What is the best company for life insurance? It’s a question that pops up when you’re thinking about protecting your loved ones, but finding the right answer can feel like navigating a maze. With so many different companies and policies out there, it’s easy to get lost in the details. But don’t worry, we’re here to help you break down the basics and find the best fit for your needs. Whether you’re a young adult just starting out or a seasoned pro looking to make sure your family is taken care of, this guide will equip you with the knowledge to make an informed decision.

First, you’ll need to understand your own situation. How much coverage do you need? What kind of policy is right for you? There are a lot of factors to consider, like your age, health, family size, and financial goals. Once you’ve got a good grasp of your needs, you can start comparing companies based on their financial stability, customer service, claim processing, and policy features. We’ll guide you through the key factors to evaluate and help you navigate the world of life insurance.

Understanding Life Insurance Needs

Life insurance is a crucial financial tool that provides financial protection to your loved ones in the event of your untimely demise. It ensures that your family can maintain their financial stability and achieve their financial goals, even in your absence.

Types of Life Insurance Policies

Life insurance policies are designed to meet various needs and financial situations. Here’s a breakdown of the most common types:

- Term Life Insurance: This is the most basic and affordable type of life insurance. It provides coverage for a specific period, typically 10, 20, or 30 years. If you pass away within the term, your beneficiaries receive a death benefit. If you outlive the term, the policy expires and you don’t receive anything back. Term life insurance is ideal for individuals who need temporary coverage, such as those with young children or a mortgage.

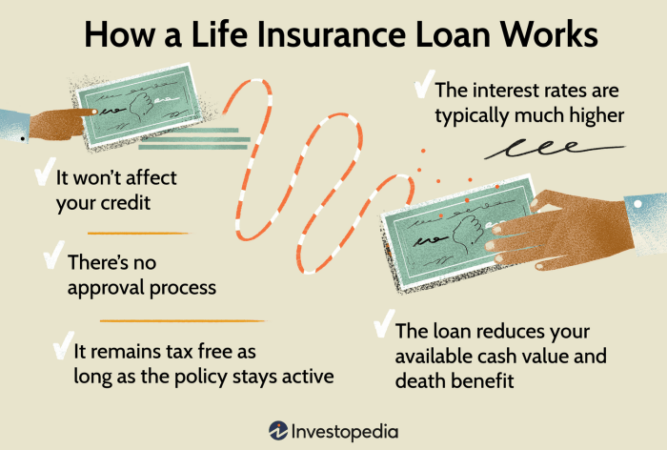

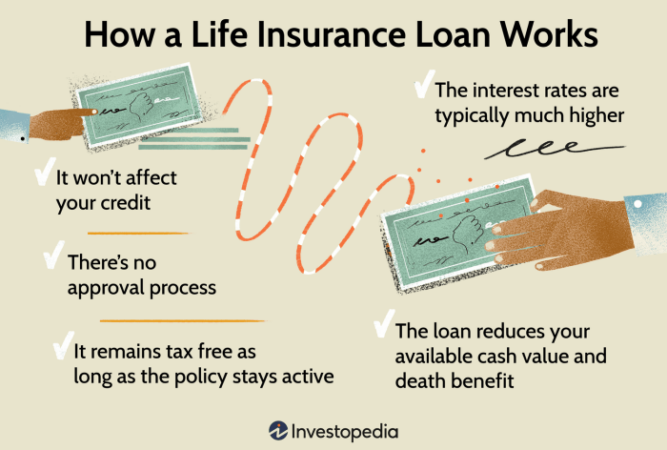

- Whole Life Insurance: This type of insurance provides lifelong coverage, meaning your beneficiaries will receive a death benefit regardless of when you pass away. It also builds cash value over time, which you can borrow against or withdraw. Whole life insurance is more expensive than term life insurance but offers a combination of death benefit and savings.

- Universal Life Insurance: This type of insurance offers flexibility in terms of premiums and death benefit. You can adjust your premiums and death benefit to suit your changing needs. Universal life insurance also builds cash value, but the growth is not guaranteed.

- Variable Life Insurance: This type of insurance allows you to invest your premiums in sub-accounts, similar to mutual funds. The death benefit and cash value growth depend on the performance of your investments. Variable life insurance offers potential for higher returns but also carries more risk.

Factors to Consider When Choosing a Life Insurance Policy

Choosing the right life insurance policy involves several considerations, including:

- Age and Health: Your age and health status significantly impact the cost of life insurance. Younger and healthier individuals generally pay lower premiums.

- Family Size and Dependents: The number of dependents you have and their financial needs will influence the amount of life insurance you need.

- Financial Goals: Your financial goals, such as paying off a mortgage, funding your children’s education, or providing for your spouse’s retirement, should be factored into your life insurance needs.

- Budget: Your budget will determine the type and amount of life insurance you can afford.

Situations Where Life Insurance Is Essential

Life insurance is essential in several situations, including:

- Young Families with Children: Life insurance provides financial security for children in case of a parent’s death. It can help cover living expenses, education costs, and other needs.

- Individuals with a Mortgage: Life insurance can help pay off a mortgage in the event of death, preventing the surviving spouse from facing foreclosure.

- Business Owners: Life insurance can provide financial protection for a business in case of a key employee’s death. It can help cover business expenses, maintain operations, and protect the business’s value.

- Individuals with Significant Debt: Life insurance can help pay off debts, such as credit card debt, student loans, or other outstanding obligations.

Key Factors to Evaluate Companies

Choosing the right life insurance company is a big decision, and it’s crucial to do your research to find a company that meets your needs and provides the best value for your money. There are several key factors to consider when evaluating life insurance companies, including their financial stability, customer service, claim processing procedures, and policy features. By taking the time to carefully consider these factors, you can make an informed decision and choose a company that will provide you with the protection you need.

Financial Stability

A company’s financial stability is a crucial factor to consider when choosing a life insurance provider. You want to ensure that the company you choose is financially sound and will be able to pay out your death benefit when the time comes. There are several ways to evaluate a company’s financial stability.

- AM Best Rating: AM Best is a leading credit rating agency that specializes in the insurance industry. They assign financial strength ratings to insurance companies based on their financial health and operating performance. Look for companies with an A or A+ rating, which indicates a strong financial position.

- Moody’s Rating: Moody’s is another well-respected credit rating agency that provides financial strength ratings for insurance companies. Their ratings are similar to AM Best’s, and a high rating from Moody’s also indicates a strong financial position.

- Standard & Poor’s Rating: Standard & Poor’s is a third major credit rating agency that assigns financial strength ratings to insurance companies. Their ratings are similar to AM Best’s and Moody’s, and a high rating from Standard & Poor’s also indicates a strong financial position.

- Company’s Financial Statements: You can also review a company’s financial statements, which are publicly available on their website or through the Securities and Exchange Commission (SEC). Look for trends in the company’s financial performance, such as its profitability, capital reserves, and debt levels. These factors provide insight into the company’s financial health and ability to fulfill its obligations.

Customer Service

Customer service is another important factor to consider when choosing a life insurance company. You want to make sure that you can easily get in touch with a representative, that they are knowledgeable and helpful, and that they will be there to assist you when you need them.

- Online Reviews and Ratings: Websites like Trustpilot, Yelp, and the Better Business Bureau (BBB) can provide valuable insights into a company’s customer service reputation. Look for companies with high ratings and positive reviews from previous customers. These reviews can give you a sense of the company’s responsiveness, professionalism, and overall customer experience.

- Customer Service Availability: Consider the company’s availability for customer service. Look for companies that offer multiple ways to contact them, such as phone, email, and live chat. Ensure the company has a dedicated customer service department that is available during convenient hours.

- Customer Testimonials: Look for testimonials from satisfied customers on the company’s website or social media pages. These testimonials can provide valuable insights into the company’s customer service quality and how they handle customer issues.

Claim Processing

Claim processing is a crucial aspect of life insurance, as it determines how quickly and smoothly you receive your death benefit. You want to choose a company with a streamlined and efficient claim processing system.

- Claim Processing Time: Research the average claim processing time for the company. Look for companies with a proven track record of processing claims promptly and efficiently. This can save you time and hassle during a difficult time.

- Claim Process Transparency: Understand the company’s claim process and the documentation required. Look for companies that have a clear and transparent claim process, making it easy for you to understand the steps involved and the information needed to file a claim.

- Claim Denial Rates: Consider the company’s claim denial rates. Look for companies with a low claim denial rate, indicating a fair and reasonable approach to claim processing. This can give you peace of mind knowing your claim is likely to be processed smoothly.

Policy Features

Policy features are an important aspect of life insurance, as they determine the specific benefits and protections you receive. It’s crucial to choose a policy with features that meet your specific needs and goals.

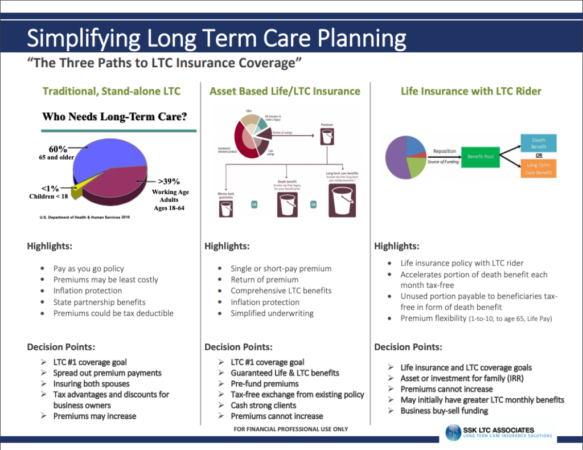

- Riders: Riders are optional add-ons to your life insurance policy that provide additional benefits or coverage. Some common riders include accidental death benefits, terminal illness benefits, and long-term care benefits. These riders can provide extra protection and peace of mind.

- Premium Payment Options: Consider the different premium payment options offered by the company. Some companies offer flexible payment schedules, such as monthly, quarterly, or annual payments. Choose a payment option that fits your budget and financial situation.

- Policy Flexibility: Consider the flexibility of the policy. Some companies offer policies that can be adjusted as your needs change. This can be helpful if your family size or financial situation changes over time.

Top Life Insurance Companies: What Is The Best Company For Life Insurance

Choosing the right life insurance company is a big decision. You want a company that’s financially strong, has a good reputation for customer service, and offers policies that meet your needs. But with so many options available, it can be tough to know where to start.

Top-Rated Life Insurance Companies

This table highlights some of the top-rated life insurance companies in the United States, based on their financial strength ratings, customer satisfaction scores, and policy offerings.

| Company | Financial Strength Rating | Customer Satisfaction Score | Policy Offerings |

|—|—|—|—|

| Northwestern Mutual | A++ (AM Best) | 4.5/5 (J.D. Power) | Term life, whole life, universal life, variable life, indexed universal life |

| New York Life | A++ (AM Best) | 4.3/5 (J.D. Power) | Term life, whole life, universal life, variable life, indexed universal life |

| MassMutual | A++ (AM Best) | 4.2/5 (J.D. Power) | Term life, whole life, universal life, variable life, indexed universal life |

| Prudential | A++ (AM Best) | 4.1/5 (J.D. Power) | Term life, whole life, universal life, variable life, indexed universal life |

| State Farm | A++ (AM Best) | 4.0/5 (J.D. Power) | Term life, whole life, universal life |

Note: Financial strength ratings are based on the company’s ability to pay claims and meet its financial obligations. Customer satisfaction scores are based on customer surveys. Policy offerings may vary by company.

Top Performers by Life Insurance Category

Here are some of the top performers in each category of life insurance:

| Category | Top Performers |

|—|—|

| Term Life | Northwestern Mutual, New York Life, MassMutual |

| Whole Life | Northwestern Mutual, New York Life, MassMutual |

| Universal Life | Northwestern Mutual, New York Life, MassMutual |

| Variable Life | Northwestern Mutual, New York Life, Prudential |

| Indexed Universal Life | Northwestern Mutual, MassMutual, Prudential |

Key Features and Pricing Comparison

This table compares the key features and pricing of policies offered by leading companies.

| Company | Term Life (20-Year, $500,000 Coverage) | Whole Life ( $500,000 Coverage) |

|—|—|—|

| Northwestern Mutual | $25/month | $150/month |

| New York Life | $23/month | $145/month |

| MassMutual | $24/month | $140/month |

| Prudential | $22/month | $135/month |

| State Farm | $20/month | $125/month |

Note: Pricing is based on a 35-year-old male in good health. Actual premiums may vary depending on your age, health, and other factors.

Getting Quotes and Choosing the Right Policy

You’ve figured out how much life insurance you need, and you’ve got a good idea of the type of policy that’s right for you. Now it’s time to get quotes from different companies and find the best deal. This is where things can get a little tricky, but don’t worry, we’ll walk you through it.

Obtaining Life Insurance Quotes

It’s easier than ever to get life insurance quotes. You can do it online, over the phone, or by meeting with an insurance agent in person. Most companies offer a quick and easy online quote form. You’ll need to provide some basic information about yourself, such as your age, health, and the amount of coverage you want. Once you submit the form, you’ll receive a quote within minutes.

Comparing Quotes and Considering Overall Value

Don’t just go for the cheapest quote! You need to compare quotes from different companies and consider the overall value of the policy. Think about things like the company’s financial stability, its customer service reputation, and the policy’s features and benefits.

- Financial Stability: Look for companies with strong financial ratings from agencies like A.M. Best, Moody’s, and Standard & Poor’s. This ensures that the company will be able to pay out your death benefit when the time comes.

- Customer Service Reputation: Check online reviews and ratings from organizations like the Better Business Bureau (BBB). This can give you an idea of how well the company treats its customers.

- Policy Features and Benefits: Compare the features and benefits of different policies, such as the death benefit amount, the premium payment period, and the policy’s grace period.

Negotiating with Insurance Agents

While you can get quotes online, sometimes it’s helpful to talk to an insurance agent in person. They can answer your questions and help you find the right policy for your needs. Don’t be afraid to negotiate with the agent to get the best rate. Here are a few tips:

- Shop around: Get quotes from several different companies before you make a decision. This will give you a good idea of the market and help you negotiate a better price.

- Ask about discounts: Many companies offer discounts for things like non-smoking, good health, and group affiliations. Ask the agent about any discounts you may qualify for.

- Be willing to walk away: If you’re not happy with the agent’s offer, be willing to walk away. There are other companies out there, and you don’t want to settle for a policy that’s not right for you.

Additional Considerations

When choosing a life insurance policy, it’s crucial to consider factors beyond just price and coverage. Navigating the world of life insurance can be overwhelming, but there are resources and strategies that can help you make informed decisions.

The Role of Independent Insurance Agents and Brokers

Independent insurance agents and brokers can be valuable allies in your life insurance search. They work with multiple insurance companies, allowing them to offer a wider range of options and find the best fit for your individual needs.

- Expertise and Guidance: Agents and brokers have specialized knowledge about different life insurance policies and can help you understand complex terms and conditions. They can also advise on the right coverage amount, policy type, and riders that align with your unique situation.

- Personalized Service: Agents and brokers take the time to understand your financial goals, risk tolerance, and family circumstances. This personalized approach ensures you receive recommendations that truly meet your needs.

- Negotiation Power: Agents and brokers often have relationships with insurance companies and can negotiate better rates and terms on your behalf.

Purchasing Life Insurance Online

The convenience of online platforms has made purchasing life insurance easier than ever.

- Accessibility and Speed: Online platforms allow you to compare quotes from multiple companies and apply for coverage at your convenience.

- Transparency and Cost Savings: Online platforms often offer lower premiums due to reduced overhead costs and streamlined processes.

However, there are some potential drawbacks:

- Limited Personalization: Online platforms may not offer the same level of personalized guidance as an agent or broker.

- Potential for Misinformation: It’s crucial to carefully review the policy details and make sure you understand all the terms and conditions.

Understanding the Fine Print, What is the best company for life insurance

Life insurance policies can be filled with technical jargon and legal language. It’s essential to thoroughly read and understand the fine print before signing any documents.

- Key Policy Provisions: Pay close attention to the policy’s coverage amount, premium payment schedule, death benefit payout options, and any exclusions or limitations.

- Riders and Exclusions: Familiarize yourself with any optional riders you’ve chosen and their associated costs. Also, understand any exclusions that might limit your coverage, such as pre-existing conditions or risky activities.

- Grace Period and Policy Lapse: Understand the grace period for premium payments and the consequences of policy lapse.

- Contestability Period: Be aware of the contestability period, which is a time frame during which the insurance company can investigate your application and potentially deny coverage if it discovers any inaccuracies or misrepresentations.

Wrap-Up

Finding the best life insurance company is a journey, not a destination. It’s about taking the time to understand your needs, explore your options, and choose a company that aligns with your values and goals. Remember, this isn’t a one-size-fits-all situation. Take the time to research, ask questions, and get quotes from different companies. With a little effort, you can find the perfect life insurance policy to provide peace of mind and financial security for your loved ones.

FAQ Compilation

How much life insurance do I need?

The amount of life insurance you need depends on your individual circumstances. Consider your income, dependents, debts, and future financial goals. A financial advisor can help you determine the right amount of coverage.

What is a life insurance beneficiary?

A beneficiary is the person or people who will receive the death benefit from your life insurance policy. You can choose anyone you want as your beneficiary, but it’s important to make sure they are aware of their role and responsibilities.

Can I get life insurance if I have health issues?

Yes, you can still get life insurance even if you have health issues. However, your premiums may be higher, and you may need to undergo medical underwriting. There are also life insurance options specifically designed for people with health conditions.

What is the difference between term life and whole life insurance?

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. Whole life insurance provides lifetime coverage and builds cash value that you can borrow against. The best type of life insurance for you depends on your individual needs and financial goals.