What is a good car insurance company sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of car insurance can feel like driving through a maze of confusing terms and endless options. But don’t worry, we’re here to break it down and help you find the best fit for your needs, like a trusty GPS guiding you to the perfect coverage.

This guide dives into the essential elements of car insurance, from understanding the different types of coverage to evaluating the top companies based on factors like reputation, financial stability, and customer service. We’ll also provide tips for getting the best rates and navigating the claims process, ensuring you’re equipped to make informed decisions and protect yourself on the road.

Understanding Car Insurance Basics

Car insurance is a vital financial safety net that protects you and your vehicle in the event of an accident or other unforeseen circumstances. It’s a legal requirement in most states, and it can help you avoid significant financial burdens. To navigate the world of car insurance, understanding the different types of coverage and factors that influence premiums is essential.

Types of Car Insurance Coverage

Car insurance policies typically offer various coverage options, each designed to address specific risks.

- Liability Coverage: This coverage is the most basic and essential. It protects you financially if you cause an accident that results in injury or damage to another person or their property. Liability coverage is usually expressed in limits, such as 100/300/100, which means you have up to $100,000 in coverage per person injured, up to $300,000 total for all injuries in an accident, and up to $100,000 for property damage.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. It covers the cost of repairs, minus your deductible, which is the amount you pay out of pocket before your insurance kicks in. For example, if you have a $500 deductible and your vehicle sustains $2,000 in damage, you would pay $500, and your insurance would cover the remaining $1,500.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, natural disasters, or animal collisions. Like collision coverage, it has a deductible, and the insurance company pays for the repairs or replacement after you pay your deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It can help pay for your medical bills, lost wages, and vehicle repairs.

- Personal Injury Protection (PIP): This coverage helps pay for your medical expenses, lost wages, and other related costs, regardless of who’s at fault in an accident. It’s often required in certain states, and it can be especially helpful if you’re injured in an accident and are unable to work.

Factors Determining Car Insurance Premiums, What is a good car insurance company

The cost of car insurance premiums can vary widely depending on several factors.

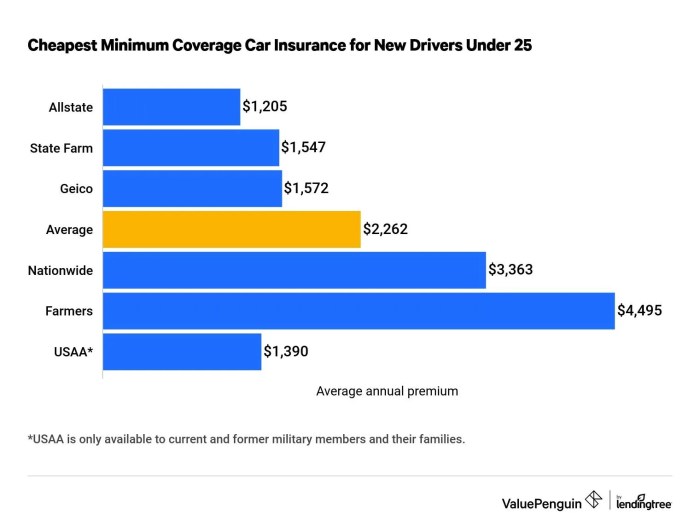

- Age and Driving Record: Younger drivers and those with a history of accidents or traffic violations generally pay higher premiums. Insurance companies consider younger drivers to be more likely to be involved in accidents, and a poor driving record reflects a higher risk.

- Vehicle Type: The make, model, and year of your vehicle can significantly influence your premiums. High-performance cars, luxury vehicles, and vehicles with a history of theft or accidents tend to be more expensive to insure.

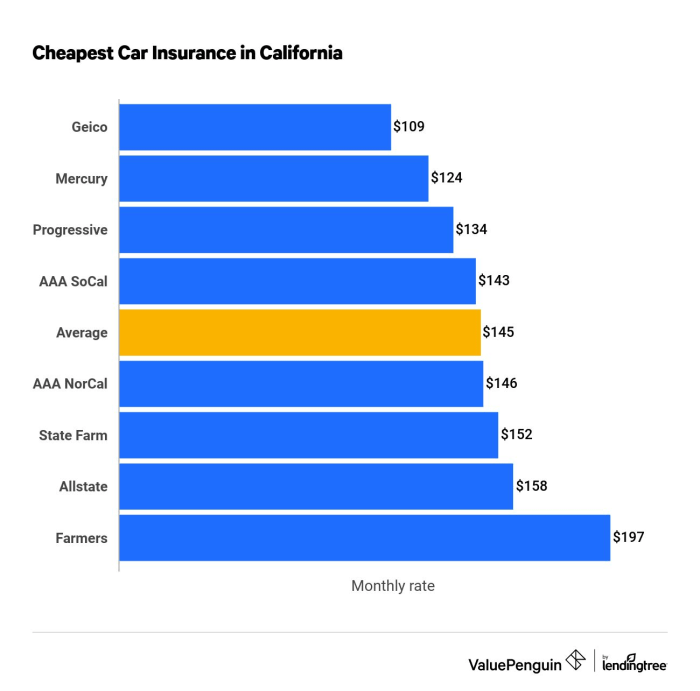

- Location: Where you live can impact your premiums. Areas with higher crime rates, traffic congestion, or a higher frequency of accidents typically have higher insurance rates.

- Credit Score: In some states, insurance companies use your credit score to assess your risk. A lower credit score may indicate a higher risk, leading to higher premiums.

- Driving Habits: Factors like your annual mileage, commuting distance, and driving history can influence your premiums. For example, if you drive long distances frequently, you’re considered a higher risk and may pay more.

Common Car Insurance Scenarios

To illustrate how different coverage options apply in real-life situations, consider these scenarios:

- Scenario 1: You’re at fault in an accident, causing damage to another car. Your liability coverage will pay for the repairs to the other vehicle, up to your policy limits. If the damages exceed your limits, you could be personally responsible for the remaining costs.

- Scenario 2: You’re involved in an accident, and your vehicle is damaged. Your collision coverage will help pay for repairs or replacement, minus your deductible. If you don’t have collision coverage, you’ll be responsible for the entire cost of repairs.

- Scenario 3: Your car is stolen. Your comprehensive coverage will help pay for the replacement or repairs of your stolen vehicle, minus your deductible. Without comprehensive coverage, you’ll have to bear the cost of replacing or repairing your vehicle.

- Scenario 4: You’re hit by an uninsured driver. Your uninsured/underinsured motorist coverage will help pay for your medical bills, lost wages, and vehicle repairs. Without this coverage, you’ll be responsible for these costs.

Evaluating Car Insurance Companies

You’ve got your wheels, now it’s time to get them insured! But with so many car insurance companies out there, it can feel like trying to find a needle in a haystack. Don’t worry, we’re here to help you navigate this insurance jungle and find the perfect policy for your needs.

Factors to Consider When Choosing a Car Insurance Company

Choosing the right car insurance company is crucial, like picking the right team for your fantasy football league. You want a company that’s reliable, affordable, and has your back when you need it most. Here are some key factors to consider:

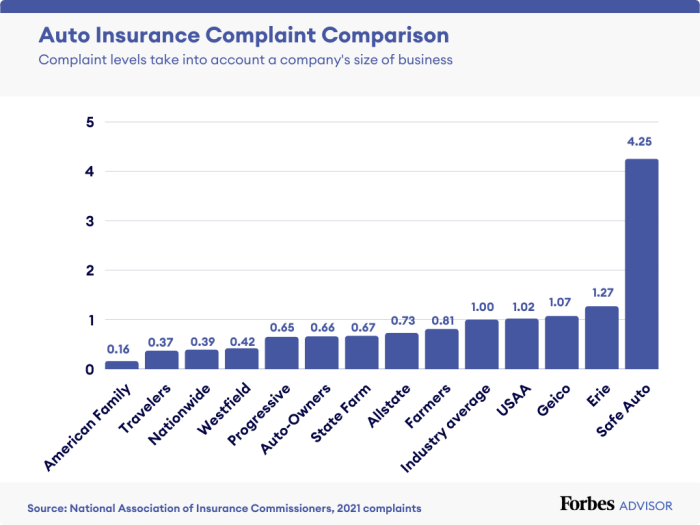

- Reputation: Look for companies with a solid track record of customer satisfaction. You can check online reviews, ratings from organizations like J.D. Power, and see if they’ve received any awards for excellent customer service.

- Financial Stability: You want a company that’s financially sound and can pay out claims when you need them. Look at their financial ratings from agencies like AM Best or Standard & Poor’s. A high rating indicates a strong financial position.

- Customer Service: Think about how you want to interact with your insurance company. Do you prefer online interactions, phone calls, or in-person visits? Make sure the company offers the communication channels you’re comfortable with and has a reputation for excellent customer service.

- Claims Process: Accidents happen, and when they do, you want a smooth and efficient claims process. Research how different companies handle claims. Do they have online claim filing options? How quickly do they process claims? What are their customer reviews regarding the claims process?

- Discounts: Every penny counts, so look for companies that offer discounts to lower your premiums. Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for safety features in your car.

- Add-ons: Some companies offer additional coverage options like roadside assistance, rental car reimbursement, or gap insurance. These add-ons can provide extra peace of mind but come at an additional cost. Evaluate whether these add-ons are worth the price for you.

- Coverage Options: Different companies offer various coverage options. Make sure the company you choose offers the coverage you need, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. You may also want to consider optional coverage like personal injury protection (PIP) or medical payments coverage (MedPay).

Comparing Car Insurance Companies

Now that you know what to look for, it’s time to compare apples to apples. Different companies offer different features and benefits, so it’s important to do your research and find the best fit for your needs.

- Get Quotes: Start by getting quotes from several different companies. Use online quote tools or contact companies directly to get personalized quotes. Be sure to provide accurate information about your vehicle, driving history, and desired coverage levels.

- Compare Coverage: Once you have quotes from several companies, carefully compare the coverage options, premiums, and discounts offered. Pay attention to any limitations or exclusions in the policy.

- Read Reviews: Don’t just rely on quotes alone. Read reviews from other customers to get a sense of their experiences with different companies. Look for reviews on websites like Trustpilot, Consumer Reports, and the Better Business Bureau.

- Contact Customer Service: If you’re still unsure, contact the customer service departments of the companies you’re considering. Ask questions about their policies, claims process, and overall customer experience. This will give you a better feel for the company’s responsiveness and professionalism.

Top 5 Car Insurance Companies

Here’s a table comparing some of the top car insurance companies based on key metrics:

| Company | Customer Satisfaction (J.D. Power) | Financial Strength (AM Best) | Claim Handling (Consumer Reports) |

|---|---|---|---|

| Geico | 858 | A++ | 87 |

| USAA | 876 | A++ | 90 |

| State Farm | 839 | A++ | 85 |

| Progressive | 827 | A+ | 84 |

| Allstate | 815 | A+ | 82 |

Remember, this is just a starting point. It’s crucial to do your own research and choose the car insurance company that best meets your individual needs and preferences.

Getting Quotes and Comparing Rates: What Is A Good Car Insurance Company

Shopping for car insurance is like shopping for any other big purchase – you want to make sure you’re getting the best deal possible. The first step is to get quotes from different insurance companies. This will give you a good idea of the range of rates available and help you compare apples to apples.

Obtaining Car Insurance Quotes

You can obtain car insurance quotes online, over the phone, or in person. Online is usually the fastest and easiest way to get quotes. Most insurance companies have user-friendly websites where you can enter your information and get a quote in minutes. When you get quotes online, be sure to provide accurate information about your driving history, car, and coverage needs.

Comparing Car Insurance Quotes

Once you have a few quotes, it’s time to compare them. Look at the rates, deductibles, and coverage options. Make sure you understand what each quote covers and what the limitations are. Don’t just go for the cheapest option. Consider the company’s reputation, customer service, and claims handling process.

Negotiating Car Insurance Premiums

You can often negotiate your car insurance premiums, especially if you have a good driving record and are willing to shop around. Here are some tips for negotiating:

- Ask about discounts. Most insurance companies offer discounts for things like good driving records, safety features on your car, and bundling your insurance policies.

- Consider raising your deductible. A higher deductible means you’ll pay more out of pocket if you have an accident, but it can lower your premium.

- Be willing to switch insurance companies. If you’re not happy with your current rate, don’t be afraid to switch to a different company.

Understanding Policy Details and Coverage

You’ve got your eye on a sweet ride, and you’re ready to hit the road. But before you put the pedal to the metal, you need to understand the fine print of car insurance. It’s not just about picking the cheapest policy; it’s about finding the right coverage that protects you and your wheels.

Key Provisions of a Standard Car Insurance Policy

Understanding the key provisions of a standard car insurance policy is like knowing the rules of the game. It’s essential to understand what’s covered, what’s not, and how much you’ll be responsible for.

Deductibles

Your deductible is the amount you’ll pay out of pocket before your insurance kicks in. It’s like a down payment for your claim. The higher your deductible, the lower your premium.

A higher deductible means you pay less each month, but you’ll have a bigger chunk of change to pay if you need to file a claim.

Limits

Your policy limits are the maximum amounts your insurer will pay for certain types of claims. It’s like a cap on how much they’ll cover.

The limits are usually split between bodily injury liability and property damage liability. For example, your policy might have a $100,000 limit for bodily injury liability per person and a $300,000 limit for bodily injury liability per accident.

Exclusions

Exclusions are situations where your insurance won’t cover your losses. It’s like the fine print you have to read carefully.

Common exclusions include driving under the influence of alcohol or drugs, using your car for illegal activities, and driving without a valid license.

Reviewing and Understanding Your Policy

Think of your car insurance policy like a contract. It’s a legal document that Artikels the terms of your agreement with your insurance company.

Take your time to read it carefully. Don’t just skim it. Pay attention to the details, especially the exclusions and limitations.

Common Car Insurance Claims and How They Are Handled

Here’s the deal. You know your policy. Now, let’s see how it works in real life.

Most car insurance claims involve collisions, comprehensive coverage, and liability.

Collision Coverage

Collision coverage pays for repairs or replacement of your car if it’s damaged in an accident. It’s like a safety net for your ride.

You’ll need to pay your deductible, but your insurance will cover the rest.

Comprehensive Coverage

Comprehensive coverage protects your car from damage caused by things other than collisions, like theft, vandalism, or natural disasters. It’s like a backup plan for unexpected events.

You’ll need to pay your deductible, but your insurance will cover the rest.

Liability Coverage

Liability coverage protects you if you cause an accident that injures someone or damages their property. It’s like having a guardian angel in case you make a mistake.

Your insurance will pay for the other person’s medical expenses, lost wages, and property damage, up to your policy limits.

Managing Your Car Insurance

You’ve picked the right car insurance company and have a policy that fits your needs. Now it’s time to make sure you’re doing everything you can to manage your policy and keep your premiums low.

Maintaining a Good Driving Record

A clean driving record is the key to keeping your car insurance premiums low. Here’s how to keep your record spotless:

* Obey the law: This might sound obvious, but it’s crucial. Avoid speeding, running red lights, and driving under the influence.

* Drive defensively: Be aware of your surroundings and anticipate potential hazards. This means staying focused while driving, checking your mirrors regularly, and maintaining a safe following distance.

* Take a defensive driving course: Many insurance companies offer discounts for completing a defensive driving course. These courses teach you valuable skills that can help you avoid accidents.

* Avoid distractions: This includes using your phone, eating, or applying makeup while driving. Distracted driving is a major cause of accidents.

* Be a safe driver: It’s not just about avoiding accidents. You can also reduce your premiums by driving less overall.

* Check your driving record regularly: You can obtain a copy of your driving record from your state’s Department of Motor Vehicles.

Filing a Claim with Your Insurance Company

Accidents happen, and when they do, you’ll need to know how to file a claim with your insurance company.

* Report the accident immediately: Contact your insurance company as soon as possible after an accident. The sooner you report it, the sooner the claims process can begin.

* Gather information: Get the names, addresses, and insurance information of all parties involved. Take pictures of the damage to your car and the other vehicles involved.

* Be honest and cooperative: Be truthful with your insurance company about what happened. Provide all the information they request and be prepared to answer their questions.

* Understand your coverage: Review your policy to understand your coverage limits and deductibles. This will help you determine how much your insurance company will pay for the repairs.

* Negotiate with your insurance company: If you disagree with the amount your insurance company is offering, you can negotiate a higher settlement.

Managing Your Car Insurance Policy

Once you have a policy, it’s important to manage it effectively to ensure you’re getting the best coverage at the best price.

* Review your policy annually: Make sure your policy still meets your needs. Your insurance needs may change as you get older, buy a new car, or add a new driver to your household.

* Shop around for better rates: Don’t be afraid to compare quotes from different insurance companies. You may be able to find a better deal with another insurer.

* Take advantage of discounts: Many insurance companies offer discounts for things like good driving records, safety features on your car, and multiple policies. Ask your insurance company about the discounts they offer.

* Make changes as needed: If your circumstances change, be sure to update your policy. For example, if you move to a new state, you’ll need to change your policy to reflect the new state’s insurance requirements.

* Keep your insurance company informed: Notify your insurance company of any changes to your driving record, vehicle, or living situation.

Conclusive Thoughts

So, buckle up and join us on this journey to find the best car insurance company for you. We’ll equip you with the knowledge to make informed decisions, negotiate the best rates, and feel confident knowing you’re covered in case of any unexpected bumps in the road. After all, driving should be about enjoying the journey, not worrying about the risks. Let’s hit the road and find the perfect insurance partner for your driving adventures!

Common Queries

What is the difference between liability and collision coverage?

Liability coverage protects you if you cause an accident, covering damages to the other driver’s car and any injuries. Collision coverage covers damage to your own car, even if you’re at fault. Think of it as protecting your own vehicle from bumps and scrapes.

How do I know if I need comprehensive coverage?

Comprehensive coverage protects you from non-collision damages, like theft, vandalism, or damage caused by natural disasters. It’s a good idea to consider if you have a newer or more expensive car, or if you live in an area prone to these types of events.

What are some common discounts I can get on car insurance?

Many insurance companies offer discounts for good driving records, safe driving courses, bundling your car insurance with other policies like homeowners or renters insurance, and even for being a good student or having a good credit score. It’s worth asking about these discounts when getting quotes.