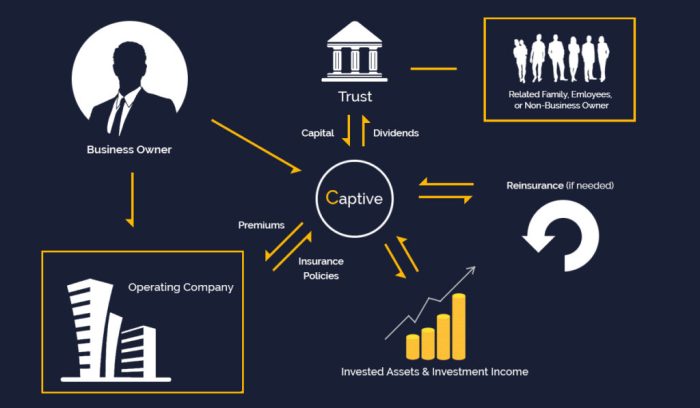

What is a captive insurance company? Imagine a company that essentially creates its own insurance company, specifically designed to cover its own risks. It’s like having your own personal insurance superhero, tailored to your exact needs. This is the essence of a captive insurance company, a powerful tool for businesses looking to manage their risks more effectively and potentially save some serious cash.

Captive insurance companies are becoming increasingly popular as businesses seek greater control over their risk management strategies. By creating a captive, companies can take a more proactive approach to insurance, potentially reducing premiums, accessing alternative risk transfer mechanisms, and even benefiting from tax advantages.

Case Studies and Examples of Captive Insurance Companies

Captive insurance companies have become increasingly popular in recent years, with many businesses realizing the benefits of self-insuring their risks. To understand the impact and effectiveness of captive insurance companies, it’s essential to examine real-world examples across various industries. This section explores successful captive insurance companies, analyzing their key factors for success and discussing the challenges they faced and how they were overcome.

Examples of Successful Captive Insurance Companies, What is a captive insurance company

Captive insurance companies are gaining traction across various industries, demonstrating their ability to manage risk and provide financial stability. These companies have successfully navigated the challenges associated with captive insurance, proving its viability as a risk management strategy.

- The Coca-Cola Company: Coca-Cola established a captive insurance company to self-insure its product liability risks. This strategy allowed them to control premiums and retain a larger portion of their profits. By creating a captive, Coca-Cola effectively managed its risk and reduced its reliance on traditional insurance providers.

- Ford Motor Company: Ford implemented a captive insurance company to cover its workers’ compensation claims. This move enabled them to customize coverage, control costs, and gain deeper insights into their risk profile. By managing its workers’ compensation risk internally, Ford was able to optimize its financial performance.

- Target Corporation: Target established a captive insurance company to manage its property and casualty risks. This captive allowed Target to reduce its insurance premiums and gain greater control over its risk management strategy. By self-insuring, Target could leverage its own expertise and tailor coverage to its specific needs.

Factors Contributing to the Success of Captive Insurance Companies

Several factors contribute to the success of captive insurance companies. These factors highlight the key advantages of self-insuring and demonstrate why captive insurance has become a popular risk management strategy.

- Cost Savings: One of the primary benefits of captive insurance is cost savings. By self-insuring, companies can reduce their reliance on traditional insurance providers and negotiate more favorable premiums. Captive insurance companies have the potential to significantly lower insurance costs and improve the bottom line.

- Risk Management Control: Captive insurance companies provide businesses with greater control over their risk management strategy. By self-insuring, companies can customize coverage, set their own risk tolerance levels, and actively manage their risks. This level of control allows for more tailored and efficient risk management practices.

- Tax Advantages: Captive insurance companies can offer tax advantages, particularly in jurisdictions that provide favorable tax treatment for captives. These tax benefits can further enhance the financial attractiveness of captive insurance and provide companies with additional savings.

Challenges Faced by Captive Insurance Companies

Despite the potential benefits, captive insurance companies face several challenges. These challenges require careful consideration and strategic planning to ensure the success of a captive insurance program.

- Regulatory Compliance: Captive insurance companies must comply with various regulatory requirements, including licensing and solvency standards. Navigating these regulations can be complex and require specialized expertise. To overcome this challenge, companies should seek guidance from experienced professionals and ensure they meet all regulatory obligations.

- Financial Stability: Captive insurance companies must maintain adequate financial stability to meet their obligations. This requires careful risk assessment, appropriate reserves, and robust financial management practices. To ensure financial stability, companies should implement sound risk management strategies and maintain sufficient capital to cover potential losses.

- Expertise and Resources: Establishing and managing a captive insurance company requires specialized expertise and resources. Companies need to invest in skilled professionals with experience in captive insurance and risk management. To overcome this challenge, companies can partner with experienced captive insurance managers or build internal expertise through training and development.

Last Point: What Is A Captive Insurance Company

So, if you’re a business owner looking to level up your risk management game, a captive insurance company might be your secret weapon. It’s a unique and powerful tool that can help you manage your risks, potentially save money, and gain greater control over your financial future.

Expert Answers

What are some of the risks that a captive insurance company can cover?

Captives can cover a wide range of risks, including property damage, liability claims, workers’ compensation, and even cyber risks. The specific risks covered will depend on the needs of the parent company.

How much does it cost to set up a captive insurance company?

The cost of setting up a captive can vary depending on factors like the size and complexity of the company, the chosen domicile, and the level of regulatory oversight. However, it’s generally considered a significant investment, so it’s important to weigh the potential benefits against the costs.

Are there any regulatory challenges associated with captive insurance companies?

Yes, captive insurance companies are subject to regulatory oversight, which can vary depending on the domicile. It’s essential to understand the regulatory requirements and ensure compliance to avoid potential issues.