What is full coverage car insurance in Florida? In the Sunshine State, where weather can be unpredictable and traffic congested, having comprehensive car insurance is essential for many drivers. Full coverage car insurance offers a safety net for drivers, protecting them from financial burdens in case of accidents, theft, or damage caused by natural disasters.

This type of insurance combines various coverages, including liability insurance, collision coverage, and comprehensive coverage, to provide comprehensive protection for your vehicle and financial liability. Understanding the intricacies of full coverage car insurance in Florida, its components, and the factors influencing its cost is crucial for making informed decisions about your car insurance needs.

What is Full Coverage Car Insurance?

Full coverage car insurance is a term often used to describe a comprehensive car insurance policy that provides the most protection for your vehicle. This type of policy includes multiple types of coverage designed to safeguard you from various risks associated with car ownership.

Types of Coverage in Full Coverage Car Insurance

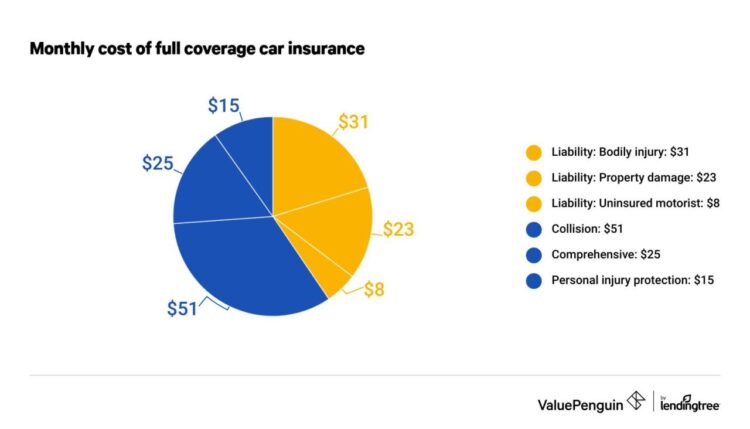

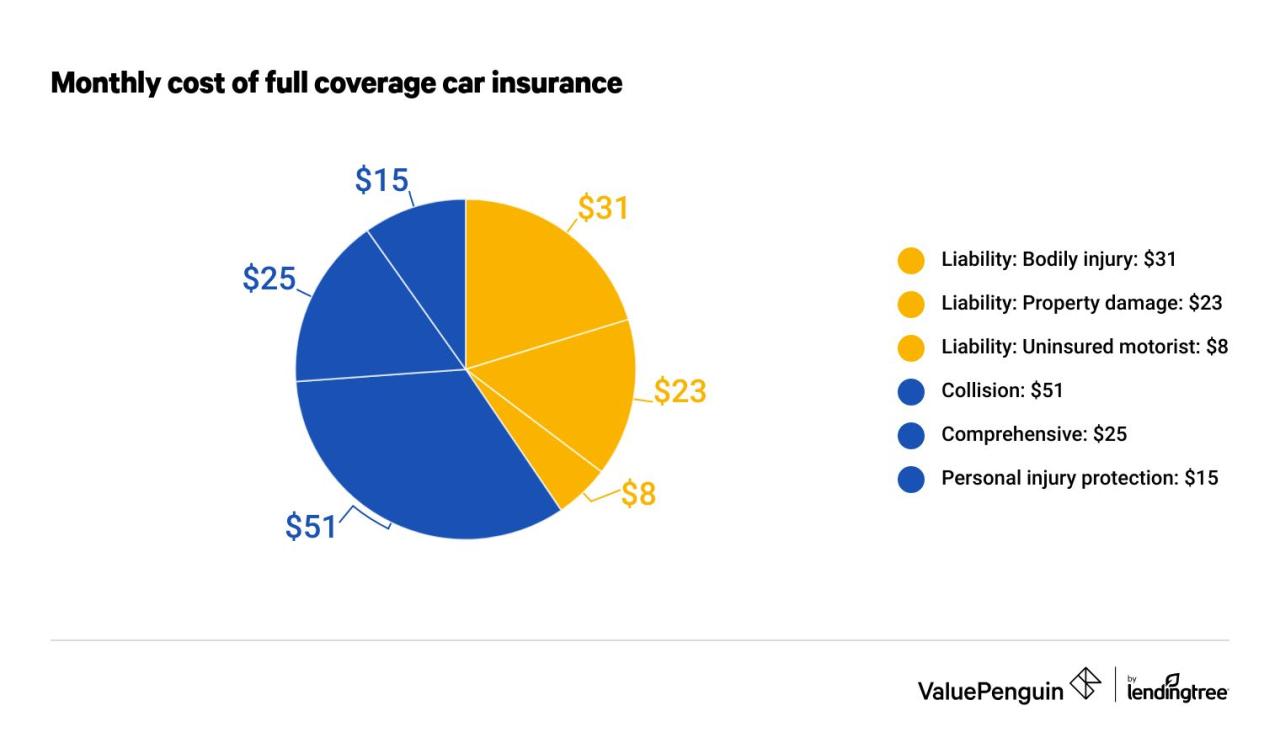

A typical full coverage car insurance policy includes several essential types of coverage. Here’s a breakdown of the key components:

- Liability Coverage: This is the most basic type of car insurance, required by law in most states. It covers damages to other people’s property and injuries to other people if you are at fault in an accident. Liability coverage is divided into two parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for injuries to other people in an accident.

- Property Damage Liability: This covers repairs or replacement costs for damage to another person’s vehicle or property.

- Collision Coverage: This covers repairs or replacement costs for your vehicle if it is damaged in an accident, regardless of who is at fault. It includes accidents with another vehicle, a stationary object, or even a pothole.

- Comprehensive Coverage: This covers damage to your vehicle caused by events other than accidents, such as theft, vandalism, fire, hail, flood, or animal collisions.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This coverage is available in some states and helps pay for medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident.

Situations Where Full Coverage Insurance is Beneficial

Full coverage car insurance can be beneficial in a wide range of situations. Here are some examples:

- New Car Purchases: When you buy a new car, it’s essential to have full coverage to protect your investment. New cars are typically more expensive to repair or replace, and full coverage provides comprehensive protection.

- High-Value Vehicles: If you own a luxury car, a classic car, or a vehicle with a high market value, full coverage is crucial. It helps ensure you can repair or replace your vehicle if it is damaged or stolen.

- Living in a High-Risk Area: If you live in an area with a high rate of car theft, vandalism, or accidents, full coverage can provide peace of mind.

- Significant Debt on Your Vehicle: If you have a loan or lease on your car, your lender may require you to have full coverage insurance. This ensures they can recover their investment if the vehicle is damaged or destroyed.

- Driving in High-Traffic Areas: If you frequently drive in areas with heavy traffic, you are more likely to be involved in an accident. Full coverage can help protect you from financial losses in such situations.

Florida’s Unique Insurance Landscape

Florida’s car insurance market is significantly influenced by a variety of factors that contribute to its unique landscape. Understanding these factors is crucial for drivers seeking comprehensive coverage and for insurance companies navigating the complexities of the state’s market.

Factors Influencing Car Insurance Costs

The cost of car insurance in Florida is shaped by several key factors, including:

- Weather Conditions: Florida’s frequent hurricanes and severe storms significantly increase the risk of vehicle damage, leading to higher insurance premiums. The state’s high frequency of weather-related claims drives up insurance costs for all drivers, regardless of their personal driving history.

- Traffic Density: Florida’s densely populated urban areas, particularly in South Florida, contribute to increased traffic congestion and accidents. This higher risk of collisions translates into higher insurance premiums for drivers in these regions.

- Claim Frequency: Florida has a higher-than-average rate of car insurance claims, influenced by factors like weather, traffic, and a large number of uninsured drivers. This increased claim frequency directly impacts insurance costs, as insurers must factor in the higher probability of paying out claims.

Comparison of Florida’s Insurance Regulations with Other States

Florida’s insurance regulations differ significantly from those in other states. Some notable distinctions include:

- No-Fault Insurance: Florida is a no-fault insurance state, meaning drivers are primarily responsible for covering their own medical expenses after an accident, regardless of fault. This system aims to reduce lawsuits and expedite claim processing, but it can also lead to higher premiums.

- Personal Injury Protection (PIP): Florida mandates PIP coverage, which pays for medical expenses and lost wages following an accident. This coverage is a key element of the no-fault system, but the state’s regulations on PIP benefits are complex and subject to change.

- Limited Tort: Florida’s limited tort option allows drivers to choose a lower premium in exchange for limited rights to sue for non-economic damages (such as pain and suffering) in most cases. This option can be advantageous for drivers seeking lower premiums but can limit their legal recourse in the event of a serious accident.

Role of the Florida Office of Insurance Regulation (OIR)

The Florida Office of Insurance Regulation (OIR) plays a critical role in overseeing the state’s insurance industry, including car insurance. The OIR’s responsibilities include:

- Licensing and Regulation: The OIR licenses and regulates insurance companies operating in Florida, ensuring they meet specific financial and operational standards.

- Consumer Protection: The OIR advocates for consumer protection, investigating complaints against insurance companies and enforcing state insurance laws.

- Rate Oversight: The OIR reviews and approves insurance rates, ensuring they are fair and reasonable for consumers. This includes monitoring the impact of factors like weather and claim frequency on rate adjustments.

Factors Affecting Full Coverage Premiums: What Is Full Coverage Car Insurance In Florida

Several factors influence the cost of full coverage car insurance in Florida. Understanding these factors can help you make informed decisions about your insurance coverage and potentially reduce your premiums.

Key Factors Determining Full Coverage Premiums

Here’s a breakdown of the major factors that impact your full coverage insurance premiums in Florida:

| Factor | Impact on Premiums |

|---|---|

| Driver’s Age | Younger drivers typically have higher premiums due to their lack of experience and higher risk of accidents. Older drivers generally have lower premiums due to their more mature driving habits. |

| Driving History | A clean driving record with no accidents or violations leads to lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will significantly increase your premiums. |

| Vehicle Type | The type of vehicle you drive influences your premium. Expensive cars, high-performance vehicles, and those with a higher risk of theft typically have higher premiums. |

| Location | Your location in Florida plays a role. Areas with higher rates of car accidents and theft tend to have higher insurance premiums. |

| Credit Score | In Florida, insurers can use your credit score to assess your risk. A higher credit score often translates to lower premiums. |

| Coverage Levels | The amount of coverage you choose, including deductibles and limits, directly affects your premiums. Higher coverage levels typically result in higher premiums. |

Tips for Reducing Full Coverage Premiums

Here are some strategies to help you lower your full coverage insurance premiums in Florida:

- Maintain a clean driving record by avoiding accidents and traffic violations.

- Consider increasing your deductible. A higher deductible means you pay more out of pocket in the event of an accident but will lead to lower premiums.

- Shop around for quotes from different insurance companies. Prices can vary significantly between insurers.

- Take advantage of discounts offered by your insurer. Many insurers offer discounts for good students, safe drivers, and those who bundle their car and home insurance.

- Consider driving a less expensive and less risky vehicle.

- Improve your credit score. A higher credit score can lead to lower insurance premiums in Florida.

Comparison of Florida and National Average Costs

While exact costs vary depending on individual circumstances, the average cost of full coverage car insurance in Florida is generally higher than the national average. This is due to factors like Florida’s high population density, traffic congestion, and a higher number of uninsured drivers.

According to recent data, the average annual cost of full coverage car insurance in Florida is around $2,000, compared to the national average of about $1,700. However, it’s important to note that these figures are just estimates and can vary greatly based on the factors mentioned above.

Choosing the Right Full Coverage Policy

Finding the right full coverage car insurance policy in Florida involves careful consideration of your individual needs and the options available. It’s crucial to understand the various aspects of different policies to make an informed decision.

Understanding Policy Terms and Conditions

Policy terms and conditions are the foundation of your insurance coverage. It’s essential to understand key elements like deductibles, coverage limits, and exclusions to make sure your policy aligns with your needs and financial situation.

- Deductibles represent the amount you pay out-of-pocket before your insurance kicks in for covered events. Higher deductibles generally lead to lower premiums, while lower deductibles mean higher premiums. Consider your financial capacity and risk tolerance when choosing a deductible.

- Coverage Limits specify the maximum amount your insurance company will pay for a particular covered event. For instance, your policy might have a limit on the amount paid for repairs after an accident. Higher limits generally mean higher premiums, so you need to balance your coverage needs with your budget.

- Exclusions are situations or events not covered by your policy. Common exclusions include wear and tear, intentional damage, and damage caused by certain natural disasters. Reviewing the exclusions carefully helps you understand the scope of your coverage and avoid surprises later.

The Importance of Seeking Advice, What is full coverage car insurance in florida

While researching and comparing policies online is convenient, seeking advice from an insurance broker or agent can provide valuable insights and personalized guidance.

- Expert Knowledge: Brokers and agents possess in-depth knowledge of the Florida insurance market, including various insurance companies and their policies. They can help you navigate the complexities of insurance and understand your options.

- Personalized Recommendations: They can tailor recommendations based on your specific needs, budget, and risk profile. This ensures you get the right coverage without overpaying for unnecessary benefits.

- Negotiation: Brokers and agents can leverage their relationships with insurance companies to negotiate better rates and terms on your behalf. They can also help you understand the nuances of different policies and their impact on your overall cost.

Beyond Full Coverage

While full coverage car insurance offers significant protection in Florida, it’s not the only type of coverage you should consider. Several additional options can provide extra peace of mind and financial security in case of accidents or other unforeseen events.

Understanding Optional Coverage

Understanding the benefits of optional coverage is crucial for tailoring your car insurance policy to your specific needs and risks. These additional coverages provide financial protection beyond the basic requirements mandated by Florida law.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. It’s essential for newer vehicles, as it can help you recover from a significant financial loss. For example, if you’re involved in an accident and your car is totaled, collision coverage can help you purchase a new vehicle or receive compensation for the value of your old car.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It’s especially beneficial for older vehicles or those with high market value, as it can help you recover from unexpected losses. For instance, if your car is stolen, comprehensive coverage can help you replace it or receive compensation for its value.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you’re involved in an accident with a driver who is uninsured or has insufficient insurance. It can help cover medical expenses, lost wages, and property damage. For example, if you’re hit by a driver who doesn’t have insurance, uninsured motorist coverage can help pay for your medical bills and vehicle repairs.

The Importance of Personal Injury Protection (PIP)

In Florida, all drivers are required to have personal injury protection (PIP) coverage. This coverage pays for medical expenses and lost wages for you and your passengers, regardless of who caused the accident. PIP coverage in Florida is limited to $10,000 per person, and it can cover up to 80% of medical expenses and 60% of lost wages.

PIP coverage is essential for Florida drivers because it provides financial protection for medical expenses and lost wages after an accident, regardless of fault.

Filing a Car Insurance Claim in Florida

Filing a car insurance claim in Florida can be a complex process, but understanding the steps involved can make it smoother. Here’s a flowchart outlining the general process:

Step 1: Contact your insurance company.

Step 2: Provide details of the accident.

Step 3: File a claim.

Step 4: Gather necessary documentation.

Step 5: Cooperate with your insurance company.

Step 6: Negotiate a settlement.

Step 7: Receive payment.

Ultimate Conclusion

Navigating the world of car insurance in Florida can be complex, but understanding the nuances of full coverage car insurance empowers you to make informed choices. By carefully considering your individual needs, comparing quotes from different providers, and staying informed about Florida’s unique insurance landscape, you can secure the best possible car insurance protection for your peace of mind on the road.

Key Questions Answered

What is the difference between full coverage and liability insurance in Florida?

Full coverage insurance encompasses liability, collision, and comprehensive coverage, providing more extensive protection than liability insurance alone, which only covers damage caused to others.

Is full coverage car insurance mandatory in Florida?

No, full coverage car insurance is not mandatory in Florida. However, lenders often require it as a condition for financing a vehicle.

How can I get the best deal on full coverage car insurance in Florida?

Shop around for quotes from multiple insurance providers, consider bundling your car insurance with other policies, maintain a good driving record, and explore discounts for safety features in your vehicle.