What happens when a insurance company totals your car? It’s a question that can leave you feeling like you’re in a car crash all over again. Suddenly, your ride is deemed beyond repair, and you’re faced with a whole new set of decisions. But don’t worry, you’re not alone. This guide will walk you through the process, explaining everything from the initial assessment to your options for getting back on the road.

From understanding the criteria used to declare a total loss to navigating the insurance payout process, this guide covers all the essential aspects. We’ll explore the different types of coverage that apply, the role of your deductible, and the documentation required to receive your payment. We’ll also discuss the options available to you, including accepting the payout, keeping the vehicle, or negotiating with the insurance company.

Determining Total Loss: What Happens When A Insurance Company Totals Your Car

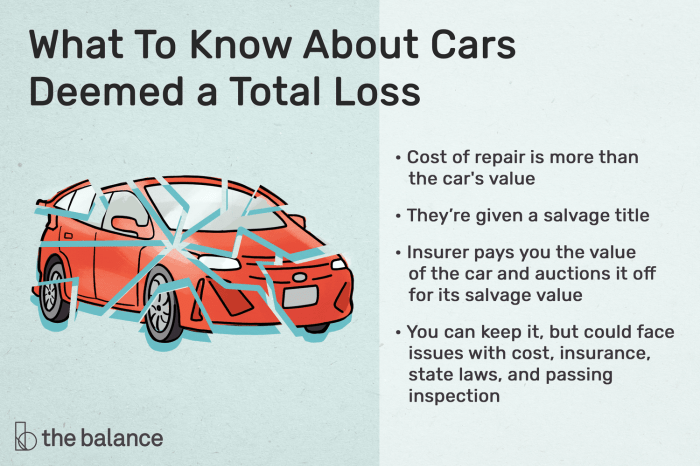

Your car has been in an accident, and the insurance company has deemed it a total loss. This means that the cost to repair the damage exceeds the car’s actual cash value (ACV). This is a common occurrence, and the insurance company has a specific set of criteria to determine whether a vehicle is totaled.

Factors Influencing Total Loss Determination

Several factors play a role in determining whether a vehicle is a total loss. These factors include the extent of the damage, the age of the vehicle, and the market value.

- Repair Costs: The primary factor in determining a total loss is the cost of repairs. If the cost of repairs exceeds the actual cash value of the vehicle, the insurance company will typically declare it a total loss. For example, if your car is worth $10,000, and the repair costs are $12,000, the insurance company will likely total the vehicle.

- Vehicle Age: The age of the vehicle is also a significant factor. Older vehicles are generally worth less than newer ones. If an older car sustains significant damage, it may be totaled even if the repair costs are relatively low. For example, if a 10-year-old car with an ACV of $5,000 sustains $4,000 in damage, it may be totaled because the repair costs are close to the vehicle’s value.

- Market Value: The market value of the vehicle is also a factor in determining a total loss. This is the amount the vehicle would sell for in the current market. If the market value of the vehicle is less than the cost of repairs, the insurance company may declare it a total loss. For example, if your car is worth $8,000, and the repair costs are $10,000, the insurance company may total the vehicle because the repair costs exceed the vehicle’s market value.

Examples of Totaled Vehicles, What happens when a insurance company totals your car

Here are some examples of situations where a vehicle might be considered totaled:

- Major Structural Damage: If a vehicle has sustained significant damage to its frame, it may be considered totaled. This is because the damage is likely to affect the vehicle’s structural integrity and safety.

- Engine or Transmission Damage: Extensive damage to the engine or transmission can make a vehicle uneconomical to repair. If the cost of replacing or repairing these components is significant, the insurance company may total the vehicle.

- Multiple Accidents: If a vehicle has been involved in multiple accidents, it may be considered totaled. This is because the vehicle may have sustained cumulative damage that makes it unsafe to drive.

- Fire or Flood Damage: Vehicles that have been damaged by fire or flood may be considered totaled. This is because these types of damage can cause extensive corrosion or other problems that make the vehicle unsafe to drive.

Insurance Coverage and Payment

When your car is totaled, your insurance company will step in to help you get back on the road. But before you start celebrating that new car smell, it’s important to understand how insurance coverage works and what you can expect in terms of payment.

Types of Coverage

The amount of money you receive from your insurance company depends on the type of coverage you have. Here’s a breakdown of the most common types of insurance coverage that apply when your car is totaled:

- Collision Coverage: This coverage pays for repairs or replacement of your car if it’s damaged in an accident, regardless of who is at fault. You’ll need to pay your deductible before the insurance company covers the rest.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your car if it’s damaged by something other than a collision, such as theft, vandalism, or a natural disaster. You’ll also need to pay your deductible.

- Liability Coverage: This coverage pays for damages to other people’s property or injuries to other people if you are at fault in an accident. It does not cover your own vehicle.

Calculating the Payout

The payout you receive from your insurance company is based on the actual cash value (ACV) of your car. The ACV is the fair market value of your car at the time of the accident, taking into account factors like age, mileage, condition, and the current market value of similar vehicles.

- Deductible: You’ll need to pay your deductible before your insurance company pays anything. The deductible is the amount you agreed to pay out-of-pocket for covered losses.

- Formula: The insurance company uses a formula to calculate the ACV of your car. The formula takes into account the car’s age, mileage, condition, and market value.

ACV = (Market Value) – (Depreciation)

Receiving the Insurance Payment

Once your insurance company has determined the ACV of your car, they will issue you a payment. The process for receiving the payment may vary depending on your insurance company, but generally involves the following steps:

- Documentation: You will need to provide your insurance company with documentation, such as the police report, the vehicle title, and any repair estimates.

- Negotiation: If you disagree with the insurance company’s valuation of your car, you may be able to negotiate a higher payout.

- Payment: The insurance company will issue the payment to you by check or direct deposit.

Options After a Total Loss

So, your car is totaled. That’s a bummer, but it’s time to move on and figure out your next steps. You have a few options, each with its own pros and cons, so let’s break it down.

Accepting the Payout

This is the most common option, and it’s pretty straightforward. Your insurance company will give you a check for the actual cash value (ACV) of your car, which is its market value before the accident. You can then use this money to buy a new car, fix up your current one (if it’s repairable), or even just pocket the cash.

- Pros: It’s the simplest option and you get a lump sum of money to do with as you please.

- Cons: The ACV is usually less than what you paid for the car, so you might not have enough to buy a comparable replacement.

Keeping the Vehicle

You can choose to keep your totaled car, but you’ll have to pay the insurance company the ACV and then get it repaired. This is a good option if you’re handy and can fix the car yourself, or if you just have a sentimental attachment to it.

- Pros: You can keep your car and potentially save money on repairs if you do them yourself.

- Cons: The car may not be safe to drive after an accident, and you’ll have to pay for the repairs yourself. Also, you might have to pay for storage and registration, and you’ll have to sell it to someone who understands that it’s a salvage title.

Negotiating with the Insurance Company

Sometimes, the insurance company’s ACV estimate might be too low. You can try to negotiate with them to get a higher payout. This might be possible if your car was in excellent condition before the accident or if you have documentation of upgrades or repairs you’ve made.

- Pros: You could get a higher payout, which would help you buy a better replacement car.

- Cons: This process can be time-consuming and stressful, and the insurance company might not be willing to budge.

Legal Considerations

When your car is totaled, you might think the insurance company is on your side. But remember, they are a business, and their goal is to make a profit. That’s why it’s crucial to understand your legal rights and be prepared to advocate for yourself.

Your insurance policy is a legally binding contract. It Artikels your rights and responsibilities in the event of a total loss. It’s essential to review your policy carefully to understand your coverage and the process for filing a claim.

Negotiating the Payout

The insurance company will determine the value of your totaled car. This value, called the “actual cash value” (ACV), is usually based on the car’s age, mileage, condition, and market value. However, you may disagree with the insurance company’s assessment, especially if you believe your car was worth more.

You have the right to negotiate the payout with the insurance company. You can present evidence, such as recent appraisals or sales of similar vehicles, to support your claim. You can also seek assistance from an independent appraiser to get an unbiased evaluation of your car’s worth.

Disputing the Insurance Company’s Decision

If you believe the insurance company’s decision is unfair or unreasonable, you have the right to dispute it. You can file a formal complaint with the insurance company or your state’s insurance commissioner. You may also have the right to pursue legal action, but this should be a last resort.

Potential Legal Issues

Several legal issues can arise after a total loss. Some common issues include:

- Disputes over the value of the vehicle.

- Disagreements about the coverage provided by the insurance policy.

- Claims of fraud or misrepresentation by the insurance company.

- Issues related to the salvage value of the totaled vehicle.

Seeking Legal Advice

If you are facing legal issues after a total loss, it’s essential to seek legal advice from an experienced attorney. An attorney can review your insurance policy, assess your legal rights, and help you negotiate with the insurance company. They can also represent you in court if necessary.

Remember, you have rights as a policyholder. Don’t be afraid to stand up for yourself and fight for what you deserve.

Practical Considerations

Okay, so your car’s been totaled, and you’re probably feeling a mix of emotions: sadness, frustration, maybe even a little bit of relief. But regardless of how you’re feeling, there are some practical things you need to handle. This is where the real work begins, so buckle up!

Documenting the Damage and Dealing with the Insurance Company

The first thing you need to do is document the damage to your vehicle. Take pictures of the damage from all angles, including the interior. This documentation will help you make your case to the insurance company and ensure you get a fair payout. Don’t forget to keep a record of all your conversations with the insurance company, including dates, times, and the names of anyone you speak to. This is important for tracking progress and protecting yourself if any disputes arise.

Managing Financial and Logistical Challenges

Losing your car can be a financial blow, so you’ll need to plan accordingly. You’ll need to figure out how to get around while you’re waiting for your new car. Public transportation, ride-sharing, or borrowing a car from a friend or family member are all options. Also, if you have a car loan, you’ll need to work with your lender to figure out what happens to the loan now that your car is gone. You might be able to get out of the loan, or you might need to find a new car to replace the one you lost.

Buying a New or Used Vehicle

Now comes the fun part: shopping for a new car! But before you start browsing dealerships, you need to figure out your budget. Your insurance company will give you a payout for your totaled car, but it might not be enough to cover the cost of a brand new car. If you need to finance a new car, you’ll need to get pre-approved for a loan. This will give you a clear picture of how much you can afford to spend. Once you know your budget, you can start looking at different vehicles. Think about what you need in a car: size, fuel efficiency, safety features, and so on. Remember, you’re not just replacing your old car; you’re buying a new one, so don’t be afraid to go for something different!

End of Discussion

Facing a totaled car can be a stressful experience, but it doesn’t have to be overwhelming. By understanding your rights, options, and the process involved, you can navigate this situation with confidence. Remember, communication is key. Stay informed, ask questions, and don’t hesitate to seek legal advice if needed. You’ve got this!

Top FAQs

What if I disagree with the insurance company’s total loss determination?

You have the right to get a second opinion from an independent appraiser. This can help determine if the vehicle’s value is truly beyond repair.

Can I keep my totaled car?

In some cases, you can choose to keep the totaled car, but you’ll need to pay the insurance company the difference between the payout and the actual value of the vehicle.

How long does it take to receive my insurance payout?

The processing time varies depending on the insurance company and the complexity of your claim. It’s best to contact your insurance company directly for an estimated timeline.