insurance companies often offer discounts to customers who have multiple policies with them. This can save you money on your overall insurance costs.

Top Homeowners Insurance Companies: What Company Has The Best Homeowners Insurance

Choosing the right homeowners insurance company can feel like navigating a maze. You want a company that offers solid coverage, competitive pricing, and excellent customer service. But with so many options out there, it can be tough to know where to start.

Reputable Homeowners Insurance Companies

To help you make an informed decision, here’s a list of reputable homeowners insurance companies known for their strengths and weaknesses, along with insights from customer reviews and ratings:

- State Farm: Known for its wide network of agents, excellent customer service, and competitive pricing. However, some customers have reported difficulty filing claims.

- Allstate: Offers a wide range of coverage options and discounts, including bundling with other insurance policies. However, some customers have criticized its claims handling process.

- Liberty Mutual: Renowned for its strong financial stability and personalized service. However, its pricing can be higher than some competitors.

- Farmers Insurance: Offers a variety of coverage options and discounts, including bundling with other insurance policies. However, some customers have reported issues with customer service.

- USAA: Exclusively available to military members and their families, USAA is known for its excellent customer service and competitive pricing.

Customer Reviews and Ratings

Independent sources like J.D. Power and Consumer Reports provide valuable insights into customer satisfaction with different insurance companies. These ratings consider factors such as:

- Claim satisfaction: How quickly and efficiently claims are processed.

- Customer service: Responsiveness and helpfulness of agents and representatives.

- Policy clarity: Ease of understanding policy terms and conditions.

Homeowners Insurance Company Comparison

Here’s a table comparing key features and pricing of different companies, based on data from independent sources:

| Company Name | Coverage Options | Pricing | Customer Satisfaction |

|---|---|---|---|

| State Farm | Comprehensive coverage options, including earthquake and flood insurance. | Competitive pricing, with discounts available for bundling and safety features. | Above average, with high ratings for customer service and claims handling. |

| Allstate | Wide range of coverage options, including identity theft protection. | Competitive pricing, with discounts available for bundling and good driving records. | Average, with mixed reviews on customer service and claims handling. |

| Liberty Mutual | Comprehensive coverage options, including personal liability coverage. | Higher pricing than some competitors, but offers discounts for bundling and good driving records. | Above average, with high ratings for financial stability and customer service. |

| Farmers Insurance | Variety of coverage options, including replacement cost coverage for your belongings. | Competitive pricing, with discounts available for bundling and safety features. | Average, with mixed reviews on customer service and claims handling. |

| USAA | Comprehensive coverage options, including coverage for military-specific risks. | Competitive pricing, with discounts available for military members and their families. | Excellent, with consistently high ratings for customer service and claims handling. |

Specialized Homeowners Insurance Needs

Your home is your castle, and you want to make sure it’s protected. But not all homes are created equal, and some require specialized insurance coverage. This is especially true if you have a unique property or valuable possessions.

Insurance Options for Unique Homes

Many homes are unique, with features that require special insurance considerations.

- Historic Properties: Historic homes often require specialized coverage because of their age and unique features. These policies may include coverage for damage caused by historic preservation efforts, as well as for the loss of historical value.

- Homes with Valuable Collections: If you have a valuable collection of art, antiques, or other valuables, you’ll need to make sure your homeowners insurance policy provides adequate coverage. Some insurers offer specialized policies for collectors, which can provide higher limits of liability and coverage for specific types of items.

Coverage Options for Specific Risks

Some homes are more vulnerable to certain risks than others.

- Flooding: Homes located in flood-prone areas may need to purchase flood insurance separately from their homeowners insurance policy. This is because standard homeowners insurance policies typically don’t cover flood damage.

- Earthquakes: Homes in earthquake-prone areas may also need to purchase separate earthquake insurance. This type of insurance can cover damage to your home and belongings caused by an earthquake.

Identifying Your Specific Insurance Needs

It’s important to carefully assess your individual circumstances when choosing homeowners insurance.

- Property Value: Your home’s value is a key factor in determining how much insurance you need.

- Personal Property: Make a list of your valuable possessions, including their estimated value. This will help you determine how much coverage you need for your belongings.

- Location: Your home’s location can impact your insurance needs. For example, homes in flood-prone areas or areas with high crime rates may require additional coverage.

- Personal Risk Tolerance: Consider your own risk tolerance. If you’re concerned about potential risks, you may want to purchase additional coverage.

Getting Quotes and Making a Decision

Now that you’ve got the lowdown on what to consider when choosing homeowners insurance, let’s talk about how to get the best deal. It’s like shopping for a new phone – you want to compare prices, features, and customer service to find the perfect match for your needs.

Obtaining Quotes from Different Insurance Companies

Getting quotes from different insurance companies is the first step to finding the best homeowners insurance policy. It’s like trying on different shoes before you decide which pair is the most comfortable. You can get quotes online, over the phone, or in person. Most insurance companies have a website where you can get a quote. You’ll need to provide some basic information about your home, such as its address, square footage, and age. You’ll also need to provide information about your coverage needs, such as the amount of coverage you want for your home and your belongings.

Here are some tips for getting quotes from different insurance companies:

- Get quotes from at least three different companies. This will give you a good idea of the range of prices and coverage options available.

- Compare apples to apples. Make sure that you’re comparing quotes for the same coverage amounts and deductibles. This will help you make an accurate comparison.

- Ask about discounts. Many insurance companies offer discounts for things like home security systems, fire alarms, and smoke detectors. You could save a bundle!

Comparing Quotes and Selecting the Best Policy

Once you have a few quotes, it’s time to compare them and choose the best policy for you. Think of it like picking the best song for your playlist. You want to find a policy that offers the right coverage at a price you can afford.

Here are some things to consider when comparing quotes:

- Coverage amount. Make sure that the policy you choose provides enough coverage for your home and your belongings. You don’t want to be underinsured if you have a major claim.

- Deductible. Your deductible is the amount of money you’ll have to pay out of pocket before your insurance company starts covering your claim. A higher deductible will usually result in a lower premium, but you’ll have to pay more if you have a claim.

- Premium. This is the amount of money you’ll pay for your insurance policy. You’ll want to find a policy that offers the right coverage at a price you can afford.

- Customer service. Look for an insurance company with a good reputation for customer service. You’ll want to be able to get help quickly and easily if you have a claim.

Negotiating Insurance Premiums

Once you’ve found a policy that you like, you may be able to negotiate a lower premium. It’s like haggling at a flea market – you might be able to get a better deal if you know how to ask.

Here are some tips for negotiating insurance premiums:

- Shop around. Get quotes from several different insurance companies before you settle on a policy.

- Ask about discounts. Many insurance companies offer discounts for things like home security systems, fire alarms, and smoke detectors.

- Be prepared to walk away. If you’re not happy with the price, don’t be afraid to walk away. There are other insurance companies out there.

Resources for Additional Information and Support

If you’re still not sure how to choose the best homeowners insurance policy, there are a few resources that can help. Think of it like having a trusted advisor in your corner.

- Your insurance agent. Your insurance agent can help you understand your coverage options and find a policy that meets your needs.

- Consumer Reports. Consumer Reports publishes ratings of insurance companies, which can help you find a company with a good reputation.

- The National Association of Insurance Commissioners (NAIC). The NAIC is a non-profit organization that provides information and resources about insurance.

Ending Remarks

Finding the best homeowners insurance isn’t just about finding the cheapest policy. It’s about finding the right coverage for your unique needs and budget. By taking the time to understand your options, comparing quotes, and asking questions, you can make an informed decision that protects your home and your peace of mind. Remember, your home is more than just bricks and mortar; it’s where you build memories and create a life. Make sure you’re covered for the unexpected, so you can focus on what matters most.

General Inquiries

What is the difference between actual cash value and replacement cost coverage?

Actual cash value (ACV) coverage pays for the depreciated value of your belongings, while replacement cost coverage pays for the full cost of replacing them with new items.

How can I lower my homeowners insurance premium?

You can lower your premium by increasing your deductible, bundling your policies, making home improvements, and maintaining good credit.

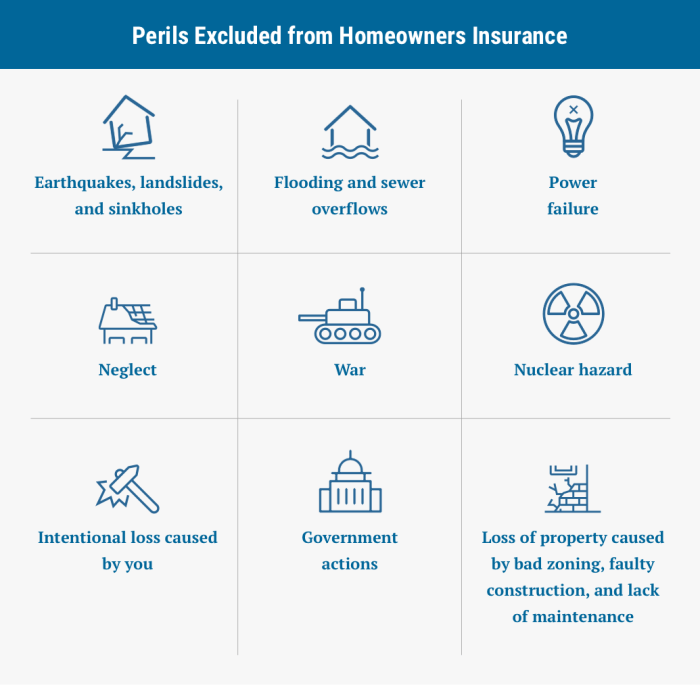

What are some common exclusions in homeowners insurance policies?

Common exclusions include damage caused by floods, earthquakes, and acts of war. You may need to purchase additional coverage for these risks.

What is a claims history, and how does it affect my premium?

Your claims history is a record of the claims you’ve filed on your insurance policies. A history of frequent claims can lead to higher premiums.