What is a good insurance company? It’s a question that pops up when life throws you a curveball – a fender bender, a leaky roof, or even a surprise medical bill. You want to know you’ve got a solid team on your side, a company that’s got your back when things go sideways. But with so many options out there, how do you find the right fit? It’s all about digging deeper, looking beyond the flashy ads and finding the insurance company that’s built for your needs.

This guide is your roadmap to navigating the insurance world, helping you understand the key factors to consider when choosing an insurance company. From financial stability to customer service, we’ll break down the essentials, empowering you to make informed decisions about your coverage.

Defining “Good” Insurance

Finding the right insurance company can feel like navigating a maze of confusing jargon and endless options. But don’t worry, it doesn’t have to be a nightmare! To find the best fit for your needs, it’s all about knowing what makes a company “good.” Think of it like choosing a partner: you want someone reliable, trustworthy, and who’s got your back when you need them most.

Factors to Consider

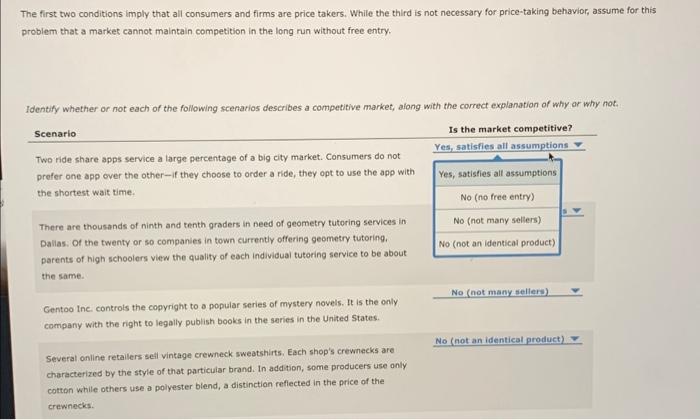

Deciding what makes an insurance company “good” is subjective and depends on your individual priorities. But, generally speaking, there are several factors that most people consider:

- Financial Stability: This is like the foundation of a house – you want a company that’s strong and unlikely to crumble when you need them. Look for companies with high ratings from agencies like AM Best or Standard & Poor’s. These ratings reflect a company’s financial health and ability to pay claims.

- Customer Service: Nobody wants to deal with a frustrating phone call or a confusing website. Look for companies with a reputation for responsive, helpful customer service. Check online reviews and consider companies with easy-to-use online portals or mobile apps.

- Claims Handling: When you need to file a claim, you want a company that’s efficient, fair, and easy to work with. Look for companies with good claim settlement ratios and positive customer reviews about their claims process.

- Pricing: Insurance is an expense, so it’s important to find a company that offers competitive rates without sacrificing quality. Get quotes from multiple companies and compare them carefully. Remember, the cheapest option isn’t always the best, especially if it compromises on other factors like financial stability or customer service.

Types of Insurance

Insurance is like a safety net, protecting you from financial hardship in case of unexpected events. Here are some of the most common types of insurance:

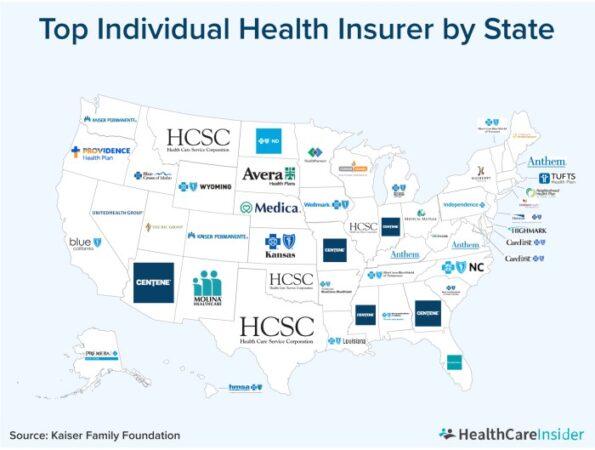

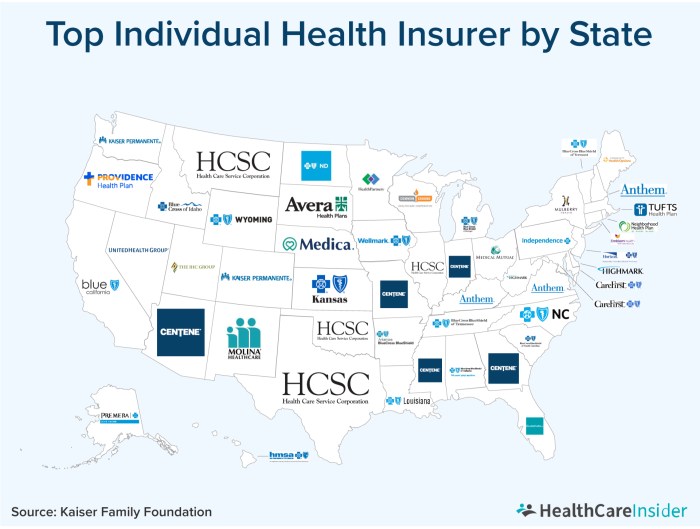

- Health Insurance: This is essential for covering medical expenses, like doctor visits, hospital stays, and prescription drugs. Health insurance can be provided through your employer, purchased individually, or through government programs like Medicare or Medicaid.

- Auto Insurance: This is required by law in most states and covers damage to your vehicle, injuries to yourself or others, and property damage in case of an accident.

- Home Insurance: This protects your home and belongings from damage caused by events like fire, theft, or natural disasters.

- Life Insurance: This provides financial protection for your loved ones in case of your death. The policy pays out a death benefit to your beneficiaries, helping them cover expenses like funeral costs, mortgage payments, or college tuition.

Key Features of a Desirable Insurance Company

Here are some key features that make an insurance company desirable:

- Financial Stability: A company with a strong financial track record is more likely to be able to pay out claims in the future. Look for companies with high ratings from independent agencies like AM Best or Standard & Poor’s.

- Customer Service: Good customer service is essential for a positive experience. Look for companies with responsive, helpful customer service representatives, easy-to-use online portals, and positive online reviews.

- Claims Handling: A company with a smooth and efficient claims process can make a big difference when you need to file a claim. Look for companies with good claim settlement ratios and positive customer reviews about their claims process.

- Pricing: While price is important, it shouldn’t be the only factor you consider. Compare quotes from multiple companies and make sure you’re getting a good value for the coverage you need.

Researching Insurance Companies

Finding the right insurance company is like finding the perfect pair of jeans – you gotta try on a few to find the fit that’s just right for you. Don’t settle for the first insurance company you see; shop around and compare quotes to make sure you’re getting the best deal.

Comparing Insurance Quotes

Comparing insurance quotes from multiple companies is crucial for finding the best value for your money. Just like you wouldn’t buy the first car you see, don’t settle for the first insurance quote. Different companies offer different coverage options, deductibles, and premiums, so it’s important to compare apples to apples.

Researching Insurance Companies

To find the best insurance company for your needs, you’ll need to do some research. It’s like being a detective, gathering clues to find the best fit. Here are some tips to help you in your investigation:

- Online Reviews: Check out online reviews from other customers to get a sense of their experiences with different insurance companies. Websites like Yelp, Trustpilot, and Consumer Reports can provide valuable insights into customer satisfaction, claims handling, and overall reputation. Think of it like reading the reviews on a restaurant before you decide to eat there.

- Financial Ratings: Insurance companies are rated by financial stability and strength by agencies like A.M. Best, Moody’s, and Standard & Poor’s. These ratings can give you an idea of how likely the company is to be around to pay your claims if you need them. It’s like checking the safety rating of a car before you buy it.

- Industry Awards: Look for insurance companies that have won awards for customer service, innovation, or financial performance. These awards can be a good indicator of a company’s commitment to excellence. It’s like seeing a restaurant with a Michelin star – you know it’s gotta be good.

Comparison of Insurance Company Features, What is a good insurance company

Here’s a table comparing some common features offered by different insurance companies:

| Feature | Company A | Company B | Company C |

|---|---|---|---|

| Coverage Options | Comprehensive, Collision, Liability, Personal Injury Protection | Comprehensive, Collision, Liability, Personal Injury Protection, Uninsured/Underinsured Motorist | Comprehensive, Collision, Liability, Personal Injury Protection, Uninsured/Underinsured Motorist, Roadside Assistance |

| Deductibles | $500, $1000, $2000 | $250, $500, $1000 | $100, $250, $500 |

| Premiums | $100 per month | $125 per month | $150 per month |

Understanding Insurance Policies

You might think insurance policies are just boring documents, but trust me, they’re more important than that TikTok you’re about to watch. Understanding your policy is like having a cheat sheet for life’s unexpected twists and turns. It’s your guide to knowing exactly what’s covered, what’s not, and how much you’ll pay if something happens.

Policy Terms Explained

Insurance policies are filled with jargon that can be confusing, but knowing these key terms can save you a lot of headaches (and money) in the long run.

Coverage Limits

Think of coverage limits as the maximum amount your insurance company will pay for a covered event. For example, if you have a $100,000 liability limit on your car insurance, that’s the most your insurer will pay if you’re found responsible for an accident.

Exclusions

Exclusions are the things your policy specifically doesn’t cover. For example, most homeowner’s insurance policies won’t cover damage caused by earthquakes or floods. It’s important to know what’s excluded so you can take steps to protect yourself.

Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance kicks in. If you have a $500 deductible on your car insurance, you’ll have to pay the first $500 of any repair costs after an accident.

Analyzing Insurance Policies

Think of this as a crash course on deciphering your insurance policy. It’s like reading a recipe for your financial protection.

Step 1: Read the Entire Policy

Yes, I know it’s a lot of text, but trust me, it’s worth it. You’ll be surprised at how much you learn by reading the whole thing.

Step 2: Highlight Key Sections

Mark the sections that cover things like deductibles, coverage limits, exclusions, and your responsibilities. You can even use sticky notes or color-coded highlighters for easy reference.

Step 3: Ask Questions

If you’re still confused about anything, don’t be afraid to call your insurance agent. They’re there to help you understand your policy.

Step 4: Keep It Handy

Don’t just shove your policy in a drawer and forget about it. Keep it somewhere accessible so you can refer to it whenever you need to.

Assessing Customer Service and Claims Handling: What Is A Good Insurance Company

Customer service and claims handling are the true tests of an insurance company’s character. When you’re dealing with a stressful situation like a car accident or a house fire, you need an insurance company that will be there for you, every step of the way. Think of it like this: You’re not just buying a policy; you’re investing in a relationship.

Importance of Customer Service and Claims Handling

An insurance company’s customer service and claims handling processes are crucial for several reasons:

- Customer Satisfaction: Good customer service and claims handling can make a world of difference in how customers perceive an insurance company. If you have a positive experience, you’re more likely to stick with that company, recommend it to others, and even pay a slightly higher premium.

- Reputation: In the digital age, word of mouth travels fast. A company with a history of excellent customer service and claims handling will have a strong reputation, which can attract new customers and boost their brand image.

- Loyalty: When customers feel valued and supported, they are more likely to remain loyal to an insurance company.

- Financial Stability: Efficient claims handling can help insurance companies manage their financial risks and maintain stability.

Examples of Good and Bad Customer Service

Good Customer Service

- Prompt Response: A good insurance company will respond to your inquiries and claims quickly. You shouldn’t have to wait days or weeks for a response.

- Helpful and Knowledgeable Representatives: The representatives you speak with should be knowledgeable about insurance policies and able to answer your questions clearly and concisely.

- Empathy and Understanding: Insurance companies should understand that you’re going through a difficult time when you’re filing a claim. They should be empathetic and supportive throughout the process.

- Smooth and Efficient Claims Process: The claims process should be straightforward and efficient, with minimal paperwork and hassle.

Bad Customer Service

- Long Wait Times: Waiting on hold for hours or days to speak with a representative is a huge red flag.

- Unhelpful and Unresponsive Representatives: If you’re met with rudeness, disinterest, or a lack of knowledge, it’s a sign that the company doesn’t prioritize customer service.

- Unreasonable Denials: A company that denies your claim without a valid reason or tries to lowball your settlement is a sign of poor claims handling.

- Complex and Confusing Claims Process: If the claims process is overly complicated and requires excessive paperwork, it’s a sign that the company is not customer-focused.

Evaluating Customer Service and Claims Handling

When evaluating an insurance company’s customer service and claims handling practices, consider the following:

- Customer Reviews and Ratings: Read online reviews and ratings from independent sources like Consumer Reports, J.D. Power, and the Better Business Bureau.

- Customer Testimonials: Look for testimonials from satisfied customers on the insurance company’s website or social media pages.

- Industry Awards: Check if the company has received any awards for customer service or claims handling excellence.

- Customer Service Availability: Does the company offer multiple channels of communication, such as phone, email, chat, and social media?

- Claims Process Transparency: Is the claims process clearly Artikeld on the company’s website?

- Claims Handling Timelines: What is the average time it takes for the company to process claims?

- Customer Service Training: Does the company provide training to its customer service representatives?

- Claims Resolution Process: How does the company handle disputed claims?

Financial Stability and Reputation

You wouldn’t trust your car to a mechanic who’s been on the job for a week, right? The same goes for insurance. A financially stable insurance company is crucial because they’re the ones who pay out your claims. Think of it like this: if they go belly up, you’re left holding the bag. So, how do you sniff out a solid insurance company?

Credit Ratings and Solvency Ratios

To assess an insurance company’s financial health, look at their credit ratings and solvency ratios. These are like the company’s report card. Credit ratings are assigned by agencies like A.M. Best, Moody’s, and Standard & Poor’s, and they reflect the company’s ability to meet its financial obligations. A high credit rating means they’re financially sound and have a low risk of defaulting on claims. Think of it like a AAA credit score for a company.

- A.M. Best: A.M. Best is a leading credit rating agency that specializes in the insurance industry. They assign ratings based on a company’s financial strength, operating performance, and business profile. A.M. Best’s ratings are widely recognized and used by insurance professionals and consumers alike.

- Moody’s: Moody’s is another well-known credit rating agency that evaluates the financial health of companies, including insurance companies. Their ratings are based on factors like a company’s profitability, liquidity, and capital adequacy.

- Standard & Poor’s: Standard & Poor’s is a global credit rating agency that provides ratings on a wide range of financial instruments, including insurance companies. Their ratings are based on a company’s financial performance, regulatory environment, and overall business risk.

Solvency ratios, on the other hand, measure an insurance company’s ability to pay its claims. A high solvency ratio means they have enough money on hand to cover their obligations. Think of it as their cash reserves. The higher the ratio, the better.

A solvency ratio of 200% means an insurance company has enough assets to cover twice its liabilities.

Reputation

Just like a good restaurant, an insurance company’s reputation is a big deal. Word-of-mouth, online reviews, and industry rankings can give you a good idea of how they treat their customers. Do they pay claims promptly? Are they responsive to customer concerns? Are they known for their integrity? These are all factors that contribute to their reputation.

- J.D. Power: J.D. Power is a well-known consumer research company that conducts surveys and ratings on a variety of industries, including insurance. Their ratings are based on customer satisfaction with insurance companies, covering areas like claims handling, customer service, and overall satisfaction.

- Consumer Reports: Consumer Reports is a non-profit organization that provides unbiased product reviews and ratings. They also evaluate insurance companies based on factors like financial stability, customer satisfaction, and claims handling.

- Better Business Bureau (BBB): The BBB is a non-profit organization that accredits businesses based on their ethical practices and customer service. They provide ratings and reviews on businesses, including insurance companies, based on customer complaints and business practices.

Choosing the Right Insurance Company

So, you’ve done your homework and understand what makes a good insurance company. Now, it’s time to put that knowledge into action and pick the perfect one for your needs. Choosing the right insurance company is like finding the perfect pair of jeans: it takes some time and effort, but it’s worth it in the end.

Step-by-Step Process for Selecting an Insurance Company

The key is to approach this process strategically. It’s not about picking the first company you see, it’s about finding the one that’s the best fit for you. Imagine it like finding the perfect match on a dating app – you want to make sure you’re compatible, right?

- Identify Your Needs: Before you start browsing insurance companies, you need to figure out what you’re looking for. What type of insurance are you looking for? What are your coverage needs? What’s your budget? Think of it like setting up your dating profile – you need to be clear about what you’re looking for in a partner (or in this case, an insurance company).

- Research Potential Companies: Once you know what you need, it’s time to start researching. Check out online reviews, compare quotes from different companies, and look for companies that have a good reputation. It’s like scrolling through profiles on your dating app – you’re looking for someone who seems like a good fit based on their profile.

- Compare Quotes and Coverage: Don’t just go for the cheapest option. Compare quotes from different companies and make sure you’re getting the coverage you need. Think of it like comparing different profiles – you’re looking for the best combination of features and price.

- Read the Fine Print: Before you sign anything, make sure you understand the terms and conditions of the policy. This is like reading someone’s dating profile carefully – you want to make sure you’re not surprised by any hidden clauses or conditions.

- Assess Customer Service and Claims Handling: A good insurance company should have excellent customer service and a smooth claims process. Check out online reviews and ask friends and family for recommendations. It’s like looking for someone who’s communicative and responsive – you want to make sure they’ll be there for you when you need them.

- Check Financial Stability and Reputation: Make sure the company you choose is financially stable and has a good reputation. Think of it like checking someone’s background – you want to make sure they’re trustworthy and reliable.

- Make Your Decision: Once you’ve considered all the factors, you can make your decision. It’s like making a decision about who to go on a date with – you’re choosing the best option based on your criteria.

Flowchart for Selecting an Insurance Company

This flowchart can help you visualize the decision-making process:

+-----------------+

| Identify Needs |

+-----------------+

|

|

+-----------------+

| Research Companies |

+-----------------+

|

|

+-----------------+

| Compare Quotes |

+-----------------+

|

|

+-----------------+

| Read Fine Print |

+-----------------+

|

|

+-----------------+

| Assess Customer |

| Service & Claims |

+-----------------+

|

|

+-----------------+

| Check Financial |

| Stability & Rep |

+-----------------+

|

|

+-----------------+

| Make Your Decision |

+-----------------+

Checklist of Questions to Ask Potential Insurance Companies

Here are some key questions to ask potential insurance companies to help you make an informed decision:

- What types of coverage do you offer? This question helps you understand the scope of their services.

- What are your premiums and deductibles? This is crucial for comparing costs and understanding your financial responsibilities.

- What is your claims process like? Knowing this will give you insight into their efficiency and customer support.

- What is your financial rating? This helps assess their stability and trustworthiness.

- What are your customer service hours and contact information? This ensures you can easily reach them if needed.

- Do you offer any discounts or special programs? This could save you money in the long run.

- What is your cancellation policy? This helps you understand the terms of ending the contract.

- Do you have any customer testimonials or reviews? This gives you insights from real customers.

Concluding Remarks

Choosing the right insurance company is a big decision, but it doesn’t have to be overwhelming. By doing your homework, comparing options, and understanding your needs, you can find the insurance partner that gives you peace of mind and protects what matters most. Remember, a good insurance company isn’t just about the price tag, it’s about the support and security they provide when you need it most.

FAQs

How do I know if an insurance company is trustworthy?

Look for companies with good financial ratings from reputable agencies like AM Best and Standard & Poor’s. Check online reviews and see if the company has a history of fair claims handling.

What are the most important things to consider when choosing insurance?

Your specific needs, coverage options, premiums, deductibles, customer service, and the company’s financial stability are all key factors.

How can I get the best insurance rates?

Shop around and compare quotes from multiple companies. Consider bundling policies (like auto and home) and ask about discounts for good driving records, safety features, or other factors.